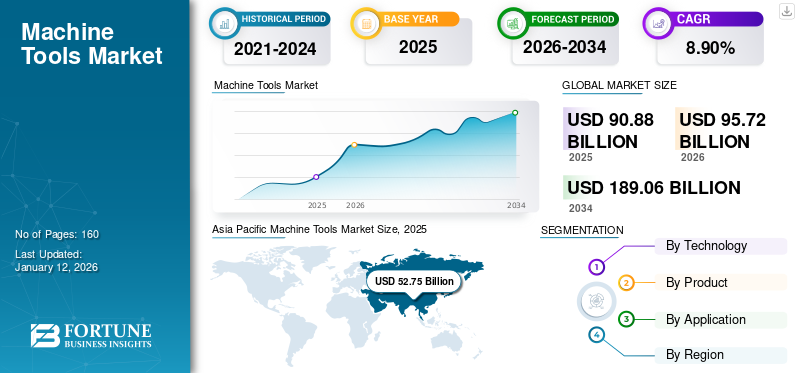

Machine Tools Market Size, Share & Industry Analysis, By Technology (Conventional and CNC (Computerized Numerical Control)), By Product (Metal Cutting and Metal Forming), By Application (Automotive, General Machinery, Precision Machinery, Transport Machinery, and Others), and Regional Forecast, 2026-2034

Machine Tools Market Size

The global machine tools market is valued at USD 90.88 billion in 2025 and is projected to grow from USD 95.72 billion in 2026 to USD 189.06 billion by 2034, exhibiting a CAGR of 8.90% during the forecast period. Asia Pacific dominated the global market with a share of 58.00% in 2025.

Machine tools have a wide range of applications across industries including metal & mining, automotive, and others. These tools manufacture parts with high precision and accuracy withstanding forces and producing high-quality components. Due to their extensive applications such as drilling, cutting, planing, surface finishing, and producing manufacturing parts machine tools market is experiencing steady growth over the forecast period. Rising demand for precise, custom-built, and high-volume products is prominently anticipated to upsurge the machine tools market growth.

With the advent of advanced AI and Industry 4.0, significant transformation is being observed in the machine tools industry making the manufacturing facilities smarter and integrated with technology. Automation is further reshaping the manufacturing processes and further boosting the efficiency of facilities enabling real-time monitoring and informed decision making. For instance, using AI and IoT connectivity, manufacturers have enhanced the equipment’s efficiency considerably by reducing its downtime and sizable cost cutting for end users. For instance, NUM a software developer company has introduced, a state-of-the-art AT software package for CNC machine tools monitoring with any additional devices in 2023.

Global Machine Tools Market Overview

Market Size:

- 2025 Value: USD 90.88 billion

- 2026 Value: USD 95.72 billion

- 2034 Forecast Value: USD 189.06 billion

- CAGR: 8.90% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific led the market with a share of 58.00% in 2025, driven by strong investments in precision machining, industrial automation, and electronics manufacturing.

- Segment Leadership:

- Product: Metal forming machines are projected to hold the highest growth rate over the forecast period.

- Application: Automotive sector maintains the largest share by revenue due to demand for high-precision components.

Industry Trends:

- Rising demand for CNC and smart machine tools aligned with Industry 4.0 and precision manufacturing needs.

- Growing adoption of metal cutting and forming equipment in battery, EV, aerospace, and electronics industries.

- Enhanced investment in automation, robotics, and digital integration across machining cycles.

Driving Factors:

- Increasing need for accurate, high-volume part production, especially in automotive, aerospace, and electronics manufacturing.

- Rising automation across factories and widespread adoption of AI-enabled machining and smart diagnostics.

- Continuous innovation by key players (e.g., Mazak, Doosan, Trumpf, AMADA) in high-performance, eco-efficient machine tools.

Growing demand for continuous production capacities, safer work environments, and high demand for precise parts are all boosting the market growth. The market is primarily being influenced by its wide applications across automotive, transportation machinery, and industries. The COVID-19 pandemic showed a significant impact on the market which led to reduced investment in production facilities, the financial impact on end users, and a temporary halt on manufacturing facilities across diverse geographies. However, the slow relaxation of regulations and growing demand across industries have shown a positive impact on the market share post-pandemic period.

