Generator Sales Market Size, Share, and Industry Analysis, By Power Rating (Below 75 kVA, 75-375 kVA, 375-750 kVA, and Above 750 kVA), By Fuel Type (Diesel, Gas, and Others), By Application (Continuous Load, Peak Load, and Standby Load), By End-User (Mining, Oil & Gas, Construction, Residential, Marine, Manufacturing, Pharmaceuticals, Commercial, Telecom, Utility, Data Center, and Others), and Regional Forecast, 2026-2034

Generator Sales Market Size

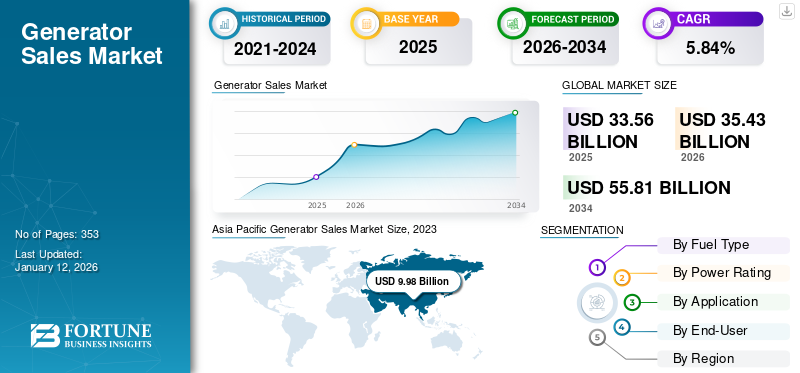

The global generator sales market size was valued at USD 33.56 billion in 2025 and is projected to grow from USD 35.43 billion in 2026 to USD 55.81 billion by 2034, exhibiting a CAGR of 5.84% during the forecast period. Asia Pacific dominated the global market with a share of 31.67% in 2025. The generator sales market in the U.S. is projected to grow significantly, reaching an estimated value of USD 9.63 billion by 2032, driven by the frequent power outage due to aging infrastructure and natural disasters.

The impressive advancements and rapid industrialization have resulted in a growing need for more power. The necessity for consistent power supply, both during peak shaving and continuously, has elevated the significance of generators or gensets across residential, commercial, and industrial settings. Gensets play a crucial role by transforming mechanical energy into electrical energy, catering to various agricultural and industrial applications. These genset units comprises of several integral parts, including an engine, fuel system, alternator, primary assembly, cooling, exhaust system, and other components, all working harmoniously to generate and regulate electricity efficiently. Since, the increasing power demand cannot be encountered through grid power alone, usage of gensets has been imperative.

Global Generator Sales Market Overview

Market Size:

- 2025 Value: USD 33.56 billion

- 2026 Value: USD 35.43 billion

- 2034 Forecast Value: USD 55.81 billion

- Forecast CAGR: 5.84% (2026–2034)

Market Share:

- Regional Leader: Asia Pacific dominated with a 31.67% share in 2025

- Fastest‑Growing Region: Asia Pacific, driven by industrialization, infrastructure build‑out, and rising energy needs

- End‑User Leader: Diesel fuel–based generators (by fuel type) lead globally

Industry Trends:

- Rise of Diesel Dominance: Diesel remains the leading fuel segment due to its efficiency and reliability in heavy-duty applications

- Growing Infrastructure & Industrial Demand: Urbanization, industry expansion, and data centers drive commercial & industrial uptake

- Focus on Hybrid / Bi‑fuel Solutions: Adoption of hybrid and bi‑fuel generators is rising in response to sustainability goals

- Increasing Resilience Investment: Power backup for grid instability, outages, and natural disasters is fueling sales growth

Driving Factors:

- Rising need for reliable backup power due to frequent blackouts and aging grids

- Industrial & commercial growth in sectors like telecom, data centers, oil & gas, and manufacturing

- Technological advancements in efficient, compact gensets and adoption of inverter, hybrid, and bi‑fuel technologies

