Luxury Car Rental Market Size, Share & Industry Analysis, By Rental Type (Business and Leisure), By Booking Mode (Online and Offline), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

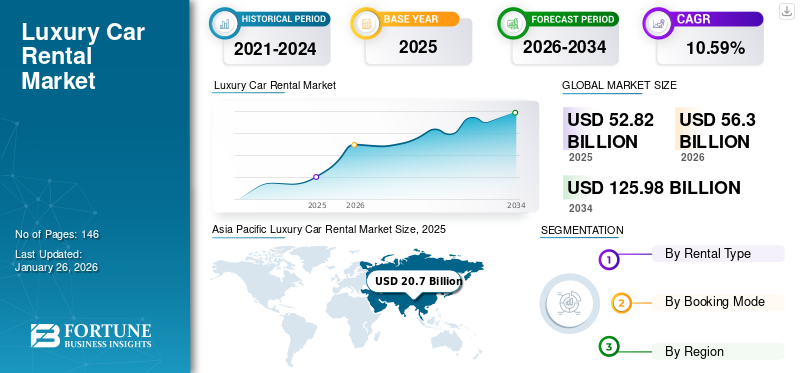

The global luxury car rental market size was valued at USD 52.82 billion in 2025 and is projected to grow from USD 56.30 billion in 2026 to USD 125.98 billion by 2034, exhibiting a CAGR of 10.59% during the forecast period. Asia Pacific dominated the global market with a share of 39.19% in 2025. The Luxury Car Rental Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 13.14 billion by 2032.

A luxury car is more expensive than a standard car and offers better performance, levels of comfort, quality, and status. The term refers to both the characteristics of the car and the manufacturer's brand recognition. Luxury car rentals are growing in popularity. There are companies or groups that rent out high-end vehicles for a fee. Depending on the person, this arrangement may endure for an hour, a day, or even weeks. Luxurious transportation, the ability to choose from a variety of models, and assistance in projecting the appropriate image for particular events are some of the main factors driving exotic vehicle rentals' appeal.

The COVID-19 pandemic significantly impacted the global luxury car rental market as travel restrictions, lockdown measures, and economic uncertainties led to a sharp decline in the demand for luxury car rental services. With reduced travel and tourism activities, luxury car rental companies faced challenges in maintaining their operations and generating revenue. However, as vaccination efforts progress and travel restrictions ease, the luxury car rental market is expected to gradually recover.

Luxury Car Rental Market Trends

Change in Rental Preference from Normal Cars to Luxury Cars to Witness Positive Growth

According to Autocar, Rolls-Royce achieved the best performance in its 116-year history, delivering 1,380 cars, up 62% from 2020, surpassing its previous high from 2019. Porsche's revenue surpassed the 2020 value by more than USD 110 million in 2022, reaching an all-time more than USD 35 billion. Bentley was an exception, shutting down for seven weeks only at the cost of USD 10 million per week and still delivering more cars than ever before.

According to Luxe Digital, when the crisis ends, the luxury sector would be among the first to recover while before the COVID-19 pandemic, the luxury vehicle market was thriving. Hence, the inherent tendency of this market to grow is anticipated to influence the rental preference of these cars over normal cars.

Download Free sample to learn more about this report.

Luxury Car Rental Market Growth Factors

Rise of Demand-Responsive Transport to Provide Significant Boom to the Market

Demand-responsive transport services encompass luxury passenger vehicles and charter vehicles equipped with features, such as real-time feedback, vehicle tracking, and rating, to end consumers. Numerous mobile applications make it easier to find luxury cars and compare prices with the respective car rental companies.

For instance, in February 2021, Humax announced that it would supply the WTC mobility service platform the 'Auto Rent RAiDEA', allowing users to compare nearby taxi, luxury car rental, and ride-hailing prices companies in a single app. In addition, in April 2021, GoAir collaborated with Eco Europcar to launch rental services in 100 Indian cities, including 25 airports. Further, GoAir will offer cars that are chauffeur driven ranging from mid-range to luxury car segments through Eco Europcar. Furthermore, such exotic car rental services provide customers with various functions. As a result, the demand-responsive transport trend is on the rise.

