Japan Pancake and Waffle Market Size, Share & COVID-19 Impact Analysis, By Product (Waffle [Fresh and Frozen] and Pancake [Fresh and Frozen]), By Distribution Channel (Hospitality [City Hotel, Business Hotel, Resorts, Japanese Style Hotels, and Airline Lounge] and Food service [Restaurants, Quick Service, and Institutional]), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

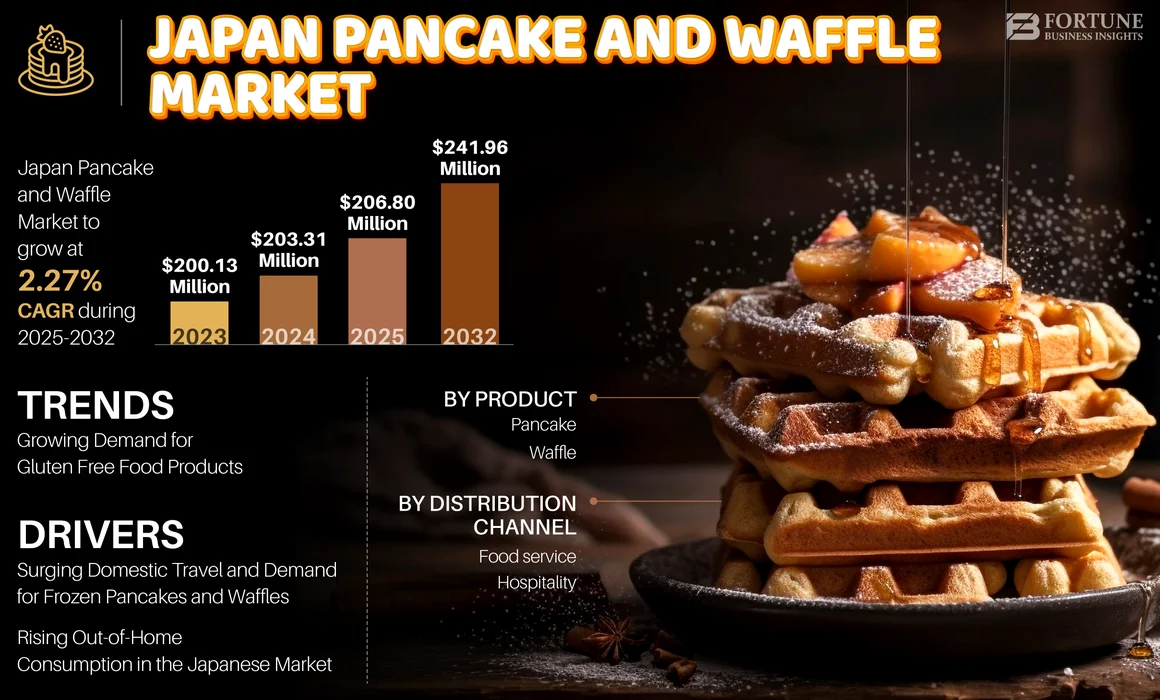

The Japan pancake and waffle market size was valued at USD 203.31 million in 2024. The market is expected to grow from USD 206.80 million in 2025 to USD 241.96 million by 2032, exhibiting a CAGR of 2.27% during the forecast period.

The expansion in the Japanese bakery industry has brought significant changes in the market scenario. Technological advancements and changing consumption patterns have resulted in the development of several types of pancake and waffle products, such as dorayaki, okonomiyaki, and others in different flavors, including creamy, chocolate, and others.

Japanese consumers are health conscious and are inclined toward products that are of high quality. In addition, the healthy lifestyle campaigns launched by the Japanese government will have a significant influence toward overall food consumption in Japan, including bakery products such as pancake and waffle mix, Japanese pancake, Kodiak pancake and waffle mix, Bisquick pancakes, Belgian waffle, bubble waffle, waffle cookies, and others. In Japan, the name Dorayaki pancake is familiar and very popular. Dorayaki belongs to the type of traditional Japanese cake (Wagashi) that looks a bit round, consisting of two pieces of glued pancake with red bean paste.

Japan is anticipated to witness market growth in the upcoming years due to the increase in consumers' adoption of Westernized culture. The rise in new restaurants and cafes being established in the countries in Japan has opened new opportunities for the market.

Global Japan Pancake and Waffle Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 203.31 million

- 2025 Market Size: USD 206.80 million

- 2032 Forecast Market Size: USD 241.96 million

- CAGR: 2.27% from 2025–2032

Market Share:

- The pancake segment held the largest share in the Japan pancake and waffle market in 2024, supported by strong demand for traditional items like dorayaki and okonomiyaki, along with rising Western influence and tourism.

- By distribution channel, the hospitality segment dominated the market in 2024, with business hotels accounting for the highest share due to growing inbound tourism and increasing popularity of Western breakfast items.