- Recovery from COVID‑19 disruptions impacting supply chains and installations

- Government and regulatory push for sustainability and resilient infrastructure investments

The COVID-19 pandemic had a significant impact on the market growth. In the power sector, companies faced several challenges due to decreased resources and manpower. The market was affected by a combination of factors, including disruptions to supply chains, reduced demand for uninterrupted power supply devices, and hampered consumption in many end-use industries growth. This was due to disruption of services, technology, and hindrance in activities caused by the social distancing norms. Due to the lack of skilled professionals to use the technology, COVID-19 has significantly impacted this market. As a result of the shutdown of manufacturing units around the world, the revenue of the market also decreased.

Generator Sales Market Trends

Increasing adoption of Hybrid Generators, Inverter Generators, and Bi-fuel Generators are the Major Factors Driving Market Growth

Hybrid generators offer both the reliability of traditional fuels and the sustainability of renewables, such as solar or wind. This resonates with environmentally conscious consumers and businesses. Hybrid generators can operate more efficiently by switching between fuel sources based on demand, leading to lower operating costs. Inverter generators produce high-quality power with fewer harmonics, making them suitable for sensitive electronics and residential applications.

These modern generators offer solutions for various applications, from environmentally conscious homeowners to businesses seeking backup power with lower emissions. Manufacturers are constantly improving these technologies, making them more efficient, reliable, and user-friendly. Overall, the rising adoption of hybrid, inverter, and bi-fuel generators is a clear indicator of the evolving generator market. Technological advancements, growing environmental concerns, and diverse customer needs are fueling their popularity. By addressing challenges and offering innovative solutions, the industry can ensure continued growth and cater to the evolving power needs of customers.

Growing Concerns to Mitigate Operational Risks Due to Power Outages to Favor Market Growth

Various natural calamities or machine errors leave residential, commercial, and industrial operations vulnerable to performing daily tasks owing to a power outage.

- On 25 January 2022, the cities of Kyrgyzstan and Uzbekistan faced a severe power outage due to a grid failure caused by a water drought and a recent explosion in cryptocurrency mining. Accordingly, government and private establishments are widely developing energy storage technologies to diminish such problems. The wide adoption of energy storage will aid in enduring erratic conditions.

Download Free sample to learn more about this report.

Generator Sales Market Growth Factors

Growing Need for Reliable Backup Power Sources to Drive the Generator Sales Market Growth

The need for a reliable backup power source is a primary and critical driver for the market growth. In today's interconnected and technologically advanced world, electricity is essential for functioning in various sectors, ranging from residential and commercial to industrial and institutional. Any interruption in the power supply can lead to disruptions, financial losses, and even safety concerns. This dependency on consistent electricity has propelled the demand for backup power solutions, such as generators. Additionally, the growing expenditure on national construction to build energy-efficient setups boosts the requirement for gensets. For instance, as the U.S. Census Bureau published in July 2022, the spending on public buildings across the U.S. totalled about USD 353.1 billion.

Businesses rely heavily on uninterrupted power to maintain operations, especially critical data storage, communication, and customer service. A reliable backup power source, such as a generator, ensures that companies can continue functioning during power outages, minimizing productivity losses, and potential revenue downturns. Essential services, such as hospitals, emergency response centres, and utilities, require constant power to provide life-saving functions. Generators are vital to ensuring these critical facilities remain operational during emergencies.

Modern societies and economies rely heavily on electricity, including running critical infrastructure, communication systems, healthcare facilities, data centres, manufacturing processes, and more. Any power outage can lead to significant losses in terms of productivity, revenue, and even potential safety hazards. Ageing power grids and infrastructure can be susceptible to failures, leading to frequent power outages. Businesses and industries can face substantial financial losses due to these interruptions. Generators provide a reliable solution to bridge the gap during power grid failures. Many industries, such as mining, construction, and agriculture, operate in remote areas where grid power is not readily available. Generators are crucial to power equipment and machinery in these scenarios.

