Glycerine Market Size, Share & Industry Analysis, By Grade (USP Grade and Technical Grade), By Application (Personal Care, Food & Beverages, Pharmaceuticals, Polyether Polyols, Chemical Intermediate, Tobacco, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

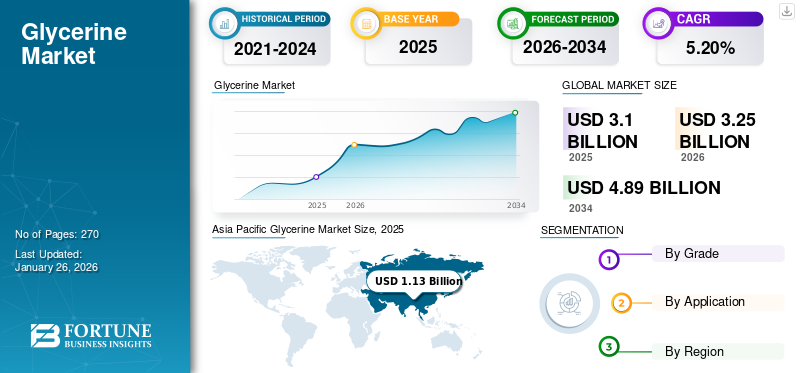

The global glycerine market size was valued at USD 3.1 billion in 2025 and is projected to grow from USD 3.25 billion in 2026 to USD 4.89 billion by 2034, exhibiting a CAGR of 5.20% during the forecast period. Asia Pacific dominated the glycerine market with a market share of 36.40% in 2025.

Glycerine, also known as glycerol, is a simple polyol compound that exists as a colorless, odorless, viscous liquid with a sweet taste and non-toxic properties. It has several applications due to its unique physical and chemical properties. It serves as a solvent, humectant, sweetener, and it may help preserve foods. In personal care formulations, it is valued for its effectiveness as a moisturizer, helping to soften and smooth the skin. It is also used in the production of certain pharmaceuticals and acts as an ingredient in antifreeze and is used in e-liquid for e-cigarettes, showcasing its versatility across various industries.

The COVID-19 pandemic impacted the economies of India, China, and the U.S. In order to prevent the spread of the virus, governments imposed strict lockdowns that restricted the movement of people and business activities, such as manufacturing units, sales offices, and logistics services. This had a severe impact on the chemical industry, affecting the supply and demand of various chemical products, including glycerine. Major producers faced shortages of workforce and raw materials. Furthermore, the demand from end-use applications such as personal care, cosmetics, and chemical intermediates also declined for a brief period. Despite the uncertainties, the market recovered from the effects of the pandemic. Demand for the product increased owing to the rise in activities of end-use industries.

Global Glycerine Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 3.10 billion

- 2026 Market Size: USD 3.25 billion

- 2034 Forecast Market Size: USD 4.89 billion

- CAGR: 5.20% during the forecast period (2026-2034)

Market Share:

- Asia Pacific dominated with a 36.40% market share in 2025.

- U.S. glycerine market projected to reach USD 470.13 million by 2032, driven by personal care, pharmaceuticals, and food processing sectors.

Regional Insights

- Asia Pacific: Largest market share in 2025, expected to lead through forecast period. Growth driven by booming personal care and pharmaceutical industries, textile, paper, plastics manufacturing, and increasing biodiesel production.

- Europe: Demand driven by stringent regulations, safe ingredient mandates, and growth in food, pharma, and cosmetics industries. Growing biodiesel industry supports steady glycerine supply.

- North America: Strong demand from personal care, cosmetics, and pharmaceuticals, with rising interest in natural, organic products.

- Latin America: Driven by large agricultural sector and biodiesel production, especially in Brazil.

- Middle East & Africa: Growth supported by urbanization, rising personal care and pharmaceutical consumption, food & beverage sector, and increasing biofuel adoption.

