Hydronic Radiators Market Size, Share & Industry Analysis, By Type (Panel, Baseboard, Convector, Fan Coil, and Others), By Material (Steel, Aluminium, Cast Iron, and Others), By End-User (Industrial, Commercial, and Residential), and Regional Forecast, 2026-2034

Hydronic Radiators Market Size

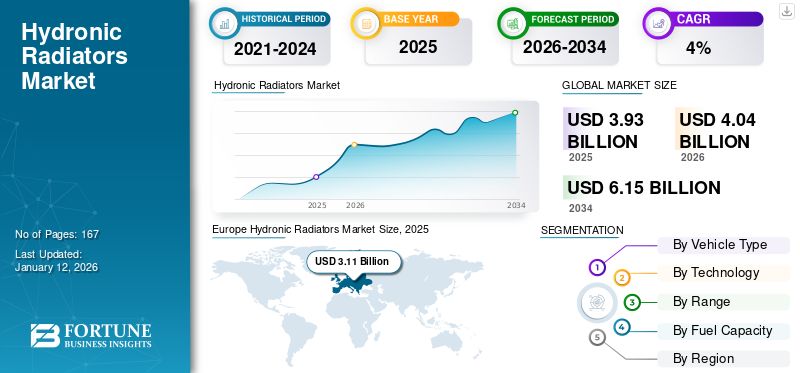

The global hydronic radiators market size was valued at USD 3.93 billion in 2025. The market is projected to grow from USD 4.04 billion in 2026 to USD 6.15 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period. Europe dominated the global market with a share of 79.04% in 2025. The hydronic radiators market in the U.S. is projected to grow significantly, reaching an estimated value of USD 183.55 million by 2032, driven by the green building standards and improved radiator designs.

Hydronic radiators are heating devices that utilize hot water as a heating source. They can be more energy-efficient than forced air heaters as heat is not lost via the transportation of heated air. In addition, the absence of air movement and the lack of airborne particulates have made these radiators popular among consumers who suffer from respiratory ailments or allergies.

The COVID-19 pandemic negatively impacted the market’s growth, affecting the demand and supply of these radiators due to several factors, such as lockdowns, border closures, and disruptions in global trade.

The American Society of Heating, Refrigerating, and Air-Conditioning Engineers highlighted the high likelihood of airborne transmissions of the virus, prompting the need to manage exposure. Changes in building operations, including ventilating, heating, and air-conditioning systems aimed at reducing airborne exposures, affect the demand for new heating systems.

Hydronic Radiators Market Trends

Increasing Automation in Hydronic Radiator Systems

The automation of hydronic heating is expected to be a popular market trend in the coming years. The rising trend of smart homes will give rise to the need for smart heating and cooling products. For instance, in September 2022, Aqara launched HomeKit-compatible smart radiator thermostat named Radiator Thermostat E1. This product facilitates the automation of hydronic radiators, receiving signals from outside the unit. The product supports Zigbee 3.0 at launch, accompanied by Google Home, HomeKit, IFTTT, Amazon Alexa, and other technologies, with expected support for smart home protocols in upcoming software updates. This product is unique from its competitors as it receives temperature readings directly from a connected Aqara temperature sensor. When combined with a Window Sensor and Aqara Door, the thermostat can turn off the heat when it detects an open window or door. These properties help reduce energy waste. In addition, this thermostat can be powered only by AA batteries and has a 12-month battery life.

Download Free sample to learn more about this report.

Hydronic Radiators Market Growth Factors

Increasing Prevalence of Extreme Weather Events and Changing Climate Patterns Underscores the Importance of Resilient and Adaptable Heating Solutions

The effects of climate change, such as extreme weather events and fluctuating temperatures, are becoming more pronounced globally. Hydronic radiators offer a reliable and adaptable solution in regions where traditional heating systems struggle to adapt to these changes. This drives demand for hydronic heating systems in both established and emerging markets. Hydronic radiators stand out as a viable option to meet these evolving needs, contributing to greater energy efficiency and comfort in established and emerging markets worldwide.

In November 2023, Purmo Group announced a 25% reduction in the energy needed to produce radiators at its factory in Meiningen, Germany. This decrease in energy demand per radiator is due to several production improvements at the plant, which used more than 4.2 million kWh of combined electricity and gas to produce radiators in 2020.

Increasing Technology Advancements in Hydronic Radiators to Boost Demand for Product

Companies are introducing modern hydronic radiators to consumers to upgrade the old technologies and make radiators more energy efficient. These hydronic systems are integrated with multiple functions to make them more attractive and suitable for the new infrastructure.

- In July 2022, Conex Bänninger launched a pressure-independent control valve in the Middle East. Conex’s Pressure Independent Control Valves (PICVs) utilize dynamic balancing to handle pressure variations in a building’s hydronic heating system.

