Hemodialysis Equipment Market Size, Share & Industry Analysis, By Product (Hemodialysis Machines (In-center Hemodialysis Machines and Home Based Hemodialysis Machines) and Hemodialysis Consumables (Dialyzers, Dialysate, Access Products, and Others)), By End-user (Dialysis Center & Hospital and Home Healthcare), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

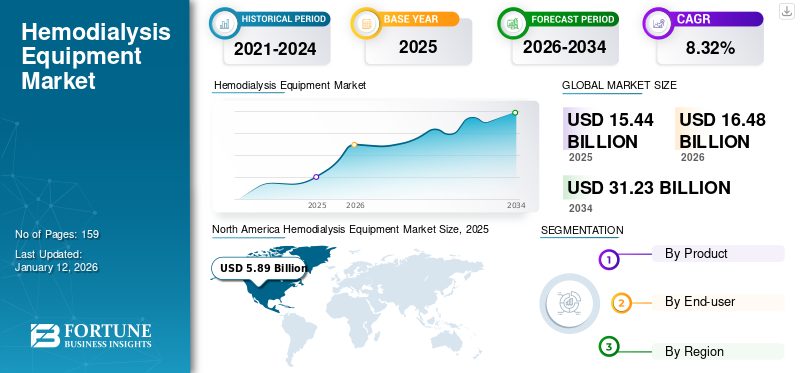

The global hemodialysis equipment market size was valued at USD 15.44 billion in 2025 and is projected to grow from USD 16.48 billion in 2026 to USD 31.23 billion by 2034, exhibiting a CAGR of 8.32% during the forecast period. North America dominated the hemodialysis equipment market with a market share of 38.11% in 2025.

Hemodialysis is a blood filtration process used to treat patients suffering from kidney failure. The process helps to clean blood with the help of a dialyzer, also known as an “artificial kidney.” There are two types of options for hemodialysis, namely in-center hemodialysis or home-based hemodialysis. In-center hemodialysis is usually performed three times a week for about 4 hours, while home-based hemodialysis is performed more regularly, 4-7 times per week for shorter hours each time.

The rising prevalence of end-stage renal disease (ESRD) and the global geriatric population are the key factors driving the global market growth. Certain conditions such as diabetes, high blood pressure, excessive alcoholism, drug abuse, and genetic disorders are also causing end-stage renal disease.

- For instance, according to data published by the Centers for Disease Control and Prevention in 2020, diabetes is the leading cause of ESRD cases in developed countries.

Furthermore, technological advancements in hemodialysis equipment, such as improved machines with enhanced safety features, are expected to propel the demand for these devices to treat chronic kidney diseases. Moreover, the surging demand for home-based machines and the growing number of mergers and acquisitions by the market players are anticipated to create several growth opportunities in the market during the forecast period.

- In August 2022, W. L. Gore & Associates, Inc. announced the acquisition of InnAVasc Medical, Inc., a privately-held medical devices company focused on delivering advanced care for patients suffering from kidney disorders who utilize graft circuits for dialysis treatment.

The pandemic period witnessed numerous severe COVID-19 cases which recorded acute kidney failure. This contributed to an increased global demand for hemodialysis equipment despite several constraints such as lockdown restrictions. Furthermore, the increased demand resulted in a shortage of dialysis machines and specialized dialysis nurses worldwide. For instance, according to the data published by the Indiana Clinical and Translational Sciences Institute (CTSI), in April 2022, hospitals in New York reported a shortage of ICU dialysis machines. This heightened demand has led significant pressure on key market players. Furthermore, Baxter’s renal care segment witnessed a 3.2% increase in its revenue in 2020 compared to the prior year and was valued at USD 3,757.0 million. The growth was mainly driven by higher sales of product for acute care treatment.

However, the market experienced slower growth in 2021, 2022, and 2023 due to the normalization of operations after the pandemic. Furthermore, in 2024, the market is expected to reach the growth rate of pre-pandemic levels.

Hemodialysis Equipment Market Snapshot & Highlights

Hemodialysis Equipment Market Size & Forecast:

- 2025 Market Size: USD 15.44 billion

- 2026 Market Size: USD 16.48 billion

- 2034 Forecast Market Size: USD 31.23 billion

- CAGR: 8.32% from 2026–2034

Market Share:

- North America dominated the global hemodialysis equipment market in 2025, accounting for 38.11% of total revenue. This leadership is primarily attributed to the rising prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), the widespread adoption of advanced home-based dialysis technologies, and the strong presence of major players such as Fresenius Medical Care and Baxter.

- By product, hemodialysis consumables held the highest market share in 2024. This was driven by the growing number of dialysis procedures and consistent demand for dialyzers, dialysate, and vascular access products, particularly in dialysis centers and hospitals. Increasing product innovation and accessibility in both developed and developing regions are expected to maintain the segment’s dominance through 2032.

