Livestock Vaccines Market Size, Share & Industry Analysis, By Type (Inactivated, Live Attenuated, Recombinant, and Others), By Animal Type (Bovine, Swine/ Porcine, Poultry, and Others), By Route of Administration (Oral, Parenteral, and Others), By Distributional Channel (Veterinary Hospitals, Veterinary Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

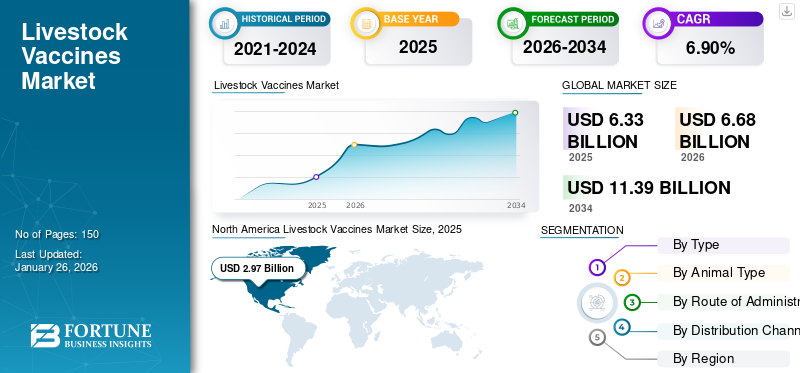

The global livestock vaccines market size was valued at USD 6.33 billion in 2025. The market is projected to grow from USD 6.68 billion in 2026 to USD 11.39 billion by 2034, exhibiting a CAGR of 6.90% during the forecast period. North America dominated the livestock vaccines market, accounting for a 46.90% market share in 2025. Moreover, the U.S. livestock vaccines market size is projected to grow significantly, reaching an estimated value of USD 4.29 billion by 2032, driven by government efforts to promote animal health and manage livestock diseases.

Livestock vaccines play a crucial role in safeguarding the health and well-being of farm animals. These vaccines help prevent outbreaks and reduce the economic losses associated with livestock illnesses by providing immunization against various diseases, including foot and mouth diseases. The livestock vaccines are administered through various routes of administration, such as intravascular, subcutaneous, spray, oral, and nasal. Furthermore, the veterinary vaccines for farm animals are of various types, such as live attenuated vaccine, inactivated vaccine, toxoid vaccine, and recombinant vaccine.

The rising prevalence of diseases related to farm animals will influence the global livestock vaccines market growth. Furthermore, the growing demand for advanced vaccines and the rising number of vaccines launched by the market players are expected to boost the market growth over 2025-2032.

The COVID-19 pandemic had a significant impact on the market, causing slower growth in 2020. The decline in the number of animal visits to hospitals and clinics for vaccination and treatment played a role in this scenario of slower growth. However, the market managed to avoid negative growth despite the overall market slowdown. Some major companies saw a slight increase in their sales of animal health products, including livestock vaccines, during the COVID-19 period, indicating potential growth in the global market in the coming years. Overall, the market witnessed a slow but positive recovery, with a significant increase in vaccination programs and animal visits in 2020 and 2021.

Global Livestock Vaccines Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 6.33 billion

- 2026 Market Size: USD 6.68 billion

- 2034 Forecast Market Size: USD 11.39 billion

- CAGR: 6.90% from 2026–2034

Market Share:

- Region: North America dominated the market with a 46.90% share in 2025. The region's growth is driven by a surge in vaccine launches by market players, widespread adoption of advanced and modified vaccine products, a large livestock population, and an increase in animal visits for vaccination programs.

- By Type: The Live Attenuated segment held the largest market share in 2024. This is attributed to the growing outbreak of diseases in farm animals, high demand for these products in developing countries, and their effectiveness in creating a strong, long-lasting immune response.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, the market is driven by increasing vaccination programs and a growing animal population. Rising awareness about the risks associated with zoonotic diseases is also fueling the demand for preventive health measures.

- United States: Market growth is strongly supported by government efforts to promote animal health and manage diseases. High reported cases of zoonotic diseases, such as animal rabies, and significant R&D initiatives by major U.S.-based companies are key drivers for vaccine adoption.

