Hair Care Market Size, Share & Industry Analysis, By Product (Hair Colorants, Shampoo, Conditioner, Hair Oil, and Others), By Category (Synthetic and Natural), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online Stores, and Others), and Regional Forecasts, 2026– 2034

KEY MARKET INSIGHTS

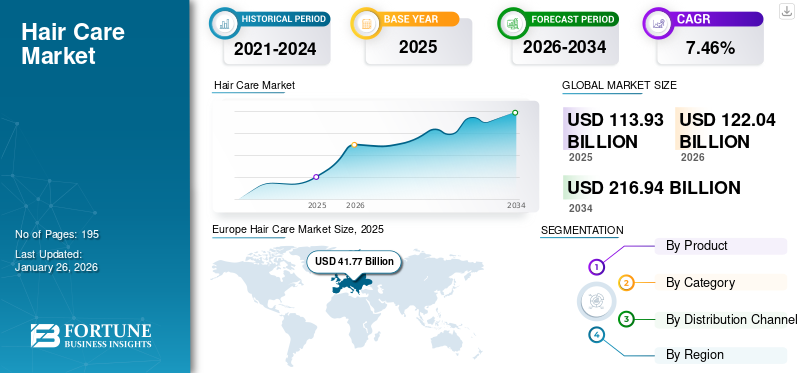

The global hair care market size was valued at USD 113.93 billion in 2025. The market is anticipated to grow from USD 122.04 billion in 2026 to USD 216.94 billion by 2034, exhibiting a CAGR of 7.46% during the forecast period. Europe dominated the hair care market with a market share of 36.67% in 2025.

Hair care products help men and women maintain their hair health, cleanliness and protect them from damage. The products include shampoo, conditioner, oil, serum, and others, which are used in hair nourishment and available in different forms, such as liquid, gel, cream, and lotion. Various products are sold in the marketplace for different applications depending on the hair type. This includes shampoos for dry and oily hair, conditioners for damaged scalp & hair maintenance, and different shampoos for colored hair and curly hair.

An increasing consumer emphasis on hair health, along with the surge in demand for natural and organic products, is driving the market forward. Additionally, alongside an increasing desire in product formulations and personalization, as well as breakthroughs in technology and packaging, also play a substantial role in the market growth.

Moreover, manufacturers such as L'Oréal, Unilever, Procter & Gamble, and Johnson & Johnson are focusing toward product innovations and portfolio expansion. For instance, in June 2022, Procter and Gamble (P&G) launched sustainable and environmentally friendly bars of shampoo and conditioners in Europe. This launch focuses on paper packaging boxes made of FSC-certified paper. The bars are highly concentrated, which enables users to replace two bottles of shampoo, resulting in a cost-friendly and long-lasting product.

Market Dynamics

Market Drivers

Increasing Demand for Grooming and Advanced Hair Repair Solutions among Men to Boost Market Growth

Nowadays, men view grooming as a way to enhance well-being and self-confidence. The increased popularity of hair coloring and the growing trend of men adopting longer hair have contributed to a rise in the demand for hair repair products. This evolving fashion landscape and changing societal norms have led to an increased acceptance of diverse hair color trends, further boosting the market growth. For instance, according to a survey conducted by the International Journal of Research Publication and Reviews on ‘A Study on the Growing Interest of Male Toward Grooming Industry’ with a sample size of ~50 respondents, in March 2023, around 18% of the respondents are very familiar with hair products, 13% are somewhat familiar with them, 11% are not very familiar, and 7% of them are not aware of their hair products.

Growing Demand for Organic and Clean Hair Care Products to Boost Market Growth

The rise of the clean beauty movement has led to greater scrutiny of product ingredients. Consumers, particularly younger generations, are actively evaluating product labels and demanding transparency from beauty care brands regarding ingredient information. This shift is allowing manufacturers to innovate and offer products with plant-based and ethically sourced ingredients, further driving the hair and organic hair maintenance products. For instance, in November 2023, Straand, an Australian scalp care brand, started operating in the U.K. The company focuses on developing cruelty-free and microbiome-centric products to achieve product differentiation in the intensely competitive landscape.

Market Restraints

Allergic Reaction to Sensitive Hair Hampers Market Growth

Individuals with sensitive hair or scalp become cautious of the product usage, leading to the avoidance of many mainstream products. This reduces the product consumption across different regions, reducing the market revenue of hair products. Additionally, negative consumer experiences damage brands' reputation and customer loyalty, restricting new consumers from perceiving specific hair repair solutions. Therefore, the rising number of people with sensitive hair experiencing an allergic reaction from hair cleansing products, such as shampoos, cleansers, serums, and others, due to the presence of toxic chemicals is probable to hamper the global hair care market growth. For instance, according to the Global Allergy and Asthma Patient Platform Constitution data, in June 2025, around 30% to 40% of individuals across the globe have one or more allergies.