Key Country Highlights:

- Japan: Japan continues to show high demand for hemodialysis equipment due to the country’s aging population and strong institutional support for in-center dialysis care. The presence of over 4,000 dialysis centers and increasing clinical trials for advanced dialysis technologies further support growth.

- United States: Market growth in the U.S. is propelled by rising ESRD incidence, strategic federal initiatives such as the executive order to promote home-based dialysis, and the introduction of advanced systems like Baxter’s Versi HD and Fresenius’s 5008X. Home-based modality adoption is gaining pace due to convenience, reduced travel time, and increasing patient awareness.

- China: China is seeing rapid expansion in dialysis infrastructure, driven by rising CKD prevalence, aging demographics, and increasing access to health insurance. Local and global companies are launching innovative and affordable dialysis solutions, making it one of the fastest-growing countries in Asia Pacific for hemodialysis equipment.

- Europe: The region ranks second globally in terms of market share, driven by the high burden of kidney diseases and favorable regulatory environment. Government initiatives and approvals for next-gen devices like Quanta Dialysis’s compact home-based systems are supporting the growth of personalized and home healthcare dialysis services.

Hemodialysis Equipment Market Trends

Growing Adoption of Home-Based Modality to Boost Market Growth

The prevalence of patients requiring Renal Replacement Therapies (RRTs) is increasing globally, and due to the unavailability of treatment, many of these patients die prematurely. In-center hemodialysis is the most commonly performed treatment globally. However, many patients find it unsuitable due to their fragile health conditions, time lost in travel, and difficulties ambulation. As a result, such patients find home-based dialysis machines more suitable. Moreover, the surge in awareness regarding the benefits of home-based modalities has enabled several manufacturers to increase their clinical research activities for introducing home-based machines.

- For instance, in June 2021, Max@Home partnered with NephroPlus to launch home hemodialysis services. This partnership would boost the adoption of these products over the forecast period.

The increasing focus on developing and launching home-based machines is estimated to increase the equipment demand from 2025-2032.

Download Free sample to learn more about this report.

Hemodialysis Equipment Market Growth Factors

Growing Prevalence of Chronic Kidney Disease to Drive Market Growth

The rapidly growing prevalence of kidney disorders, such as kidney failure and chronic kidney diseases, is the primary factor driving the growing adoption of hemodialysis equipment worldwide. For instance, according to the Fresenius Medical Care Annual Report 2024, around 4.8 million people suffered from chronic kidney failures in 2022, and this number is projected to exceed 6.5 million by 2033. Furthermore, the demand for products such as dialysate and machines is projected to rise due to the large patient pool for dialysis treatment. For instance, in 2022, approximately 3.9 million patients regularly underwent dialysis treatment worldwide. As a result, manufacturers are launching new equipment, fueling the growth of the global market.

- For instance, in December 2020, Medtronic plc announced the U.S. commercial launch of the Carpediem Cardio-Renal Pediatric Dialysis Emergency Machine to treat acute kidney injury.

Such new product launches, along with the growing prevalence of kidney disorders, are projected to increase the patient population seeking dialysis treatment, thereby influencing the growth of the global market.

Rising Clinical Activities for Introduction of Technologically Advanced Products Boosts Market Growth

The increasing prevalence of various kidney-related disorders, such as end-stage renal diseases and chronic kidney diseases, has prompted healthcare providers to intensify their research and development activities to introduce technologically advanced equipment.

- For instance, in May 2021, Kidney Research U.K., the largest kidney research charity in the U.K., in collaboration with IN-PART’s Discover platform, launched a Kidney MedTech competition to enhance dialysis treatment options that would significantly impact patients’ lives.

Additionally, several manufacturers are focusing on the development of cutting-edge equipment for the treatment of various kidney-related conditions.

- For instance, as per the data published by Kidney Research U.K. in October 2023, the Kidney Research U.K.-funded team at the University of Edinburgh had reached the final step in creating a workable and wearable kidney.

Such product advancements, which offer enhanced safety features, are expected to increase the adoption of hemodialysis equipment globally.

RESTRAINING FACTORS

High Costs and Adverse Effects Associated with These Equipment to Hamper Market Growth

Hemodialysis machines can potentially expose patients to harmful toxic compounds, according to the study revealed by the U.S. Food and Drug Administration (U.S. FDA). In addition, the U.S. FDA discovered specific dialysis machines that may lead to such exposure. For instance, Fresenius Medical Care dialysis machines, such as the 2008K2, 2008T, and 2008K model, caused potential exposure to toxic compounds such as Non-Dioxin-Like (NDL), Polychlorinated Biphenyl Acids (PCBAs), and NDL Polychlorinated Biphenyls (PCBs). Furthermore, the U.S. FDA is working with manufacturers to collect and evaluate data to regulate the risk of exposure to NDL PCBs and NDL PCBAs in patients and developing strategies to address this issue.

Although dialysis is often essential for individuals with Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD), it can incur significant expenses.

- For instance, as per the data published by TalktoMira, Inc. in January 2024, depending on the insurance status and the type of dialysis the patients are receiving, the costs can vary anywhere from USD 10,000 to USD 90,000 per annum. The average cost of in-center hemodialysis was reported to be nearly USD 72,000 to USD 88,000 per year.

The higher costs associated with the installation and maintenance of such equipment is hampering market growth. Moreover, infections associated with hemodialysis equipment are further expected to hamper the global hemodialysis equipment market growth to a certain extent.

Hemodialysis Equipment Market Segmentation Analysis

By Product Analysis

Hemodialysis Consumables Segment to Hold the Highest Share Owing to Growing Number of Treatment Procedures

Based on product, the market is segmented into hemodialysis machines and hemodialysis consumables. The hemodialysis machines segment is further sub-segmented into in-center hemodialysis machines and home based hemodialysis machines. The hemodialysis consumables segment is further sub-segmented into dialyzers, dialysate, access products, and others.

The hemodialysis consumables segment accounted for the highest market share in 2026 accounting for an 84.51%. The growth was mainly attributed to the rising prevalence of kidney disorders and the high demand for hemodialysis consumables, particularly in developed countries. The increasing number of hemodialysis treatment procedures and the introduction of advanced consumables products by market players is anticipated to drive the segment’s growth rapidly over the forecast period.

- For instance, in November 2021, Fresenius Medical Care launched FX CorAL- a new dialyzer for hemodialysis that combines clinical performance with improved hemocompatibility.

Moreover, some of the companies are involved in the development of technologically advanced accessories for dialysis procedures.

- For instance, as per the data published by MMDI in March 2024, Ubiplug, a France-based startup company, is developing smart valves to ease hemodialysis for patients with end-stage renal disease. The innovative smart valves minimize the risk of infections by allowing nurses to switch between session steps without opening the catheter.

The hemodialysis machines segment is poised to hold a considerable market share during the forecast period of 2024-2032. The segmental growth is due to the launches of various government policies for the improvement of kidney care.

- For instance, in July 2019, the U.S. President, signed an executive order to reorganize the overburdened kidney care and transplant system in America. This initiative aimed to improve kidney care by introducing new treatments, including at-home dialysis.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Dialysis Center & Hospitals Accounted for the Highest Share Due to the High Adoption of Hemodialysis Equipment for Diagnosis

Based on end-user, the hemodialysis equipment industry is segmented into dialysis center & hospitals and home healthcare. The dialysis center & hospital segment arepresented the largest sub-segment in 2026, holding an 83.57% market share. This growth is mainly attributed to the increasing number of patients seeking treatment for kidney-related disorders in these healthcare settings. Moreover, the growing adoption of consumables such as dialyzers, dialysate, and access products for continuous treatment in these settings is expected to drive segmental growth during the forecast timeframe. Also, the presence of a large number of facilities for dialysis treatment is one of the major factors responsible for segment’s growth.

- For instance, as per the data published by the National Center for Biotechnology Information (NCBI) in May 2020, a total of 4,413 facilities in Japan were providing dialysis treatment as of 2017.

The home healthcare segment is expected to grow at a significant CAGR during the forecast period. Companies operating in the market are focused on launching home-based dialysis services. This, in turn, is projected to drive the demand for products in home care settings growth in the near future.

- For instance, in April 2021, Apollo Dialysis Clinics, a dialysis service provider in India, launched a new home hemodialysis service in Bangalore and Chennai to provide patients with safe and optimum dialysis care.

REGIONAL INSIGHTS

Geographically the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Hemodialysis Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America held the highest market share in 2026, recording a substantial revenue of USD 5.89 billion. This dominant position is expected to persist in the upcoming years, driven by various key factors. These include the escalating number of patients afflicted with kidney diseases, a growing influx of patients seeking treatment and diagnosis, and the formidable presence of major market players in the U.S. Furthermore, the swift uptake of home-based hemodialysis machines and the introduction of cutting-edge technology in hemodialysis equipment by leading industry players are anticipated to further fuel market expansion in North America.

- In July 2022, Fresenius Medical Care launched CombiSet SMARTECHTM, the first single-use integrated bloodline, to support fluid management in dialysis in North America.

Europe

Europe, in 2023, occupied the second-highest market share and is projected to record substantial CAGR during the forecast period. This expansion can be attributed to the considerable number of patients suffering from end-stage renal disease (ESRD) and chronic kidney diseases in the region. Furthermore, the increasing approvals of hemodialysis equipment by the European Union are expected to open up growth prospects for countries within the region. The UK market reaching USD 0.87 billion by 2026 and the Germany market reaching USD 1.12 billion by 2026.

- For instance, in June 2022, Quanta Dialysis Technologies raised USD 48 million for the commercial launch of a device that makes home hemodialysis more straightforward and economical for kidney failure patients. The money was utilized for the launch of this technology in the U.K.

Asia Pacific

Asia Pacific is expected to exhibit the highest CAGR during the forecast period. This growth is driven by the growing awareness regarding treating kidney disorders, increasing focus on improving healthcare infrastructure, and rising product launches by companies across China, Japan, and India. Also, the presence of large number of facilities for hemodialysis treatment is one of the factor responsible for segments growth. The Japan market reaching USD 0.88 billion by 2026, the China market reaching USD 1.38 billion by 2026, and the India market reaching USD 0.68 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa markets are expected to witness robust growth prospects over the forecast period. This is owing to the increased patient visits to dialysis centers in these regions.

List of Key Companies in Hemodialysis Equipment Market

Fresenius Medical Care and Baxter International Inc. to Account for the Significant Market Share in Terms of Revenue

In 2024, Fresenius Medical Care and Baxter stood out as major players in the market, together holding a significant market share.

Fresenius Medical Care is a dominant player in the global market, holding a major share. The company is reinforcing its strategic position owing to its robust distribution network, post-sale support, superior quality, and strong brand presence.

- For instance, in February 2024, Fresenius Medical Care received the U.S. FDA 510(k) approval for its 5008X Hemodialysis System. This system is designed to provide high-volume hemodiafiltration dialysis therapy.

Other players operating in the industry include B. Braun SE, NIPRO CORPORATION, Nikkiso Co., Ltd., Asahi Kasei Corporation, TORAY INDUSTRIES, INC., and JMS Co., Ltd. These companies employ various strategies such as partnerships, collaborations, R&D activities, and new product launches to fortify their market positions.

LIST OF KEY COMPANIES PROFILED:

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Baxter (U.S.)

- B. Braun SE (Germany)

- NIPRO (Japan)

- Nikkiso Co., Ltd. (Japan)

- Asahi Kasei Medical Co., Ltd. (Asahi Kasei Corporation) (Japan)

- Medtronic (Ireland)

- Kimal (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 - Quanta Dialysis Technologies, a medical technology company, announced that it had submitted a 510(k) premarket notification to the U.S. FDA for indication expansion of the Quanta Dialysis System, a compact and easy-to-use hemodialysis device.

- August 2023 - Fresenius Medical Care announced the U.S. FDA’s clearance of Versi HD with GuideMe Software, a completely reinvented self-guided interface for the company’s Versi HD chronic home hemodialysis (HHD) system.

- April 2022 - Dialyze Direct, a home hemodialysis service provider, announced that it had completed its previously announced acquisition of Compass Home Dialysis. The company is a regional dialysis provider in Pennsylvania that offers on-site dialysis services in nine skilled nursing facilities (SNFs) and an outpatient dialysis clinic.

- March 2022 - Nipro Medical Corporation announced the commercial launch of the SURDIAL DX Hemodialysis System in the U.S.

- February 2022 - D.Med Healthcare GmbH & Co. KG and Metco Care Health Services entered a strategic partnership to provide high-quality services and products in Qatar.

- July 2019 - Quanta Dialysis Technologies raised USD 48 million in funding to support the commercial launch of a home hemodialysis device for the treatment of kidney failure patients.

REPORT COVERAGE

The market research report provides a detailed competitive landscape. It focuses on key aspects such as new product launches in the market. Additionally, it includes the prevalence of kidney disorders, market dynamics, and key industry developments such as mergers, partnerships, and acquisitions. Moreover, it covers regional analysis of different segments, and company profiles of key market players. The report encompasses qualitative and quantitative insights contributing to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.32% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The global hemodialysis equipment market size was valued at USD 15.44 billion in 2025 and is projected to grow from USD 16.48 billion in 2026 to USD 31.23 billion by 2034, exhibiting a CAGR of 8.32% during the forecast period.

In 2025, the North America market value stood at USD 5.89 billion.

The market is expected to exhibit a CAGR of 8.32% during the forecast period of 2026-2034.

By product, the hemodialysis consumables segment is set to lead the market.

Rapidly growing prevalence of end-stage renal disease and chronic kidney disease are expected to boost the market during the forecast period.

Fresenius Medical Care AG & Co. KGaA and Baxter currently hold the maximum share of the global market.

North America region dominated the market in 2023.

Surging prevalence of diabetes, high blood pressure, excessive alcoholism, drug abuse, and genetic disorders is a major factor contributing to end-stage renal disease (ESRD), driving product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us