Gluten-free Food Market Size, Share & Industry Analysis, By Type (Baby Food, Pastas & Pizzas, Snacks & RTE Products, Bakery Products, and Condiments & Dressings), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Drugstores & Pharmacies, and Online Retails), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

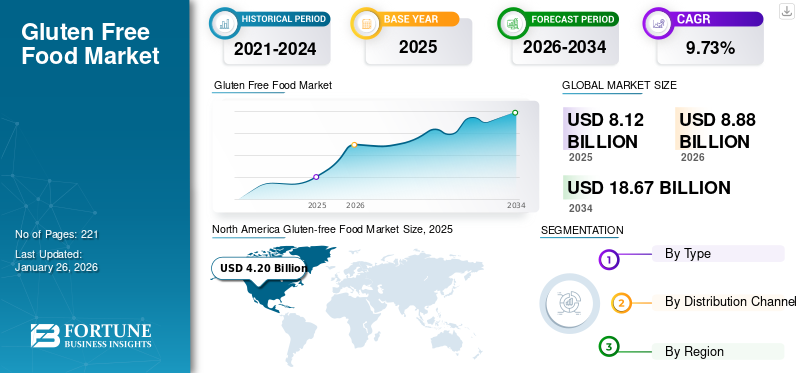

The global gluten-free food market size was valued at USD 8.12 billion in 2025. The market is projected to grow from USD 8.88 billion in 2026 to USD 18.67 billion by 2034, exhibiting a CAGR of 9.73% during the forecast period. North America dominated the gluten free food market with a market share of 51.69% in 2025.

The gluten-free food market includes food products specifically made to be free of gluten, a protein in wheat, barley, rye, and other grains. The products are primarily targeted at individuals who have celiac disease, gluten intolerance, or who have opted for a gluten-free diet for other reasons. The market involves a large variety of items, such as gluten-free bread, pasta, and snacks. The consumers' demand for gluten-free food is rising globally due to the inclination of consumers toward healthier products for health & wellness purposes.

Over the last few years, gluten-free food consumption has become a more prevalent diet trend due to the consciousness of gluten allergies and intolerances. This is due to healthier diagnostic tools becoming accessible, and an increased number of buyers are following this diet regardless of their medical needs. Major players operating in the market include The Kraft Heinz Company, Mondelez International, Inc., General Mills, Inc., Conagra Brands, Inc., and Kellanova.

Impact of COVID-19

The uncertainty and hurdles caused by the COVID-19 pandemic negatively affected the global economy, and the supply chain sector was no exception. The pandemic created challenges in the supply chain, which led to a shortage of essential edibles, trading hurdles, and business closures globally. Likewise, other industries, the market, were also harshly affected by the onset of COVID-19. During the lockdown, the import-dependent countries (the U.S. and Japan) of gluten-free raw materials, mainly rice, experienced a shortage in supply. This situation emerged as a result of China being a substantial producer of rice, which faced trade restrictions. Strict air flight control and quarantine policies led to delayed shipments and sometimes cancellations of orders, which caused backlogs.

The difficulties in the supply chain caused by the pandemic also affected the price of preservatives, sugar, rice flour/oats flour, and other raw ingredients used for gluten-free foods. The majority of gluten-free companies had to incur increased freight charges and high labor costs due to longer delivery times for raw materials. As a result, such factors affected both the demand and supply of gluten-free products.

Global Gluten-Free Food Market – Key Takeaways

Global Market Size

- 2025: USD 8.12 billion

- 2026: USD 8.88 billion

- 2034: USD 18.67 billion

- CAGR (2026–2034): 9.73%

Top Regional Markets

- North America is the largest market at USD 3.84 billion, driven by health-conscious consumers and product variety in 2024.

- Europe is estimated to reach USD 1.94 billion at a CAGR of 9.29% in 2025.

- Asia Pacific is projected to reach USD 1.32 billion, driven by rising celiac awareness and lifestyle shifts in 2025.

- South America is projected to touch USD 0.34 billion, supported by niche product launches in 2025.

Key Country-Level Markets

- The U.S. will reach USD 3.49 billion in 2025.

- The U.K. will record USD 0.60 billion in 2025.

- India is expected to hit USD 0.24 billion in 2025.

- Germany is projected at USD 0.19 billion in 2025.

- France will reach USD 0.17 billion in 2025.

- China will stand at USD 0.13 billion in 2025.

- Saudi Arabia will reach USD 0.13 billion in 2025.

