Garbage Truck Bodies Market Size, Share & Industry Analysis, By Product Type (Front Loaders, Rear Loaders, and Side Loaders), By Application (Urban Garbage Treatment, Building & Mining Industry, and Others), By Technology (Manual and Semi-/Fully Automatic), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

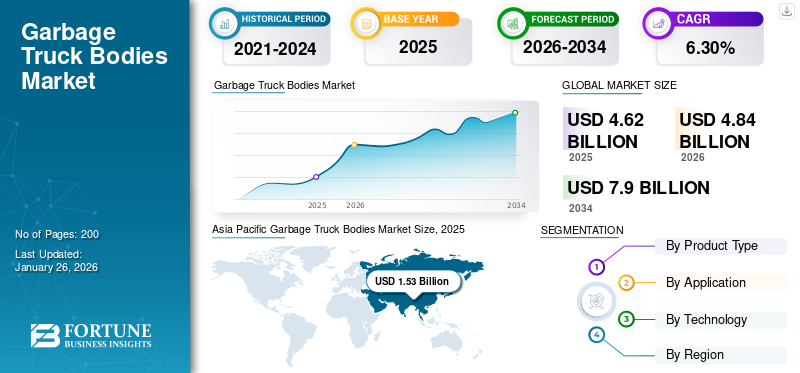

The global garbage truck bodies market size was valued at USD 4.62 billion in 2025. The market is projected to grow from USD 4.84 billion in 2026 to USD 7.90 billion by 2034, exhibiting a CAGR of 6.30% during the forecast period. Asia Pacific dominated the global market with a share of 33.02% in 2025. The garbage truck bodies market in the U.S. is projected to grow significantly, reaching an estimated value of USD 974.5 million by 2032, driven by the growing waste generation and implementation of latest technology of connectivity in garbage collection vehicles to boost the demand in U.S.

The garbage truck bodies market involves the production and distribution of specialized vehicle components designed for waste collection and disposal. These components include refuse containers, compactors, and other equipment necessary for efficient garbage collection operations, catering to municipal and commercial waste management needs worldwide. The global garbage truck bodies market is witnessing significant growth, driven by the increasing emphasis on waste management and environmental sustainability.

Download Free sample to learn more about this report.

Global Garbage Truck Bodies Market Overview

Market Size:

- 2025 Value:USD 4.62 billion

- 2026 Value:USD 4.84 billion

- 2034 Forecast Value:USD 7.90 billion, with a CAGR of 6.30% from 2026–2034

Market Share

- Regional Leader:Asia Pacific led the market in 2025 with approximately USD 1.53 billion, supported by strong recycling initiatives and governmental waste-management policies

- Fastest‑Growing Region:Asia Pacific continues to project the fastest growth through 2034, thanks to urbanization and growing waste management infrastructure investments

- End‑User Leader (Product Type):The rear loader segment accounts for the largest share globally, due to its widespread preference in residential and municipal collection systems

Industry Trends

- Electrification of Waste Fleets:Rising deployment of electric and hydrogen refuse vehicles is accelerating demand for compatible truck bodies, particularly in North America and Europe

- Automation & AI Integration:Leading players are incorporating robotics and AI-based curbside recognition to enable automated side-loading and fleet optimization

- Smart Manufacturing Practices:Adoption of Industry 4.0 technologies—like cloud-based execution systems and robotic assembly—is enhancing production efficiencies and product consistency

Driving Factors

- Urbanization & Waste Generation:Continued population and urban growth fuel demand for efficient waste collection solutions and truck body deployments

- Environmental Regulations:Stringent emission and sustainability norms are prompting fleet operators to adopt eco-friendly refuse trucks, boosting compatible body sales

- Fleet Modernization Needs:Aging fleets and the desire for optimized operations are triggering equipment upgrades, particularly toward side-loading and automated bodies

Governments worldwide are implementing strategies to enhance waste collection and disposal.

Key players are adopting innovative technologies, including electric and alternative fuel systems, to reduce carbon emissions. Regions such as Asia Pacific, Europe, North America, and other parts of the world are actively contributing to the market expansion, creating a dynamic and evolving landscape. These factors generate a high demand for truck bodies to adhere to the rapidly evolving advanced technology and regulations within the waste management industry.

