Level Sensors Market Size, Share & Industry Analysis, By Type (Contact Level Sensors and Non-contact Level Sensors), By Technology (Ultrasonic, Float, Microwave/Radar, Hydrostatic/Pressure, Conductive, Capacitance, Optical, Magnetostrictive, and Others), By Monitoring Type (Continuous Level Sensing, Point Level Sensing, and Interface Level Sensing), By End-use (Oil & Gas, Chemical & Petrochemicals, Water & Wastewater Treatment, Healthcare & Pharmaceuticals, Metals & Mining, Food & Beverage, and Others), and Regional Forecast, 2026-2034

Level Sensors Market Size

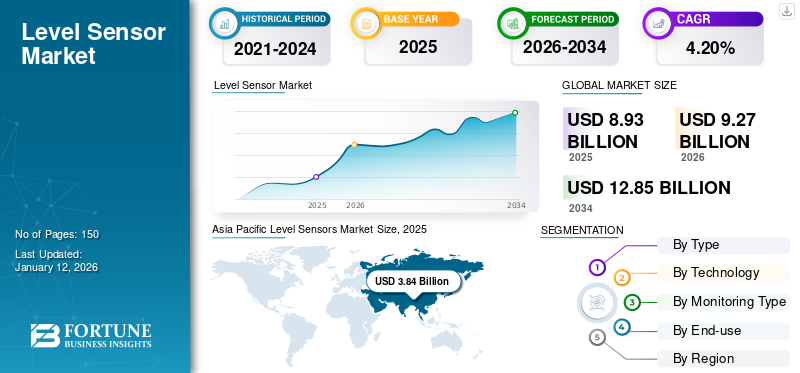

The global level sensors market size was valued at USD 8.93 billion in 2025 and is projected to grow from USD 9.27 billion in 2026 to USD 12.85 billion by 2034, exhibiting a CAGR of 4.20% during the forecast period. Asia Pacific dominated the global market with a share of 43.00% in 2025.

Level sensors detect the levels of liquids, powders, or granular materials within a container, tank, or other storage systems. They come in various types, including contact-type sensors (such as float switches and conductive sensors) and non-contact sensors (such as ultrasonic, radar, and capacitive sensors). Such sensors are used across many industries for various applications, such as monitoring tank levels in reservoirs, treatment tanks, processing and storage tanks, monitoring fuel and fluid levels in vehicles, and level measurement in medicine production processes, among others.

The market is driven by many factors, including increased automation in manufacturing and processing industries, stringent regulations regarding waste management and emissions, and the integration of technological advancements, such as wireless communication and the Internet of Things (IoT).

Moreover, the COVID-19 pandemic affected the market in the initial phase, with disruptions in supply chains and manufacturing leading to a slowdown in global level sensors market growth. However, the post-pandemic era showcased the need for automation and remote monitoring, accelerating the adoption of such sensors. Industries, such as pharmaceuticals and food and beverage, which were critical during the pandemic, witnessed increased demand for level sensors to ensure uninterrupted production and supply chain management.

The market is poised to witness potential growth over the forecast period. Technological advancements, such as wireless level sensing, are setting trends in the global market. For instance,

- November 2023: Worldsensing introduced a wireless vibration monitoring sensor called The Vibration Meter. This sensor uses a tri-axial MEMS accelerometer and is designed for long-term vibration monitoring projects. The Vibration Meter is suitable for industries, such as construction and mining, ensuring safety and structural integrity.

Additionally, companies are leveraging Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and better process optimization.

GENERATIVE AI IMPACT

Improved Process Optimization & Predictive Maintenance to Foster Integration of Gen AI in Level Sensing

Generative AI significantly influences the global market by enhancing the capabilities and applications of these sensors. Gen AI processes vast amounts of data from such sensors, providing deeper insights and more accurate predictions. This improves process optimization and predictive maintenance, reducing downtime and operational costs.

Moreover, generative AI facilitates the integration of level sensors with the Internet of Things (IoT), enabling real-time monitoring and control. This integration leads to smarter, more interconnected industrial systems, improving overall operational efficiency. The adoption of AI-enhanced sensors drives market growth by opening up new applications and improving existing ones. Industries, such as oil and gas, water treatment, and manufacturing, benefit from the advanced capabilities offered by AI-integrated sensors. For instance,

- July 2024: Keyence introduced the IV4 vision sensor and the FR Series radar level sensor in its product portfolio. The IV4 vision sensor offers enhanced image processing capabilities, making it ideal for a wide range of inspection applications. The FR Series radar level sensor provides precise level measurement for liquids and solids in challenging environments, utilizing advanced radar technology for accurate and reliable performance.