Ongoing Advancements in Generator Technology to Stimulate the Generator Demand Driving Market Growth

The generator industry has witnessed significant technological advancements over the years, and these ongoing innovations continue to drive demand in the market. These advancements encompass various aspects of generator technology, including efficiency, reliability, environmental friendliness, and integration with other smart systems. Modern generators are designed to be more efficient and deliver higher performance.

Advanced engine designs, improved fuel injection systems, and better control algorithms have led to generators that can produce more power with less fuel consumption. This efficiency reduces operational costs and lowers emissions, making generators more environmentally friendly. Hybrid systems that combine generators with renewable energy sources, such as solar panels and wind turbines, are gaining traction. Smart controllers can manage power sources based on availability and demand, ensuring optimal energy utilization. This integration allows for greater flexibility, reduced dependency on fossil fuels, and cost savings. Hybrid generators that combine traditional fuel sources (such as diesel or natural gas) with renewable energy sources (such as solar or wind) offer increased efficiency and reduced dependency on fossil fuels. These systems are particularly attractive in applications with unreliable or expensive grid power. Many modern generators have smart features that enable remote monitoring, diagnostics, and control. This real-time monitoring allows for proactive maintenance, reducing downtime, and enhancing overall reliability.

Microgrids combine generators with other energy sources and storage systems to create localized and self-sustaining power networks. These systems can improve energy resiliency, especially in areas prone to grid outages. Digital control systems offer precise load management, voltage regulation, and seamless grid, and backup power transitions. This automation enhances the performance and reliability of generators.

RESTRAINING FACTORS

Rising Adoption of Clean Energy Technologies Along with Stringent Emission Norms Restrains the Market Growth

As the world increasingly shifts toward cleaner and more sustainable energy sources, such as solar, wind, hydroelectric, and geothermal power, the demand for traditional generators that rely on fossil fuels can decrease. Clean energy technologies are often favored due to their lower environmental impact and long-term cost benefits. This transition toward cleaner alternatives can limit the generator sales growth, especially in areas where clean energy sources are becoming more accessible and affordable.

Governments and international organizations are implementing stricter emission norms and regulations to reduce pollution and combat climate change. These regulations often target pollutants emitted by traditional generators, such as carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter. Compliance with these norms can require expensive upgrades or modifications to existing generators or even lead to the phasing out of older, more polluting models. Manufacturers might also require research and development to create generators that meet these emission standards, adding to their costs. As the energy landscape evolves, generator manufacturers may need to adapt new strategies to target industries or regions where generators are still essential due to reliability concerns or lack of clean energy infrastructure.

Generator Sales Market Segmentation Analysis

By Fuel Type Analysis

Ease of Maintenance to Boost Diesel Segment Growth

Based on fuel type, the global market is segmented into diesel, gas, and others.

The diesel segment is projected to lead the generator sales market with a share of 58.45% in 2026. Industries are running their operations smoothly based on diesel generators. In today’s world, without backup power, nothing is possible, and having a backup energy option is valuable. Diesel generators are one step forward from any other fuel engine. These generators are easy to maintain and do not require additional attention for external components. Diesel generators can survive under worse weather conditions and function longer than any other fuel generator.

Gas segment is second dominating market after diesel generators due to their power quality, fuel supply, fuel costs, and functionality. The generators run on natural gas instead of other fuels such as diesel or petrol. Power generation of this fuel type, which runs on alternative fuels are cost effective and efficient to operate compared with other types of generators.

To know how our report can help streamline your business, Speak to Analyst

By Power Rating Analysis

Above 750 kVA is Dominating the Market Due to its Rising Demand in Industrial and Commercial Applications

Based on power rating, the global generator sales market is segmented into below 75 kVA, 75 kVA - 357 kVA, 357 kVA - 750 kVA, and above 750 kVA.

The above 750 kVA segment is leading the market due to its ability to provide power support to an entire manufacturing facility and commercial buildings and keep the operations running in situations, such as power outages.

