Limb Prosthetics Market Size, Share & Industry Analysis, By Type (Upper Limb Prosthetics and Lower Limb Prosthetics), By Technology (Conventional Prosthetic Devices, Electric Prosthetic Devices, and Hybrid Prosthetic Devices), By Component (Socket, Appendage, Joint, Connecting Module, and Others), By End User (Orthotists & Prosthetists (O&P) Clinics, Orthopedic Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

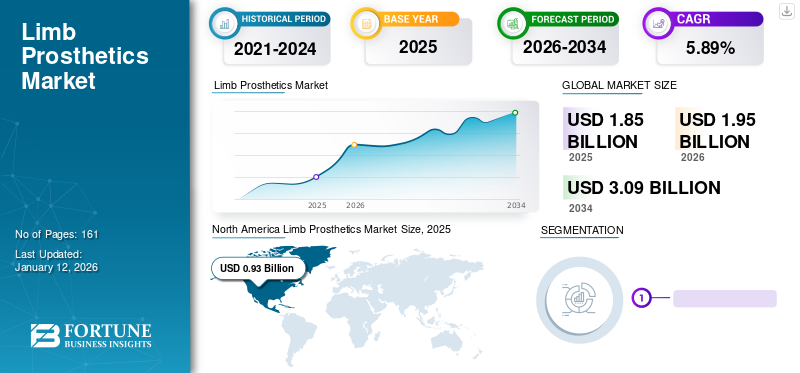

The global limb prosthetics market size was valued at USD 1.85 billion in 2025. The market is projected to grow from USD 1.95 billion in 2026 to USD 3.09 billion by 2034, exhibiting a CAGR of 5.89% during the forecast period. North america dominated the limb prosthetics market with a market share of 50.05% in 2025.

The products that prosthetists prescribe to replace a part of the body, correct a physical deformity or physiological malfunction, and support a weak or deformed part of the body are limb prosthetics. A surge in cases of diabetes, blood vessel diseases, cancers, infections, excessive tissue damage, dysfunction, pain, are leading to amputations, which has boosted the growth of the market. During the pandemic, the market witnessed a sharp decrease due to factors, including a decline in the number of amputations and lower product sales due to decline in patient visits. Significant companies witnessed a decrease in their revenue for the year 2020.

As the volume of amputations continues to increase in the global scenario due to a number of factors, several stakeholders are engaged in clinical trials to develop cutting-edge products. For instance, in December 2021, the University of Washington performed a functional assessment study. The study compared the functional differences between two types of foot prostheses for people with ankle disarticulation (Syme's) amputations. The conduction of such critical studies for the development of novel products is anticipated to boost global limb prosthetics market growth.

Limb Prosthetics Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 1.85 billion

- 2026 Market Size: USD 1.95 billion

- 2034 Forecast Market Size: USD 3.09 billion

- CAGR: 5.89% from 2026–2034

Market Share:

- North America dominated the global limb prosthetics market with a 50.05% share in 2025, driven by the high prevalence of limb loss, advanced prosthetic adoption, favorable reimbursement policies, and strong healthcare expenditure in the U.S. and Canada.

- By type, lower limb prosthetics held the largest market share in 2024, attributed to the high incidence of lower-limb amputations and advanced product launches such as ISRO’s intelligent artificial limb for above-knee amputees.

Key Country Highlights:

- Japan: Growth is driven by technological advancements in bionic limbs and the increasing elderly population. Government-backed research initiatives and a strong healthcare infrastructure also support market expansion.

- United States: The U.S. leads the global market due to the highest limb loss prevalence, robust insurance coverage, and early adoption of technologies such as myoelectric and mind-controlled prostheses. For example, Atom Limbs’ brain-controlled arm innovation is expected to significantly impact the market.

- China: Increasing healthcare spending and a rising diabetic population contribute to the growing demand for prosthetics. Government focus on rehabilitation services and localized prosthetic manufacturing is enhancing accessibility.

- Europe: Supported by favorable reimbursement policies and strong R&D presence, the region is witnessing rapid adoption of microprocessor-controlled and lightweight limb prosthetics. Strategic acquisitions, such as Ottobock’s acquisition of Livit B.V., are strengthening market presence across Western Europe.