Market Opportunities

Investment toward Digital and E-commerce Expansion to Surge Product Consumption

The surge in global online shopping has presented a significant opportunity for beauty and personal care retailers to expand their e-commerce presence and tap into a new customer base. Therefore, investing in robust digital platforms, along with enhancing website user experience and offering convenient delivery options, has helped beauty care retailers capture a larger share of the growing e-commerce sector. For instance, in January 2023, Kerastase, a French beauty care brand, launched an e-commerce website for the Indian market. The brand aimed to capture a new customer base across India through its direct-to-customer retail channels within the country.

Hair Care Market Trends

Rising Demand for Product Innovation & Customized Hair Care Solutions to Boost Market Growth

Customized hair products help consumers personalize their products according to their hair and scalp requirements, lifestyle and personal preferences. Moreover, as technology advances in terms of research and development activities, customized hair repair products are becoming more accessible and effective, driving increased purchases of customized hair products. Through this investment, companies are able to address niche markets, with specialized products, expanding market penetration and consumer loyalty toward the brand, boosting the overall hair care industry. For instance, in October 2022, Schwarzkopf Professional, a haircare brand of Henkel AG & Co. KGaA, launched a new B2B, and B2C hyper-personalized professional hair care brand named ‘SalonLab&Me’. The brand focuses on combining hairdresser expertise with a digital experience to provide hyper-personalized hair maintenance recommendations to their clients.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

Shampoo Segment to Hold Highest Market Share Due to Presence of Various Hair Enrichment Ingredients

Based on product, the market is divided into hair colorants, shampoo, conditioner, hair oil, and others.

The shampoo segment holds the leading share of 34.25% in 2026. Shampoo compiles various hair enrichment ingredients, such as vitamins, botanical extracts, minerals, oils, and others, which help stimulate hair growth from the scalp follicles. Besides, consumers' intense usage of various shampoos is expected to boost the segment's growth and drive the hair and scalp care market.

The hair oil segment is predicted to exhibit a second leading market position over the forecast period of 2025-2032. Consistent salon and hair transplant surgeon experts' recommendations of the usage of hair oil to avoid hair dryness drive the global hair oil sales. Furthermore, rising demand for hair massaging oils at spas and professional hairdressers to provide better quality hair grooming services drives the hair oil segment's growth worldwide.

To know how our report can help streamline your business, Speak to Analyst

By Category

Availability of Synthetic Products at Lower Prices to Boost Segment Growth

Based on category, the market is bifurcated into natural and synthetic.

The synthetic segment holds the major share in the market. Synthetically designed hair products are formulated from basic ingredients that provide consistent performance for the hair caring routines. In addition, synthetic hair products are available at cheaper prices compared to natural products, thus boosting segment growth.

The natural segment is expected to grow at a fastest CAGR during the forecast period. The rising number of eco-conscious consumers preferring natural and organic hair maintenance products and consistent manufacturers' implementation of ethical business practices while producing personal care goods positively contributes toward the future segmental development.

By Distribution Channel

Convenience while Shopping Contributes to Supermarket/Hypermarket Segment Dominance

Based on distribution channels, the market is fragmented into supermarket/hypermarket, specialty stores, online stores, and others.

The supermarket/hypermarket segment is expected to hold the largest market share of 35.82% in 2026 due to the availability of a wide range of hair products under a single roof, eliminating the need to browse multiple stores. Similarly, the consumers' ability to physically view the item reduces the chance of purchasing counterfeit goods.

The online segment is expected to grow at a fastest CAGR over the forecast period. Growing innovations in tools and technology, added with value-driven customer services by e-commerce firms, enable the consumer to try out products virtually, boosting the consumer's online shopping experiences and favoring online stores' segmental growth.

HAIR CARE MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America and the Middle East & Africa.

Europe

Europe Hair Care Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 41.77 billion in 2025 and USD 44.89 billion in 2026. Europe leads the global market throughout the forecast period of 2025-2032. The high number of beauty-conscious consumers and significant adoption of hair grooming products generated considerable key players’ product revenues across the region. In addition, the rising number of hairdressing salons and spa clinics preferring luxury hair washing & grooming products accelerates product sales across the Western European region. According to the National Hair & Beauty Federation (NHBF), between 2023 and 2024, the number of hair & beauty businesses in the U.K. increased by 1,240 (2.5%). while the Germany market is valued at USD 11.42 billion by 2026.

North America

North America emerged as the third largest region in the market. The region is anticipated to create a significant presence in the market owing to the high expenditure on personal care, including hair-based products. The rising number of salons and hairdresser settings preferring functional shampoos, hair sprays, and oils to groom their customers' hair increases the demand for these products across the U.S. and Canada. The U.S. market is valued at USD 14.76 billion by 2026.