Smart thermostats offer greater flexibility and control of heating systems, conserving energy by automatically adjusting temperatures based on occupancy and notifying users about open windows to prevent heat loss. All these energy-saving characteristics also help to save money on heating bills.

Technological advancements have led to the development of high-efficiency hydronic radiators equipped with features such as programmable thermostats, adaptive controls, and smart heating algorithms. These technologies optimize heating performance, reduce energy consumption, and enhance comfort by maintaining precise temperature control in different zones of a building.

RESTRAINING FACTORS

Availability of Hydronic Radiator Alternatives to Hamper Market Growth

One of the major factors hindering hydronic radiators market growth is the availability of alternatives, such as electric radiators, air heating, and others. A broad array of optional heating options creates a competitive market situation, providing end-users with numerous options when selecting a heating system for their buildings. Some alternative heating options are more well-established and readily available, impacting the demand for hydronic radiators. For instance, electric radiators use electric power to generate heat to warm the room and they are quite compact and can be easily fixed into small, narrow rooms. They are experiencing increased demand due to their lower operating costs, easy maintenance, efficiency in maintaining accurate temperatures, and wide range of applications. In addition, some developments in electric radiators indicate that their demand is increasing.

- In May 2023, Stelrad launched a new series of electric radiators. Stelrad is one of the major brands in central heating radiators and aims to expand its presence in the electric market with a highly competitive range of aluminium and steel electric radiators. The new electric radiator series has been available via merchants since September 2023.

- In May 2023, Kelvin, one of the growing companies in smart, decarbonized HVAC solutions for legacy buildings, announced the closing of USD 30 million in Series A funding. The rebranding from Radiator Labs to Kelvin reflects the company's progress beyond radiators, including expansion into the European and the U.S. markets and aiming at older building decarbonization where emissions reduction is a crucial climate goal.

Hydronic Radiators Market Segmentation Analysis

By Type Analysis

Panel Segment Dominates the Market Due to its Beneficial Properties

Based on type, the market is segmented into panel, baseboard, convector, fan coil, and others.

The panel segment is the dominant segment in the market due to its beneficial properties, with a market share of 42.82% in 2026, such as space-saving designs, quick warm-up time, even heat distribution, energy efficiency, and silent operation.

Baseboard holds the second leading position in the segment. Hydronic baseboard heat offers even more heat distribution than electric baseboards and is an efficient heater. In addition, it decreases the overall energy use by cycling on and off less frequently than other heating systems.

Fan coil radiators are expected to dominate the market in the coming years. Fan coil radiators utilize warm water from the heat source to heat the room. However, traditional radiators need electricity to propel the fan, which draws cool air over internal radiator fins and gently blows warm air back into the room.

By Material Analysis

Steel Segment is Projected to Lead With its Superior Material Characteristics

Based on material, the market is segmented into steel, aluminium, cast iron, and others.

The steel segment is anticipated to hold the largest hydronic radiators market share of 75.00% in 2026, due to its widespread availability and cost-effectiveness. In addition, steel has excellent conductivity, resulting in quick heating compared to other materials. These characteristics of steel hydronic radiators decrease the waiting period for the space to heat up during the winter season and retain heat efficiently even after being turned off.

The aluminium segment’s growth is anticipated to be faster in the coming years. It offers numerous advantages, such as being easily recyclable, and radiators made from recycled aluminium are becoming increasingly common. In addition, it heats up quickly and requires less water. These characteristics, along with its recyclable properties, may make it a potential choice, especially in environmentally conscious settings.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Residential Sector Leads owing to Growing Emphasis on Energy Efficiency and Sustainability

Based on end-user, the market is segmented into industrial, commercial, and residential.

The residential sector dominates the global hydronic radiator market with a share of 71.04% in 2026, due to its several advantages. The residential sector represents a large and growing market for these radiators. With rising demand for energy-efficient and cost-effective heating systems in homes, the need for residential hydronic radiators is expected to witness robust growth.

The commercial sector segment is the second most dominant segment. Commercial buildings, such as offices, hospitals, schools, and hotels, require efficient heating systems. Hydronic radiators provide consistent and reliable heating, making them a preferred choice in these environments. Many commercial buildings are undergoing retrofitting and modernization to improve energy efficiency. Hydronic radiators are often included in these upgrades due to their compatibility with modern energy-efficient systems. These factors collectively contribute to the dominance of the commercial segment in the hydronic radiator market.

REGIONAL INSIGHTS

Based on geography, the global market has been analyzed across North America, Europe, the Asia Pacific, and the rest of the world.