COVID-19 IMPACT

Market Witnessed a Decline Owing to Cancellation of Appointments and a Drop in the Number of Injuries and Amputations

Due to the COVID-19 pandemic in 2020, there was a decline in the number of patient visits for prosthetic services. For instance, according to the 2021 data published by the National Institutes of Health (NIH), the COVID-19 pandemic has significantly impacted prosthetic services, with face-to-face appointments primarily reserved for urgent patients and inpatients in key countries such as the U.K.

Owing to the pandemic, in FY 2020, a number of major companies engaged in the sales of these products witnessed a drop in their revenues. As the situation improved in FY 2021, after lifting the pandemic restrictions and the resumption of normal activities on a global level, these companies saw an increase in their product sales. One of the market leader, Össur recorded a decrease of 1.6% in 2020 when compared to FY 2019. The company recovered in 2021, with an increase of 21.8% in FY 2021. Also, the company gained an increase of 1.0% in 2022 compared to previous year. The substantial increase in sales due to increased patient visits also contributed to the surge in market growth.

Despite the overall negative impact associated with the pandemic, institutions in this market that had adopted teleconsultations and other digital technologies were able to sustain themselves. According to a survey published in the journal JMIR Rehabilitation and Assistive Technologies in August 2020, 77.0% of the respondents stated that the adoption of digital technologies in prosthetics improved patient outcomes during the pandemic. These factors have also contributed to the market's resurgence in 2021 and market recovery in 2022. The overall market is expected to witness stable growth during the forecast period.

LATEST TRENDS

Download Free sample to learn more about this report.

Development of Myoelectric Prostheses and Mind-Controlled Prosthesis to Drive the Adoption of these Devices

The global market has witnessed an increased focus on the development of myoelectric prostheses. The increasing number of amputations leads to an intense need for prosthetic devices. This has directed prominent players to expand their product portfolio with an aim to cater to the growing demand. For instance, in April 2022, Blackrock Neurotech and Phantom Neuro collaboratively launched a neurotech startup to deliver a high-accuracy system for lifelike control of robotic orthopedic technologies.

Further, development initiatives for mind-controlled prostheses are one of the most prevalent trends in the global market. The arm can be controlled by the brain commands obtained from an electroencephalography (EEG) headset. For instance, the startup company Atom Limbs plans to launch a mind-controlled prosthetic arm and prosthetic shoulder to market in 2023. The technology was first developed over 10 years of research at Johns Hopkins’ Applied Physics Laboratory with a USD 120.0 million grant from the U.S. Department of Defense. These factors are projected to contribute to the market's growth prospects in the forecast period.

DRIVING FACTORS

Rise in Number of Amputations Strengthened Market Growth

Some traumatic causes, such as accidents, injuries, or surgeries due to multiple reasons, such as diabetes, blood vessel diseases, cancer, infection, excessive tissue damage, dysfunction, and pain are the leading causes of amputations. This has increased demand for prosthetic devices, significantly improving patient lifestyles. For instance, according to an article published by the National Institutes of Health (NIH) in 2021, 57.7 million people were living with limb amputation due to traumatic causes globally in 2017. Furthermore, on average, an amputation is done every 30 seconds on a global level. These abovementioned factors are critically driving the global market.

Peripheral vascular disease is one of the common leading causes of limb loss. For instance, as per the article published by American Heart Association, Inc., in 2020, microvascular disease upsurges amputation in patients with peripheral artery disease. The high vulnerability of vascular disease patients contributes to amputations.

As these devices are considered to be rehabilitating in terms of nature and lead to an improved quality of life for the amputee, favorable reimbursement is extended to these products. Some of the components of the prosthetics process that are extended reimbursement coverage include physicians’ consultations, measurements, fabrication, fitting, device training, repair, and replacement, amongst others. These factors are anticipated to contribute to the global market’s prospects in the forecast period.

