Instant Noodles Market Size, Share & Industry Analysis, By Type (Chicken, Vegetable, Seafood, Beef, and Others), By Raw Material (Oats, Rice, Wheat, and Others), By Packaging (Bag and Cup), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Convenience Stores, and Online Retail), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

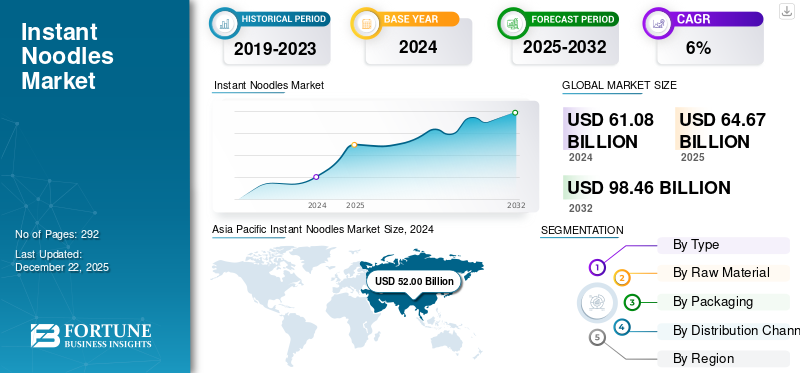

The global instant noodles market size was valued at USD 61.08 billion in 2024. The market is projected to grow from USD 64.67 billion in 2025 to USD 98.46 billion by 2032, exhibiting a CAGR of 6.19% during the forecast period. Asia Pacific dominated the instant noodles market with a market share of 85.13% in 2024.

These noodles are dried noodles that are pre-cooked and require minimal preparation before consumption. Such products are consumed by adding boiling water to the product. These packaged food products contain flavoring powder and seasoning oil, which enhance the flavor of the cooked product. They are sold in cup and packet formats and are typically made of wheat, rice, or other grains. They originated in Japan in the 1950s, and today it is produced in over 90 countries worldwide. It has become one of the most internationally recognized food products that is consumed across several developing, as well as developed countries. Convenience, taste, nutrition, and affordable price are major factors contributing to its increasing popularity among consumers.

Nissin Food Holdings, Nestle S.A., ITC Limited, and Unilever Plc. are a few of the key players operating in the market.

IMPACT of COVID-19

The COVID-19 pandemic influenced consumers’ choices, with most consumers gravitating toward packaged products as a convenient and affordable option. During 2020-21, the cost of fresh foods grew enormously, directly boosting the intake. Along with affordability, the surging trend of snacking also supported the increased consumption worldwide. According to the World Instant Noodles Association, a representative body, the consumption of these products increased across Asia Pacific. For instance, instant noodle consumption in China grew from 41.45 billion servings in 2019 to 46.36 billion servings in 2020, and in Vietnam, it increased from 5.4 billion servings in 2019 to 7.03 billion servings in 2020.

Global Instant Noodles Market Key Takeaways

Global Market Size

- 2024: USD 61.08 billion

- 2025: USD 64.67 billion

- 2032: USD 98.46 billion

- CAGR (2025-2032): 6.19%

Top Regions

- Asia Pacific remains the largest market, valued at USD 52.00 billion, led by high consumption in China, Indonesia, India, Vietnam, and Japan in 2024.

- North America is projected at USD 3.93 billion, supported by product innovation and multicultural preferences in 2025.

- The Middle East & Africa will reach USD 2.19 billion, with strong growth in Nigeria, Saudi Arabia, and other GCC countries in 2025.

- Europe is expected to be valued at USD 2.03 billion, with growth in the U.K., Germany, and France in 2025.

- South America shows rising demand for ready-to-eat foods through hypermarkets and online retail in 2025.

Leading Countries

- China will reach USD 21.98 billion in 2025.

- Japan will record USD 4.75 billion in 2025.

- India is expected to hit USD 4.60 billion in 2025.

- The U.S. will grow to USD 3.01 billion in 2025.

- Saudi Arabia will stand at USD 410 million in 2025.

- The U.K. will reach USD 217 million in 2025.

- Germany is projected at USD 112.2 million in 2025.

- France will hit USD 35.68 million in 2025.

By Type

- Beef-flavored instant noodles lead with a 29.40% share in 2024.

