Home / Healthcare / Medical Device / Germany Pneumococcal Vaccines Market

Germany Pneumococcal Vaccines Market Size, Share & Industry Analysis, By Product Type (PCV10, PCV13, and PPSV23), By End User (Hospitals, Clinics, and Others) and Region Forecast, 2024 - 2032

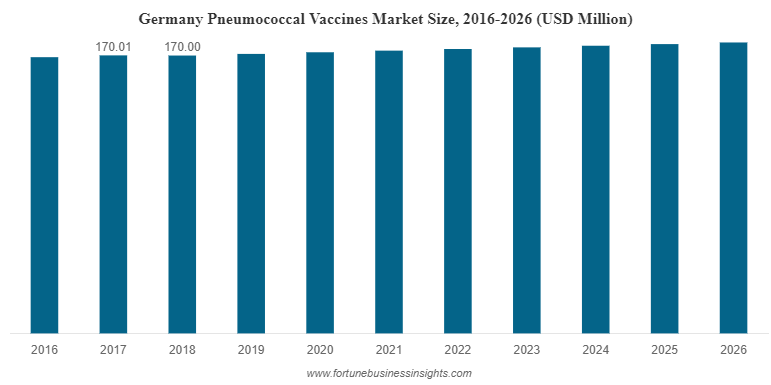

Report Format: PDF | Published Date: Sep, 2024 | Report ID: FBI101808 | Status : PublishedThe Germany pneumococcal vaccines market size stood at USD 170.01 million in 2018 and is projected to reach USD 200.9 million by 2026, exhibiting a CAGR of 2.1% during the forecast period.

Pneumonia is a severe and potentially life-threatening disease which is caused by various strains of bacteria known as Streptococcus Pneumoniae. Although the causative agents of pneumonia may often include different types of viruses, the bacteria, Streptococcus Pneumoniae, is the primary causative agent for the disease or disorder. One of the more severe cases of pneumonia is known as invasive pneumococcal disease (IPD), which is characterized by infections such as meningitis, bacteremia, and sepsis, among others. The term invasive pneumococcal disease is derived from the invasive nature of infection, invading the blood stream, and other organs which are usually free of infection.

Pneumococcal vaccines are designed to protect pediatrics and adults from acute and serious infections caused by pneumonia. There are primarily two forms of pneumococcal vaccines available, pneumococcal conjugate vaccine (PCV), and pneumococcal polysaccharide vaccine (PPSV). These vaccines contain different serotypes of pneumococcus, which are conjugated to formulate a dose for vaccinating pediatrics and adults. Different serotypes are responsible for different infections of pneumonia, including specific serotypes responsible for the more severe form of the disease known as invasive pneumococcal disease.

Among the pneumococcal conjugate vaccines, there are two major brands containing different serotypes of pneumococcus, namely Synflorix from GlaxoSmithKline plc, (most commonly known as PCV10), and Prevenar from Pfizer (most commonly known as PCV13). Both these vaccines contain different serotypes, which are usually responsible for pneumococcal infections among infants, and pediatric patients. PCV10 and PCV13 have received approvals for infants and pediatric patients, while in March 2015, Prevenar (Pfizer) received approval for adult vaccination in the European Union. The pneumococcal polysaccharide vaccine (PPSV), also known as Pneumovax 23, is offered by few manufacturers including Merck & Co., Inc., which contains serotypes which are effective against IPD cases especially in adults above the age of 50 years.

MARKET DRIVERS

“Increasing Prevalence of Pneumonia in Germany likely to Propel the Market Growth”

One of the most crucial and significant drivers for the Germany pneumococcal vaccines market growth is the rising prevalence of pneumonia, resulting in an increased patient pool. An estimated 740,000 individuals suffer from pneumonia in the country every year. While some of the patients are treated in outpatient care facilities, approximately one-third of the cases are so severe that hospitalization is necessitated. Increasing prevalence of the disease and its increasing severity are some of the causes of the growth of the market in Germany. These trends and the advantages associated with pneumococcal vaccines is expected to drive the market. Despite the presence of advanced care facilities, an estimated 12% of the patients do not survive, and this has further intensified the increasing demand for pneumococcal vaccines in the country.