Incorporation of Cutting-edge Technologies in Limb Prosthesis to Boost Market Expansion

As the demand for technologically advanced products increases, many manufacturers are focused on the incorporation of novel technologies in their products. In terms of the global landscape, individuals with limb loss and other disabilities want products that ease their daily functioning. This has led manufacturers to increasingly focus on the development, commercialization, and manufacturing of products that solve the various problems that individuals with amputations face. In recent times, several products with advanced technologies have been launched in the global market. In February 2022, Össur launched a new product called the POWER KNEE, an advanced prosthetic knee with an actively powered microprocessor for lower limbs.

In August 2020, Blatchford Limited launched ElanIC. It is the world’s lightest and most compact waterproof microprocessor hydraulic ankle. Apart from providing the patient with improved clinical outcomes, the product also focuses on the preservation of the patient’s long-term health through the protection of bones and joints from additional wear and tear.

Many manufacturers are putting diligent efforts into introducing novel materials to design technology-based prosthetic devices to achieve a robust foothold in the global market. The introduction of technologically advanced products and devices is poised to further augment the penetration and preference for these devices by healthcare providers globally, which will subsequently drive market growth.

RESTRAINING FACTORS

High Cost of Prosthesis and Lack of Prosthetists and Orthotists Hamper Market Growth

Despite a strong need for these effective products, one of the most critical limiting factors restraining this market's growth is the high cost of these prosthetic devices. Generally, a prosthetist or orthotist prescribes these devices, and each device is customized as per the patient's requirements. The cost of these devices increases depending on the level of advancement and mechanism.

According to an article published by BionicsForEveryone in 2021, the bionic hand costs from USD 8,000 to USD 100,000 in the U.S. Some large traditional manufacturers still charge more than USD 30,000. Furthermore, newer companies seem to be pricing their bionic hands between USD 8,000 and USD 30,000.

Moreover, emerging nations lag in reimbursement policies for prostheses and prosthetists; thus, this increases cost barriers. The third-party payer restrictions create a dearth in the market, which out-of-pocket payments cannot overcome. For instance, as per an article by the American Academy of Orthotists and Prosthetists in January 2022, the existing shortfall of prosthetists and orthotists (P&Os) in Singapore will continue to grow from 2016 to 2060. These factors are limiting the adoption of prosthetics, especially in emerging countries with comparatively lower levels of reimbursement.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Large Number of Lower Limb Amputations Contributed to the Segment’s Strong Market Share in 2024

On the basis of type, the market is bifurcated into upper limb prosthetics and lower limb prosthetics, with a share of 62.11% in 2026. The lower limb prosthetics segment owing to the strong volume of lower limb amputations on a global landscape, and new advance launches contributed to the segment’s dominance in terms of global limb prosthetics market share. For instance, in September 2022, Indian Space Research Organisation (ISRO) developed an intelligent artificial limb, i.e., above-knee amputees, to walk with a comfortable gait. It is expected that it is cheaper by about 10 times and likely to be commercialized soon. Also, the rising prevalence of diabetes and orthopedic diseases is one of the primary reasons for the segment’s strong growth prospects.

The upper limb prosthetics segment is projected to grow at a limited CAGR. Increasing adoption of upper limb products and rising accidents or injuries will likely augment the segment's growth.

By Technology Analysis

Ease in Terms of Affordability Contributed to the Conventional Prosthetic Devices’ Dominant Market Share in 2024

The technology segment is divided into conventional prosthetic devices, electric prosthetic devices, and hybrid prosthetic devices. Conventional prosthetic devices were the dominant segment in the global market contributing 45.10% globally in 2026. These devices are basically body powered and are available at substantially lower prices than the products of other technologies.

Electric prosthetic devices accounted for the second dominant market segment in 2022. Favorable reimbursement policies by the government, and private insurance companies, have led to a surge in demand for these products. The electric prosthetic device, including myoelectric micro-controlled devices, offers a reduction of harnessing, access to effortless strength and multiple grip patterns, and more natural hand movements. As they significantly improve patient outcomes, various key players are launching new products in the market. Such a scenario is projected to increase demand for these products. In September 2021, Steeper Inc. launched the latest myoelectric system. It is designed to offer a durable, high-capacity upper limb system at an affordable cost harnessing popular myoelectric technology's power.