- Vegetable flavor holds a 12.64% share globally in 2024.

By Raw Material

- Wheat-based noodles dominate with a 53% share in 2025.

- Rice-based noodles are projected to grow at a CAGR of 6.19% from 2025 to 2032.

By Packaging

- Bag-packaged noodles lead with a 68% share in 2025.

- Cup noodles are expected to grow at a CAGR of 5.69% from 2025 to 2032.

By Distribution Channel

- Supermarkets and hypermarkets hold the largest share at 47% in 2025.

- Online retail is the fastest-growing channel with a CAGR of 6.92% from 2025 to 2032.

INSTANT NOODLES MARKET TRENDS

Increasing Adoption of High Quality Ingredients to Support Market Trends

Gourmet noodles are becoming popular among consumers as they are perceived to have higher nutritional benefits, with products available in a wide range of flavors and tastes. Manufacturers use high-quality ingredients with complex and nuanced sauces that add more texture and flavor to such products. Apart from meat-based noodles, vegetarian and vegan noodles are also being launched to cater to the diverse palates of consumers in the global market. For instance, in November 2023, Ishimaru, the top noodle manufacturer in Japan, launched the ‘Made in Japan for India’ dry noodle product line in the Indian market. The product range includes Udon Noodles and Ramen Noodles, which are made of 100% highest grade Japanese wheat. These new product launches support the global instant noodles market growth.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Strong Demand and Availability of Wide Variations to Boost Instant Noodles Sales

Instant noodles are one of the major staple foods in various cultures across China, Japan, South Korea, Indonesia, and Vietnam, thus driving market growth. Moreover, the increasing consumption of these noodles across the region fuels the market growth. According to the World Instant Noodle Association, China, Indonesia, India, Vietnam, and Japan are the largest consumers of instant noodles worldwide. The strong presence of international and local players offering a diverse range of products across the global market, coupled with rising disposable income spending among the middle-class population across countries, fuels the market growth. Furthermore, various major industry participants are launching new products to diversify their portfolios and attract new consumers. For instance, in October 2024, Toyo Suisan Kaisha, Ltd., a Japan-based food company, launched its new instant cup noodle, Maruchan Yamitsukiya Sichuan Style Dry Dandan Noodles.

Growing Demand for Convenient Ready-To-Cook Food Products to Support Market Growth

The demand for convenience foods is increasing significantly owing to the rising number of working professionals and the growing number of students in China, Japan, India, and South Korea. According to the National Bureau of Statistics of China, a government agency, in 2023, the number of employed individuals was 470.32 million in urban areas across China. These noodles eliminate the need for lengthy meal preparation and extensive cooking skills, allowing working individuals & students to offer a hot meal without any hassle. Additionally, these are one of the preferred options for quick meals across budget-conscious consumers owing to their reasonable costs.

Market Restraints

Variation in Raw Material Production and Availability to Hamper Market Growth

Although noodles are made of different ingredients, wheat is one of the most widely used ingredients in their preparation. Some of the common varieties of wheat used in the preparation of noodles include semolina, wheat flour, whole wheat flour, and others. Any disruption in production and availability can significantly impact the noodle market. Disruption in the consistent supply of raw materials, mainly wheat, can significantly affect the production and availability of noodles in the market. In recent years, the escalation of geopolitical conflicts in key wheat-producing countries has increased the risk associated with the instant noodles supply chain. Such interruption led to fluctuations in the production and market price of these products. As per data provided by ITC Trademap, wheat exports declined during the period 2021 to 2023, declining from 200.63 million tons to 163.34 million tons. Moreover, climate change is also impacting crop yield in several parts of the world, leading to reduced availability of raw materials and negatively impacting the market.

Market Opportunities

Growth in Clean Label Products to Create Opportunity for Product Innovation

Consumers are becoming increasingly health-conscious and are seeking out clean products that are free from artificial ingredients, colors, and preservatives. There is a rising preference for clean-label and organic products. Various studies have linked sodium and refined carbohydrate content present in such products with cardiovascular disease, obesity, and other health complications. Hence, manufacturers are launching healthier versions in the market to meet the growing demand. For instance, in July 2022, Foodle Noodle, a rice noodle company, launched its first clean-label organic cup noodle product line in Thailand.