Machine Tools Market Trends

Demand for Precision Manufacturing to Boost CNC Machines Market

Smart manufacturing provides enhanced performance owing to digital transformation and integrated systems with real-time monitoring. Growing demand for precision machining across sectors such as automotive, aerospace, etc., is significantly influencing demand for integrated and automated systems. Industries seek higher precision, automation, and efficiency at the manufacturing facilities to meet increasing end-user demands such as accurate components across industries including automotive, and electronics. CNC machine enhances productivity aligning with evolving demand in the manufacturing sector further leading to rising demand for the CNC machine tools market. With zero effect on the environment and greater accuracy, these CNC tools also provide enhanced personnel safety to the operators.

Download Free sample to learn more about this report.

Machine Tools Market Growth Factors

High Demand for Complex Components across Industries to Upsurge the Market Growth

Tools are expected to produce high-precision components across varied industries including aerospace, electronics, and automotive due to which machine tools market demand is expected to showcase a robust growth over the forecast period. As product design is becoming highly complex, the demand for high-quality products further increases generating strong demand with cutting edge technology such as CNC machines. High-precision machine tools enabled efficient production, enhanced quality products, and reduced material wastage. Several manufacturers are focusing on adding features such as real-time monitoring and predictive maintenance while minimizing the downtime and cost for end users.

RESTRAINING FACTORS

High Development Cost to Hinder Market Growth

With advanced technologies and increased cost of raw materials, the initial cost of machine tools includes, installation, shipping, and maintenance expenses which increases the initial costs significantly. Changing demand for custom products, requires CNC machines to be updated, high costs mainly associated with modifications, and requirements varying according to end users. High installation and operating costs might hinder the growth, especially in price-sensitive economies such as Asian countries proving to be a restraining factor for the market growth.

Machine Tools Market Segmentation Analysis

By Technology Analysis

CNC Tools to have Largest Market Revenue Share With Their Enhanced Efficiency and Improved Safety

Based on technology, the market is categorized into conventional and CNC (Computerized Numerical Control). CNC machine tools are anticipated to dominate the market.

Industrial automation and investment in smart and integrated tools are being done in order to achieve greater speed and higher efficiency for several applications such as cutting and drilling. Such factors are showing prominent impact on the demand for CNC machines. CNC segment covered with market share of 75.96% in 2026. CNC machines are modern data-driven tools that offer efficient and precision materials processing across several industries such as automotive and metal fabrication. CNC machines provide enhanced production capacity and high-precision parts along with enhanced personnel safety resulting in the largest revenue share in the market.

CNC machines in the long run act as a sustainable solution for end users resulting in reduced energy consumption and lowered production costs thereby resulting in a robust growth rate over the forecast period.

By Product Analysis

Metal Cutting Finds Wide Array of Application Across Various Industries Leading

Based on product, the market segmentation is done into metal cutting and metal forming.

Metal cutting segment by product is by far the largest revenue shareholder with a share of 67.43% in 2026. Metal cutting is further is classified into machining centers, turning machines, grinding machines, milling machines, eroding machines, and others. Metal forming is further classified into sub-segments that include bending machines, presses, punching machines, and others.

Metal cutting is prominently used in manufacturing processes for feature creation, finished parts, and components production. Metal cutting primarily includes several processes such as turning, drilling, grinding, eroding, etc. across diverse industries boosting the demand for machine tools. In recent years, with changing trend towards smart manufacturing and technological integration in manufacturing processes, manufacturers are introducing machines with enhanced material removal rates and optimized cutting errors which is further boosting the sales of metal cutting machines. Metal forming machines to exhibit highest CAGR during the forecast period.

By Application Analysis

Increasing Electrification of Vehicles and Demand for Precise Parts Is Surging the Demand For The Product In The Automotive Sector

Based on application, the market is classified into automotive, precision engineering, transport machinery, general machinery, and others. Others include the construction, marine industry, woodworking, and aerospace industry. The automotive sector by application dominates the market.

Modern manufacturing and smart facilities are widely demanding user-friendly operations, with data-driven monitoring in order to make better production decisions. Electrification and advancements in vehicles are surging the growth of CNC machines across the sector. Efficient and minimal waste-producing CNC machines are gaining huge traction across the automotive sector, therefore automotive applications are accounting for the largest revenue with a share of 32.71% in 2026.

Components and parts with maximum levels of precision and tight tolerances are required for precision engineering which is anticipated to create huge demand for the market across industries. Precision engineering is thereby projected to experience the highest growth rate during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market is further segmented based on region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific Machine Tools Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region has remained dominant in the market share across the globe accounting for more than half of the market revenue share. Supportive government initiatives, international investments, collaborations, and a wide array of applications across automotive, aerospace, and transportation sectors are all influencing the growth across the region.

