Hydrogen Compressor Market Size, Share & Industry Analysis, By Type (Reciprocating and Centrifugal), By Application (Power Plants, Hydrogen Refueling Station, Industrial Furnaces, Petrochemical & Chemical, Pharmaceuticals, Oil & Gas, and Others), and Regional Forecast, 2026-2034

Hydrogen Compressor Market Size

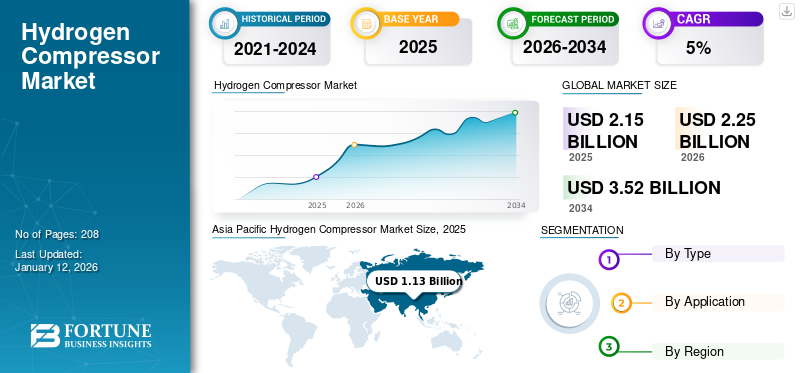

The global hydrogen compressor market size was valued at USD 2.15 billion in 2025. The market is projected to grow from USD 2.25 billion in 2026 to USD 3.52 billion by 2034, exhibiting a CAGR of 5.77% during the forecast period. Asia Pacific dominated the global market with a share of 52.81% in 2025.

Hydrogen compressor is a device designed to increase the pressure of hydrogen gas, for storage or transportation purposes. Hydrogen compressors are important for the hydrogen fuel industry, as compressed hydrogen gas takes up less space and can be more easily transported than uncompressed hydrogen gas. The development of hydrogen compression units is a vital part of this transition as the units enable the storage and transport of hydrogen in a safe and efficient manner. On a global scale, the development of hydrogen technology has been gaining momentum in recent years.

The impact of COVID-19 on the hydrogen compressor market has been moderate as it hampered hydrogen consumption in many end-user industries. This was due to disruptions in the raw material supply chain, unavailability of workforce, and hindrance in activities due to social distancing norms, which led to the shutdown of many industries requiring hydrogen and hydrogen compressors. Due to the pandemic and social-distancing measures, the requirement for these compressors almost came to a standstill for a few months, creating a negative impact on the market.

Despite the challenges of the pandemic, the governments of countries across the globe have continued to invest in hydrogen infrastructure and other clean energy projects to achieve a net zero emissions target. According to the Hydrogen Council, 131 hydrogen-related projects have been announced across the globe, reaching a total of 359, with an estimated investment of around USD 500 billion across the entire value chain by 2030. These initiatives are touted to boost the growth of the hydrogen compressor market.

Hydrogen Compressor Market Trends

Rising Demand for Fuel Cell Electric Vehicles to Push the Market Growth

Fuel cell electric vehicles (FCEVs) have been gaining traction in the market as an alternative to conventional fuel vehicles for lowering carbon emissions. Various research and development activities are in the process of accelerating the adoption of FCEV due to its longer driving ranges compared to other non-zero emission alternatives such as battery-based electric vehicles. FCEVs utilize hydrogen fuel cells to generate electricity, emitting only water vapor as a byproduct, thereby addressing concerns about air pollution and climate change.

As governments worldwide tighten regulations on vehicle emissions and strive to meet ambitious sustainability targets, the automotive industry is increasingly shifting toward FCEVs. For instance, at COP27, the U.S. set a target to only sell and produce zero-emissions medium and heavy-duty vehicles such as school buses and tractor-trailers by 2040 and achieve zero emission target by then.

Such a shift necessitates the establishment of robust hydrogen fueling infrastructure, including hydrogen compressor stations, to support the widespread adoption of FCEVs. Hydrogen compressors play a key role in facilitating the compression and storage of hydrogen gas, enabling the efficient refueling of FCEVs. Hence, a rise in the sales of FCEVs would provide an opportunity for the expansion of the market.