Generators below 75 kVA is dominating the market due to its vast use in on-grid areas such as telecommunications sector, small industries, petrol stations, commercial establishments, and small restaurants. They are primarily used as a main power source in off-grid areas and emergency power sources in on-grid industrial areas.

By Application Analysis

Continuous Load Segment to Dominate Due to the Increasing Actions to Equip Heavy-Duty Operations

By application, the global market is segmented into continuous load, peak load, and standby load.

The continuous load segment is projected to lead this market with a share of 49.82% in 2026, during the forecast period, as they function and act as a main power source running continuously or operated for lengthy periods. They specialize in remote projects located off the main power grid, such as mining, oil & gas, drilling, construction, and marine work, such as in large ships. These generators are built with more durable raw materials and heavy-duty components that can support the generator in running with maximum output and managing heavy loads without stopping.

Standby load is the second dominating segment in the market due to most commonly used in utility and emergency application creating its demand. The projected fast-paced growth of the standby load segment in the market reflects the increasing recognition of the importance of backup power solutions in ensuring operational continuity, data integrity, and public safety.

By End-User Analysis

Advancement in Residential Power Backup Technology to Drive Residential Segment Growth

Based on end-user, the global market of generator sales is segmented into mining, oil & gas, construction, residential, marine, manufacturing, pharmaceuticals, commercial, telecom, utility, data center, and others.

The residential segment is expected to lead the market with a share of 23% in 2026, due to the growing demand for increased urbanization and consistent power backups. The rising work-from-home trend is a primary driving factor for the segment. The (EIA) has declared a rise in residential usage of solar-powered generators for households. Rural areas face additional challenges, such as water supply at several homes from their wells, but when there’s no power, there is no way to pump the water out of the ground. Moreover, there are more chances for power loss to occur due to extreme weather, downed lines, and various other reasons, and if it is not restored quickly, the need for generators increases.

The manufacturing segment is the second leading segment in the generator sales market. Expanding manufacturing activities, particularly in developing economies, require an uninterrupted power supply for smooth production. Generators act as reliable backup options during grid outages or power fluctuations.

REGIONAL INSIGHTS

This market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Generator Sales Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Among all regions, the Asia Pacific market for generator sales holds the largest market share with a valuation of USD 10.63 billion in 2025 and USD 11.34 billion in 2026. Asia Pacific is the largest producer and consumer of generator sales. Asia Pacific has been investing heavily in developing backup power technology and infrastructure, leading to establishing high production across the region. Adopting smart technologies, including IoT-enabled generators, allows for remote monitoring, control, and predictive maintenance, further enhancing operational efficiency and reducing downtime. The Japan market is projected to reach USD 1.13 billion by 2026, the China market is projected to reach USD 4.15 billion by 2026, and the India market is projected to reach USD 2.46 billion by 2026.

The UK market is projected to reach USD 1.11 billion by 2026, and the Germany market is projected to reach USD 0.88 billion by 2026.

North American is the second leading region in the market for generator sales as it attributed to the increasing demand for renewable energy sources. The U.S. market is projected to reach USD 6.93 billion by 2026. The U.S. government has been actively promoting the use of generators due to the lack of electrical service or power failures. The U.S. government has leapt to the use of generators on the field. For instance, the U.S. Army has tapped liquid pistons to develop a lightweight battlefield power generator for the dismounted soldier. LiquidPiston, Inc. based in Connecticut is responsible for the USD 8.3 million contract for the launch of the XTS-210 rotary engine with a 10 KW compact generator set, which will be field-tested by the army later.

Key Industry Players

Rolls Royce Enhances its Collaboration with Other Players to Deliver High-Power Products

Rolls-Royce enhances its collaboration with other players to deliver high-power products. The industry has observed many product manufacturers delivering units with different power rating applications at the global and regional levels. This market has observed numerous small and large-scale participants with well-established production lines to cater to specific end-user industry segments. Furthermore, the companies increasingly focus on partnering with other players to strengthen their foothold and outline the competitive landscape.

