Gluten-Free Pasta Market Size, Share & COVID-19 Impact Analysis, By Raw Material (Chickpeas, Brown Rice, Multigrain, Lentil, and Others), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience/Grocery Stores, and E-commerce), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

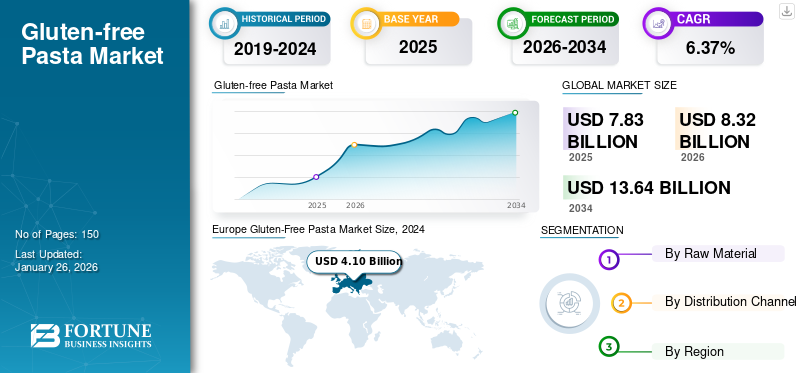

The global gluten-free pasta market size was valued at USD 7.83 billion in 2025. The market is projected to grow from USD 8.32 billion in 2026 to USD 13.645 billion by 2034, exhibiting a CAGR of 6.37% during the forecast period 2026-2034. Europe dominated the gluten-free pasta market with a market share of 55.66% in 2025.

Moreover, the U.S. gluten-free pasta market is projected to reach USD 2.54 billion by 2032, owing to increasing gluten intolerance and dietary trends.

Gluten-free pasta is made from ingredients that do not contain gluten, such as corn, chickpeas, lentils, and others. These products are specifically designed for consumers with an allergy to gluten, people with celiac disease or any other digestive disorders that cause difficulty in digestion of gluten products. Furthermore, the grains used in the production of gluten-free products such as brown rice, corn, chickpeas, and others are known for containing significant amino acids, thus being highly nutritious, which is one of the major factors contributing toward their adoption in the global market.

In addition, in recent times, new emulsifiers and ingredients have been developed that can assist in replicating the texture and taste of products that have gluten. This factor is expected to bolster the gluten-free pasta market growth. Moreover, multigrain, which is made from two or more grains, is one of the major raw materials used in the production of gluten-free pasta, which owes to its texture and quality, significantly resembling conventional pasta.

COVID-19 IMPACT

Increased Consumption of Multigrain Products and Sudden Lockdown Implementation Had a Mixed Impact

The COVID-19 pandemic significantly impacted food production on account of the sudden implementation of lockdowns by several governments across the globe, which resulted in the closing down of factories during the pandemic’s initial stages. In addition, the companies faced a shortage of laborers, which further restricted and had a negative impact on the overall production of food and beverage products. Furthermore, the closing of borders had a significant impact on the supply chain, with increased freight charges during the pandemic.

However, owing to the pandemic, consumption patterns among individuals saw a significant shift with a rise in the consumption of healthy food products. Consumers stockpiled food products, including chickpeas, multigrain, and other healthy pasta products, which have a long shelf life and high nutritional benefits. The sudden increase in demand and supply chain constraints resulted in a surge in prices of chickpeas, corn and other grains used in the production of gluten-free pasta. Thus, the increased cost and demand led to moderate growth and asserted a mixed impact on the market.

Gluten-Free Pasta Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 7.83 billion

- 2026 Market Size: USD 8.32 billion

- 2034 Forecast Market Size: USD 13.64 billion

- CAGR: 6.37% from 2026–2034

Market Share:

- Europe dominated the gluten-free pasta market with a 55.66% share in 2025, supported by strong cultural affinity for pasta, rising health consciousness, and growing demand for low-gluten alternatives in countries like Italy and Greece.