- China: The market is expanding due to increasing awareness about the risks of zoonotic diseases and rising spending on animal healthcare. The large livestock population creates a substantial and growing demand for effective vaccines.

- Europe: The market is propelled by the increasing prevalence of zoonotic diseases and government-backed awareness campaigns. For instance, the European Food Safety Authority (EFSA) launched a major campaign to raise awareness and halt the spread of African swine fever.

Livestock Vaccines Market Trends

Technological Advancements Focused on Various Types of Vaccines

In recent years, some of the global livestock vaccines market trends include significant advancements in traditional vaccines, such as vector vaccines, recombinant vaccines, and irradiated vaccines. Vector vaccines have effectively prevented diseases, such as infectious bovine rhinotracheitis (IBR) in cattle, Newcastle disease in poultry, and porcine reproductive and respiratory syndrome (PRRS) in pigs. The ability of vector vaccines to offer more efficient disease control and prevention has driven their adoption as vital tools in livestock health management.

Furthermore, in 2020, Boehringer Ingelheim International GmbH received marketing authorization in the U.S. for a second trivalent form, Vaxxitek HVT+IBD+ILT. In 2019, the company launched its first trivalent form, Vaxxitek HVT+IBD+ND, in the U.S. The second trivalent vaccine would protect against Marek's disease (M.D.), infectious bursal disease (IBD), and Infectious Laryngotracheitis (ILT). These are all highly infectious and commercially disruptive diseases that affect the poultry industry worldwide.

Moreover, there have been significant advancements in live attenuation-based vaccines, specifically modified live livestock vaccines. These vaccines offer distinct advantages over the other types, including long-lasting and rapid immunity and the potential for broader and stronger immune responses to the presence of attenuated, live pathogens.

Additionally, there have been developments in the field of DNA vaccines for livestock, which involve the introduction of genetic material encoding specific antigens into the animal's cells. The technology has demonstrated promising results in terms of protection against various diseases, with the potential for improved safety and efficacy compared to traditional vaccines.

Download Free sample to learn more about this report.

Livestock Vaccines Market Growth Factors

Increasing Cases of Zoonotic Diseases Coupled with Rising Awareness Associated with Livestock Healthcare to Propel Market Growth

The market for livestock vaccines is anticipated to experience significant growth over the forecast period. This is due to the increasing occurrence of zoonotic diseases and the growing awareness related to animal health. Zoonotic diseases, which can be transmitted from animals to humans, have become a major concern due to their potential to cause outbreaks and public health emergencies.

- Furthermore, according to the article published by National Foundation for Infectious Diseases in March 2023, in the U.S., approximately 5,000 animal rabies cases are reported each year, with more than 90% occurring in wildlife. Such high cases of critical diseases are set to augment the livestock vaccine demand for more efficient disease prevention and higher livestock productivity.

In addition, the rising awareness amongst livestock owners and farmers about the importance of healthcare for their animals is expected to contribute to the market growth. Moreover, governments are implementing supportive initiatives and regulations to control zoonotic diseases and promote vaccination in livestock populations. These factors are anticipated to boost the adoption of livestock vaccines.

- For instance, in August 2020, the European Food Safety Authority (EFSA) launched a major campaign aimed at raising awareness and halting the spread of African swine fever in south-east Europe.

Such awareness initiatives related to diseases create a favorable environment for increased vaccine demand in the foreseeable future. Hence, rising animal population and government initiatives to control the spread of zoonotic diseases are expected to propel the market growth during the forecast period.

R&D Initiatives by Major Market Players to Boost Industry Growth

The growing size of livestock vaccines industry can be attributed to the extensive research and development (R&D) initiatives by key market players. These companies are investing in R&D to develop vaccines that effectively cater the evolving demand from livestock owners and farmers by providing enhanced solutions for disease prevention and control.

Furthermore, major players are continuously expanding their vaccine portfolios by introducing new vaccines catering to various livestock species. They are also addressing the requirements of these products for the emerging diseases in livestock animals. This expansion allows them to meet the diverse needs of livestock owners and farmers, which is expected to contribute to the growth of the market during the forecast period.