Download Free sample to learn more about this report.

Hydrogen Compressor Market Growth Factors

Escalating Demand for Hydrogen across Various End-user Industries to Fuel the Market Growth

Hydrogen has been one of the essential components in the petrochemical, chemical, metallurgy, electronics manufacturing, and other industries for the production of different products. Petrochemical and chemical processes require large volumes of hydrogen for hydrogenation, desulfurization, ammonia synthesis, methanol production, and other activities. Thus, to cater to the rising demand for hydrogen in these industries, hydrogen compressor demand is escalating for maintaining the necessary pressure levels during the production, storage, and transportation of hydrogen within these facilities.

Moreover, the petrochemical & chemical industries are expanding at a rapid rate due to the rise in population, urbanization, and the expansion of industries such as packaging, automotive, and others. According to the European Chemical Industry Council, the global chemical sales, including petrochemicals, have increased from around USD 4,109 billion in 2019 to about USD 6,423 billion in 2022. Thus, a surge in the sales of chemicals supported by the rising production requires huge quantities of hydrogen, further leading to the hydrogen compressor market growth.

Rising Government Initiatives for Promoting Hydrogen to Drive the Market Growth

The global greenhouse gas emissions have continuously been on the rise owing to the growing population, industrial activities, and electricity production worldwide. The countries participating in the United Nations decided to reduce the global temperature by 2 degrees Celsius by limiting carbon emissions by 45% by 2030 from 2010 levels and reach net-zero emissions by 2050. The governments of various countries across the globe have been taking numerous initiatives and measures to limit the emission of greenhouse gases and promote clean energy solutions.

One of the initiatives is the application of hydrogen in various areas, such as transportation, stationary power generation, and industrial processes. Various subsidies, policies, and funding programs for hydrogen infrastructure development have been proposed by countries such as India, the U.S., China, and others to fuel the utilization of hydrogen, further creating the demand for hydrogen compressors. For instance, in China, the hydrogen policy was launched in the 14th Five-Year Plan (2021-2025), officially the 14th Five-Year Plan for Economic and Social Development and Long-range Objectives. The "14th Five-Year Plan for Industrial Green Development" outlines a strategic focus on advancing hydrogen technology innovation and bolstering infrastructure for industrial decarbonization.

Moreover, the European Commission has set out strategies focusing on turning hydrogen into a solution to decarbonize different sectors over time. The goal is set to install at least 6 GW of renewable hydrogen electrolyzers in the EU by 2024 to produce 1 million tons of hydrogen and 40 GW by 2030 to produce 10 million tons of hydrogen. Similarly, other countries have also formulated strategies to achieve the net zero emission target through hydrogen further propelling the hydrogen compressor market expansion.

RESTRAINING FACTORS

High Cost Related to Hydrogen Compression to Restrain the Market Growth

Hydrogen compressor systems require substantial upfront investment, encompassing the purchase of equipment, installation, and infrastructure development. One of them is the initial procurement cost of hydrogen compression equipment, which consists of around 30%-40% of the hydrogen compressing cost. The compressors must meet stringent safety standards and technical specifications to handle hydrogen gas effectively, which often necessitates the use of specialized materials and engineering designs.

Additionally, the relatively low viscosity and high diffusivity of hydrogen gas present unique challenges for compression, requiring advanced compressor technologies that can operate efficiently and reliably under these conditions. Moreover, the compressor compresses and cools the gas, pressurizing it up to 5,000-10,000 psi for storage and transport, which further adds USD 1-3 per kg to the hydrogen produced. The development and production of such specialized equipment typically entail higher manufacturing costs, contributing to the overall expense of hydrogen compressor systems.

Furthermore, the infrastructure for hydrogen production includes the construction of hydrogen production facilities, storage systems, transportation networks, and refueling stations. Establishing a comprehensive hydrogen infrastructure is essential for ensuring a reliable supply chain and accessibility of hydrogen fuel but it also involves significant capital outlay. Moreover, the need for existing infrastructure may require additional investments in retrofitting or building new facilities, driving up costs for stakeholders. These costs turn out to be prohibitive for businesses and industries considering the transition to hydrogen-based technologies, particularly compared to alternative energy solutions.