Key Country Highlights:

- Japan: Domestic travel resurgence post-COVID-19 and increasing demand for convenient frozen breakfast options drive market growth.

- Japan: Rising demand for gluten-free products, driven by health-conscious consumers and aging population trends, boosts innovation in pancake and waffle offerings.

- Japan: Growth in out-of-home consumption, especially among single-person households, enhances foodservice sales of pancakes and waffles.

- Japan: Market growth is restrained by a declining birth rate and rising inflation, impacting household spending and reducing food consumption.

COVID-19 IMPACT

Disruption Caused by COVID-19 Pandemic Impacted Market Growth Significantly

The rapid spread of infection and the rising number of patients in the country resulted in governments implementing lockdowns and other restrictions to control the spread of the virus. In the wake of the coronavirus pandemic, Japan faced continued disruption to its food service industry. All the sectors were impacted moderately due to the COVID-19 outbreak. However, the hospitality and food service sector experienced a significant loss.

With all the people in the country confined to their homes to curb the spread of the disease, hotels, restaurants, and resorts were empty without any tourists and visitors.

For instance, according to the Statistics Bureau of Japan, in 2020, a drop of 27.2% in the revenues from eating and drinking places was recorded compared to the previous year. Furthermore, revenues from take-out and online food delivery services dropped by 11% in the year 2020 compared to the year 2019

Japan Pancake and Waffle Market Trends

Rising Demand for Gluten Free Food Products

Japan has shown a radical change in its consumption pattern among individuals in recent times. Japanese consumers are health conscious and with the rising geriatric population in the country the consumers have significantly shifted toward healthy and gluten-free, allergen-free, and sugar-free products.

The rising demand for gluten-free foods in Japan is owing to the individuals who are not gluten-intolerant, as the consumption of these products is not limited to gluten-intolerant individuals. The country has a significant awareness among consumers about the health benefits of gluten-free diets.

Thus, consumers in Japan are depicting a greater inclination toward healthier and gluten-free food product, including pancake recipes and waffles. This is further expected to fuel the market growth over the forecast period.

Download Free sample to learn more about this report.

Japan Pancake and Waffle Market Growth Factors

Increasing Domestic Travel and Demand For Frozen Pancakes and Waffles in Food Service Establishments to Boost the Market Growth

The food products preserved by the rapid freezing process are said to be frozen foods. These products are kept frozen and packed until used. Owing to the rising busy lifestyle in the country and the increasing number of double-income households in Japan, the consumption of frozen foods, including bakery products such as pancake and waffles, is gaining popularity. These products are easy to prepare and serve and are ideal for foodservice operators during busy schedules such as breakfast. As pancakes and waffles are breakfast products, this is expected to show significant Japan pancake and waffle market growth.

Experimentation with new food types, growing interests in travel, interest in exploring local as and international cuisines, and increasing disposable income are the factors that are attracting consumers to food service establishments in which pancakes and waffles are considered as the popular breakfast items in Japan.

After the outbreak of COVID-19, Japanese consumers started visiting domestic destinations. The growth in domestic tourist visits has amplified the revenues of food service establishments in the last year that have been increasing greatly since 2021.

Growing Out-of-Home Consumption in the Japanese Market to Accelerate the Market Growth

The consumer market in Japan is considered highly urbanized and consumers usually live busy lives. A Japanese government report estimates that one in five laborers works more than 49 hours a week. Long-distance commutes, lengthy working hours, and increased employment of women have escalated the desire for convenient formats and solutions for on-the-go food consumption.

According to statistics released by the Japanese government in 2017, 35% of households are made up of only one person. In large cities, single-family homes account for almost half of all households, with the majority of them being single, as young people are living alone, longer than previous generations. Thus, people staying alone usually choose single-serve meals that are easy to prepare and practical. This habit is also observed in their food service orders, with pancake recipe being one of the most popular snacking items in Japan. With single-person households expected to keep growing over the next decade, the spending on food service establishments is expected to flourish, benefitting the growth in the sales of pancakes and waffles in the food service industry.

RESTRAINING FACTORS

Declining Birth Rate and Rising Inflation is Restricting Market Growth in Japan

Japan’s falling birth rate has been a major challenge for the growth of the food industry in Japan.

Japan is among the few countries in the world with low birth rates. With a declining birth rate and aging population, spending on food also saw a decrease in the last decade. A lower birth rate results in fewer target consumers, and fewer consumers further impacts the market negatively. If Japan increases its fertility rate in the coming decades, it will bring huge economic benefits, which will cause the country's food industry to flourish.

In Japan, household spending declined by 2.8% YOY in September 2023, compared with a decline of 2.7% after 2.5% in the prior months of July and August, respectively.

