Lead Acid Battery Market Size, Share & Industry Analysis, By Type (Flooded and VRLA {AGM, GEL}), By Application (SLI, Stationary, E-Bikes, Low Speed EVs, and Others), and Regional Forecast, 2026-2034

Lead Acid Battery Market Size

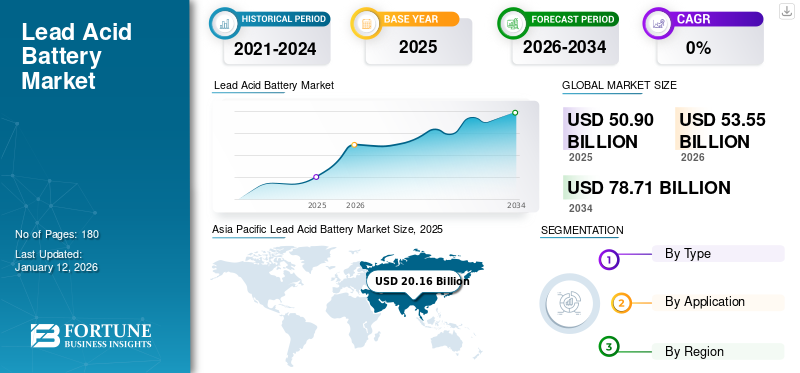

The global lead acid battery market size was valued at USD 50.9 billion in 2025 and is projected to grow from USD 53.55 billion in 2026 to USD 78.71 billion by 2034, exhibiting a CAGR of 4.93% during the forecast period. Asia Pacific dominated the global market with a market share of 39.62% in 2025. The global market is set to grow as the demand for lead acid batteries is rising due to the growing demand for energy storage devices used in the automobile industry. The rising demand for commercial vehicles, motorcycles, and passenger car manufacturing industries is likely to boost the market. The Lead acid battery market in the U.S. is projected to grow significantly, reaching an estimated value of USD 12.29 billion by 2032.

Lead acid battery, also known as a lead storage battery, is a rechargeable battery that uses lead and sulfuric acid materials for function. Although lead acid batteries are highly reliable, they have minimal life. The battery also contains some toxic materials, which require unique removal methods at the end of their life.

The battery life is affected by overcharging and undercharging as both conditions will adversely affect them. The usage of lead acid batteries affects the pollution rates owing to their gasoline counterparts. China, the U.K., Germany, the U.S., and France are among the leading countries in the global market. Regarding lead acid battery export, the U.K., Germany, China, and South Korea showed tremendous growth in 2024.

Lead Acid Battery Market Trends

Technological Advancements in Lead Acid Battery to Drive Market Growth

Developments, such as Absorbent Glass Mat (AGM) and Gel VRLA batteries offer longer lifespan, lower maintenance, and better discharge performance compared to the traditional flooded lead-acid batteries. New electrode designs and materials, such as calcium-alloy grids and carbon additives improve conductivity, discharge rates, and cycle life, making lead-acid batteries more competitive. Pulse charging and multi-stage charging methods optimize charging processes, thereby extending battery life and reducing energy consumption.

Automation, improved production methods, and economies of scale are helping reduce manufacturing costs, making lead-acid batteries more affordable, especially for low-cost applications. New designs with higher cranking power and cold-start capabilities cater to the demands of modern vehicles with complex electrical systems. Improved VRLA technologies and cost competitiveness make lead-acid batteries suitable for backup power, UPS systems, and off-grid energy storage solutions. Lead-acid batteries' affordability and reliability make them attractive choices for power storage and other applications in regions with limited infrastructure and budget constraints.

Rising Demand for Renewables to Increase the Demand for Energy Storage Battery

According to IEA, renewable energy is estimated to account for more than 70% of the global electricity generation. In developing countries, such as India, the target for renewable energy generation for 2022 was 175 GW, which was further revised to 217 GW. Lead acid batteries are installed in the generation grid. Therefore, the demand for energy storage is likely to increase with the demand for renewable generation. These batteries are also installed in the substation, where the electricity generated is fed into the main grid. Thus, as the generation increases, the implementation of these batteries is also expected to increase significantly.

Download Free sample to learn more about this report.