- In 2020, Zoetis received approval from the European Commission for CircoMax Myco, a vaccine used for the active immunization of pigs against porcine circovirus type 2 (PCV2) and Mycoplasma hyopneumoniae.

Increasing initiatives by market players focused on product development are expected to boost market growth in the coming years.

RESTRAINING FACTORS

Adverse Effects Associated with Vaccines Might Hamper the Market Growth

The rising prevalence of zoonotic diseases in livestock animals, including blastomycosis, rabies trichinosis, histoplasmosis, and coccidiomycosis, has led market players to develop innovative vaccines for disease prevention and treatment.

However, vaccine failures and adverse effects can hamper the trust of animal owners in using vaccinations for their livestock animals. This may hamper the market growth during the forecast period.

Various articles and studies have demonstrated the adverse reactions of vaccination in livestock animals, such as cattle, poultry, and porcine. For instance, according to various articles, live-attenuated LSD vaccines may cause mild adverse reactions in cattle. Furthermore, according to an article published by NCBI in October 2021, the side effects caused by the Sheep Pox Virus (SPPV) vaccine in naïve cattle are more rarely detected than side effects caused by attenuated LSD vaccines. Such events of vaccine failures are expected to lead to lower adoption of vaccines amongst animal owners during the forecast period.

In addition to the adverse effects associated with livestock vaccines, there may also be concerns regarding their efficacy in preventing diseases in livestock animals. Limited efficacy of vaccines in terms of protection against targeted diseases may cause animal owners to hesitate to invest in vaccination programs for their livestock. This lack of confidence in the efficacy of vaccines could further hinder market growth in the livestock vaccine sector.

Livestock Vaccines Market Segmentation Analysis

By Type Analysis

Live Attenuated Segment Held the Largest Share in 2024 Due to Rising Disease Outbreak in Farm Animals

Based on type, the market is divided into inactivated, live attenuated, recombinant, and others.

The live attenuated segment captured the highest global livestock vaccines market share of 38.93% in 2026 and is estimated to record a moderate CAGR over 2026-2034. The large share of the segment is attributed to the growing outbreak of diseases in farm animals coupled with the high demand for this product, especially among developing countries. Furthermore, live attenuated vaccines exhibit more effectiveness in triggering cell-mediated immune responses, and can create a strong and long-lasting immune response among animals. This is achieved by the research and development of advanced live attenuated vaccines. Some of these R&D initiatives comprise the development of protein subunit vaccines for swine. These vaccines are administered intramuscularly. These factors are instrumental in the higher demand and preference toward this vaccine type.

The recombinant segment is anticipated to expand at the highest CAGR over the study period. This segmental growth is due to the increase in the introduction and development of advanced recombinant vaccines by industry players for the treatment of livestock population. For instance, in October 2020, the U.S. animal health business of Boehringer Ingelheim International GmbH introduced VAXXITEK HVT+IBD+ILT, a recombinant vaccine for the protection of poultry from three diseases.

To know how our report can help streamline your business, Speak to Analyst

By Animal Type Analysis

Bovine Segment Accounted for Major Share in 2024 Due to Rising Vaccine Demand

In terms of animal type, the market is segregated into bovine, swine/porcine, poultry, and others.

In 2026, the bovine segment dominated the market share 58.00%, and it is projected to register a substantial CAGR during 2026-2034. The segment share is attributed to the growing number of bovines across the globe, which is expected to stimulate the demand for bovine vaccines, boosting the segmental growth during the forecast period.

- For instance, according to GOV.UK, the bovine population was estimated to be 9,631,892 in 2022, which is an increase in the population, compared to 2020, which was 9,614,578. Such increase in the population is expected to surge the vaccination in bovines.

The poultry segment is expected to grow at the highest CAGR over 2025-2032. The segmental growth is attributed to the rising population pool of diseased poultry coupled with growing adoption of poultry vaccines by healthcare facilities to prevent poultry linked disease outbreaks. These factors are expected to surge the segmental growth during the forecast period.

The swine/porcine segment held a substantial market share in 2024. This significant share is attributed to the increasing prevalence of diseases in swine, such as porcine reproductive and respiratory syndrome (PRRS) and swine influenza. This high incidence is expected to surge the demand for livestock vaccines, propelling the segmental growth.