“Strong Pipeline of Market Players for Pneumococcal Vaccines is Anticipated to Further Augment the Growth of the Market”

The timeline of pneumococcal vaccines has witnessed limited fluctuations with regard to the introduction of new types of vaccines over the past one or two decades. The first pneumococcal conjugate vaccine PCV7 (Pfizer) was launched in 2000. This was followed by the introduction of PCV10 (Synflorix from GlaxoSmithKline plc) in 2008, and PCV13 in 2010. During these years, the introduction of new vaccines was very few and far in between. However, numerous market players including domestic and global players have been conducting clinical trials for their pipeline candidates, with an aim to introduce new and innovative vaccines in the market. V114, a potential pipeline candidate from Merck & Co., Inc., is currently in phase-3 of clinical trials. It is a 15-valent pneumococcal conjugate vaccine expected to launch by 2023, for immunization of infants and pediatric patients. Another clinical trial is being conducted by Pfizer for its 20-valent PCV vaccine candidate 20vPnC. The vaccine is projected to be launched for immunization of adults (18 years and older). In September 2019, Pfizer announced positive preliminary results for its candidate and initiated phase-3 enrollments of patients for further clinical trials. The entry of new vaccines, with additional serotypes for immunization in pediatric and adult patients, is projected to drive the demand for these vaccines, especially in Germany. The increasing cases of pneumonia are expected to lead to the adoption of advanced pneumococcal polysaccharide vaccines.

SEGMENTATION

By Product Type Outlook

“Strong Demand for PCV13 vaccines is responsible for Dominant Share of the Segment in 2018”

On the basis of product type, the Germany pneumococcal vaccine market can be segmented into PCV10, PCV13, and PPSV23.

The PCV13 segment dominated the Germany market in 2018 with the highest market share. The introduction of a new vaccine by Pfizer, called Prevenar (PCV13) – a 13-valent pneumococcal conjugate vaccine covered all the major serotypes responsible for pneumococcal infections, especially in pediatric patients and revolutionized the pneumococcal vaccines market. This led to an upsurge in demand for this vaccine, due to the established clinical efficiency of the vaccine and reduction in the overall cost of pneumococcal disease treatment. Within a year of its launch, PCV13 was included in the national immunization program by an estimated 54 countries globally, including U.S., and major European countries. This further increased the demand for these vaccines, owing to economic benefits provided by both regional and national government agencies to patients adopting the vaccine. This along with comparatively high price of PCV13 vaccine, have been instrumental in accounting for a dominant share of the segment in the global pneumococcal vaccines market in 2018.

The PPSV23 segment held the second largest share in the Germany pneumococcal vaccines market because of advanced features such as protection against 23 types of pneumococcal bacteria as compared to the protection against 13 types of pneumococcal bacteria by PCV13. The PCV10 held the smallest market share because of its comparative technological backwardness compare to the other vaccine types.

By End User Outlook

“Clinics to Hold the Highest Share among the End User Segment during the Forecast Period”

On the basis of the end user segment, the Germany pneumococcal vaccines market can be segmented into hospitals, clinics, and others. The clinics segment holds a dominant share of the global market, owing to large preference of patients in developed and emerging countries towards clinics for immunization of pediatric patients. According to The Standing Committee on Vaccination at the Robert Koch Institute (STIKO), an estimated 90% child immunization for pneumococcal vaccines in Germany are performed at Physician’s offices, while the remaining 10% immunizations are performed at school or other government settings in the country. The hospitals segment holds the second largest market share in the end user segment.

REGIONAL ANALYSIS

Germany generated a revenue of USD 170.0 million in 2018 and is anticipated to gain high revenues during the forecast period. Stringent regulatory rules regarding vaccines in Germany, the recent establishment of rules regarding vaccinations, increased engagement by the government for promotion of increasing vaccination adoption, and the adoption of advanced PCV and PPSV vaccines in the country, are factors propelling the growth of the pneumococcal vaccines market in the country.

Germany is projected to witness moderate growth in the market during 2019-2026 and also estimated to increase its market share in the European market in the forecast period due to increased adoption of advanced vaccines and increasing vaccination rates in the country. The market in Germany can be further segmented into Baden-Württemberg, Bayern, Nordrhein-Westfalen, Hessen, Niedersachsen, Sachsen, Berlin, and others. The Nordrhein-Westfalen region in Germany is projected to account for a higher market share in the country during the forecast period. Nordrhein-Westfalen region is anticipated to register a higher growth rate because the region registers a higher birth rate compared to other regions in the country. This is expected to lead to a higher rate of pneumococcal vaccinations due to the increased number of infants and further strengthen the market in Germany. The Bayern region is anticipated to account for the second-largest market share in terms of region, but register a comparatively lower CAGR.