Hybrid prosthetic devices occupy a smaller proportion in terms of market share. The segment's growth is likely to propel owing to increasing technological advancement in these devices, which involves conventional and advanced features.

By Component Analysis

Frequent Replacement of Sockets due to Greater Wear and Tear Contributed to Segment’s Maximum Market Share in 2024

Based on component, the market is segmented into socket, appendage, joint, connecting module, and others. The socket segment held a dominant share in the global market accounting for 38.82% in 2026. The sockets are typically replaced every two to four years. Furthermore, the rising number of research initiatives to increase the efficacy of sockets is pivotal for the dominance of the segment. For instance, Ability Prosthetics and Orthotics, Inc. initiated a research study to assess a socket releasing strategy for improved socket fit. The ongoing research initiative will evaluate the socket that releases during sitting and relocks before standing to improve satisfaction with people's prostheses and limb health. Thus, many studies enhancing the efficacy of sockets are expected to favor their adoption of these products.

The joint segment is projected to reflect a robust CAGR during the forecast period. Generally, a prosthesis includes wrist, elbow, shoulder, ankle, knee, or hip joints, which need regular replacements due to their wear and tear. Many amputations due to trauma and diseases contribute to the expansion of the joint segment.

The appendage segment is likely to witness steady growth prospects due to the use of prosthetic hands or feet to embrace the physical appearances among amputees; hence, these components are in demand. Demand for effective connecting modules for improved functioning of appendages and sockets is expected to contribute to the growth of the segment. All these factors, coupled with new product launches, are expected to drive the segment's growth.

By End User Analysis

Substantial Volumes of Prosthetic Devices Attributed to Orthotists & Prosthetists (O&P) Clinics to Enable the Segment to Hold Highest Market Share

Based on end user, the market is segmented into Orthotists & Prosthetists (O&P) clinics, orthopedic clinics, and others. The Orthotists & Prosthetists (O&P) clinics segment is expected to account for the largest segment in the forecast period, with a share of 87.37% in 2026. The availability of effective products in these institutions, coupled with the presence of specialized prosthetic-related care in these locations, is projected to contribute to the segment’s dominance. Other benefits offered by O&P clinics, such as customized prosthetics and reimbursements, also contribute to the segment's growth.

The orthopedic clinics segment held the second-largest market share. The increase in the number of orthopedic clinics carrying out amputation surgeries and providing prosthetic services, specifically in developing countries, is anticipated to contribute to the segment’s growth prospects. The other segment’s growth prospects are driven by the increasing number of rehabilitation centers across the globe.

REGIONAL INSIGHTS

To get more information on the regional analysis of this market, Download Free sample

In terms of geography, the global market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

North America

The North America market size stood at USD 0.93 billion in 2025. North America accounts for the most dominant region in the global market due to a number of factors, which include high limb loss incidence, the presence, and adoption of technologically advanced products, positive reimbursement trends, and strong healthcare expenditure. According to the Amputee Coalition, in 2021, an estimated 3.6 million individuals in the U.S. will live with limb loss in 2050. The U.S. market is projected to reach USD 0.92 billion by 2026.

Europe

Europe accounted for the second most dominant region in terms of the global market in 2022. Several positive factors, which included a favorable governmental and reimbursement policy, strong volume of amputations, and adoption of novel technologies, are anticipated to result in the region’s robust market share. Similarly, rising strategic acquisitions by key players to attain a strong foothold in European countries contribute to market growth. In February 2022, Ottobock completed the acquisition of Livit B.V. to expand its Western European patient care network. Such trends are anticipated to further boost the market growth in the region. The UK market is projected to reach USD 0.09 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

Asia Pacific

The Asia Pacific region has considerable growth potential owing to the region’s strong elderly population. The substantial geriatric demographic in the region, coupled with the surge in the prevalence of diseases, including diabetes, is anticipated to lead the region to grow at the highest CAGR. The rest of the world segment is projected to account for a lower market share in 2022. Various factors, including improved awareness in terms of these products and increasing healthcare expenditure in key countries, including Brazil, are expected to contribute to the region’s future growth potential. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.09 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

KEY INDUSTRY PLAYERS

Comprehensive Product Portfolio and Geographical Presence of Ottobock and Össur to Enable them to have Prominent Position