Lead Acid Battery Market Growth Factors

Rising Demand for Cost-effective Power Backup Systems to Propel Market Growth

The growing demand for power backup systems from various industries, such as the oil & gas, automotive, telecom, mining, manufacturing, chemical industry, and others, is expected to push the lead acid batteries market growth. Owing to the ease of availability, low capital cost, and large current carrying capability, they are used widely compared to other batteries.

Further, lead acid batteries provide more energy per cycle at a lower cost per kilowatt-hour than any other type of battery chemistry, translating to lower operating costs over time. These batteries are recyclable, and the recycling rate is more than 90% in certain countries, which also helps reduce battery prices and pollution and conserve resources. Henceforth, lead acid batteries are the most suitable battery for power backup systems.

Growing Data Centers and the Telecommunication Industry to Push the Demand for Lead Acid Battery

The rising number of data centers and installing towers is surging the demand for lead acid batteries. Although, the lithium-ion battery has emerged as a viable alternative to the lead acid battery. However, lithium-ion batteries are not expected to be replaced soon. Furthermore, the growing population, the age of digitalization, and the launch of 5G services are prominent factors for the growing subscriber base. With the increasing number of subscribers, companies are increasing the number of telecom towers, creating considerable demand for lead acid batteries for backup purposes.

For example, the telecom industry across India is one of the largest in the world, with a total of 1.17 billion subscribers. Stationary batteries are used for various applications where power is needed in standby or emergencies. Due to their short duration, these batteries are not frequently discharged and do not require high storage capacity. Thus, lead acid batteries offer a viable solution for the telecommunications sector.

RESTRAINING FACTORS

Shorter Lifespan of Batteries Owing to Low Capacity to Hinder Market Expansion

Lead acid batteries discharge more often when compared to other batteries; therefore, they need to be charged more frequently. This will reduce their life span. Moreover, they also have low capacity. Moreover, lead acid batteries have 500-1000 charging cycles, even with careful handling of these batteries and extra care not to over-discharge these cells.

Additionally, these types of batteries waste energy and have major efficiency problems. They waste up to 15% of the energy supplied to them through inherent charging, indicating inefficiency. So if 100 Ah of electricity is delivered, it would only store 85 Ah. This can be unsatisfying in solar charge mode, trying to get as much efficiency as possible out of each amp before sunset or being obscured by clouds.

Lead Acid Battery Market Segmentation Analysis

By Type Analysis

Flooded Lead Acid Batteries Hold Dominant Market Share Due to Increasing Demand for Stationary Applications

Based on type, the market is segmented into flooded and VRLA. The flooded segment was the largest segment owing to its longer discharge cycle and lower cost; hence, it is widely used in stationary applications & dominates the market with a share of 68.12% in 2026. However, the Valve-Regulated Lead Acid (VRLA) segment is anticipated to grow due to its growing demand in the automotive industry. VRLA batteries include Absorbent Glass Mat (AGM) and gel battery. AGM batteries are maintenance-free, have excellent electrical reliability, and are lightweight compared to other lead acid batteries.

By Application Analysis

Growing Automotive, Data Centers, and Telecom Sectors to Push SLI Batteries Demand

The main factor behind the increasing demand for SLI batteries is the rising demand for SLI batteries used in power starters, lights, and ignition systems of vehicles or internal combustion engines with long life, quality performance, and cost-effectiveness. In addition, the lead acid battery technology for all SLI applications involves a conventional internal combustion engine, & dominates in sthe egment with a market share of 75.14% in 2026

As per the International Organization of Motor Vehicle Manufacturers, vehicle sales in November 2020 stood at 71,745,408 units compared to 67,580,030 units in November 2019, registering 4.17% growth, and overall automotive exports reached 4.77 million vehicles in FY 2020. In India, EV sales, excluding e-rickshaws, witnessed 20% growth, reaching 1.56 lakh units in the fiscal year 2020. The demand for automobiles and SLI batteries will likely increase with the recovering economy over the forecast period.