- Japan will record USD 0.12 billion in 2025.

By Type

- Snacks & ready-to-eat products held a 24% share, driven by convenience and rising demand in 2024.

By Distribution Channel

- Supermarkets & hypermarkets account for 26% of global sales in 2025.

- Specialty stores are expected to grow at a CAGR of 9.58% from 2025 to 2032 due to curated offerings and expert-driven retail.

Global Gluten-free Food Market Trends

Utilization of Ancient Grains in Production of Gluten-Free Food is a Prominent Trend

Ancient grains are recognized as nutrient-rich staples in the global food industry and act as a rich source of important nutrients such as fiber, protein, bioactive compounds, and minerals. However, such traditional grains (sorghum, amaranth) were long-forgotten, mainly due to the supremacy of hydrolyzed modern grains. Lately, however, they have been rediscovered as healthy and nutritious grains for resolving the food supply chain and nutrition demand challenges.

In comparison to genetically modified modern grains (oats and corn), ancient grains provide numerous benefits in terms of nutritional value and sustainability, which makes them a captivating option. Predominantly, these ancient grains are naturally gluten-free and supply necessary amino acids, proteins, and antioxidant content. Additionally, these grains offer anti-cancer properties, aid in weight management, and improve blood sugar regulation.

As a result, these advantages necessitate food producers to explore other gluten-free grains, apart from rice, to produce gluten-free products. For instance, in February 2022, Sigma Alimentos, a Mexican brand, announced a new gluten-free amaranth-based snack wafer across the U.S. market.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Proliferating Incidences of Gluten Intolerance Bolster Demand for Gluten-Free Foods

Food allergy emerged as a public health and food safety concern globally and is currently known as the “second wave” of the allergy-based epidemic. However, food sensitivities and allergies have been recognized for centuries. Their prevalence has increased notably in recent years across both developed and developing nations.

Among several food allergies, gluten intolerance is considered one of the most prevalent allergies faced by global consumers. Predominantly, a possible reason for the spike in celiac patients is due to a sudden change in dietary habits. Over recent years, a considerable shift has been witnessed in consumers’ eating habits due to their inclination toward packaged processed foods. In today’s time, ultra-processed items have become highly popular due to shelf stability and convenience. These products are mainly composed of rye, barley, and wheat, which are the main sources of gluten and act as stabilizers/thickeners for the item. Thus, such high dependency on processed food in the form of snacking triggers gluten sensitivity, further driving the demand for gluten-free options.

Growing Consumer Reliability on Convenience Foods to Augment Growth

Consumers’ demonstration of a surge in demand for convenience and ready-to-eat meals due to their ease of consumption and preparation has positively impacted product demand. They seek ready meals that have high nutritional value, are natural, and align with their dietary requirements without compromising the taste and flavor. The most important aspect of consumers’ reliability on this type of food is the ability to help maintain their overall health amidst a fast-paced lifestyle. The rise in the working women population has increased their dependency on such ready-to-cook & eat meals as they save time and offer the required nutrition. As per the Bureau of Labor Statistics, the labor force rate of women reached 77.8%, which was the peak rate in June 2023. Furthermore, the rise in the health on-the-go trend, especially among millennials, has influenced convenience food manufacturers to come up with premium convenience foods such as deli-style snacks and ready meals inspired by world cuisines. This factor indicates consumers’ willingness to experiment with various foods, which offers ample opportunities for the gluten-free food market growth in the coming years.

Market Restraints

Hurdles in Maintaining Consistency, Lack of Awareness, Poor Shelf Life, and Surging Production Costs of Gluten-Free Products Obstruct Market Potential

One pivotal factor hindering the industry’s growth is the difficulties in maintaining the consistency of gluten-free items. Gluten, especially found in rye, barley, and wheat, is known to offer structure and elasticity to numerous sweet & savory baked snacks. The lack of cohesiveness in dough due to the absence of gluten can result in poor shelf life, texture, and volume of gluten-free products. Moreover, such types of products mainly utilize alternative additives and ingredients such as tapioca starch and rice flour, which are difficult to balance at times and may impact the overall sensory qualities.

The lack of awareness of gluten-free items among consumers is another hurdle that limits growth. Globally, most consumers have misconceptions or incorrect beliefs regarding gluten-free food, especially about its nutritional profile or reasons for adopting a gluten-free diet. Other than consumers, poor nutrition literacy among healthcare providers can also hamper the market’s potential, as they are the primary information source for patients. Another hurdle in the growth of the market is the high price of gluten-free items, such as bread, cookies, and pasta, which is mainly attributed to the complex production techniques of these food products. As a result, limited awareness adversely affects the market’s growing momentum.