Glycerine Market Trends

Rise in Biodiesel Production to Open up New Market Growth Opportunities

Glycerine, a by-product of the biodiesel manufacturing process, can be refined for use in various industries. The rise in biodiesel production directly correlates with an increase in product supply and affordability, creating new opportunities for market growth. For instance, there is a growing interest in exploring glycerol's potential as a base chemical for producing sustainable chemicals and materials. One emerging application is its use in producing propylene glycol, a compound used in the manufacturing of unsaturated polyester resins. Such initiatives align with sustainability goals and reduce consumption of crude oil-based feedstock. As biodiesel production across the globe increases, product availability is also expected to increase. This would provide a steady stream of the product, prompting end users such as chemical manufacturers to develop processes that use the product as a raw material. This, in turn, is likely to benefit and create new market growth opportunities during the forecast period.

Download Free sample to learn more about this report.

Glycerine Market Growth Factors

Increased Demand in Personal Care and Pharmaceutical Industry to Drive Market Growth

The growing product demand in the personal care and pharmaceutical industries is anticipated to boost the market significantly. Glycerine is a basic polyol compound extensively utilized for its exceptional moisturizing properties. It serves as a crucial component in numerous skincare, haircare, and personal hygiene products. Its ability to retain moisture and enhance skin barrier function, makes it effective in reducing the signs of aging, contributing to its widespread use in the personal care sector. In addition to this, the product is highly valued in the pharmaceutical sector for its role as a solvent and sweetening agent. It is used in the formulation of cough syrups, elixirs, and expectorants due to its therapeutic properties. Additionally, the product is utilized in suppositories, ointments, and creams, showcasing its versatility and importance in medical formulations. The global expansion of the personal care and pharmaceutical industries, driven by higher disposable incomes and an aging population seeking anti-aging products, contributes to the increased product demand. This, in turn, is expected to benefit and drive glycerine market growth during the forecast period.

RESTRAINING FACTORS

Fluctuating Raw Material Prices are Expected to Limit Market Growth

The product demand can be significantly impacted by fluctuations in the prices of raw materials. Various factors, such as global economic conditions, trade policies, and changes in cost dynamics, can influence product demand. For instance, an increase in the price of raw materials such as vegetable oils or animal fats can raise production costs, subsequently surging product prices and reducing demand as buyers seek cheaper alternatives. These fluctuations in the availability and price of raw materials can disrupt the supply chain; a shortage of vegetable oils, for instance, could reduce biodiesel production, and limit the supply of glycerine as a by-product. This scarcity could drive up product prices, impacting its demand. Frequent and unpredictable price fluctuations in raw materials can make it difficult for producers to plan and competitively price their products. This unpredictability may cause cautious purchasing behavior among buyers, thereby reducing overall demand and hampering market growth.

Glycerine Market Segmentation Analysis

By Grade Analysis

USP Grade Segment Accounted for the Largest Share Owing to its High Demand from Personal Care Industry

Based on grade, the market is segmented into USP grade and technical grade.

USP Grade accounted for the largest market share in 2023. USP grade product, with over 99.5% purity, represents the highest quality available and is primarily used in personal care products along with the pharmaceutical and food & beverages industries. The rise of natural and organic beauty trends has boosted glycerol's appeal due to its plant-derived origin, fitting with the “clean beauty” trend. The booming skincare industry, driven by rising disposable income, urbanization, and social media influence, further fuels segment growth. The segment captured 50.77% of the market share in 2026.

Technical grade is essential in the chemical industry, primarily as an intermediate for producing chemicals such as propylene glycol and epichlorohydrin. Propylene glycol, derived from technical grade products, is widely used in antifreeze and de-icing solutions for automotive and aviation industries, driven by its non-toxic nature and versatility. Similarly, epichlorohydrin, another derivative of technical grade product, is a crucial raw material for epoxy resins. These resins are vital for coatings, adhesives, and composites due to their strong adhesive properties and chemical resistance, further benefiting the segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Personal Care Segment Leads due to Wide Usage of Glycerine in Personal Care Products

Based on application, the market is segmented into personal care, food & beverages, pharmaceuticals, polyether polyols, chemical intermediate, tobacco, and others.

