Heterojunction Solar Cell Market Size, Share & COVID-19 Impact Analysis, By Type (Monofacial Cell and Bifacial Cell), By Application (PV Power Station, Commercial, and Residential) and Regional Forecasts, 2026-2034

Heterojunction Solar Cell Market Size

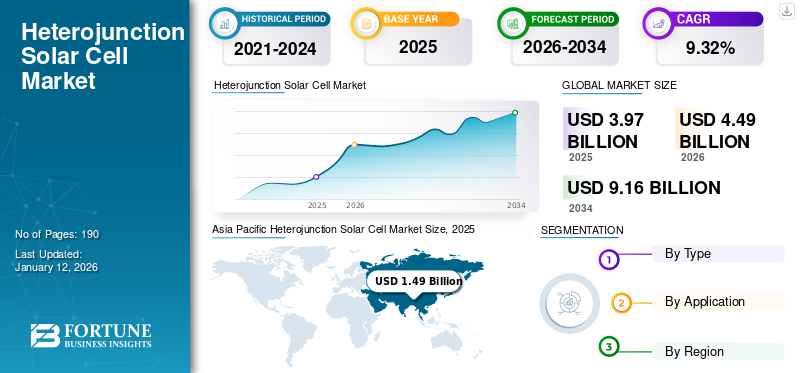

The heterojunction solar cell market size was valued at USD 3.97 billion in 2025 and is projected to grow from USD 4.49 billion in 2026 to USD 9.16 billion by 2034, exhibiting a CAGR of 9.32% during the forecast period. Asia Pacific dominated the global market with a share of 37.43% in 2025. The heterojunction solar Cell market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.64 billion by 2032.

The heterojunction solar cell is a crystalline silicon cell fitted between two layers of amorphous “thin film” silicon that captures some of the sunlight that hits it. HJT solar cell technology had the advantage of the same by building solar panels using three layers of photovoltaic materials. The single-crystal silicon layer in the middle does most of the work of converting sunlight into electricity. This increases the panels' efficiency and efficiently harvests more energy than conventional silicon solar panels.

SANYO Electric founded the HJT production concept in the 1980s (Panasonic acquired SANYO). SANYO was the first company to commercially produce amorphous silicon (a-Si) solar cells. This thin-film technology, majorly used in calculators, soaks up various light spectrums but has a low conversion efficiency.

COVID-19 IMPACT

Lockdowns and Closure of Various Sectors Caused Decreased Demand for Commercial Energy

An emergency such as the coronavirus or the COVID-19 pandemic has significantly affected commercial operations worldwide. The aftermath of this crisis has also shaken the economies of several fast-growing countries. Almost every nation worldwide has seen a steep increase in affected populations since the beginning of the current year. The unavailability of cures or vaccines against the viral infection has prompted many industry experts and players to continuously adopt multiple countermeasures to mitigate the effects. Also, the impact of the pandemic has exposed various types of problems, such as: in many countries, the renewable sector is highly dependent on imports from other countries, mainly from China. As per the Government of India, nearly 80% of solar cells and modules are imported from China, along with other equipment such as prefabricated structures, raw materials, and inverters in India.

Heterojunction Solar Cell Market Trends

Rising Adoption of Renewable Sources for Power Generation is Likely to Push the Heterojunction Solar Cell Market Growth

Rising concerns about climate change, the health effects of air pollution, energy security, energy access, and volatile oil prices in recent decades have led to the need to produce and use alternative, low-carbon technology options such as renewables.

Presently, Renewable energy sources account for about 29% of all electricity generation worldwide. Additionally, according to the International Energy Agency (IEA), renewable energy is projected to account for almost 95% of the increase in global electricity capacity by 2026, with solar PV alone accounting for more than half of the capacity, driven by increased government policy support and more ambitious clean energy targets.

Renewable energy sources that help reduce carbon emissions and act as everyday economic power sources are considered the best replacement for conventional power sources such as coal and oil. Presently, renewable sources account for around 29% of the total electricity generation globally. It is expected to rise considerably in the upcoming years and boost the market.