In terms of the competitive landscape, the global market displays a strong degree of fragmentation as the market has the presence of both regional and multinational companies. Some players such as Ottobock and Össur occupy a dominant position in terms of market size owing to their robust geographic presence, diversified and technologically advanced product portfolio, established customer base, strong emphasis on R&D, product launches, and engagement in various strategic initiatives. For example, in June 2020, Össur launched two advanced products, Balance Foot S and Balance Foot S Torsion, intending to help less-active people with lower-limb loss and maintain an ideal balance of safety, comfort, and mobility. Thus, the company's substantial market value and new launches are anticipated to further contribute to the company’s market dominance in the forecast period.

Some other key companies include Blatchford Limited, Uniprox (Bauerfeind), Steeper Inc., and Ortho Europe are progressively engaged in the strengthening of their market presence. To increase their market presence, these companies have successfully executed several strategic initiatives, including collaborations and launches of novel products. In November 2021, Bauerfeind ME entered into a Joint Venture Contract (JVC) with the Zayed Higher Organization for People of Determination (ZHO) at the UAE pavilion of Expo 2020. According to the signed contract, Bauerfeind will employ and train people to produce prosthetics and orthotics at the ZHO facility in Abu Dhabi.

Also, newer entrants, including Fillauer LLC (Fillauer Companies, Inc.), Hanger, Inc., WillowWood Global LLC., and many others, are developing an edge over the other competitors owing to the expansion of manufacturing capabilities through venture capitalism and utilization of advanced technologies.

LIST OF KEY COMPANIES PROFILED:

- Fillauer LLC (Fillauer Companies, Inc.) (U.S.)

- Hanger, Inc. (U.S.)

- Össur (Iceland)

- Blatchford Limited (U.K.)

- Ottobock (Germany)

- WillowWood Global LLC. (U.S.)

- Steeper Inc. (U.K)

- Uniprox (Bauerfeind) (Germany)

- Ortho Europe (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- September 2022: Siemens Caring Hands, a global charitable organization, provided USD 250,000 to Unlimited Tomorrow for Global Initiative to secure prostheses for victims in Ukraine.

- July 2022: Unlimited Tomorrow partnered with Singularity Group to bring functional prosthetic limbs to those in need. This organization launched a USD 1.0 million GoFundMe initiative to create and provide functional prosthetic limbs to 100 amputee victims of the Russian invasion of Ukraine.

- April 2022: Indian Institutes of Technology (IIT) Madras researchers launched polycentric prosthetic knee in India.

- February 2022: Össur launched a new product, POWER KNEE. It is the world’s first actively powered microprocessor prosthetic knee for people with above-knee amputation or limb differences.

- December 2021: Ortho Europe launched straight and pre-flexed suspension gel sleeves. It provides a secure sealing solution to lower limb amputees.

REPORT COVERAGE

The global market research report provides a detailed analysis of the market. The global market analysis focuses on key aspects such as market dynamics, key industry developments - mergers, acquisitions and partnerships, new product launches, technological advancements, reimbursement scenarios, statistics related to limb loss and amputations, key players, and the COVID-19 pandemic impact on the global market. Besides this, the market report includes insights into the key industry dynamics and highlights market trends. Additionally, the report encompasses several factors and market statistics that have contributed to the growth of the global market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.89% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type, Technology, Component, End User, and Region |

|

By Type |

|

|

By Technology |

|

|

By Component |

|

|

By End-user

|

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.85 billion in 2025 and the market is expected to grow USD 3.09 billion by 2034.

In 2025, the North America market stood at USD 0.93 billion.

Growing at a CAGR of 5.89%, the market will exhibit steady growth in the forecast period (2026-2034).

The lower limb prosthetics segment is expected to be the leading segment in this market during the forecast period.

Rise in the number of amputations, strong focus on clinical studies proving the efficacy of these products, and technological advancements in the global market are driving the market growth.

Ottobock and Ossur are some of the major market players in the global market.

North America dominated the market in 2025.

New product launches, rising government initiatives to increase the adoption of prosthetics, and rise in cases of amputations across the globe drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us