The personal care segment held the largest glycerine market share in 2023. It is extensively used in personal care products for its excellent moisturizing properties. In skincare formulations, such as lotions, creams, serums, and soaps, glycerine helps retain moisture and improve skin hydration. The increasing consumer demand for effective and safe moisturizing agents is a significant driver for personal care products. The trend toward natural and sustainable ingredients in personal care formulations has boosted the product’s popularity, as it is derived from plant-based sources. The versatile nature of the product in the personal care industry ensures that it remains a key ingredient, contributing to the formulations of multifunctional products that meet consumer requirements and drive segment growth. This segment is set to hold 28% of the market share in 2026.

In the pharmaceutical industry, glycerol serves various essential roles as a solvent, sweetener, and preservative in oral medications, providing stability and enhancing taste. In topical formulations, the product acts as a humectant and smoothing agent. The major factor driving product demand in the pharmaceutical industry is its safe nature and compatibility with a wide range of active ingredients.

The food & beverage segment is expected to grow considerably in the global market. Increasing adoption of processed food & vegetables is expected to drive product adoption in the food & beverage segment. This segment is likely to record a substantial CAGR of 5.38% during the forecast period (2024-2032).

The tobacco segment is projected to indicate slower growth compared to other segments in the long term. Strict regulations imposed on tobacco usage are expected to hamper this segment's growth in the market in the near future.

REGIONAL INSIGHTS

By geography, the market is studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Glycerine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held the largest share of the market, valued at USD 1.13 billion in 2025 and USD 1.20 billion in 2026. The region is estimated to hold the leading position throughout the forecast period owing to its robust growth rate, driven by its booming personal care industry. China and India are the emerging economies assisting the personal care industries with mounting product demand as a humectant and smoothing agent in skincare products. In addition to this, the region’s growing pharmaceutical sector is utilizing the product in various medications and drug formulations. Regions robust industrial growth is also driving product demand, as it is used in textile, paper, and plastic manufacturing. The Chinese market is anticipated to be valued at USD 0.8 billion in 2026. Moreover, the expanding biodiesel production in various Asian countries is generating more crude glycerine as a byproduct, increasing its availability and affordability, driving the market growth. India is set to be worth USD 0.14 billion in 2026, while Japan is expected to stand at USD 0.04 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the second largest market poised to gain USD 1.11 billion in 2025, displaying a considerable CAGR of 4.15% during the forecast period (2024-2032). In Europe, the stringent regulatory environment significantly drives product demand across the food, pharmaceutical and cosmetics industries. Regulatory bodies such as the European Food Safety Authority (EFSA) and the European Medicines Agency (EMA) prioritize the use of safe, non-toxic, and environmentally friendly substances. Glycerol's natural, biodegradable nature and long history of safe use make it a preferred choice. In the food & beverages industry, the product acts as a humectant, solvent, and sweetener, enhancing texture and shelf life while complying with EFSA standards. The cosmetic industry benefits from the product’s moisturizing properties, with the European Commission's Cosmetics Regulation encouraging the use of natural and sustainable ingredients, aligning with eco-friendly consumer preferences. The U.K. market continues to grow, projected to reach a market value of USD 0.1 billion in 2026. The region’s strong push toward renewable energy and sustainability has resulted in a growing biodiesel industry. This creates a steady product supply that simulates its utilization across various industries, driving market growth. Germany is expected to hit USD 0.28 billion in 2026, while France is predicted to gain USD 0.14 billion in 2025.

North America

North America is the third largest market foreseen to be worth USD 0.60 billion in 2025. The product demand in North America is fueled by its extensive use in personal care products and cosmetics. The region has a well-established market for beauty and skincare products, with consumers placing high importance on effective and safe ingredients. The popularity of natural and organic skincare products has also increased, with glycerol, as a naturally derived ingredient, aligning well with this trend. In addition, this region’s robust pharmaceutical industry, particularly in the U.S., contributes to product demand. The product acts as a solvent, sweetener, and excipient in various pharmaceutical formulations, enhancing the stability and efficacy of medications. Its versatility in a wide range of medical products is expected to drive market growth. The U.S. market is poised to be valued at USD 0.58 billion in 2026.