Europe Hydronic Radiators Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the hydronic radiator market due to the presence of multiple industry players, and the climate conditions in the U.K., Russia, and Germany make heating a basic need. For instance, in February 2023, the U.K. introduced a USD 33.65 million heat network support program. This initiative aimed to refurbish outdated and unproductive heat networks to produce inexpensive energy and decrease carbon emissions for numerous homes across Wales and England. Through the newly launched heat network efficiency plan, out-of-date equipment will be replaced with energy-efficient substitutes, such as underfloor heating controls, pipe insulation, and replacement pumps. In addition, the established tourism sector in Europe also surges the demand for hydronic radiators, with establishments such as hotels and restaurants. For instance, according to Eurostat, 62% of EU residents embarked on at least one personal tourism trip in 2022. In addition, the first half of 2023 witnessed the highest number of overnight stays at tourist places in the past decade. This indicates a considerable growth in the tourism industry's performance in many countries.

North America is also one of the major markets. The region's rapidly changing climate is the primary driver of the North American hydronic radiators market growth. The U.S. market is projected to reach USD 0.13 billion by 2026. The region's cold weather is also propelling the demand for heating systems. Steps are being taken by the authorities in the region to achieve a high level of efficiency in residential and commercial buildings. The region has set a target to achieve carbon neutrality, increasing the deployment of renewable sources in the heating sector.

Hydronic radiators are being increasingly adopted in the Asia Pacific. Yet, the adoption rate is not high compared to other developed regions. One factor is the relatively lower level of awareness about the benefits of these radiators. Many people are unfamiliar with the technology and may be unaware of the potential savings in energy consumption that can be achieved using these technologies. The Japanese market is projected to reach USD 0.019 billion by 2026, and the China market is projected to reach USD 0.48 billion by 2026.

KEY INDUSTRY PLAYERS

Purmo Group Focuses on Having a Strong Presence Globally Through Contracts and Agreements

Purmo Group is one of the world’s major suppliers of indoor climate comfort solutions in both electrical and hydronic forms. It supplies products ranging from heating or cooling to its distribution, control, and emission. Purmo Group’s radiators are the most popular devices, comprising different model types, such as decorative panels, convectors, and towel warmers.

- September 2022: ArrowXL, one of the U.K.’s most prominent companies in 2-person home delivery, was awarded a contract with Purmo Group U.K. to deliver designer radiators to homes across the country.

LIST OF TOP HYDRONIC RADIATORS COMPANIES:

- Runtal North America Inc. (U.S.)

- Purmo (Finland)

- Advanced Hydronics (U.S.)

- Rehau Group (U.K.)

- Zehnder Rittling (U.S.)

- Henrad (Belgium)

- WISELIVING (Australia)

- Bosch Home Comfort Group (Germany)

- Hudson Reed (U.K.)

- Beizhu Radiator Company (China)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: Ironworks Radiators has announced the launch of Fondital's Cool series of towel rail radiators in Canada. Made by Italian company Fondita, the cool towel radiators aim to strike a balance between form and function, bringing warmth with an elegant and contemporary design.

- December 2023: Stelrad, in partnership with Tata Steel, introduced the “Green Steel” radiator range. Tata Steel is supplying U.K.-manufactured 90% Carbon Lite steel solely to Stelrad within the radiator market. This initiative enables consumers to choose from the Green Compact radiator range, contributing to the reduction of atmospheric carbon dioxide levels.

- February 2023: The U.K. government launched a USD 33.65 million heat network support program. This scheme focuses on old and unproductive heat networks to produce inexpensive energy and decrease carbon emissions for numerous homes across Wales and England. Through the newly launched heat network efficiency plan, out-of-date equipment would be developed with energy-efficient substitutes, such as underfloor heating controls, pipe insulation, and replacement pumps.

- September 2022: Therma-HEXX, a leading North American company in modular radiant and heating systems, announced the launch of high-performance ThermaPANEL modular hydronic radiant and heating systems. These systems are designed for newly built and refurbished residential, commercial, and industrial buildings and projects.

- October 2021: Manufacturer Stelrad, which currently dominates the UK steel panel radiator market with more than 50%, is considering an IPO to fund a significant expansion. This expansion plan would mean diversifying into other low-carbon heating products and moving geographically into new markets.The group, which is headquartered in Mexborough, Yorkshire, sees a three-pronged growth opportunity, which would mean organic growth. Exploit its distribution and brands to move into new territories and diversify into product areas such as air transport.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Material, End-User, and Region |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights study shows that the global market was worth USD 3.93 billion in 2025.

The global market is projected to record a CAGR of 5.40% during the forecasted period.

The market size of Europe stood at USD 3.11 billion in 2025.

Based on end-user, the residential segment dominates the global market.

The global market size is expected to reach USD 6.15 billion by 2034.

Increased demand for energy efficient heating systems for residential and commercial sectors is a key factor driving market growth.

Purmo Group, Runtal North America, and Zehnder Rittling are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us