- By type, the multigrain segment is expected to retain the largest market share in 2025, driven by its improved texture, higher fiber content, and rising consumer preference for nutrient-dense, gluten-free formulations.

Key Country Highlights:

- United States: Projected to reach USD 2.54 billion by 2032, owing to increasing gluten intolerance, product innovations, and growing preference for multigrain and wholegrain pasta options.

- China: Rapid adoption of Western diets and rise in working-class population are driving demand for convenient and healthy pasta alternatives.

- Japan: Gluten-free pasta demand is growing due to increasing awareness of celiac disease and a cultural preference for light, health-focused meals.

- Brazil: As one of the top pasta producers globally, Brazil is witnessing rising demand for gluten-free variants, supported by urbanization and growth in health-conscious consumers.

Gluten-Free Pasta Market Trends

Changing Consumer Lifestyle and Increase in Demand for Healthier Products to Fuel Market Growth

The pandemic has significantly influenced global food and beverage consumption trends, and thus, a rise in the consumption of nutritional, convenient, and vegan food products has shown rapid growth. These rapid changes in consumption patterns among individuals have resulted in the adoption of a vegan or vegetarian diet and rising demand for plant-based food products. Furthermore, the increasingly fast-paced lifestyle and the rising influence of Western culture in developing markets have further contributed to the increasing demand for pasta products.

These changing consumer trends have positively fueled the demand for gluten-free pasta as these pasta products are made from chickpeas, multigrain, and other ingredients that are nutritious and healthy. Thus, manufacturers are creating new product varieties containing organic grains to cater to the market needs. For instance, in January 2023, Jovial Foods announced its all-new organic product.

Download Free sample to learn more about this report.

Gluten-Free Pasta Market Growth Factors

Increasing Prevalence and Awareness of Celiac Disease to Drive the Market Growth

Celiac disease is hereditary; one needs to inherit specific genes, which are variants of HLA-DQA1 and HLA-DQB1 genes. These genes are said to provide instructions that make proteins that play an important role in the immune system. The disease is autoimmune and is triggered when one eats food that contains gluten, such as wheat, barley, and others, leading to a significant demand for gluten-free products, including pasta. Thus, the increasing number of individuals with celiac disease is fueling the demand for gluten-free products, including pasta and is said to be driving the gluten-free market globally.

The increasing awareness of the health benefits of consuming gluten-free products is further said to fuel the market growth during the forecast period. In addition, the increase in the number of product launches and new product developments by major players is poised to contribute toward the growth. For instance, in June 2022, ZENB, one of the leading producers of plant-based products, announced the launch of its all-new gluten-free spaghetti.

Augmentation in Consumer Inclination toward Western Cuisine in the Asia Pacific to Fuel the Market Growth

Western cuisine is highly convenient in terms of preparation, and with the increasing urbanization in Asian countries, the consumption of convenient food products such as pasta has shown rapid growth in recent years. Countries such as South Korea, India, China, and Australia have been showing significant economic development owing to the rising number of double-income households in these countries.

Furthermore, with the increasing Western influence owing to the rapid adoption of social media and increasing internet penetration in these countries, the demand for new and varied pasta dishes has shown rapid growth. The trend of cooking different and artistic recipes was on the rise resulted in being resulting in rapid growth in the global market post-pandemic. Thus, the rapid adoption of Western cuisine in the Asia Pacific region and the increasing prevalence of cooking new and creative recipes at home shall drive the growth of the global market.

RESTRAINING FACTORS

Challenges Faced while Maintaining the Consistency in Taste and Texture of Gluten-Free Products May Restrain the Market Growth

The product is manufactured using grains such as corn, chickpeas, and others or also by mixture of these grains which is called multigrain pasta. Gluten is protein which gives a consistency in terms of texture and taste of food products by forming a protein network. As the major ingredient of gluten free products to eliminate gluten, it impacts the texture and taste quality of these products which restraints the growth of this market.