Level Sensors Market Trends

Increasing Digital Transformation to Drive Demand for Smart and IoT-enabled Level Sensors

Smart and IoT level sensors represent a transformative trend in the global market, significantly enhancing the capabilities of traditional sensors. These advanced sensors integrate Internet of Things (IoT) technologies, enabling seamless connectivity and real-time data exchange. Such sensors aid in enhancing the automation of manufacturing processes, effective monitoring and management of water resources and waste levels, accurate level measurements in tanks and pipelines, and optimizing irrigation and storage of agricultural products through precise level monitoring.

As industries increasingly embrace digital transformation, the market demand for smart and IoT-enabled sensors is expected to rise, driving innovation and growth in the market. For instance,

- November 2022: Infineon Technologies introduced the XENSIV-Connected Sensor Kit (CSK), an IoT sensor platform designed for rapid prototyping and development of customized IoT solutions. The kit is listed in the AWS Partner Device Catalog. It includes environmental sensor variants, such as the CSK PASC02 for evaluating carbon dioxide levels (CO2 ppm) and the CSK BGT60TR13C, a 60 GHz radar variant for vital sensing, presence detection, and additional applications.

Download Free sample to learn more about this report.

Level Sensors Market Growth Factors

Reliance on Level Sensing for Smart Manufacturing Systems to Drive Market Growth

Non-contact sensors utilize technologies, such as radar, ultrasonic, and laser to measure liquid or solid levels without physical contact, minimizing the risk of contamination or damage. They operate in harsh environments, such as extreme temperatures and pressures, making them ideal for industries, such as oil and gas, chemicals, and food processing.

As industries increasingly adopt automation and IoT technologies, the demand for non-contact sensors continues to grow. Their integration into smart manufacturing systems enables real-time data collection and monitoring, enhancing operational decision-making. Consequently, the rise of non-contact sensors significantly contributes to the expansion of the global market, driven by technological advancements and the need for reliable measurement solutions. For instance,

- January 2024: Baumer launched the PL240 capacitive level sensor that is designed to function effectively without being affected by film adhesion. Its design ensures reliable performance, making it suitable for industries that require precise monitoring despite potential obstacles.

RESTRAINING FACTORS

Requirement of Significant Upfront Investments and Integration with Existing Systems to Hamper Market Growth

Advanced level sensor technologies, particularly non-contact sensors, often come with high initial costs. This can deter smaller companies from investing in these solutions, limiting market penetration. The uncertainty regarding the long-term benefits and reliability of new technologies can make companies hesitant to invest large sums upfront. This risk aversion can slow market adoption. Some sensors might require specialized installation and calibration, which can complicate deployment and lead to increased operational downtime.

Moreover, integration with existing systems can pose challenges, especially in older facilities with legacy equipment. This can slow down adoption rates. These factors collectively challenge the growth of the global market.

Level Sensors Market Segmentation Analysis

By Type Analysis

Growing Need for Elimination of Contamination & Maintenance to Drive Demand for Non-contact Level Sensors

Based on type, the market is divided between contact level sensors and non-contact level sensors.

The non-contact level sensors segment holds the largest global level sensors market share of 58.13% in 2026 and is expected to continue its dominance over the forecast period. Their ability to measure levels without physical contact eliminates issues, such as contamination, wear, and maintenance associated with contact sensors. This reliability makes them particularly appealing in industries, such as food and beverage, pharmaceuticals, and chemicals, where hygiene and accuracy are critical.

Non-contact sensors utilize advanced technologies, such as radar, ultrasonic, and laser, providing high precision and performance even in challenging conditions. Additionally, the growing trend of automation and the Internet of Things (IoT) drives demand for non-contact sensors, as they easily integrate into smart manufacturing systems for real-time data monitoring and analytics.

Contact level sensors come into contact with the material being measured, such as a liquid in a tank or container. They can be used to detect leaks, monitor liquid levels, and handle the speed of liquid movement. They cater to many industries, including manufacturing, food and beverage, and medicine, to provide accurate and reliable readings.