Download Free sample to learn more about this report.

Heterojunction Solar Cell Market Growth Factors

Decarbonization in Energy Sectors has enhanced the Production of Green Energy

The world is moving towards a clean energy transition to reduce carbon emissions and adapting renewable energies. The dramatic improvements to solar technologies and other clean energy technologies have enabled recent rapid growth in deployment and are providing cost-effective options for decarbonizing the energy sectors.

For example, Nextracker was selected by Mahindra Sustain to be the Solar supplier for Sakaka Solar Park. The project is part of a national program to deploy clean energy assets totaling 9.5 GW by 2023 and 58.7 GW by 2030.

The UK government aims to have about half its electricity from renewables in 2025. Germany is also on its path to accounting for renewables for 65% of its total energy by 2030. China plans to achieve 16% of its energy from renewables in Asia by 2030.

Technological Advancements and Increasing R&D Investment in Heterojunction (HJT) Solar Cells to Propel the Market Growth

Heterojunction solar cells are manufactured by combining two different technologies into one cell, in which a crystalline silicon cell is placed between two layers of amorphous thin-film silicon that increases the efficiency of solar panels. The heterojunction solar cell has high efficiency. They have 26% conversion efficiency for monofacial modules and more than 30% for bifacial modules. Further, these type of solar cells have a good temperature coefficient.

Heterojunction solar cells have high bifaciality factors, approximately 92%, which makes them a great performer when designed as a bifacial module. Also, their manufacturing process is easy. The factors mentioned above make them suitable for limited space applications, the power source for wearable devices, and utility-scale operations.

Additionally, improving solar cell technology and the efficiency of heterojunction solar cells by using diffraction grating and antireflection coating engineering is driving the market. Investment in R&D, technological advancement, and efficiency gains will lead to lower manufacturing costs and improved performance.

RESTRAINING FACTORS

High Initial Investment Restraints the Heterojunction Solar Cell Market Growth

The production of the solar cell requires high investment in the manufacturing line and interconnection technology, and it also leaves out the manufacturers the option to upgrade existing products. Such factors interpret as high investment risk.

Heterojunction Solar Cell Market Segmentation Analysis

By Type Analysis

Monofacial Heterojunction Solar Cells Segment Dominates Due to Lightweight Feature

The heterojunction solar cell market share is bifurcated based on type into mono-facial and bifacial cells. The Monofacial Cell segment holds the dominant market share of 75.68% in 2026, owing to its lightweight, as there is no solar cell on the back side of the monofacial solar panel. Furthermore, the mono-facial cell is more affordable than the bifacial cell and does not need a reflective surface. Bifacial solar panels deliver more power generation, especially where space is at a premium, and provide more power at a slightly higher installation cost, reducing LOCE costs.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

PV Power Station Application Segment to Dominate Due to Increasing Power Generation from Solar PV

The market is segmented by application into PV Power Station, Commercial, and Residential. The PV Power Station application holds the dominant market share of 44.79% in 2026, due to the increasing power generation from solar PV. Solar PV is one of the most significant renewable electricity technology, accounting for 3.6% of global electricity generation.

The residential segment is propelling due to strong government policies like the solar Investment Tax Credit, rapidly declining costs, and growing demand for clean electricity. For instance, as per Solar Energy Industries Association, more than 140GW of solar capacity is installed in the U.S., which can power up to 25 million homes.

REGIONAL INSIGHTS

This market is studied across the regions like North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Countries like China, India, Japan, South Korea, and Australia are some of the key market contributors to the Asia-Pacific. Some factors driving this region's growth are high renewable energy demand, rapid industrialization, and population.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 1.49 billion in 2025 and USD 1.73 billion in 2026. HJT solar cell demand in Asia Pacific comes primarily from the PV power station, driven by strong demand for electric generation and rising awareness of renewables. The Japan market is projected to reach USD 0.13 billion by 2026, the China market is projected to reach USD 1.14 billion by 2026, and the India market is projected to reach USD 0.21 billion by 2026.