Segmentation Analysis

By Type

Beef Noodle Type Accounts for Highest Market Share Due to Wider Consumption in Asia Pacific

On the basis of type, the market is fragmented into chicken, vegetable, beef, seafood, and others.

Among these types, beef accounts for the highest market share in 2024, owing to wider consumption in the Asian region.

Beef noodles are rich in flavor and have an umami taste compared to other noodle varieties. It can be cooked and consumed using different cooking methods.

Chicken flavor is another prominent flavor that is popular among consumers. Chicken is one of the most widely consumed meat formats across the world, and these noodle varieties are popular among consumers.

Seafood is another fast-growing segment in the global market due to increasing demand for nutritious foods, paired with the often cheaper prices and availability of raw materials. Moreover, ongoing global market trends of natural and vegan are likely to boost the vegetable varieties globally, especially in Europe.

Other types, such as pork and egg noodle varieties, are also popular among consumers. Pork noodles are specifically popular among consumers in the Asian region, which contributes to their growth.

- Beef-flavored instant noodles accounted for 29.40% of global market share in 2024, making it the most popular variant.

To know how our report can help streamline your business, Speak to Analyst

By Raw Material

Greater Digestibility Property to Lead Wheat Segment’s Dominance

On the basis of raw material, the market is fragmented into oats, rice, wheat, and others.

Wheat segment holds a prominent share of the global market, due to the numerous functional properties such as physicochemical properties, pasting properties, and rheological properties, wheat flour enhances the quality of noodles.

Rice noodles are significantly popular across Asian countries, including China, Vietnam, Japan, and the Philippines, owing to the traditional diet practices. Rice noodles are suitable for consumers who prefer gluten-free options that can be digested easily. As Asia Pacific is the leading producer of rice and consumer of noodles, this grain is used for manufacturing a wide range of noodles.

The oats segment is projected to evolve as a fast-growing segment. The rich nutritional value and gluten-free factor have influenced the usage of oats or oat flour in the production.

- Wheat-based instant noodles represents 53% of the market in 2025.

- Rice-based noodles are projected to grow at a CAGR of 6.19% from 2025 to 2032, driven by gluten-free and regional preferences.

By Packaging

Bag Products Packaging to Multiply Global Market Size Owing to High Portion Size

On the basis of packaging, the market is segmented into bag and cup.

Bag noodles account for the highest market share in 2024, owing to the high portion size and economical price options compared to cup noodles. The large product size of the noodles allows consumers to prepare and customize the meal according to their convenience. Price-conscious consumers also prefer bag noodles as the price per serving is lower than cup noodles.

- Bag-packaged noodles dominated the market with a 68% share in 2025, due to affordability and bulk purchase trends.

- Cup noodles are expected to grow at a CAGR of 5.69% during 2025–2032, supported by their convenience and premium positioning.

The cup packaging of the product has become more popular among producers in recent years. As compared to bag packaging, cups are safer during transportation and storage. Furthermore, waterproof polyester material used in cup production allows the users to put the cups directly into the microwave during noodle preparation, which is more convenient. Such benefits are likely to drive the segment’s growth.

By Distribution Channel

Supermarkets/Hypermarkets to Hold a Major Market Share due to their Offering of a One-stop Shopping Experience

On the basis of distribution channel, the market segmentation includes supermarket/hypermarket, specialty stores, convenience stores, and online retail.

- Supermarkets and hypermarkets held the largest share in 2025, accounting for 47% of global sales.

- Online retail is the fastest-growing channel, with a projected CAGR of 6.92% from 2025 to 2032, driven by e-commerce expansion and direct-to-consumer marketing.

Supermarket/hypermarkets account for the highest market share in 2024.

The rapid emergence of mass merchandisers in developing markets, such as India, China, and other economies, enables higher sales momentum of the product worldwide. These giant retailers have expertise in offering several facilities, such as separate product shelves, informative product boards, and others, which offer a good shopping experience to the consumers under a single roof. However, the e-commerce boom has effectively provided tailwinds to online retail sales of food products. Hence, online retail is expected to register the fastest growth during the forecast period (2025-2032).