Latin America

Latin America is the fourth largest market anticipated to hold USD 0.15 billion in 2025. Latin America’s product demand is significantly influenced by its robust agricultural sector and expanding biodiesel industry. Brazil, in particular, stands out as a leading biodiesel producer, largely due to extensive soybean cultivation. The surge in biodiesel production directly increases the glycerol availability in the region, which is repurposed for various industrial and commercial applications, maximizing resource efficiency and driving market growth during the forecast period.

Middle East & Africa

Several factors primarily drive the product demand in the Middle East & Africa. The growing population and urbanization have increased the consumption of personal care and pharmaceutical products, where glycerine is a key ingredient. In addition to this, the expanding food and beverage industry, especially in the Middle East, increases the product demand as a food additive and sweetener. On the other hand, the rising awareness and adoption of biofuels, particularly in Africa, contributes to increased product supply. These factors collectively fuel the product demand, driving market growth.

KEY INDUSTRY PLAYERS

Capital Intensive Nature of Industry to Create Entry Barrier for New Entrants

The level of competition in the market can vary based on factors such as market growth, product differentiation, and capacity utilization. In markets with slow growth, competition can be fierce as companies fight for market share. However, in growing markets or segments where glycerine has a distinct advantage or unique application, rivalry might be less intense. A few of the key players operating in the market include Wilmar International Ltd, IOI Corporation Berhad, P&G Chemicals, and Avril Group, among others.

LIST OF TOP GLYCERINE COMPANIES:

- Wilmar International Ltd (Singapore)

- Cargill Inc. (U.S.)

- Emery Oleochemicals (U.S.)

- IOI Corporation Berhad (Malaysia)

- Kao Corporation (Japan)

- Godrej Industries Limited (India)

- Croda International Plc (U.K.)

- P&G Chemicals (U.S.)

- KLK OLEO (Malaysia)

- CREMER OLEO GmbH & Co. KG (Germany)

- GLACONCHEMIE GmbH (Germany)

- Timur Network Sdn Bhd (Malaysia)

- Sakamoto Yakuhin Kogyo Co. Ltd (Japan)

- Twin Rivers Technologies, Inc. (U.S.)

- Avril Group (France)

KEY INDUSTRY DEVELOPMENTS:

- February 2022: Sakamoto Yakuhin Kogyo Co. Ltd started operating a new plant to produce glycerine. The new plant has a production capacity of approximately 20,000 tons per year. This expansion helps the company to capture a larger market share in the market.

- October 2021: IOI Corporation Berhad Company announced a new 110,000 MT/year capacity oleochemical plant in Prai, Penang. This plant aims to cater to the demand for palm and palm kernel-based fatty acids and glycerine, primary raw materials for personal care and cosmetic products.

- April 2020: Croda International Plc supported sanitizer manufacturing efforts during the outbreak of COVID-19. The company supplied enough glycerine free of cost to manufacture five million bottles of hand sanitizer. Such initiatives taken by the company help them to gain positive support from various players in the market.

REPORT COVERAGE

An Infographic Representation of Glycerine Market

To get information on various segments, share your queries with us

The research report provides both qualitative and quantitative insights into the global market. Quantitative insights include market sizing in terms of value (USD Billion) and volume (Kiloton) across each segment, sub-segment, and region profiled in the scope of study. Additionally, it provides market analysis and growth rates of segments and key counties across each region. Qualitative insight covers the elaborative analysis of key market trends, drivers, restraints, and growth opportunities. The competitive landscape section includes detailed company profiles of key players operating in the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

CAGR (2024-2032) |

CAGR of 5.20% from 2026-2034 |

|

Unit |

Volume (Kiloton), Value (USD Billion) |

|

Segmentation |

By Grade

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.1 billion in 2025 and is projected to reach USD 3.35 billion by 2034.

The market will exhibit a CAGR of 5.20% over the forecast period.

Personal care led the segment in 2023.

Increased demand in the personal care and pharmaceutical industry is a key factor driving market growth

Asia Pacific dominated the market share in 2025.

Wilmar International Ltd, IOI Corporation Berhad, P&G Chemicals and Avril Group are a few of the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic