Hemophilia Drugs Market Size, Share and Industry Analysis By Disease Indication (Hemophilia A, B & C), By Therapy Type (Recombinant Therapy, Plasma Therapy & Others), By Distribution Channels (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy), and Regional Forecast 2026-2034

Hemophilia Drugs Market Size and Share

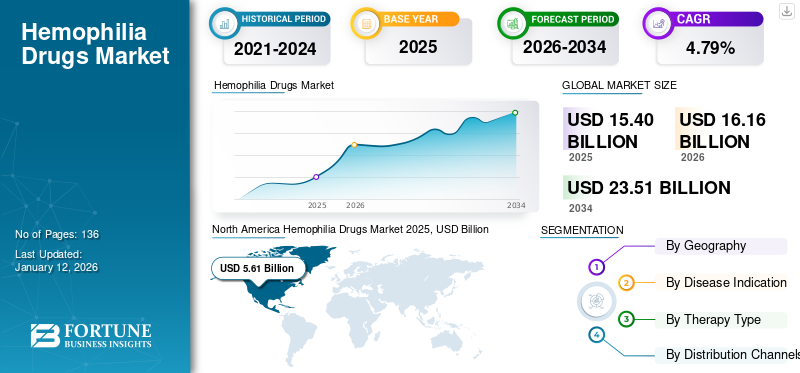

The global hemophilia drugs market size was valued at USD 15.4 billion in 2025. It is projected to grow from USD 16.16 billion in 2026 to USD 23.51 billion by 2034, exhibiting a CAGR of 4.79% during the forecast period based on our analysis in the existing report (2026-2034). North America dominated the hemophilia drugs market with a market share of 4.63 % in 2025.

The rising burden of rare disorders among people globally is a major concern for the healthcare field. Hemophilia is one of the rarest bleeding disorders in which blood lacks sufficient blood clotting factors. Patients suffering from hemophilia usually bleed abnormally and for a longer time than other people, as the abnormality in the hemophilia gene slows the blood clotting process. Hemophilia is generally caused by gene mutation, and around 70% of the hemophilia cases are inherited.

Increasing awareness of such rare diseases among the population and government participation in the prevention and control of these life-threatening diseases are the key factors associated with the estimated growth of hemophilia drugs market. Moreover, rising investment by key pharmaceutical companies in R&D of novel therapies for hemophilia is propelling the expansion of the market at a remarkable rate.

Download Free sample to learn more about this report.

GLOBAL HEMOPHILIA DRUGS MARKET OVERVIEW

Market Size:

- 2025 Value: USD 15.4 billion

- 2026 Value: USD 16.16 billion

- 2034 Forecast Value (with CAGR): USD 23.51 billion (CAGR of 4.79%)

Market Share:

- Regional Leader: North America 4.63% market share in 2025

- Fastest-Growing Region: Asia Pacific

- End-User Leader: Hemophilia A Segment (85.0% market share in 2018)

Industry Trends:

- New product launches are accelerating regulatory approvals (e.g., Jivi by Bayer)

- High adoption of recombinant therapy due to better treatment outcomes

- Rising awareness and government initiatives for rare diseases

Driving Factors:

- Growing prevalence of hemophilia and rare bleeding disorders globally

- Increased investment by pharmaceutical giants in R&D of novel hemophilia therapies

- Regulatory approval of breakthrough treatments in key markets (e.g., Australia, Japan)

- Expansion of pharmaceutical distribution networks, especially in Asia Pacific

- Rising government and private sector funding to improve healthcare infrastructure

"New Product Launch to Accelerate the Market Growth"

Green signal by regulatory authorities for the launch of new products is a major factor expected to boost the hemophilia drugs market growth. For instance, in August 2018, Bayer announced the FDA approval for Jivi for the treatment of Hemophilia A in adolescents age 12 years and above and adults. Also, the rising prevalence of hemophilia, backed by increased government efforts and initiatives to address the need of hemophilic patients is projected to favor the hemophilia drugs market revenue.

According to the Centers for Disease Control and Prevention, about 400 babies are born with hemophilia A every year in the U.S., which is estimated to boost the demand for hemophilia drugs during the forecast period.

Market Segmentation

Based on disease indication, the global hemophilia drugs market includes hemophilia A, hemophilia B, hemophilia C. Hemophilia has three types, which are hemophilia A, B, and C, out of which the incidence rate for hemophilia A and B is relatively significant. The annual cost of care associated with the hospitalization and medications for hemophilia A treatment is considerably high. The green signal by regulatory authorities for major brands such as Humira in mid of 2017 has improved the hemophilia A treatment scenario across the globe.

To know how our report can help streamline your business, Speak to Analyst

The high cost of Humira and other drugs for hemophilia A treatment, and considerable patient pool for disease type is expected to augment the growth of hemophilia A segment in terms of revenue during the forecast period, accounting for an estimated 81.17% market share in 2026. In terms of therapy type, the hemophilia drugs market segments include recombinant therapy, plasma-derived, and others. The recombinant therapy accounted for maximum market share in 2024, owing to the improved outcome of recombinant therapeutics over the plasma-derived. However, others segment, which is comprised of gene therapy, biospecific drugs, and other such drugs, is anticipated to witness relatively high growth rate during the forecast period. Based on distribution channels, global market segments include hospital pharmacy, retail pharmacy, and online pharmacy.

Regional Analysis

North America Hemophilia Drugs Market 2025, USD Billion

To get more information on the regional analysis of this market, Download Free sample

"Improved Distribution Network of Pharmaceutical Giants Enables Market to Exhibit Highest CAGR in Asia Pacific"

North America

The hemophilia drugs market in North America generated maximum revenue of USD 5.61 billion in 2025 and is expected to dominate throughout the forecast period. Strategies of key pharmaceutical companies in the U.S. and rising prevalence of hemophilia A & B in the U.S. and Canada are projected to boost the expansion of the market in North America. The hemophilia drugs market Europe is anticipated to be the second most prominent region in terms of revenue by 2032.

Asia Pacific

However, the hemophilia drugs market in Asia Pacific is likely to register highest CAGR during the forecast period, attributable to the green signal by regulatory authorities in Australia and Japan for the approval of novel therapeutics for hemophilia A and improved funding by public & private players for the improvisation of healthcare facilities in India and China.The Japan market is projected to reach USD 0.43 billion by 2026, the China market is projected to reach USD 0.82 billion by 2026, and the India market is projected to reach USD 1 billion by 2026.

The market is Latin America and Middle East, and Africa is estimated to witness considerable expansion owing to the increased government efforts to provide a novel therapy for hemophilia and improving healthcare investment.

Europe

The UK market is projected to reach USD 0.89 billion by 2026, while the Germany market is projected to reach USD 0.59 billion by 2026.

Key Market Drivers

"Takeda Pharmaceutical Company Limited, F. Hoffmann-La Roche Ltd, and Novo Nordisk to Account for More Than Half of the Market Share in Terms of Revenue"

Takeda Pharmaceutical Company Limited has emerged as a leading player in the global hemophilia drugs market after acquiring Shire Plc, a leader in the bleeding disorder therapeutics. Takeda is estimated to retain its position in the forecast duration owing to its efficient business expansion strategies that are currently being implemented in potential countries. This company, together with F. Hoffmann-La Roche Ltd and Novo Nordisk currently holds over half of the market share in terms of revenue. Other players operating in the global hemophilia drugs market are Pfizer, Inc., CSL Limited, Grifols, S.A., Bioverativ Inc., Octapharma AG, FERRING LÄKEMEDEL AB, and Aptevo Therapeutics.

List of Companies Profiled

- Grifols SA

- CSL Behring

- Octapharma AG

- Pfizer, Inc.

- Bioverativ Inc.

- FERRING LÄKEMEDEL AB

- Aptevo Therapeutics

- Takeda Pharmaceutical Company Limited

- Hoffmann-La Roche Ltd

- Novo Nordisk

- Other players

Report Coverage

With adequate and effective treatment, a patient suffering from hemophilia can live a healthy life. The missing clotting factors are injected into the patient’s bloodstream to cease the abnormal bleeding. With numerous innovative therapeutic options in the pipeline, the hemophilia drugs industry is expected to witness remarkable growth in near future.

The report provides qualitative and quantitative insights on the hemophilia drugs industry trends and detailed analysis of hemophilia drugs market size and growth rate for all possible segments in the market. The hemophilia drugs market is segmented by therapy type, disease indication, and distribution channel. On the basis of therapy type, the global market is segmented into recombinant therapy, plasma-derived, and others. In terms of disease indication, the market is categorized into hemophilia A, hemophilia B, and hemophilia C. Various distribution channels covered under the report are hospital pharmacy, retail pharmacy, and online pharmacy.

Geographically, the hemophilia drugs market is segmented into five major regions, which are North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The regions are further categorized into countries.

Along with this, the report analysis includes market dynamics and competitive landscape. Various key insights provided in the report are the prevalence of coagulation factor deficiency and hemophilia, recent industry developments such as mergers & acquisitions, the regulatory scenario in key countries, new product launch, pipeline analysis, reimbursement scenario, and key industry trends.

Request for Customization to gain extensive market insights.

SEGMENTATION

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 4.79% from 2026 to 2034 |

|

Segmentation |

By Disease Indication

By Therapy Type

By Distribution Channels

By Geography

|

Key Industry Developments

- July 2021- BioMarin Pharmaceutical Inc announced the European Medicines Agency (EMA) approval for marketing authorization of its investigational gene therapy, valoctocogene roxaparvovec, for adults who are dealing with severe hemophilia A.

- May 2021 – CSL Behring announced the completion of commercialization and licensing agreement with uniQure for etranacogene dezaparvovec (AMT-061) for the treatment of Hemophilia B. The candidate is developed by uniQure and is currently in the Phase III clinical study.

- July 2020 - Spark Therapeutics, a gene therapy company, published the updated data from three dose cohorts of the ongoing Phase I/II clinical trial of investigational SPK-8011 in hemophilia A at a virtual congress at the International Society of Thrombosis and Hemostasis (ISTH) 2020.

Frequently Asked Questions

According to Fortune Business Insights, the hemophilia drugs market was valued at USD 16.16 billion in 2026 and is projected to reach USD 23.51 billion by 2034.

In 2025, the North America hemophilia drugs market was valued at USD 5.61 billion.

Growing at a CAGR of 4.79%, the market will exhibit significant growth in the forecast period (2026-2034)

The market is segmented into hemophilia A, B, and C, with hemophilia A accounting for the largest share due to its higher prevalence.

Key factors include increasing awareness of rare diseases, government initiatives, and rising investments in R&D for novel therapies.

Leading companies include Novo Nordisk A/S, Octapharma AG, Pfizer Inc., Sanofi SA, Swedish Orphan Biovitrum AB, and Takeda Pharmaceutical Company Limited.

North America dominated the hemophilia drugs market with a market share of 36.63% in 2024.

Recent advancements include the development of gene therapies, such as Hemgenix for hemophilia B, which offers a one-time treatment option.

Gene therapy has the potential to revolutionize hemophilia treatment by providing long-term solutions, thereby influencing market dynamics and patient preferences.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us