Asia Pacific Heterojunction Solar Cell Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America and Europe

The market in North America and Europe is expected to propel due to government regulations regarding adopting renewable energy sources. For instance, the U.S. Office of Energy Efficiency & Renewable Energy summarizes the Federal Government's requirement to consume at least 7.5 percent of its electricity from renewable sources. The UK market is projected to reach USD 0.18 billion by 2026, and the Germany market is projected to reach USD 0.41 billion by 2026. The U.S. market is projected to reach USD 0.97 billion by 2026.

Latin America and Middle East & Africa

Furthermore, the market growth in Latin America, the Middle East & Africa is anticipated by decreasing solar technologies costs, further increasing concerns about climate change impacts.

KEY INDUSTRY PLAYERS

Companies Focus on Mergers & Acquisitions and Partnerships to Gain Competitive Edge

The market for heterojunction solar cells is fragmented and competitive, with various players accounting for the majority of the stakes in the market globally. Further, the key players are enhancing their production capacities by increasing operational enhancement and adopting digital tools, a benchmark factor. Subsequently, most of the key players operating in the market majorly provide mono facial solar cell modules, resulting in the dominating share of the HIT solar cell by type. Moreover, the bifacial solar cell provides lucrative opportunities as these panels can produce 27% more energy when compared to other solar cell modules.

In parallel, the adoption of HIT (heterojunction) solar cells is growing because HJT technology is the best approach to increase efficiency and power output to their highest levels. Increasing production capacity and R&D resources for heterojunction technology will benefit all downstream customers. It only helps reduce costs, increase efficiency, and improve reliability.

List of Top Heterojunction Solar Cell Companies Profiled:

- REC (India)

- GS-Solar (China)

- Jinergy (China)

- HuaSun (China)

- Akcome (China)

- TW Solar (Spain)

- Canadian Solar (Canada)

- Risen Energy (China)

- Enel (3SUN) (Italy)

- Meyer Burger (Switzerland)

- Hevel Solar (Russia)

- EcoSolifer (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 - Huasun signed an agreement to build a 5 GW HJT solar cell and module production facility in Hefei, Anhui province of China. The facility will be Huasun’s third production base outside its headquarters in Xuancheng city, equipped with the most advanced HJT manufacturing facility with the largest single-site production capacity.

- November 2022 - REC Group announced the production of the REC TwinPeak 5 Series, the fifth generation of its multiple-award-winning TwinPeak solar panels. The new product has improvised strength, including REC’s revolutionary Twin Design. REC introduced its patented split cell and junction box technology back in 2014

- December 2022 – Akcome has entered the top 500 Chinese Energy enterprises organized by China Energy News and the Chinese Institute of Energy Economics Research. This has reflected Akcome's comprehensive strength and leading position in new energy manufacturing and services.

- April 2022 - JINERGY announced the mass production of its ultrahigh-efficiency heterojunction modules in the second Jinneng Technology Developer Forum hosted by JINERGY during the SNEC 2017 PV Power Expo.

- November 2021 - Jinergy collaborates with Shaanxi Luonan to build a comprehensive demonstration solar PV project for agriculture tourism in n Luonan, Shaanxi Province. Jinergy has supplied 22.7 MW high-efficiency PERC bifacial double-glass solar modules for the project, helping to adjust the energy structure in the Luonan region and high-yield PV products to promote the consolidation and development of rural revitalization projects.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.32% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (MW) |

|

Segmentation |

By Type, By Application, and By Region |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 3.97 billion in 2025.

The market will likely grow at a CAGR of 9.32% over the forecast period (2026-2034).

Based on the application, the PV Power Station segment holds the dominating share in the global market.

The market size in Asia Pacific stood at USD 1.49 billion in 2025.

Technological Advancements and Increasing R&D Investment in Heterojunction (HJT) Solar Cells have propelled the market growth.

Some of the top players in the market are Brookfield business partners, GS Yuasa, Enersys, and Exide.

Asia Pacific dominated the global market with a share of 37.43% in 2025.

High Initial Investment Restraints the Market Growth

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us