For instance, in July 2021, Rolls Royce publicized the delivery of its generator to the renovated Testbed 108 in Bristol, U.K., from the company’s facility in Norway for the use of the 2.5 MW Power Generation System 1 (PGS1) demonstrator program.

LIST OF TOP GENERATOR SALES COMPANIES:

- Caterpillar Inc. (U.S.)

- Cummins Inc. (U.S.)

- Himoinsa (Spain)

- John Deere (U.S.)

- Aggreko (U.S.)

- Atlas Copco (Sweden)

- Ingersoll Rand (U.S.)

- Kirloskar Electric Co. Ltd. (India)

- Generac Power Systems (U.S.)

- Honda Motor Co. Inc. (Japan)

- Wärtsilä (Italy)

- DAIHATSU DIESEL MFG. CO., LTD. (Japan)

- Yanmar Holdings Co., Ltd (Japan)

- Briggs & Stratton (U.S.)

- Kohler SDMO (France)

- BGG.UK (U.K.)

- PRAMAC (Italy)

- FG Wilson (U.K.)

- Wacker Neusen (Germany)

- HiPower Systems (U.S.)

- New Way (South Africa)

- J C Bamford Excavators Ltd. (U.K.)

- Inmesol (Spain)

- Dagartech (Spain)

KEY INDUSTRY DEVELOPMENTS:

- July 2023 - Himoinsa presents its customers with a novel diagnostic system, enabling them to easily and intuitively conduct advanced diagnostic and maintenance procedures on HIMOINSA generator sets. Known as the HIMOINSA Diagnostic, this tool assists users in recognizing error codes, pinpointing specific parts and their placements, and executing tasks that entail parameter adjustments across various ECUs. These tasks encompass activities, such as sensor calibration, operational parameter configuration, and the replacement and regeneration of the DPF, among several others.

- May 2023 - Caterpillar has introduced two fresh collections of mobile generators within its XQP series of mobile diesel generator sets, meeting the requirements of EU stage 5 regulations. These new generator sets represent the highest and lowest capacities within the XQP spectrum. This development implies that Caterpillar currently provides a total of five sets, spanning from 20 to 550 kVA prime power, all following the prevailing European emissions criteria.

- April 2023- Atlas Copco has launched the NGP 130+ as the latest addition to the PSA nitrogen generator series. Simultaneously, the company has unveiled advanced control and automation technology for its smaller units. This expansion has resulted in a comprehensive premium range encompassing various sizes and features, ensuring optimal cost of ownership, dependability, and customer adaptability.

- February 2023 - Cummins Inc. has introduced readily available natural gas standby generator sets with power outputs of 175KW and 200KW for customers in North America. These newly launched generator sets form an integral component of Cummins' ongoing commitment to sustainable and innovative technologies, aligning with their "Zero Destination" strategy to achieve emissions-free products.

- May 2022 - Generac Power Systems, Inc. has announced a pair of new additions to their lineup, the Powermate 4500 Watt Dual Fuel Portable Generator and the Powermate 7500 Watt Dual Fuel Portable Generator. These two models are engineered to function flexibly, being compatible with either gasoline or LP gas as fuel sources.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.84% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Fuel Type

|

|

By Power Rating

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Country

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 35.43 billion in 2026 and is projected to reach USD 55.81 billion by 2034.

The market is likely to grow at a CAGR of 5.84% over the forecast period (2026-2034).

The diesel segment is expected to lead the market due to the development of generators globally.

The Asia Pacific market for generator sales stood at USD 10.63 billion in 2025.

The growing need for reliable backup power sources and ongoing advancements in generator technology to stimulate the generator demand are expected to drive the market growth.

Some of the top players in the market are Caterpillar Inc., Cummins Inc., John Deere, and Atlas Copco.

The global market size is expected to reach USD 55.81 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us