Hydrogen Compressor Market Segmentation Analysis

By Type Analysis

Reciprocating Segment Leads the Market Due to its Varied Usage

Based on type, the market is segmented into reciprocating and centrifugal.

The reciprocating segment is currently dominating segment with market share of 66.67% in 2026, and is anticipated to grow at the fastest rate as well in the hydrogen compressor market during the forecast period. These compressors are favored in the hydrogen industry due to their ability to manage a wide range of hydrogen flow rates and discharge pressures. They are quite efficient when it comes to energy consumption and have a longer lifespan than other compressor types. Reciprocating compressors are perfect for small-scale hydrogen production applications, such as laboratories or fuel cell vehicles. Therefore, the preference for reciprocating compressors is increasing globally.

Centrifugal type hydrogen compressor are likely to witness significant growth during the forecast period due to their ability to efficiently handle large volumes of gas flow at relatively lower compression ratios, making them well-suited for applications requiring continuous and high hydrogen compression.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Wide Application Base in the Petrochemical and Chemical to Boost the Petrochemical & Chemicals Segment Growth

Based on application, the market is segmented into power plants, hydrogen refueling station, industrial furnaces, petrochemical & chemical, pharmaceuticals, oil & gas, and others.

The petrochemical & chemical segment holds the largest hydrogen compressor market share of 39.11% in 2026. Hydrogen is broadly used to produce ammonia, methanol, and other chemicals, attracting attention for the use of hydrogen compression units in the industry. Additionally, the surging investment in the chemical & petrochemical industry and rising FDI among the nations to cater the global demand for their end-product is projected to lead the market share in the coming years.

Hydrogen refueling station is projected to grow at the fastest rate in the coming years due to the rising research & development for the commercialization of fuel cell vehicles. These vehicles use hydrogen fuel cells as their power source, and they require high-pressure hydrogen gas for their operation. Hence, hydrogen compressors is required for pressurizing hydrogen gas to high levels and enabling efficient storage and delivery to the fuel cell stack, where it undergoes electrochemical reactions to produce electricity.

REGIONAL INSIGHTS

By geography, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Hydrogen Compressor Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the global hydrogen compressor market. The region is the largest producer and consumer of hydrogen. The regional market has witnessed significant growth in industries such as petrochemicals, chemicals, and oil & gas, which are some of the major consumers of hydrogen gas. As a result, the demand for hydrogen compression units in these industries has increased. The Japan market is projected to reach USD 0.069 billion by 2026, the China market is projected to reach USD 0.7 billion by 2026, and the India market is projected to reach USD 0.2 billion by 2026. Moreover, Japan, South Korea, and China are investing heavily in the development of hydrogen fuel cell technology and infrastructure, driving the growth of the market in the region.

North America, especially the U.S., has shown substantial growth in hydrogen compressor technology in recent years. The U.S. government has endorsed hydrogen as a clean energy source and invested in hydrogen infrastructure development. One of the major initiatives in the U.S. is the hydrogen and fuel cell technologies office (HFTO), which is a part of the DOE (Department of Energy). The HFTO emphasizes the development of hydrogen and fuel cell technologies and supporting research, development, and demonstration projects. The U.S. market is projected to reach USD 0.33 billion by 2026.

Europe has numerous companies and countries leading the way in the development of new technologies and applications for hydrogen. Various companies in Europe are also investing in hydrogen technology and infrastructure. For instance, In June 2024, The European Commission has approved Germany's around USD 3.25 billion plan to create a Hydrogen Core Network (HCN). This initiative is part of the EU’s Hydrogen Strategy and ‘Fit for 55’ package, which aims to speed up the development of renewable hydrogen infrastructure across Europe. The UK market is projected to reach USD 0.02 billion by 2026, while the Germany market is projected to reach USD 0.032 billion by 2026.