INDUSTRY KEY PLAYERS

“Pfizer, and Merck & Co. Inc. Dominate the German Pneumococcal Vaccines Market”

The Germany pneumococcal vaccines market is characteristically a consolidated market, with very few players operating in the global space. The market consists of a monopoly comprising of Pfizer, especially in the pneumococcal conjugate vaccines space (PCV), while a small share of the PCV segment is captured by GlaxoSmithKline plc. In the pneumococcal polysaccharide market space (PPSV23), a major chunk of market share is captured by Merck & Co., Inc., along with Sanofi and Pfizer. A strong distribution network and higher preference of healthcare providers for PCV13 (Prevenar 13) from Pfizer, along with comparatively high price of the vaccine, are some of the major factors responsible for the dominant share of the company in the global market in 2018. The approval of its 20vPnc (a 20-valent PCV vaccine) which is currently entering phase-3 clinical trials, is expected to be further augment the share of the company. Merck & Co., Inc., is projected to increase its market share amongst the key market players during the forecast period, based on projections which include successful launch of its 15-valent PCV vaccine (V-114) during the forecast period. The 15-valent PCV vaccine (V-114) recently exhibited positive results in its clinical trials. These vaccine candidates are anticipated to be launched in Europe and this also is anticipated to further strengthen the market in Germany.

LIST OF KEY COMPANIES PROFILED:

- Pfizer

- Merck & Co. Inc.

- GlaxoSmithKline plc

- Sanofi

REPORT COVERAGE

The increased demand for effective vaccinations, a stringent government vaccination policy and the adoption of advanced and technologically superior pneumococcal vaccines are expected to contribute to the Germany pneumococcal vaccines market growth.

Along with this, the report provides an elaborative analysis of the Germany market dynamics and competitive landscape. Various key insights presented in the report are pipeline analysis of key global players, pricing analysis of key products (2018), key mergers and acquisitions, prevalence of pneumonia in various regions of Germany, and immunization coverage of pediatric patients in Germany, among others.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

Study Period |

2016-2026 |

Base Year |

2018 |

Forecast Period |

2019-2026 |

Historical Period |

2016-2017 |

Unit |

Value (USD million) |

Segmentation |

By Product Type

|

By End User

|

|

|

By Country

|

INDUSTRY DEVELOPMENT:

- August 2016: The German Committee on Vaccination (“Ständige Impfkommission” or STIKO) announced an updating of the German pneumococcal vaccination policy recommending pneumococcal vaccination through a sequential vaccination scheme, i.e. pneumococcal conjugate vaccine (PCV13) followed by pneumococcal polysaccharide vaccine (PPSV23) post six months and a booster with PPSV23 every six years in immune-incompetent or high risk patients aged two years and older as well as in children and adolescents aged 2-15 years with selected underlying chronic diseases also classified as high risk patients.

Frequently Asked Questions

How much is the Germany pneumococcal vaccines market worth in Future?

Fortune Business Insights says that the Germany pneumococcal vaccines market is projected to reach USD 200.9 million by 2026.

What was the value of the Germany Pneumococcal Vaccines market in 2018?

The Germany pneumococcal vaccines market was USD 170.0 million in 2018.

At what CAGR is the Germany pneumococcal vaccines market projected to grow in the forecast period (2019-2026)?

The Germany pneumococcal vaccines market will grow at a CAGR of 2.1% during the forecast period (2019-2026)

Which is the leading segment in the Germany pneumococcal vaccines market?

PCV13 is the leading segment in the Germany pneumococcal vaccines market.

What is the key factor driving the Germany pneumococcal vaccines market?

Stringent government vaccination policy coupled with increased patient pool requiring pneumococcal vaccination will drive the growth of the Germany pneumococcal vaccines market.

Who are the top players in the Germany pneumococcal vaccines market?

Pfizer, and Merck & Co. Inc. are the top players in the Germany pneumococcal vaccines market.

Which factors are expected to drive the adoption of pneumococcal vaccines in Germany?

Increased technological advancements in pneumococcal vaccines, stringent governmental initiatives for vaccinations, strong R&D vaccination pipeline & increasing number of patients requiring pneumococcal vaccines would drive the adoption.

What are the trends in the pneumococcal vaccines market in Germany?

Increased technological superiority of new vaccines, strong German vaccination policy, presence of key market players, anticipated global product launches and subsequent regulatory approvals & increasing number of patients needing pneumococcal vaccinations are the trends.

- Europe

- 2018

- 2015-2017

- 90