In the U.S., the increasing consumer demand for sustainably-made hair oils, gels, shampoos, and manufacturers' continual production of eco-friendly ingredient-based hair repair products positively contribute to the country’s market growth. Furthermore, the growing number of direct-to-consumer (DTC) brands offering natural ingredients, paraben-free, and sulfate-free formulation-based hair oil, colorants, and sprays enable users to sustainably personalize their hair style, with such products positively contributing to the market expansion in the region. For instance, in June 2025, Typology, a French DTC personal care brand, expanded its presence by offering a diverse range of hair and skincare products in the U.S. market.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to grow at a fastest CAGR during the forecast period. The increasing number of hair transplant and scalp treatment centers recommending their patients to use serums, exfoliators, and hair masks to avoid hair loss during hot seasons positively contribute to the market growth in the region. The growing prevalence of hair loss & baldness and the increasing number of consumers seeking innovative anti-hair loss products, including shampoos and serums containing caffeine and biotin ingredients, create newer market growth prospects in the region. According to the National Council of Aging (NCOA), as of 2024, 63% of Indian men aged 21 to 65 are suffering from some form of hair loss. Additionally, 250 million Chinese (1 in 6) are suffering from hair loss as of 2024. The Japan market is valued at USD 13.71 billion by 2026, the China market is valued at USD 11.7 billion by 2026, and the India market is valued at USD 5.58 billion by 2026.

South America and Middle East & Africa

South America, and Middle East & Africa is expected to grasp a considerable share in the market. Both the regions are estimated to create a crucial presence in the market due to the rapid growth of urban population, thereby increasing the number of people investing in personal care & maintenance products. The Middle East & Africa is embracing market progress as many countries witnessing robust economic development have helped foster the consumption of hair cleaning products.

Competitive Landscape

Key Industry Players

Key Players are Adopting Effective Strategies and Shifting toward Eco-Friendly Solutions

The global market is highly fragmented owing to the presence of several local and domestic players. Manufacturers focus on launching innovative ingredient based products to meet consumer demand for the product, addressing specific hair concerns. In addition, they use natural/organic ingredients and plant-based extracts to produce sustainable products. For instance, in May 2021, the Jonna Breitenhuber brand developed shampoo packaging, which is expected to positively impact the environment and improve its popularity over alternative products.

LIST OF KEY HAIR CARE COMPANIES PROFILED

- L'Oréal S.A. (France)

- Coty Inc. (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Unilever PLC (U.K.)

- The Procter & Gamble Company (U.S.)

- Revlon, Inc. (U.S.)

- Kao Corporation (Japan)

- Natura & Co. (Brazil)

- Johnson & Johnson Services, Inc. (U.S.)

- Aveda Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2025: L’Oreal Paris, an international personal care brand, launched an award-winning hair color device, Colorsonic, at Target stores across the U.S. and Target.com shopping site. The device enables users to effectively color their hair to the required length, hair types, and textures. The brands’ premium hair coloring products sales are slated to increase with such a device.

- June 2025: Unilever Plc. acquired Dr. Squatch, a men’s personal care brand offering various products including hair, skincare & cologne, shave care products, soap & body wash, and others. Through this acquisition, the company aims to expand its portfolio of personal care products made of natural extracts and quality-based ingredients.

- September 2024: Coty, Inc. held a Scientific Advisory Board meeting at the Skincare Research & Innovation Center of Excellence in Monaco. The meeting was held to develop strategies for building the company’s position in premium skin health, skin repair, and hair scalp health.

- January 2024: Henkel inaugurated its latest Asia-based Research and Development (R&D) center for Consumer Brands in Shanghai, marking a significant investment of around USD 13.84 million. Serving as Henkel's largest R&D facility in Asia, this new center is poised to draw top scientific talent, enhance local R&D capacities in Hair, Skincare, and Laundry & Home Care segments, and solidify Henkel consumer products as industry leaders.

- June 2023: The Procter & Gamble Company, in a retailer partnership with Lazada, launched HairDNA, a new hair repair microsite to build its product reach across Southeast Asia.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, end-users, and leading product types. Besides this, it provides the current market trends and highlights key industry developments, such as mergers & acquisitions and new product launches. In addition to the abovementioned factors, it encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.46% during 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Category

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 113.93 billion in 2025.

Registering a CAGR of 7.46%, the global market is expected to grow during the forecast period of 2026-2034.

By product, the shampoo segment is expected to be the leading segment in the market during the forecast period.

The increasing number of hair-related issues are projected to drive the growth of the market.

LOreal Professional, Coty Professional, Henkel AG & Co. KGaA, and Unilever are a few of the top players in the market.

Europe is expected to hold the highest market share.

The online segment is expected to grow the fastest during the forecast period.

Rising awareness regarding scalp care products and increasing inclination toward organic & herbal products and various hair coloring solutions are the key trends driving the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us