Key Industry Players

Key Players Are Focusing On Expanding Their Product Capabilities And Developing New Products

The global market comprises a few global players and numerous small and medium-scale players. Major players include Siemens, Mitsubishi Power, Neuman & Esser Group, Atlas Copco AB, Howden Group, and Ingersoll Rand. The major companies capture more than half of the market share and many regional and local players for various applications hold the remaining market share. New product development has been a major market strategy adopted by major players. For instance, Pure Energy Centre (PEC) has been developing, manufacturing, designing, and installing low-high-pressure compressors globally. They are offering services and products for hydrogen compression units globally, aiming at various industries, which include energy storage, renewables, chemical, oil and gas, manufacturing, hydrogen filling stations, and other applications.

List of Top Hydrogen Compressor Companies:

- Siemens (Germany)

- Mitsubishi Power (Japan)

- Neuman & Esser Group (Germany)

- Atlas Copco AB (Sweden)

- Howden Group (U.K.)

- Ingersoll Rand (U.S.)

- Pure Energy Centre (U.K.)

- Hoerbiger (Switzerland)

- Cook Compression (U.S.)

- Hycomp Inc. (U.S.)

- Sundyne (U.S.)

- HIPERBARIC (Spain)

- Mehrer Compression GmbH (Germany)

- PDC Machines (U.S.)

- Baker Hughes (U.S.)

- SIAD Macchine Impianti S.p.A. (Italy)

- CYRUS S.A. (Greece)

- Burckhardt Compression AG (Switzerland)

- Ariel Corporation (U.S.)

- Fluitron (U.S.)

- HYDRO-PAC, INC. (U.S.)

- HyET Group (Netherlands)

- Lenhardt & Wagner GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- January 2024- Atlas Copco announced the acquisition of Hycomp, which specializes in high-pressure oil-free compressors and boosters for a variety of industries. Hycomp is a Salt Lake City, Utah, a U.S.-based company with 37 employees and a revenue of around USD 8 million in 2023. The acquired company also has extensive expertise in high-pressure, oil-free compressors, which would lead to the expansion of Atlas Copco's product range.

- January 2024- Hyperbaric participated in the HyVolution exhibition held between January 30 and February 2 to increase its presence in the European market. The HyVolution trade show is the reference event for the hydrogen industry in Europe. It brings together more than 100 exhibitors from 20 countries, along with representatives of governments, institutions and companies from all over the world.

- October 2023- Dover, the parent company of Cook Compression, announced the acquisition of FW Murphy Production Controls, which is a subsidiary of Genisys Controls LLC. The acquisition was completed for a value of around USD 530 million. After the acquisition, FW Murphy Production Controls started operating as a part of Dover Precision Components, which is an operating unit of Dover Corporation within its Pumps & Process Solutions segment.

- June 2023 - Ingersoll Rand agreed to acquire Howden Roots from Chart Industries for around USD 300 million. Howden Roots is one of the leading providers of low-pressure comdpression and vacuum technologies. Roots had a revenue of approximately USD 115 million by then and an established installed base that supports a strong aftermarket business model.

- January 2022- Ariel Corporation and Hoerbiger, a prominent provider of technology for reciprocating gas compressor components, announced that they entered into an agreement to offer non-lube compressor solutions that would meet the hydrogen compression needs of the future hydrogen mobility market. These solutions would be suitable for various high-pressure, high-volume vehicle-fueling applications, including public transportation, large fleet vehicles, private trucking companies, trains, boats/ships, and others.

REPORT COVERAGE

The global market research report grants a complete industry assessment by proposing valuable insights, facts, industry-related information, competitive landscape, and past data. Various methodologies and approaches are accepted to make expressive assumptions and views to formulate the global market analysis.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.77% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Application, and Region |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the global market was valued at USD 2.15 billion in 2025.

The global market is expected to grow at a CAGR of 5.77% during the forecast period.

The Asia Pacific market size stood at USD 1.13 billion in 2025.

Based on type, the reciprocating segment leads in the global market.

The global market size is expected to reach USD 3.52 billion by 2034.

The key market driver is the growing government efforts to achieve net zero emissions that ultimately increase the demand for hydrogen.

The top players in the market are Siemens, Mitsubishi Power, Neuman & Esser Group, and Atlas Copco AB.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us