By Technology Analysis

Functional Ability of Ultrasonic Sensors in Harsh Conditions Fuels Segmental Demand

By technology, the market is categorized into ultrasonic, float, microwave/radar, hydrostatic/pressure, conductive, capacitance, optical, magnetostrictive, and others.

Ultrasonic sensors hold the largest share of 20.17% in 2026 global market due to their versatility, accuracy, and non-contact measurement capabilities. They are widely used in various industries, including water treatment, food and beverage, and chemicals, as they can measure both liquid and solid levels without direct contact. Their ability to function in harsh conditions and provide reliable data without being affected by the properties of the material being measured enhances their appeal. Additionally, advancements in ultrasonic technology have improved their performance and affordability, further driving their adoption.

The hydrostatic/pressure segment is forecast to grow with the highest CAGR in the market. Hydrostatic/pressure sensors are highly accurate, especially for liquid level measurement, and are essential in applications requiring precise pressure readings, such as oil and gas, wastewater management, and pharmaceuticals. As industries increasingly focus on safety and regulatory compliance, the demand for reliable and precise hydrostatic sensors has surged.

By Monitoring Type Analysis

Growing Popularity of Real-time Monitoring of Fluid & Solid Levels Boosts Continuous Level Sensing Segment Growth

By monitoring type, the market is categorized into continuous level sensing, point level sensing, and interface level sensing.

The continuous level sensing segment holds the largest share of 47.67% in 2026 global market due to its widespread applicability across various industries. This technology provides real-time monitoring of fluid and solid levels, ensuring consistent process control and safety. Continuous sensors are ideal for applications where maintaining a specific level is critical, such as in chemical processing, water treatment, and food production. Their ability to provide ongoing data, enhances operational efficiency and reduces downtime, making them a preferred choice for many companies.

However, the point-level sensing segment is forecast to grow with the highest CAGR in the market due to the increasing demand for specific level detection in applications where precise measurements are necessary. Industries are increasingly recognizing the importance of point sensors for monitoring critical levels and preventing overflow or dry-running situations. The growth of automation and smart manufacturing systems further fuels this demand, as point sensors are integral for safety and efficiency in various processes.

By End-use Analysis

To know how our report can help streamline your business, Speak to Analyst

Extensive Reliance on Precise Measurement Technologies Boosts Demand in Oil & Gas Sector

By end-use, the market is categorized into oil & gas, chemical & petrochemicals, water & wastewater treatment, healthcare & pharmaceuticals, metals & mining, food & beverage, and others.

The oil & gas segment holds the largest share of the global market due to its extensive reliance on precise measurement technologies for safety, efficiency, and regulatory compliance. Such sensors are critical in monitoring fluid levels in tanks, pipelines, and processing facilities, ensuring optimal operation and preventing spills or leaks. The sector's need for high accuracy in harsh environments further drives demand for advanced sensor technologies.

However, the water & wastewater treatment segment is forecast to grow with the highest CAGR in the market & it is expected to account for 23.29% of the market in 2026. This growth is fueled by increasing global concerns over water scarcity and pollution, prompting investments in infrastructure and treatment facilities. These sensors play a vital role in managing water levels, monitoring treatment processes, and ensuring regulatory compliance. The rising focus on sustainable practices and smart water management systems further enhances the demand for innovative level-sensing solutions in this sector.

REGIONAL INSIGHTS

The global market scope is classified across five regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Level Sensors Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific accounts for the largest global market size owing to its rapid industrialization, urbanization, and increasing investments in infrastructure. In Asia Pacific, China, India, and Japan are experiencing significant growth due to booming manufacturing sectors and rising demand for automation. The region is witnessing a shift toward smart technologies, with industries adopting IoT-enabled sensors for real-time monitoring and enhanced efficiency. Government initiatives promoting renewable energy and sustainable practices further boost demand, especially in sectors such as water treatment, food and beverage, and chemicals. The Japan market is projected to reach USD 0.68 billion by 2026, the China market is projected to reach USD 0.99 billion by 2026, and the India market is projected to reach USD 0.85 billion by 2026.