Digitization in the Booking Process, Payment Process, and Management of Luxury Car Rental to Propel Market Growth

On a global scale, this market is expanding rapidly. By improving their efficiency and adopting new automated technologies, all market participants provide better services and discounts to increase bookings. Digitization, one of the automated technologies trending presently, is having a significant impact on every industry segment, including the car rental industry. Moreover, rental companies have evolved due to digitalization to increase profitability while improving customer experience. These rental companies use car rental management software to improve their services and automate their operations. Also, the car rental management software reduces management tasks and increases operational efficiency.

Furthermore, management software includes favorable payment management, fleet optimizations, and custom reports, which assist these companies in expanding their businesses. For instance, Hertz and Fox Rent-a-car, two car rental apps, are usually the main contenders for obtaining this information. As a result, the application of car rental management software represents a significant growth opportunity for the market players.

Rising Number of Air Travelers to Fuel the Market Growth

Rising number of air travelers due to decreasing fares, growing disposable income, and expanding leisure & tourism industry across emerging and developed economies are likely to fuel the demand for car rental services across airports. For instance, according to the International Air Transport Association (IATA) forecast in October 2018, the number of air travelers globally could double to 8.2 billion by 2037.

Moreover, businesses are expanding globally, further influencing the growth of business travelers. Therefore, rising demography of corporate or business travelers is surging the car rental industry's demand for premium executive cars.

RESTRAINING FACTORS

High Deposit Amounts and Rental Costs Could Limit the Market Growth

The market involves obtaining a large deposit, ranging from USD 2,500 to USD 50,000, financial information and vetting, and installing GPS devices in the cars to follow them if something goes wrong during the rental. It also means checking to confirm whether the renter has personal insurance coverage, which will secure liability and the car's worth or at least a portion of it. For instance, fleet insurance on a USD 200,000 car can cost USD 400 to USD 1,300 per month, yet many policies have high premium and do not cover customer theft. In addition, limited shares to opt for these services also hinder the market growth in some regions. Therefore, these cost factors are expected to restrain the market growth rate during the forecast period.

Changing Consumer Preferences toward Alternative Mobility Solutions May Restrain the Market

As consumers increasingly prioritize convenience, affordability, and sustainability, they are exploring alternative transportation options such as ride-hailing services, car-sharing platforms, and subscription-based models. These alternatives offer flexibility without the commitment of owning or renting a luxury car, appealing to a broader range of consumers.

Additionally, the COVID-19 pandemic accelerated the adoption of remote work and virtual meetings, reducing the need for business travel and corporate rentals of luxury vehicles. Many companies have implemented remote work policies, leading to a decline in corporate travel and a corresponding decrease in demand for luxury car rental services for business purposes.

Furthermore, the growing popularity of electric and autonomous vehicles presents a challenge for the luxury car rental market. As governments worldwide implement stricter emissions regulations and promote sustainable transportation initiatives, there is a growing shift toward electric vehicles (EVs) and autonomous driving technology. While luxury car rental companies may offer EVs in their fleets, the infrastructure for charging and servicing these vehicles may not be as developed as for traditional combustion engine vehicles, limiting their appeal to customers.

Overall, the emergence of alternative mobility solutions, changing consumer preferences, the impact of the COVID-19 pandemic, and the rise of electric and autonomous vehicles pose significant challenges for the global luxury car rental market. To remain competitive, luxury car rental companies must adapt their business models, invest in innovative technologies, and diversify their offerings to meet evolving customer needs and preferences.

Luxury Car Rental Market Segmentation Analysis

By Rental Type Analysis

Business Segment to Dominate the Market Due to Growing Preference from Corporate Consumers

The market is segmented into business and leisure based on rental type.

The business segment is anticipated to hold the largest share with a 53.30% in 2026, globally over the forecast period. Most private enterprises and government corporations have been renting luxury cars for their top executives for many years. The corporations update the cars to be rented to the personnel based on their designation and annual advancement. It also facilitates the firm to not add fixed assets and inventory cost of these luxury cars while facilitating the executives to use these luxurious cars while going for meetings and client visits. As a result, current luxury car rental market trends are expected to drive the market expansion over the forecast period.