Thus, the declining birth rate and rising inflation are restraining the growth of the food service industry in Japan. This will further restrain the growth of pancake and waffle consumption in the country.

Japan Pancake and Waffle Market Segmentation Analysis

By Product Analysis

Higher Demand for Pancake Coffee to Fuel Pancake Segment Growth

On the basis of product, this market is further segmented into pancake and waffle. The pancakes and waffles are further split into frozen and fresh, with fresh having a higher share.

The pancake segment holds the largest share in the Japanese market. This higher share of pancake in Japan is driven by dishes such as dorayaki, okonomiyaki, and others which have a significant demand in the Japanese market. Furthermore, with the rising western influence and tourism in the country the demand for pancake is expected to show a significant growth.

Pancakes and waffles are considered breakfast food products; thus, the consumption by food service operators is significant enough to be met by fresh packaging. Thus, fresh products have a higher demand and have a significant share in consumption.

Furthermore, to freeze food, it is required to use preservatives to increase the product shelf lives further; with Japanese consumers being significantly health conscious, the demand for frozen food is more inclined toward seafood and thus, a limited demand is recorded in bakery products including pancake and waffle.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Rising Advancement in the Food Service Sector to Fuel the Growth in the Pancake and Waffle Industry

On the basis of distribution channel, the Japan pancake and waffle market is divided into hospitality and food service.

The hospitality segment held the largest market share in 2024. The hospitality segment is further divided into city hotels, business hotels, resorts, Japanese-style hotels, and airline lounges, of which business hotels hold the highest share.

In October 2022, according to the Japan National Tourism Organization, the number of foreign visitors to Japan was estimated to have totaled to 206,500. The tourists from South Korea accounted for 32,700, followed by Vietnam accounting for 30,900, and around 18,000 from the U.S. and 17,600 from mainland China. The increasing tourism has further assisted in increasing demand for food products such as waffles and pancakes in the hospitality sector, as these products are significantly consumed in the U.S. and other Western countries.

Furthermore, the food service segment is further segmented into restaurants, quick service, and institutional, from which the institutional holds the highest share in the market. With the rising busy lifestyle, increasing participation of women in workforce, higher literacy rate is one of the key factors fueling the growth in demand for breakfast products such as pancake and waffle in institutions such as schools, workspaces, and others.

Key Industry Players

Market Players Focus on New Product Launch to Propel Market Growth

The Japanese pancake and waffle market share exhibits a moderately consolidated structure due to the establishment of several companies. The few prominent players in the industry, such as Morinaga Co., Ltd., General Mills, Nisshin Seifun Group Inc., and others, hold significant share owing to their product portfolio, supply chain, and distribution network.

The Japanese market will have growth opportunities in the coming years owing to the increasing popularity of healthy and gluten-free pancakes and waffles among consumers. Other key players in the market are Nichirei Corporation, Yamazaki Baking Co., Ltd, Europastry, and others.

LIST OF TOP JAPAN PANCAKE AND WAFFLE COMPANIES:

- Yamazaki Baking Co., Ltd (Japan)

- Pasco Shikishima Corporation (Japan)

- Europastry (Spain)

- TableMark Co., Ltd. (Japan)

- Marukyo Co., Ltd. (Japan)

- Morinaga Co., Ltd. (Japan)

- General Mills, Inc. (U.S.)

- Belgian Waffles Thijs (Belgium)

- Nichirei Corporation (Japan)

- Rosen Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- November 2020 – Yamazaki Baking Co., Ltd., one of the most prominent players in the Japanese bakery industry, announced the launch of its all-new cream pancakes under the company's popular refrigerated dessert brand ``Premium Sweets.'' It contains maple sauce and cream on top of the pancakes. These pancakes are very fluffy as they use many eggs. By using a cream with a high milk fat content, the pancakes are baked with a rich, milky flavor. This new launch helped the company to increase its product portfolio.

- June 2020 – Pasco Shikishima Corporation launched four items of bread entitled sweets in journeys in the districts of Kanto, Chubu, Kansai, Chugoku, and Shikoku. The four items are Danish with a New York taste, cream bread with the taste of Vietnamese coffee, cake with the taste of crème brulee, and pancake with a peach melba taste.

REPORT COVERAGE

The Japan pancake and waffle market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, and distribution channels. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 2.27% from 2025-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says the global market size was USD 203.31 million in 2024.

The market is likely to grow at a CAGR of 2.27% over the forecast period (2025-2032)

The pancake segment is the leading segment in the market.

Growing out-of-home consumption in the Japanese market is a major factor boosting the market growth.

The Yamazaki Baking Co. Ltd., Nichirei Corporation, Europastry, General Mills, Inc., Pasco Shikishima Corporation, and others are the major players in the market.

Increasing domestic travel and demand for frozen pancakes and waffles in food service establishments to boost the market growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us