Market Opportunities

Technological Advancements Pave Growth Prospects for Gluten-Free Industry

In today’s world, technology plays a massive role in the food industry, improving efficiency and driving product innovation, allowing operators to adapt to evolving market demands quickly. Along with this, the rising labor costs are also a considerable driving force for the adoption of technology. When labor costs increase, most businesses explore ways to streamline their production processes or automate tasks to minimize their dependency on human labor.

Likewise, prominent firms in the market are concentrating on utilizing advanced technology, which can mechanize tasks and strengthen the nutritional value and overall quality of food products. For instance, microencapsulation can be utilized in gluten-free food production to improve sensory qualities and extend its freshness. Moreover, extrusion technology is another technique in the market, particularly used for gluten-free pasta. This technology is known for enhancing textural properties.

Segmentation Analysis

By Type

Bakery Products Led Market Owing to Their Rising Popularity

Based on type, the market is segmented into baby food, pasta & pizzas, snacks & RTE products, bakery products, and condiments & dressings.

Bakery products emerged as the leading segment in the market due to growing popularity,with a share of 44.59% in 2026. They offer health benefits of gluten-free baked goods such as cookies, pastries, breads, baking mixes, and others. As bakery products are among the staple foods in Europe and North America, their demand has increased among the gluten-intolerant population and health-conscious individuals. Thus, manufacturers in these regions are launching new gluten-free baked items, which can fuel the market’s growth. For instance, in December 2023, Oreo, a brand of Mondelez, launched gluten-free golden cookies, which are their latest addition to the product range. These cookies are available in two main flavors: chocolate soft snack cakes sandwiched between peanut butter filling and peanut butter cakesters. Further, the growing innovation in the bakery sector in developing economies such as India, China, and others is likely to aid the segment's growth.

Snacks & Ready-to-Eat Products led the product category in 2024, accounting for 24% of the market share, driven by rising demand for convenient gluten-free options. The snacks and RTE products segment is witnessing significant traction among consumers due to its convenience and nutritional benefits. Due to the constrained time limit, people turn toward these convenience foods as they save food preparation and clean-up time. The introduction of various innovative and attractive foods by companies to suit hectic consumer lifestyles may contribute to the segment’s growth in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

Convenience Stores Dominated Due to Their Wide Range of Offerings

Based on distribution channel, the market is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, drugstores & pharmacies, and online retails.

On the basis of distribution channel, the convenience stores segment accounted for a major share contributing 40.65% globally in 2026. The retail sales channel offers products of various brands and price ranges for consumers to choose from. Additionally, convenience stores offer most of the essential household and grocery products, which allows consumers the ease of purchase. Further, easier accessibility and the presence of numerous convenience stores are likely to propel the segment’s performance.

- Supermarkets and hypermarkets accounts for 26% of the global sales in 2025, due to wide accessibility and shelf presence offered by them.

- Specialty stores are expected to grow at a CAGR of 9.58% during 2025–2032 due to consumers seeking curated gluten-free offerings and expert guidance.

Supermarkets/hypermarkets are gaining popularity due to their one-stop shopping benefits. These mass merchandisers offer various lucrative schemes to draw consumers' attention, such as a discount on product prices, bulk purchasing schemes, and others. Mass merchandisers stock up their shelves with free-from foods and dedicated product aisles, thereby driving the segment growth.

Global Gluten-free Food Market Regional Outlook

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Gluten-free Food Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global gluten-free food market. The dominance of the region is owing to multiple factors such as rising preference for healthier lifestyle and increasing awareness regarding disadvantages of excessive gluten consumption. The U.S. market is estimated to reach USD 3.82 billion by 2026.

In the North America region, the U.S. dominates the gluten-free food market share, driven by factors such as increased diagnosis growth rates, intensified public awareness, growing wellness trends, and a healthy culture of dietary experimentation. The comparatively higher awareness about celiac disease among consumers in the region and their growing inclination toward maintaining a healthier diet have positively impacted the regional market. The Japan market is estimated to reach USD 0.13 billion by 2026, the China market is estimated to reach USD 0.15 billion by 2026, and the India market is estimated to reach USD 0.27 billion by 2026.

- U.S. will reach USD 3.49 billion by 2025, driven by large-scale gluten-free production and increasing label transparency.