For instance, as per the European Commission, the current major problem which is faced by the gluten free pasta industry is the presence of high rate of starch and low rate of fiber in the products. These products also have less shelf life as compared to conventional products, are significantly denser, crumbly, and dry in terms of texture, and most import is for the strong off-flavors.

Gluten-Free Pasta Market Segmentation Analysis

By Raw Material Analysis

Multigrain Segment Dominated Due to Demand for Gluten-Free Products Made From Multigrain Pasta Products

The Multigrain segment led the market accounting for 42.29% market share in 2026. Based on raw material, the gluten-free pasta market is classified into lentils, brown rice, chickpeas, multigrain, and others, from which the multigrain segment holds the dominant share in the global market. Among raw materials, the multigrain is used to produce the best variety of products in the market. The significant growth in consumption of health and nutrition-based food products is one the major factors that has been driving the demand for gluten-free products, specifically the multigrain pasta products in the global market. In addition, the multigrain segment has a higher number of products available in the market to address this issue. The grains, when mixed, eliminate the brittleness and have a better texture and taste; thus, manufacturers are focused on launching new and advanced multigrain products in the market to cater to the demand.

Other than multigrain, brown rice holds a significant share in the global market owing to its ability to hold together and maintain consistency in taste. As the market is driven by taste, which resembles conventional pasta products, brown rice, owing to its highly resembling taste, is one of the most preferred gluten-free pasta products among consumers. Furthermore, brown rice, which is one of the healthy food products preferred among consumers who are more inclined to healthy eating habits, further contributes towards the global market growth.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Supermarkets/Hypermarkets Segment to Dominate Due to Easier Accessibility to More Comprehensive Product Range

Based on distribution channels, the market is divided into convenience/grocery stores, e-commerce, and supermarkets/hypermarkets. Among the several distribution channels, supermarkets/hypermarkets do hold highest share in the global market and is expected to have a significant growth in the forecast period. The Supermarkets/Hypermarkets segment led the market accounting for 43.01% market share in 2026. Consumers get the option of choosing products through proper inspection of ingredients and formulating an informed purchase decision through these distribution channels. Moreover, supermarkets/hypermarkets are designed based on providing higher convenience and are accessible to consumers allowing them to select products from a wide range of options offered by supermarkets.

Other segments, including e-commerce, are also expected to witness strong growth during the forecast period. The adoption of these channels is poised to increase significantly as they offer the ease in purchasing products at home.

REGIONAL INSIGHTS

By region, the market is divided into North America, Europe, South America, the Middle East & Africa, and the Asia Pacific.

Europe Gluten-Free Pasta Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 4.36 billion in 2025 and USD 4.65 billion in 2026. Pasta has been considered a traditional meal in this region for a long time, especially in Italy and Greece. In addition, owing to the recent growth in health-conscious behavior among individuals in this region, the demand for high carbohydrate-based food products has decreased in recent years, and thus a positive growth has been addressed in gluten-free product consumption, including pasta.

To know how our report can help streamline your business, Speak to Analyst

The North American region is the second most significant consumer of pasta due to the presence of the U.S., one of the largest consumers globally. Furthermore, the higher number of celiac disease patients and rapid growth in awareness among individuals has raised the demand for the product in the region. Thus, new products made from multigrain, wholegrain, and other gluten-free grains are being launched in the market. Furthermore, product recipes, such as gluten-free pasta salad with gluten-free pasta sauce, are provided in different restaurants and deli counters for consumers who are demand a quick meal. For instance, Senza Gluten is one of the well-known gluten-free restaurants in New York, which offers an extensive range of gluten-free food dishes, including several dishes of pasta to cater to the increasing consumer base.

The rapid growth in the adoption of Western diets has raised the demand for products such as pasta in China, India, Japan, South Korea, and Southeast Asian countries. Owing to this factor, the Asia Pacific is expected to be the fastest-growing region during the forecast period. Furthermore, with an increase in the working population and growth in disposable income, the demand for convenience food products has increased significantly in the region.