The COVID-19 pandemic disrupted the garbage truck bodies market, causing delays in manufacturing and supply chain disruptions. Reduced waste generation due to lockdowns and economic slowdowns further dampened demand for new garbage truck bodies. However, increased emphasis on sanitation and waste management in response to the pandemic drove market growth further as economies recover and prioritize public health measures.

Garbage Truck Bodies Market Trends

Growing Emphasis on Alternative Fuel and Vehicle Electrification to Drive Market Growth

Many waste service providers and sanitation departments are testing electric garbage truck bodies or adding them to their fleets to reduce emissions. Electric garbage trucks are quieter, thereby reducing noise pollution as well. For instance, in 2019, GreenWaste, a waste service provider in California, incorporated a BYD-manufactured first-generation electric waste truck into their fleet. This truck saves around 6,000 gallons of diesel and reduces emissions by 78 metric tons of CO2 equivalent annually. GreenWaste plans to transition its whole residential garbage fleet to an electric vehicle within the next few years. Hence, the emergence of electrification in the market for garbage truck is a positive trend globally.

Various companies are designing and developing heavy-duty waste collection trucks to compete with the performance of standard diesel vehicles.

- For example, in June 2023, Superior Pak, a leading truck body manufacturers of world-class mobile waste collection and compaction equipment, showcased Australia’s first hydrogen-powered garbage truck, built at Bundaberg's Superior Pak facility. The company showcased its model for industry representatives from around the nation at a recent truck and machinery expo in Brisbane. The company also recently partnered with Hyzon Motors to develop the Hydrogen Powered Side loader, an electric vehicle that runs entirely on hydrogen and produces zero emissions.

Garbage Truck Bodies Market Growth Factors

Rapid Urbanization and Population Expansion are Contributing to a Significant Surge in Waste Generation

The escalating increase in waste generation, spurred by the dual forces of urbanization and population expansion, plays a pivotal role in driving the garbage truck bodies market growth. As the global population surges toward an estimated 9.7 billion by 2050, with a significant majority residing in urban areas, the demand for efficient waste management solutions intensifies. The increasing urban population generates a substantial amount of solid waste, with each person contributing around 0.7-0.8 kilograms daily. This surge in municipal solid waste, projected to reach 3.4 million tons annually by 2050, underscores the critical need for robust waste collection and disposal systems. Garbage truck bodies, designed for effective waste transportation and management, become indispensable in addressing the challenges posed by the growing waste footprint, positioning the market for significant expansion in response to the evolving dynamics of urbanization and population growth.

Projections from UNESCO indicate that the global population will increase from 7.9 billion in 2023 to 9.7 billion by 2050, with 56% residing in urban areas. This urbanization trend is anticipated to more than double by 2050. On a global scale, each person generates approximately 0.7-0.8 kilograms of solid waste daily. The annual generation of municipal solid waste is expected to escalate from 2 million tons in 2016 to 3.4 million tons in 2050. This substantial rise in waste output, driven by population growth, will serve as a key driver for the garbage truck bodies market growth.

RESTRAINING FACTORS

Higher Development Costs May Hinder the Market Growth

A major restraining factor for the global market is the substantial initial investment required for transitioning to advanced and environmentally friendly technologies. The adoption of innovative features such as electric or hybrid propulsion systems, automated collection mechanisms, and eco-friendly materials significantly increases the overall cost of manufacturing garbage truck bodies. This poses a challenge, particularly for smaller waste management companies and municipalities with limited budgets. Additionally, the maintenance and repair costs associated with advanced technologies can be higher, further impacting the total cost of ownership. Resistance to change and a conservative approach to embracing new technologies within the waste management sector also contributes to the slow adoption rate.

Municipal solid waste collection rates exhibit substantial variations based on the development level or income status of countries. For instance, North America and Europe boast high municipal solid waste collection rates of 100% and 90%, respectively, whereas South Asia and Sub-Saharan Africa lag behind with rates of 40% and 44% respectively. Additionally, considering income levels, high-income and upper-middle-income countries demonstrate impressive municipal solid waste collection rates of 96% and 82%, respectively. In contrast, lower-middle-income and low-income countries face challenges, with rates standing at 51% and 39%, respectively. These disparities pose constraints on the market's growth potential. The challenge lies in overcoming financial barriers and facilitating a widespread transition to sustainable technologies for the comprehensive expansion of the global garbage truck bodies market trend.

Garbage Truck Bodies Market Segmentation Analysis

By Product Type Analysis

Rear Loaders Segment Dominates the Market Owing to its Large Storage Capacity

By product type, the market is segmented into front loaders, rear loaders, and side loaders.

The rear loaders segment dominates the market due to its versatile design that supports various technological advancements, enhancing work efficiency. Additionally, rear loader refuse trucks offer greater storage capacity, supporting their widespread adoption in waste management, accounting for a 48.33% market share in 2026.

The side loader segment is expected to exhibited the fastest market growth over the study period prominently due to the ease of handling. The entire process requires a single staff, which reduces the health risks and helps improve the efficiency of the entire operation.

The front loaders segment is expected to grow further over the forecast period, mainly due to the increased level of automated operations. The front loader garbage trucks perform more automated operations than rear loaders and require less manual labour.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Government’s Increasing Focus on Solid Waste Management in Urban Areas to Surge the Demand for Urban Garbage Treatment

Based on application, the market for garbage truck bodies is segmented into urban garbage treatment, building & mining industry, and others.

The urban garbage treatment segment is expected to dominate the market with the highest share during the forecast period, driven by population growth and increasing residential development projects that fuel demand for refuse trucks in urban areas. Additionally, rising concerns regarding waste disposal from urban regions are expected to boost the adoption of advanced waste management and garbage disposal practices worldwide, accounting for a 60.10% market share in 2026.

By Technology Analysis

Manual Segment Dominates the Market Due to Cost Efficiency and Easy Availability of the Technology

Based on technology, the market for garbage truck bodies is classified into manual and semi-/fully automatic.

The manual segment is dominating the market with a share of 64.03% in 2026. Manual truck bodies offer simplicity and cost-effectiveness, which makes them suitable for regions with limited technological infrastructure, drive the market growth . These systems involve manual labour for waste collection operations, sorting, and disposal.

The increasing adoption of semi-/fully automatic technologies is driven by the demand for efficiency, speed, and reduced human intervention in waste management processes. It is the fastest growing segment in the market due to the requirement of advanced sensor technologies, automated lifting mechanisms, and digital control systems to enhance the operational effectiveness of garbage trucks.

Municipalities and waste management companies are investing in these technologies to optimize waste collection routes, enhance safety, and improve overall productivity. The growth of both manual and semi-/fully automatic segments in the technology category within the global garbage truck bodies market share can be attributed to the diverse needs and preferences of waste management systems worldwide.

REGIONAL INSIGHTS

Geographically, the market is divided into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Garbage Truck Bodies Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, the Asia Pacific emerged as the dominant region in the market with a size of USD 1.53 Billion in 2026. Governments in the region are actively implementing diverse strategies and initiatives for waste collection and disposal. Moreover, there is a heightened emphasis on increasing recycling efforts to minimize the environmental impact of garbage and waste. The Japan market is projected to reach USD 0.28 Billion by 2026, the China market is projected to reach USD 1.01 Billion by 2026, and the India market is projected to reach USD 0.11 Billion by 2026.

Europe

Europe held a significant market size in 2023 and is anticipated to experience a stable CAGR throughout the forecast period. Key industry players are directing their efforts toward the adoption of electric garbage truck bodies as part of a broader initiative to reduce carbon emissions and enhance fuel efficiency through the adoption of eco-friendly alternatives and alternative fuel systems. The UK market is projected to reach USD 0.11 Billion by 2026, while the Germany market is projected to reach USD 0.16 Billion by 2026.

North America

Similarly, the North America market held a substantial market share in 2025. Growth in this region is closely linked to the adoption of electric garbage truck bodies to foster green mobility, combat pollution, and mitigate carbon emissions. Notably, the U.S. and Canada are actively deploying electric garbage truck bodies to champion sustainable mobility solutions. The U.S. market is projected to reach USD 0.71 Billion by 2026.

Rest of the world

The rest of the world also commands a considerable market share, poised for consistent growth over the forecast period. Major industry players are strategically focusing on entering the Latin American market, recognizing its potential as it encompasses developing countries that lack robust waste management systems.

List of Key Companies in Garbage Truck Bodies Market

McNeilus Truck and Manufacturing Dominates Due to Industry-Leading Production Facilities

The market's competitive landscape is defined by key players, including BYD Company Ltd., Fujian Longma Environmental Sanitation Equipment Co., Ltd., and McNeilus Truck and Manufacturing. McNeilus Truck and Manufacturing, a subsidiary of the Oshkosh Corporation, holds a prominent position in North America. Its dominance in the U.S. market, marked by higher revenue compared to other key players, has empowered the company to make substantial investments in expanding production facilities. This includes dedicated plants specifically for refuse vehicles and equipment, demonstrating a strategic commitment to meet the growing demands in the waste management industry.

For instance, in February 2023, McNeilus Truck and Manufacturing expanded its McNeilus Fleet Solutions program by adding a new 30,000-square-foot building at its Minnesota headquarters dedicated to joint pre-delivery inspection (JPDI). McNeilus revolutionizes refuse collection vehicle production through upgraded manufacturing, collaborative pre-delivery inspection, and a dedicated materials warehouse. McNeilus’ new high flow line features several Industry 4.0 technologies, including autonomous robotics, a cloud-based manufacturing execution system. Hence, these factors are responsible for the company's leading position in the market.

LIST OF KEY COMPANIES PROFILED:

- McNeilus Truck and Manufacturing (U.S.)

- Haul-All Equipment Ltd. (Canada)

- DENNIS EAGLE LTD (U.K.)

- Fujian Longma Environmental Sanitation Equipment Co., Ltd (China)

- New Way (U.S.)

- Heil (U.S.)

- BYD Company Ltd. (China)

- Labrie Enviroquip Group (Canada)

- Curbtender Sweepers, LLC (U.S.)

- Boivin Evolution Inc. (Italy)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 - Sepur, a waste management company in Paris, added 18 new Renault electric refuse trucks in Paris. Sepur uses the 18 E-Tech D Wide for the collection of household/ residential waste in the region.

- April 2023 - McNeilus showcased its new fully integrated electric truck at WasteExpo held in New Orleans, Louisiana. The new model zero-emission electric refuse collection vehicle is purpose-built. It features active safety systems, excellent visibility, a 360-degree camera, object detection, streamlined controls with a 15-inch touchscreen display and a spacious cab.

- February 2023 - Oshkosh Corporation, a leading innovator of purpose-built vehicles and equipment, developed North America’s first advance electric refuse collection vehicle.

- February 2023 - City View Specialty and New Way vehicles announced its agreement of exclusive distribution of refuse trucks in Ontario, Canada. This agreement would help expand the sales operations and a new product line for Refuse trucks. The agreement would also allow New Way to expand its market presence further and strengthen its brand image in the North American market.

- November 2022 – Rollins Machinery, Labrie Group’s certified distributor, partnered with Mack Trucks and showcased its Labrie Automizer Right-hand EV demo unit at BCTA. The unit shared plans to make demo runs for municipal and private clients in British Columbia, Canada. The company is focused on electrifying its products to lead toward future trends in the automotive industry.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report includes a detailed market analysis. It focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides this, the report offers key market insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report delivers an in-depth market analysis of several factors contributing to its growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (Units) |

|

Segmentation

|

By Product Type

|

|

By Application

|

|

|

By Technology

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 4.84 billion in 2026 and is estimated to reach USD 7.90 billion by 2034.

In 2025, Asia Pacific stood at USD 1.53 billion.

By product type, the rear loaders segment is the leading segment in the market.

McNeilus Truck and Manufacturing, Fujian Longma Environmental Sanitation Equipment Co., Ltd, and BYD Company Ltd. are the major players in the global market.

Asia Pacific dominated the global market with a share of 33.02% in 2025.

Garbage trucks are categorized as front loaders, rear loaders, and side loaders.

Rear loaders are the most commonly found type of garbage trucks in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us