According to Beyond Celiac, a research-driven celiac disease organization’s report in 2020, approximately 1% of the U.S. population will be diagnosed with celiac disease. This factor has influenced people to switch to alternatives to gluten-based foods to avoid gluten-related health complications. As bread is one of the most consumed products in the region, consumers are shifting toward baking their bread using gluten-free flours such as amaranth, tapioca, sorghum, and others. The UK market is estimated to reach USD 0.65 billion by 2026, and the Germany market is estimated to reach USD 0.21 billion by 2026.

For instance, in January 2021, Little Northern Bakehouse, a Canadian plant-based producer, launched gluten-free breads such as organic oatmeal, organic ancient grain, and organic original. Further, the gluten-free bakery category transitioning into a mainstream segment and evolving consumers’ sentiments regarding the free-from category is projected to support regional market growth.

North America was the largest regional market in 2023, valued at USD 3.52 billion, and grew to USD 3.84 billion in 2024, driven by a strong presence of health-focused consumers and product availability.

Europe

Europe accounted for a significant share of the market, attributable to the increase in demand for free-from foods. The U.K., Italy, and Germany have emerged as potential markets for gluten-free products as consumers seek healthy nutrition. Various food manufacturers are coming up with products such as gluten-free pasta. For instance, in January 2024, Dell’Ugo, a well-known producer of pasta in the U.K., strengthened its portfolio by launching a new gluten-free range of pasta and gnocchi dishes, which will cater to the rising gluten-free consumer demands. Products launched include gluten-free four cheese sauce, gluten-free ricotta & spinach cannelloni, and gluten-free fresh potato gnocchi. They are also investing in technologies to mass-produce these products quickly. Further, the fast-paced lifestyle of consumers, along with the rise in the meal snacking trend, is likely to boost regional market growth.

Europe is projected to be the second-largest market in 2025, valued at USD 1.94 billion, with a CAGR of 9.29% from 2025 to 2032.

- U.K. is expected to hit USD 0.60 billion by 2025 due to strong awareness and specialty products availability.

- Germany will record USD 0.19 billion by 2025, supported by wellness trends and dietary preferences.

- France will reach USD 0.17 billion by 2025 on the account of rising health-conscious urban consumers.

Asia Pacific

Asia Pacific is experiencing dynamic growth, driven by rising health awareness, changing dietary preferences, and a gradual increase in the diagnosis and recognition of celiac disease and gluten intolerance.

Australia stands out as one of the most mature and rapidly evolving gluten-free markets in the region. The prevalence of celiac disease in Australia is relatively high compared to global averages, with 1% of Australians affected, and a significant portion of the population also self-identifies as gluten-sensitive. Consequently, gluten-free products are widely available in supermarkets, specialty stores, cafes, and restaurants. Australian food brands are among the most innovative, offering high-quality gluten-free bread, cereals, pasta, baked goods, snacks, and ready meals.

Asia Pacific is expected to be the third-largest market in 2025, reaching USD 1.32 billion, due to awareness regarding celiac disease and dietary preferences.

- China will reach USD 0.13 billion by 2025, fueled by online platforms and Western dietary habits.

- India will reach USD 0.24 billion by 2025, with demand for gluten-free food rising from gluten intolerance diagnoses and free-from demand[MP1] .

- Japan is projected at USD 0.12 billion by 2025, supported by clean-label trends and dietary requirements of the aging population.

India represents another key market with tremendous potential for gluten-free growth, though its dynamics are distinct from those of Western countries. Traditionally, many Indian diets have relied heavily on wheat-based staples such as chapati, paratha, and puri, especially in the northern regions. Though the diagnosis rate of celiac disease in India is still relatively low due to limited awareness, the country has witnessed a noticeable rise in demand for gluten-free foods, particularly among urban, educated, and health-conscious consumers.

South America

In South America, the food choices of consumers are being redefined as they prioritize the consumption of their food and drinks that do not contain gluten, driving demand for gluten-free versions of products. Traditionally, South American diets have included naturally gluten-free staples such as rice, corn, potatoes, beans, quinoa, and cassava, which form the basis of many local dishes. However, as processed and wheat-based foods became more prevalent over recent decades, particularly in urban areas, the need for organic, gluten-free options also grew. As South America's middle class grows and health awareness increases, the gluten-free sector is becoming a vibrant part of the food market.

- South America is forecasted to be the fourth-largest regional market, reaching USD 0.34 billion in 2025, aided by niche product launches.