The leisure segment is anticipated to exhibit the highest CAGR during the forecast period. Consumers desire access to luxury cars rather than buying and owning them, and they prefer to pay for the privilege of momentarily using them. This desire is anticipated to propel the luxury car rental market growth. For example, a few years ago, the percentage of new Hyundai, Ford, Kia, and GM cars rented rather than purchased was minuscule but has now become at least 20%, according to J.D. Power & Associates research. These factors are expected to drive the growth of the leisure segment during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Booking Mode Analysis

Online Segment to Capture the Maximum Market Share Due to High Demand from Consumers Especially Millennial Consumers

Based on booking mode, the market is segmented into online and offline.

The online segment is expected to exhibit the highest CAGR during the forecast period with a share of 81.83% in 2026. The online segment is gaining popularity amongst young consumers. The consumer gets a wide range of luxury cars to choose from the online booking option. In addition, this type of cars facilitate booking round the clock and year-round availability. It facilitates users to flexibly compare the prices and provides information on the availability of luxury cars, conditions, and offers associated without physical inquiry. The online app reservation system also enables business owners to easily manage all reservations. The reservations made online are recorded and addressed directly. Hence, advancements in technologies and increasing penetration of the internet among buyers will propel the growth of the online segment.

The offline segment is expected to project steady growth during the forecast period. While online bookings are gaining traction, some consumers still prefer offline booking of luxury cars. The dominance can be attributed to customers’ convenience to rent cars in person rather than surfing online. Unlike customers who book online, offline consumers can inspect and examine the exotic car and even enquire with the staff. Hence, the offline segment will progress steadily during the forecast period.

REGIONAL INSIGHTS

Asia Pacific Luxury Car Rental Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Improving Standard of Living to Drive the Market in Asia Pacific

Asia Pacific

The market in Asia Pacific stood at USD 22.22 billion in 2026. The region is expected to dominate the global market due to consumers choosing to rent over buying. Huge population in China and India, which accounts for more than 38% of the world population, is a crucial element driving the region's market growth. The growth can also be attributed to the increasing number of billionaires in Asia Pacific. According to Forbes, Asia Pacific continues to be the frontrunner, with a staggering 1,149 billionaires in 2022, which is 370 more than the previous year, owing mostly to entrants from China and India. According to Forbes, exotic car rental is still an emerging business category in the region compared to Europe and North America; nevertheless, given the trends mentioned above, it is expected to increase significantly throughout the projected period. Imported luxury cars costing more than USD 90,830 are growing trendier in Japan among affluent individuals who cannot travel overseas due to the coronavirus outbreak but are prepared to spend money. The Japan market is projected to reach USD 3.2 billion by 2026, the China market is projected to reach USD 12.63 billion by 2026, and the India market is projected to reach USD 2.64 billion by 2026.

North America

North America holds the second-largest position in the market. The market in North America suffered during the pandemic and sold most of its vehicles during the lockdowns due to COVID-19. However, with the countries resuming travel activities and market opening up again, the demand for car rental increased more than its pre-pandemic level. According to Kayak, a travel search engine, searches about automobile rentals and pricing for luxury automobile rentals have surged during the holiday period from 12/11/2020 to 07/01/2020 compared to 2019. As per the search engine, the searches for luxury cars in 2021 were up by 230% from 2019 and 243% from 2020. Meanwhile, the average rental daily cost is 75% higher than in 2019 and 66% higher than in 2020 rates. Porsche Cars North America and Wheels Up, a private aviation firm, collaborated to provide high-end clients with road-to-sky VIP service and lifestyle experiences. The partnership grants Wheels Up members entry to Porsche Drive on-demand vehicle subscription perks and a 10% discount on short-term rentals. The U.S. market is projected to reach USD 8.95 billion by 2026.