Brazil is one of the largest pasta product producers, followed by Italy and the U.S. The per capita consumption in South America and the Middle East & Africa has shown moderate growth in recent years. For instance, as per Claudio Zanão, chairman of the International Pasta Organization (IPO), the countries in regions such as the Asia Pacific, the Middle East & Africa, and South America which have recently been introduced to pasta or have been moderate consumers of pasta are going to play a significant role in industry growth in coming years. Furthermore, owing to the rising urbanization in these regions, the demand for convenient food products has gained decent traction and thus is said to have a significant growth during the forecast period.

Key Industry Players

Development of Innovative Products by Key Players to Gain Higher Market Share

Some of the major players and gluten-free pasta brands operating in the market include Barilla G.e.R.F.lli S.p.A., The Kraft Heinz Company, Jovial Foods, and Banza LLC. The market has recorded a rise in health conscious mindset among individuals. Thus, manufacturers are focused on developing innovative product lines using legumes, barley, and rice to attract the rapid evolving consumer base which is more inclined towards healthy food consumption. For instance, in May 2021, Caulipower, a U.S.-based company, launched cauliflower-based products for the market. This new gluten-free frozen product is available in two forms: linguine and pappardelle. In addition, in 2020, the U.S.-based gluten-free product manufacturer Jovial Foods launched organic, jovial gluten-free pasta in the market. These products are available in five different shapes: spaghetti, fusilli, penne, elbows, and orzo.

LIST OF TOP GLUTEN-FREE PASTA COMPANIES:

- Barilla G. e R. F.lli S.p.A. (Italy)

- Jovial Foods Inc. (U.S.)

- Banza LLC (U.S.)

- Doves Farm Foods Ltd (U.K.)

- Quinoa Corporation (U.S.)

- Rummo S.p.A (China)

- The Kraft Heinz Company (U.S.)

- LE VENEZIANE SRL (Italy)

- ZENB (U.K.)

- Cappello's (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Pasta Rumo, a family-run business, announced the launch of its gluten-free products range across the whole foods market in the U.S. The expansion in the distribution channel aims to increase its presence in the leading pasta-consuming country.

- October 2022: Barilla, which is one of the major pasta manufacturers based in Italy, launched a brand new line of product. This new product line called Al Bronzo consists of six different types of gluten-free pasta. The company, with its new product range and manufacturing process, is looking forward to expanding its business in the rising gluten-free product demand in Europe.

- December 2021: Agro Tech Foods Ltd., known for its FMCG products globally, added a new segment to its existing ready-to-cook segment under its Sundrop brand with all-new homemade products called Sundrop Min Yum Gluten free pasta.

- July 2021: Bona Furtuna one of the prominent pasta manufacturer announced the launch of its all new organic gluten-free pasta product range made with ancient grains. With this launch the company has officially entered the organic market and aims in further expansion with the extensive product range including Rigatoni, Linguine, Casarecce, and Paccheri.

- September 2020: AGT Food and Ingredients, which one of the prominent manufacturer based in Canada, announced the launch of its all new VeggiGluten Free Pasta made with pea. The new launch is to expand its product range towards healthy food alternative with the rising demand among consumers for healthy alternative in the pasta market.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as competitive landscape, raw materials, and distribution channels. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.37% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Raw Material

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 7.83 billion in 2025.

The market is projected to grow at a CAGR of 6.37% during the forecast period (2026-2034).

Multigrain type is expected to be the leading raw material segment in the global market.

The increasing prevalence and awareness of celiac disease are expected to drive the growth of the global market.

Barilla G. e R. Fratelli S.p.A, Jovial Foods, LLC, and The Kraft Heinz Company are a few of the top players in the global market.

Europe is expected to hold the largest market share throughout the forecast period.

In terms of distribution channel, the e-commerce segment is expected to depict a strong growth during the forecast period.

The challenges faced during the maintenance of texture and taste in gluten-free products may restrain the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us