INSTANT NOODLES MARKET REGIONAL OUTLOOK

The market is segmented regionally into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Instant Noodles Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific was the largest regional market in 2023, valued at USD 49.17 billion, and grew to USD 52.00 billion in 2024. Numerous brands with product lines containing innovative flavors are popular among consumers in the region. Different countries have different choices of noodles with distinct flavors, broth levels, and spice levels, which adds to the diversity of the consumption of such products in the region. There are several companies, namely Indofood Sukses Makmur Tbk, Nissin Foods Holdings Co., Ltd., Toyo Suisan Kaisha, Ltd., Nongshim Holdings, Samyang Foods Co., Ltd., and others, which are headquartered in Asia, and are some of the largest manufacturers of these products.

To know how our report can help streamline your business, Speak to Analyst

China is one of the largest consumers of such noodles in the world. Different flavors and types of noodles, which range from flour-based to rice vermicelli and cellophane, are produced and consumed in the country. Beef, chicken, and seafood-based noodles are popular in the country. As the popularity of noodles in the country is high, consumers prefer to purchase products in large packages.

- China will reach USD 21.98 billion by 2025, driven by strong domestic demand and diverse product offerings.

- India is expected to hit USD 4.60 billion by 2025, fueled by urbanization and demand for convenient foods.

- Japan will record USD 4.75 billion by 2025, supported by a strong noodle culture and flavor innovations.

North America

As the demand for noodles in the North American market is growing, several food and beverage companies based in the U.S. are also manufacturing and launching new and innovative product lines for consumers. For instance, in March 2025, General Mills launched ramen noodles in the market. The product line includes Old El Paso Ramen Noodles – Fajita, Old El Paso Ramen Noodles – Beef Birria, Totino’s Ramen Noodles – Cheese Pizza, and Totino’s Ramen Noodles – Buffalo-Style Chicken Pizza. These products are available at Walmart stores across the U.S. Manufacturers who are also collaborating with social media influencers to market their products effectively to the younger consumer. This short-form creative content includes recipes that show ways to upgrade meals with the addition of ingredients such as chili oil, crispy onions, seaweed, and other products.

- North America is projected to be the second-largest market in 2025, with a value of USD 3.93 billion, growing at a CAGR of 6.98% during the forecast period.

- U.S. will grow to USD 3.01 billion by 2025, driven by multicultural preferences and convenience trends.

Europe

In Europe, instant noodles, which are made of healthy ingredients, are preferred among consumers. Hence, manufacturers are moving toward ingredient-based product innovation and incorporating more ingredients to make noodles that are healthy for the body. For instance, a healthier range manufactured by MAMA, a Thailand-based instant noodle manufacturer, is popular in Greece, the Netherlands, Germany, and other European countries.

- Europe is expected to be the fourth-largest market, valued at USD 2.03 billion in 2025. U.K. will reach USD 217 million by 2025, boosted by online sales and interest in Asian cuisine.

- Germany is projected at USD 112.2 million by 2025, with growing demand for quick and ethnic meal options.

- France will hit USD 35.68 million by 2025, with gradual growth among younger consumers.

South America

Increasing consumption of ready-to-eat food products in economies of South America and increasing spending of people on convenient food due to hectic lifestyles are expected to fetch opportunities for sales growth in the region. Mass merchandisers account for a major share in the distribution of instant noodles in the South American market, as consumers of the region highly prefer hypermarkets and supermarkets for grocery shopping. However, in recent years, sales of instant noodles through online retail channels have grown significantly due to increasing consumer interest in online shopping as they offer high convenience and wide product & brand choices.

Middle East & Africa

Instant noodles are growing in popularity in the African markets as well. In Nigeria, South Africa, and other African countries, the affordability and convenience of preparing noodles are making them a favorite among consumers. As per data published by the World Instant Noodles Association, consumption of these products witnessed a staggering growth of 53% in Nigeria, 160% in Kenya, 150% in Colombia, and 110% in Egypt during the period 2018 to 2022. The COVID-19 pandemic had a positive influence on the market as more consumers were opting for easy-to-prepare food products that had a long shelf life and were affordable. Hence, in African countries, the demand for these noodles has grown during and post-COVID-19 pandemic.

- The Middle East & Africa will be the third-largest market, reaching USD 2.19 billion in 2025.

Availability of ready-to-eat/ready-to-cook foods, particularly instant noodles in cups and sachets, cater to the growing demand for convenient food options in the UAE and other Middle Eastern countries. With the growth in tourism and popularity of convenient food options the growth of convenient food items in the Middle Eastern countries is also expected to increase.