By Route of Administration Type Analysis

Parenteral Segment Held Major Share due to Various Benefits Associated with this Route of Administration

In terms of route of administration, the market is segregated into oral, parenteral, and others.

The parenteral segment accounted for the highest share of 67.16% in 2026. Reliable immune response induction, versatility, established practice, and rapid onset of immunity are some of the benefits associated with the parenteral route of administration, which are expected to boost the segment growth over the forecast period.

The oral segment is expected to grow at a substantial CAGR over 2025-2032. The segmental growth is due to the surging diverse R&D initiatives and increasing clinical trials with new and advanced vaccines. Furthermore, the rise in the introduction of vaccines through this route of administration is expected to boost the segmental growth during the forecast period.

The others segment include routes of administration such as intranasal, which is limited to a single dose of vaccine.

By Distribution Channel Analysis

Veterinary Clinics Segment Recorded Major Share in 2024 Due to Growing Livestock Population Visits in Clinics

In terms of distribution channel, the market is segregated into veterinary clinics, veterinary hospitals, and others.

In 2023, the veterinary clinics segment dominated the market share and it is projected to register the highest CAGR during 2025-2032. The higher segment share is attributed to the growing adoption of livestock vaccines in clinics. Furthermore, the large number of animal visits in clinics for the treatment coupled with growing number of veterinarians is anticipated to boost the segmental growth during the forecast timeframe.

- For instance, according to the American Veterinary Medical Association, in 2022, there were 124,069 veterinarians, which is 6.9% higher than veterinarians in 2019. In 2019, the number of veterinarians was 116,091.

The increasing number of veterinarians is expected to boost the animal-visits in clinics, thereby propelling the segmental growth.

The veterinary hospitals segment is expected to grow at a notable CAGR over 2024-2032. The segmental growth is attributed to the growing preference for veterinary hospitals by animal owners when post-vaccination care is required. Furthermore, these hospitals offer advanced care infrastructure to avoid post-vaccination complications. These mentioned benefits are expected to propel the segmental growth during the forecast period.

REGIONAL INSIGHTS

North America Livestock Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 2.97 billion in 2025 and USD 3.13 billion in 2026. The region is anticipated to dominate the global share owing to surge in the launches of vaccines by market players. The widespread adoption of advanced and modified vaccines products which is further expected to drive market growth in the region. Moreover, a large population of livestock animals and the increase in the number of animal-visit for vaccination program for prevention will foster the regional market. The United States market is projected to reach USD 2.9 billion by 2026.

Europe captured a substantial market share in 2023 and it is predicted to record a substantial CAGR during the forecast period, 2024-2032. The growth is attributed to the growing adoption of poultry and swine animals and the increasing prevalence of zoonotic diseases. The regional expansion is further propelled by the growing number of veterinary clinics and improved healthcare infrastructure in European countries. The United Kingdom market is projected to reach USD 0.24 billion by 2026, while the Germany market is projected to reach USD 0.33 billion by 2026.

The market across Asia Pacific is anticipated to exhibit the highest CAGR over 2025 to 2032. The high CAGR of the region can be attributed to the increasing vaccination program coupled with growing animal population across the region. Moreover, growing awareness about risks associated with zoonotic diseases and increasing spending on animal health care are anticipated to drive the growth of the market in the emerging countries such as China and India. The Japan market is projected to reach USD 0.25 billion by 2026, the China market is projected to reach USD 0.28 billion by 2026, and the India market is projected to reach USD 0.1 billion by 2026.

Latin America and Middle East & Africa accounted for a significant share of the market due to growing animal population suffering from various diseases. These include infectious bovine rhinotracheitis (IBR) in cattle, Newcastle disease in poultry, and porcine reproductive and respiratory syndrome (PRRS) in porcine. Additional factors impelling the industry expansion in these regions constituted rising healthcare investments and increasing launches of technologically advanced vaccines by regional market players.