Additionally, the demand for lead acid batteries is likely to increase in telecom and data centers as most of the operations in data centers require a large amount of power, including backup power. Asia Pacific is focusing on a boom in the telecom sector and adding more data centers due to the growing IT sector across the region. Lead acid batteries are used as a power backup solution in these industries; therefore, the market growth is to be backed by the rising data centers and telecom sectors across the globe.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The global market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Lead Acid Battery Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the dominant lead acid battery market share, with China, India, Japan, South Korea, and Australia being the key Asian Pacific market contributors. The Japan market is projected to reach USD 3.57 billion by 2026, the China market is projected to reach USD 11.91 billion by 2026, and the India market is projected to reach USD 2.08 billion by 2026. Some factors driving this region's growth are high automobile production and sales, rapid industrialization, population growth, and the increasing demand for UPS systems. Lead acid battery sales in Asia Pacific come primarily from the automotive sector, driven by strong demand for passenger cars and rising awareness and acceptance of electric vehicles. The EV segment in the automotive sector is developing significantly to reduce its carbon footprint. The lead-acid battery is widely used in electric vehicles, and its acceptance rate is gradually increasing.

The markets in North America and Europe are expected to grow due to government regulations regarding battery disposal. For instance, putting all types of batteries in the trash is against the law in the U.S. Drained batteries are usually taken to an authorized recycling center. The U.S. market is projected to reach USD 8.84 billion by 2026. This reduces manufacturing costs as most new batteries are manufactured using raw materials sourced from recycled products. Therefore, lead acid batteries become cheaper and easily accessible to end users, which pushes the market to expand across the region. The UK market is projected to reach USD 0.66 billion by 2026, while the Germany market is projected to reach USD 2.41 billion by 2026.

Key Industry Players

Companies Focus on Mergers & Acquisitions and Partnerships to Gain Competitive Edge

The global market is fragmented with the presence of various major players. The competitive landscape of the present companies in the market has a strong foothold in their base country and region. Brookfield Business Partners, GS Yuasa, and EnerSys are leading players with a strong presence across different countries. Their operational plants' success will help them acquire contracts and gain a market share in the coming years.

In 2024, Brookfield Business Partners held the largest share of the market. GS Yuasa, EnerSys, Exide, and East Penn Manufacturing are the other key players operating in the market.

List of Top Lead Acid Battery Companies:

- Brookfield Business Partners (Bermuda)

- GS Yuasa (Japan)

- EnerSys (U.S.)

- Exide Industries Ltd. (India)

- East Penn Manufacturing (U.S.)

- FENGFAN (China)

- Luminous Power Technologies Pvt. Ltd. (India)

- FIAMM (Italy)

- HBL Power Systems Ltd. (India)

- Amara Raja Batteries Ltd. (India)

- Su-Kam Power Systems Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- January 2022 - Recyclus opened the first lead acid battery recycling plant in England. The Tipton facility is expected to increase Recyclus' production capacity for recycling lead acid batteries from an estimated 16,000 tons in the first full year of production to approximately 80,000 tons by 2027.

- June 2021 – EnerSys announced that it invested more than USD 100 million in new capital for the upcoming three years to grow its Thin Plate Pure Lead (TPPL) capacity, with a projected growth of 15%. Both initiatives collectively upgraded TPPL capacity by more than USD 500 million/year.

- May 2021 - Amara Raja Batteries, India's giant lead acid battery maker, restarted its manufacturing business. The company received closure orders from the Andhra Pradesh Pollution Control Board (APPCB) in April 2021 due to violating the Water Act, 1974, and the Air (Prevention and Control of Pollution) Act, 1981.

- January 2021 - Kolkata Discom CESC partnered with Exide for a 315kWh grid-tied battery energy storage system in a low-voltage distribution system. The development led to improved peak load control, the first advancement on this scale in West Bengal, India.

- July 2020 - EnerSys partnered with Blink Charging Company, one of the Electric Vehicle (EV) charging equipment providers. The partnership helped in developing high-power wireless DC fast charging systems that are majorly used in integrated battery storage for the transportation application.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the lead acid battery market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.93% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per a study conducted by Fortune Business Insights, the market size was valued at USD 50.9 billion in 2025.

The market is likely to register a CAGR of 4.93% over the forecast period of 2026-2034.

Based on application, the SLI segment holds the dominating share in the global market.

The market size in Asia Pacific stood at USD 20.16 billion in 2025.

The rising demand for cost-effective power backup systems is likely to propel the market growth.

Some of the top players in the market are Brookfield Business Partners, GS Yuasa, Enersys, and Exide.

China dominated the market in terms of demand in 2025

Limited usage capacity of lead acid batteries is likely to restrain product deployment to some extent.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us