Europe

Europe currently holds the third-largest market share; however, it is expected to exhibit the highest CAGR during the forecast period. Europe also faced the problem of selling the inventory during pandemic amidst rising demand after the pandemic. For instance, thousands of tourists visit the city of Malaga in Spain each year as their gateway to Spain's famed Costa del Sol. These tourists are used to spending no more than USD 600 on luxury car rental per week. The UK market is projected to reach USD 3.47 billion by 2026, and the Germany market is projected to reach USD 5.18 billion by 2026.

Rest of the world

The rest of the world consists of Latin America and the Middle East & Africa. The Middle East is anticipated to contribute significantly to the market's growth. This can be attributed to the region’s wealth and the developed travel & tourism industry. In 2021, Amazon started offering car rentals in Sharjah, Dubai, Abu Dhabi, Ajman, and Ras Al Khaimah.

Key Industry Players

Hertz Corporation’s Focus on Fleet Electrification to Enhance Its Market Share

Hertz Corporation is an American car rental company headquartered in Florida. It operates at around 12,000 locations, both domestically and internationally in 160 countries. Hertz operates in North America, Europe, Latin America, Africa, Asia, Australia, the Caribbean, the Middle East, and New Zealand. Hertz Corporation functions through Firefly Car Rental, Thrifty Car Rental, and Dollar Rent a Car brands. It has a vast fleet size, and Hertz is trying to expand in developing economies through mergers and acquisitions.

LIST OF TOP LUXURY CAR RENTAL COMPANIES

- Avis Budget Group (U.S.)

- Sixt (Germany)

- Enterprise Holdings (U.S.)

- Movida (Brazil)

- Hertz (U.S.)

- Localiza (Brazil)

- Europcar Mobility Group (France)

- Car Inc. (China)

KEY INDUSTRY DEVELOPMENTS

- February 2024 - Sime Darby Auto Bavaria partnered with Sime Darby Rent-A-Car (SDRAC)-Hertz Malaysia to introduce an electric vehicle (EV) rental service. It will offer all-electric BMW iX, at rental prices starting around USD 150 per day and USD 1,300 per month.

- January 2024 - Driverso, known as the world’s first luxury car rental platform, expanded its business in the EMEA area. It is known as one of the most prestigious rental companies with availability of premium brands such as Audi, BMW, Land Rover, Maserati, Mercedes-Benz, Ferrari, Porsche, and Lamborghini.

- January 2024 - SKIL Cabs, introduced ELECTRIC CAR RENTALS as part of its ever-expanding suite of services. With this, the company takes a momentous step in implementing decarbonization strategies through innovative business changes. This landmark initiative will revolutionize the cab-hailing landscape in India and play a pivotal role in promoting sustainable and eco-friendly travel options.

- July 2022 - Ikenna Ordor’s luxury car rental brand ‘Starr Luxury’, announced its expansion in the U.S. It announced its start of operation in major cities such as Los Angeles, Miami, Houston, Atlanta, and Austin. Starr Luxury is known for being one of the few companies of its kind in the world to have a collaboration with five-star hotels.

- July 2022 - Uber’s premium electric car service Uber Comfort Electric announced its expansion in more U.S. cities, including Las Vegas, Portland, Seattle, Denver, Baltimore, Austin, and Philadelphia.

- December 2021 - Ajman Public Transport Authority (APTA) of the UAE announced the availability of vehicle rental services to achieve the Emirate's Vision 2021 of supporting federal institutions to establish an equitable and comprehensive transportation system. The change is intended to provide clients with high-quality services conveniently. The Transport Authority's Vehicle Rental Section developed this service as part of the premium vehicle rental services.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, rental type, and booking mode. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.59% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

| Segmentation |

By Rental Type

|

|

By Booking Mode

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 52.82 billion in 2025.

In 2025, Asia Pacific stood at USD 20.7 billion.

The market is projected to grow at a CAGR of 10.59% and will exhibit steady growth during the forecast period (2026-2034).

The business segment is expected to be the leading segment in market forecast period.

Using a vehicle without owning the vehicle at lower monthly payments and maintenance costs is expected to drive market growth.

Enterprise Holdings is the leading player in the global market.

Asia Pacific dominated the market share in 2025.

Consumers increasing inclination toward luxury and the urge to meet high standards and favorable government initiatives will drive market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us