List of Key Companies in Livestock Vaccines Market

Market Players Focus on Diversified Portfolio to Strengthen Market Hold

Zoetis Services LLC, Merck Animal Health (Merck & Co., Inc.), and Boehringer Ingelheim International GmbH are some of the leading players in the market. The dominance of these players is attributable to strong direct and indirect presence worldwide with diversified and high quality and advanced vaccine portfolio. These market players are focusing on mergers, acquisitions, new subsidiaries, and the introduction of new vaccines to penetrate new markets.

Other companies operating in the global market include Phibro Animal Health Corporation, Vaxxinova International BV, Virbac, and other small and medium-sized players. These industry participants are centered on various strategic developments such as strengthening of distribution channel and enhancing the customer base by introducing new vaccines. Furthermore, the growing focus of these companies to introduce and develop innovative vaccines in emerging markets is expected to boost their share in the market.

LIST OF KEY COMPANIES PROFILED:

- Boehringer Ingelheim International GmbH (Germany)

- Virbac (France)

- Merck Animal Health (Merck & Co., Inc.) (U.S.)

- Zoetis Services LLC (U.S.)

- Ceva (France)

- Elanco (U.S.)

- HIPRA (Spain)

- Neogen Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – The Indian Immunologicals Ltd (IIL), a subsidiary of the National Dairy Development Board (NDDB), announced that it is working on the development of novel vaccines to treat infectious bovine rhinotracheitis (IBR) virus and lumpy skin disease along with a combination of vaccines for protection against rabies.

- June 2023 - Merck Animal Health, a division of Merck & Co., Inc., announced the launch of Circumvent CML, a three-in-one swine vaccine that controls for diseases, Porcine Circovirus Type 2d (PCV-2d), Porcine Circovirus Type 2a (PCV-2a), Lawsonia intracellularis and Mycoplasma hyopneumoniae.”

- February 2023- Virbac announced the first vaccine for sows to protect the piglets from diarrhea caused by rotavirus and assist pig farmers and veterinarians in the livestock industry.

- September 2022- Merck Animal Health (Merck & Co., Inc.) signed an agreement to acquire Vence in order to advance technologies in animal health.

- December 2021- Virbac signed an agreement with Pharmgate to represent itself in the U.S. market for expanded sales in swine segment. This was Virbac’s first footstep in the U.S. market for the swine segment

- October 2021- Boehringer Ingelheim International GmbH announced an investment of USD 105.2 million to expand veterinary vaccine capacity in France.

- June 2021 – The U.K. announced the setup of a U.K. Animal Vaccine Manufacturing and Innovation Centre in Surrey, for advancing the vaccine development for farm animals and controlling the spread of viral diseases. The government contributed USD 22.8 million to develop this center.

- February 2021 - Ceva inked a partnership with the French National Research Institute for Agriculture, Food, and Environment (INRAE) for R&D in the improvement of animal health and prevention of diseases from animal origin.

- January 2021 - Zoetis introduced the Poulvac Procerta HVT IBD vaccine in order to protect poultry against Infectious Bursal Disease.

- August 2020- Merck Animal Health secured rights to VECOXAN for lambs and calves to prevent them from contracting coccidiosis.

REPORT COVERAGE

The global market report provides a detailed competitive landscape. It focuses on industry overviews, such as vaccination programs, veterinary vaccination rates, and market dynamics. Besides this, the report provides information related to market segments, key industry developments, such as mergers and acquisitions, and technological advancements in the market. In addition, the report covers the impact of COVID-19 and the industry overview during the pandemic.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.90% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Type

|

|

By Animal Type

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is projected to grow from USD 6.68 billion in 2026 to USD 11.39 billion by 2034.

In 2025, the North American market stood at USD 2.97 billion.

The market is expected to exhibit a CAGR of 6.90% during the forecast period (2026-2034).

By distribution channel, the veterinary clinics segment led the market.

The rising prevalence of farm animals related to diseases, rising demand for vaccines, and the growing introduction of advanced vaccine by market players are the key factors driving the market growth.

Boehringer Ingelheim International GmbH, Merck Animal Health (Merck & Co., Inc.), and Zoetis Services LLC are the top players in the market.

North America region dominated the market in 2025.

The growing awareness vaccines among farm animal-owners coupled with innovative vaccines launches are expected to drive the product adoption in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us