North America

North America is poised for significant growth due to its strong industrial base and early adoption of advanced technologies. The region's robust manufacturing sector, particularly in industries, such as oil and gas, food and beverage, and pharmaceuticals, drives demand for accurate level measurement solutions. Additionally, significant investments in automation and smart manufacturing initiatives contribute to the widespread use of such sensors as companies seek to enhance efficiency and operational reliability. The U.S. market is projected to reach USD 1.78 billion by 2026.

Europe

Europe is expected to grow with the highest CAGR driven by a growing emphasis on sustainability and environmental regulations. European industries are increasingly focused on energy efficiency and waste management, creating a demand for advanced level sensing technologies that meet regulatory standards. Moreover, the region's commitment to Industry 4.0 and digital transformation further accelerates the adoption of IoT-enabled sensors. The UK market is projected to reach USD 0.43 billion by 2026, while the Germany market is projected to reach USD 0.42 billion by 2026. For instance,

- February 2023: Akenza AG introduced a smart level monitoring kit designed to provide real-time insights into fluid levels across various applications. The solution is particularly beneficial for industries such as agriculture, water management, and logistics, where maintaining optimal fluid levels is crucial.

Middle East & Africa and South America

The market in the Middle East & Africa and South America is known for its steady growth primarily due to ongoing investments in oil and gas, mining, and utilities. Additionally, the growing focus on smart cities and infrastructure development is driving the adoption of advanced sensors.

KEY INDUSTRY PLAYERS

Strategic Partnerships and Collaborations to Boost Market Presence of Key Players

Key players operating in the global level sensors market are entering into strategic partnerships and collaborating with other significant market leaders to expand their portfolio and provide enhanced tools to fulfill their customers' application requirements. Also, through collaboration, companies are gaining expertise and expanding their business by reaching a mass customer base. The sensors offered by major companies provide innovative solutions for industries and users to handle the growing expectations for sustaining customers.

List of Top Level Sensors Companies:

- ABB (Switzerland)

- Emerson Electric Co. (U.S.)

- SICK AG (Germany)

- Texas Instruments Incorporated (U.S.)

- TE Connectivity (Switzerland)

- Pepperl+Fuchs (Germany)

- Endress+Hauser Group Services AG (Switzerland)

- Honeywell International Inc. (U.S.)

- AMETEK.Inc. (U.S.)

- Siemens (Germany)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: ABB introduced the Ninva temperature measurement sensor with SIL2 certification, enhancing safety and simplicity across various industries. The Ninva solution streamlines temperature measurement processes, making it easier for users to monitor critical parameters effectively.

- March 2024: EBE launched an evaluation kit for its level sensor, designed to facilitate the assessment of these sensors' capabilities and performance. The evaluation kit aims to support customers in understanding how EBE's sensors can enhance their systems and processes, ultimately promoting more efficient operations.

- March 2024: Emerson introduced the Rosemount 3490 controller, designed specifically for level and flow applications. This innovative controller enhances operational efficiency in industries that require accurate level and flow management, such as oil and gas, water treatment, and chemicals.

- April 2023: BASF, THIELMANN, and NXTGN have entered into a Joint Development Agreement (JDA) to establish a strategic partnership focused on tracking intermediate bulk containers (IBCs). This level measurement solution allows for precise monitoring of IBCs, including their location, fill level, shock load, temperature, and contamination data.

- March 2023: Prominent launched a radar sensor specifically designed for level measurement applications. This innovative sensor offers accurate and reliable monitoring of various use cases, including liquids and solids. The company aims to enhance measurement accuracy and efficiency for its customers in level measurement.

REPORT COVERAGE

The report provides a competitive landscape of the market overview and focuses on key aspects such as market players, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 4.20% from 2026 to 2034 |

|

Segmentation |

By Type

By Technology

By Monitoring Type

By End-use

By Region

|

Frequently Asked Questions

The market is projected to reach USD 12.85 billion by 2034.

In 2026, the market size stood at USD 9.27 billion.

The market is projected to grow at a CAGR of 4.20% during the forecast period.

Non-contact level sensors are leading the market.

Reliance on level sensing for smart manufacturing systems is set to drive market growth.

ABB, Emerson Electric Co., SICK AG, Texas Instruments Incorporated., TE Connectivity, Pepperl+Fuchs, Endress+Hauser Group Services AG, Honeywell International Inc., AMETEK.Inc., and Siemens are the top players in the market.

Asia Pacific dominated the global market with a share of 43.00% in 2025.

Europe is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us