Brazil is the top player in South America's market, both as a consumer and producer. Being the continent's largest country in terms of population and possessing a growing middle class and a vibrant culture of health and physical fitness, Brazil has been an opportunistic platform for gluten-free innovation. The development of the market in Brazil is also driven by organizations such as the Brazilian Celiac Association (ACELBRA) that promote greater labeling, education, and availability of safe products. Cheese breads made from cassava called "pão de queijo," which is a naturally gluten-free traditional snack, have been newly popular in the country with gluten-sensitive consumers and are being developed further with healthier, more functional ingredient profiles.

Middle East & Africa

The market in the Middle East & Africa region is witnessing steady and promising growth, fueled by a mix of growing health consciousness, growing cases of celiac disease and gluten intolerance, an expanding middle class with improved disposable incomes, and changing food consumption habits. In the last decade, there has been a significant change in the food consumption patterns of consumers in the Middle East & Africa, driven by international health trends and awareness of the significance of dietary control in the prevention of chronic diseases. In the Middle East region, nations such as UAE, Saudi Arabia, Israel, and Qatar are leading the charge of the gluten-free revolution. These countries have wealthy populations with expanding health awareness and serve as regional hotspots for innovation, tourism, and food imports.

In UAE and Saudi Arabia, particularly Dubai, Riyadh, Jeddah, and Abu Dhabi, the gluten-free market has grown quickly, driven by a cosmopolitan population that is quick to embrace international health trends. Upscale health food cafes and shops target those who look for gluten-free and allergen-safe options. Restaurants, particularly those serving expats and tourists, have gluten-free menus clearly visible to attract consumers looking for customized food needs.

- Saudi Arabia will stand at USD 0.13 billion by 2025, led by increasing health awareness and wider import availability.

Competitive Landscape

Key Market Players

Portfolio Expansion Has Been a Notable Strategy Adopted by Key Market Players to Expand Their Geographical Reach

Earlier, gluten-free food was scarce and could only be found in selective retail stores. However, changing times and increasing demand have nudged the manufacturers to ponder product innovations. The consortium of various large and small regional key players results in a fragmented market structure. Kellogg’s Company, Kraft Heinz Company, Conagra Brands, Inc., and others are capitalizing on expanding their product portfolio along with expanding their geographical reach. For instance, in March 2024, The Kraft Heinz Company announced its entry into the gluten-free line and launched KD Mac and Cheese, its first plant-based offering across Canada.

List of Key Gluten-free Food Companies Profiled

- Alara Wholefoods Ltd (U.K.)

- Barilla Group (Italy)

- Katz Gluten Free (U.S.)

- The Kraft Heinz Company (U.S.)

- Mondelez International, Inc. (U.S.)

- General Mills, Inc. (U.S.)

- Prima Foods Ltd. (U.K.)

- Conagra Brands, Inc. (U.S.)

- The Hain Celestial Group, Inc. (U.S.)

- Kellanova (U.S.)

Key Industry Developments

- September 2024 – Bay State Milling, a U.S.-based family-owned firm, released the news of acquiring Montana Gluten Free, a food products supplier located in the U.S. This acquisition is expected to boost the product offerings.

- February 2024 – Grupo Bimbo SAB de CV, a Mexican food firm, acquired a Spanish gluten-free bread producer, Amaritta Food SL. The acquisition was announced on 19th February by the CEO.

- July 2023 - Gluten Free Easy, a woman-owned enterprise in the U.S., introduced its first retail line of gluten-free pizza dough, sheets, pita, puff pastry squares, among others, across the U.S.

- May 2022 – Agricultural and Processed Food Products Export Development Authority (APEDA), an Indian statutory body, launched gluten-free millet items, such as cream and milk biscuits, for all age groups.

- September 2021 - Ardent Mills, a food items supplier in the U.S., revealed the news of acquiring all the business assets of Firebird Artisan Mills, a gluten-free products company located in the U.S.

Report Coverage

The gluten-free food market report analyzes the market in depth and highlights crucial aspects such as prominent companies, competitive landscape, type, and distribution channel. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.73% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD 8.12 billion in 2025 to USD 18.67 million by 2034.

Fortune Business Insights says that the global market value stood at USD 8.12 billion in 2025.

The global market will exhibit a CAGR of 9.73% during the forecast period 2026-2034.

By type, the bakery products segment led the market.

The growing awareness about health and the rising adoption of gluten-free products are likely to drive the market.

General Mills, Mondelez International, and Kellanova are some of the leading players globally.

North America dominated the global market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us