- Saudi Arabia will stand at USD 410 million by 2025, led by rising youth and professional consumption.

Competitive Landscape

Major Players in the Market

To know how our report can help streamline your business, Speak to Analyst

Some of the prominent manufacturers of these noodles include Indofood Sukses Makmur Tbk, Nissin Foods Holdings Co., Ltd., Toyo Suisan Kaisha, Ltd., Nestle S.A., Uni-President Enterprises Corp., and others. The global market exhibits a fragmented structure and comprises several companies, both startups and well-established companies, competing to gain a strong market share.

Key Industry Players

New Product Launch and Partnership with Related Players to Support Product Expansion

Companies in the industry are increasingly launching products that will ease the adoption of noodles, thereby making it a more convenient snacking food option. The market faces cut-throat competition from the presence of several snack food industry rivals. The companies are also focusing on consumer preferences in the local markets and, based on them, they are developing a large range of products to meet consumer demands.

The major brand in the world, Nissin Food Holdings, emphasizes meeting the ongoing market trends by releasing limited-edition products to grab consumer attention. For instance, in August 2021, Nissin Foods introduced a new limited-edition Pumpkin Spice flavor for its Cup Noodles brand in the U.S. According to the brand, the Cup Noodles Pumpkin Spice flavor is "saucy" rather than "soup-based." The pumpkin seasoning in the new product is blended with a sweet, savory, and spiced flavor profile. This is the first-ever limited-edition flavor launch by the company.

LIST OF KEY INSTANT NOODLES COMPANIES PROFILED

- Nissin Food Holdings (Japan)

- Nestle S.A. (Switzerland)

- ITC Limited (India)

- Capital Foods Pvt. Ltd. (India)

- Ajinomoto Co. Inc. (Japan)

- Acecook Vietnam Joint Stock Company (Vietnam)

- The Campbell Soup Company (U.S.)

- Indofood Sukses Makmur Tbk (Indonesia)

- Toyo Suisan Kaisha Ltd. (Japan)

- Tat Hui Foods Pte Ltd. (Singapore)

KEY INDUSTRY DEVELOPMENTS

- March 2025 – General Mills, a consumer goods company based in the U.S., announced its debut in the field of instant noodles by launching Old El Paso Ramen Noodles – Fajita, Totino’s Ramen Noodles – Cheese Pizza, and others, and all products are available at Walmart across the nation.

- September 2024 – Bachelors, a brand of U.K.-based firm Premier Foods, introduced their latest flavor of instant noodles, “Super Noodles Chilli and Lime Pot.” This product is easily available across the main retailers of the U.K., including B&M, Home Bargains, Farmfoods, and others.

- August 2023 – Nissin Foods U.S. launched chilli-infused noodles through its New brand GEKI for U.S. consumers. The product is available in major offline and online stores across the country.

- March 2023 – New noodle Indian startup brand Yu launched instant Hakka noodles and instant meal bowls. The startup, which was launched in 2021, expanded its presence in the instant noodle category to attract a growing consumer base.

- September 2022 –Samyang Foods, a South Korean manufacturer, launched Hot Chicken Flavor Ramen noodles in partnership with an entertainment show, “Earth Arcade,” showcased on a local South Korea-based entertainment network named tvN.

REPORT COVERAGE

The report includes quantitative and qualitative insights into the market. It also offers detailed market research and Analysis of the market size, statistics, trends, regional market forecast, and growth rate for all possible segments. This global instant noodles market analysis provides various key insights on the market, an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, and the regulatory scenario in critical countries, market dynamics, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.19% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Raw Material

By Packaging

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says the global market size was USD 61.08 billion in 2024.

The market is likely to grow at a CAGR of 6.19% over the forecast period.

The beef segment is expected to be the leading segment in the market during the forecast period.

The growing adoption of convenient food products among consumers to driving the market growth.

Nissin Food Holdings, Nestle S.A., ITC Limited, and Unilever Plc. are a few of the key players in the market.

Asia Pacific dominated the market share in 2024.

The supermarkets/hypermarkets segment is expected to grow at the fastest rate during the forecast period.

The rising demand for fortified & healthier products and convenient foods among millennials is a major industry trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us