Emphasis on electrification of the automotive sector, several initiatives promoting sustainable vehicle growth, rising emphasis on automated manufacturing, and investment in integrated technologies are all supposed to propel the market. Regulatory policies and additional tax incentives across geographic locations are further expected to upsurge the market demand. For instance, China’s Ministry of Finance and State Administration of Taxation has announced a super deduction policy for research and Development expenses in 2023.

China is pushing and emphasizing high-precision and intelligent machines’ demand owing to rising demand for superior-quality components and parts. Suppliers and manufacturers are entering into strategic collaborations with domestic participants, are focusing on cutting-edge machine tool technologies to meet the evolving demands of customers. Several companies are finding their opportunities in emerging technologies such as smart machining centers and precision engineering enabling their strong foothold in the market. The China market is projected to reach USD 23.87 billion by 2026

Several emerging economies cater to a considerable amount of market revenue share owing to the establishment of automotive and semiconductor manufacturing facilities. For instance, In June 2023 Indian Government approved Micron for setting up of Semiconductor Unit in Gujarat with an investment of about USD 1 Billion.

Thailand is one of the prominent Southeast Asian markets to experience robust growth in the market. A few of the reasons include the shift of automotive and semiconductor manufacturing bases from China to Southeast Asian countries are political tensions, the establishment of semiconductor manufacturing across the region, and easy raw material availability for electric vehicles production. Countries such as Japan and South Korea are subjected to experiencing steady growth over the forecast period. The Japan market is projected to reach USD 12.9 billion by 2026, and the India market is projected to reach USD 1.5 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Growing demand for advanced and precision machines across small and medium-sized enterprises is propelling the demand in machine tools market across European countries. These economies along with their high productivity are constantly focusing on sustainable and eco-friendly tooling solutions with reduced energy consumption and environmental impact. Moreover, digitalization and integrated technology solutions such as CNC machine tools are gaining huge market traction in the region in order to boost production capacity and superior-quality components. Germany accounted for the largest market share followed by other European countries in 2023. The UK market is projected to reach USD 7.10 (Italy) billion by 2026, while the Germany market is projected to reach USD 13.18 billion by 2026.

Expanding manufacturing facilities, and rising demand for high-precision machine tools for components manufacturing are all boosting the volume sales across the region. Automation across manufacturing plants, technological advancements, and focus on efficient manufacturing processes to further boost the market demand.

North America

Companies in the North American market enhance their development potential through significant investments in research and development and a primary focus on technological advancements. Key developmental strategies such as collaborations, product development, and business expansion play a crucial role in driving growth. The U.S. market is projected to reach USD 7.12 billion by 2026.

Middle East & African and Latin America

Middle East & African and Latin American countries are experiencing strong growth in the market owing to economic growth, investment in infrastructure, and enhanced product offerings through industrial fairs and exhibitions. For instance, Turkey showcases the highest growth rate in the Middle East & African markets owing to rising foreign investments and supportive initiatives by the governments.

Key Industry Players

Development of Sustainable and IoT Integrated Machines to Boost the presence of Key Market Participants

Machine tool manufacturers are heavily investing in research and development activities by expanding their product portfolio in strategic collaboration with technology companies. To sustain in the market, companies are also re-establishing their brand presence through trade shows and exhibitions across geographies. Key players with collaboration and acquisitions of the domestic market participants, are developing efficient and high-performance machine tools to penetrate into the market. Hyundai has released over 20 models of machine tools including turning and machining centers

- Hyundai WIA, in July 2023 launched SE2200 Series of small and medium machine tools that offer complex machining capabilities and high-speed of operation to varied end users for diverse materials.

LIST OF TOP MACHINE TOOLS COMPANIES:

- Yamazaki Mazak Corporation (Japan)

- Doosan Machine Tools Co., Ltd. (South Korea)

- Trumpf (Germany)

- AMADA MACHINE TOOLS CO., LTD (Japan)

- JTEKT Corporation (Japan)

- MAG IAS GmbH (Germany)

- Schuler AG (Germany)

- Makino (Japan)

- Hyundai WIA (South Korea)

- Komatsu Ltd. (Japan)

- Okuma Corporation (Japan)

- FANUC Corporation (Japan)

- Haas Automation Inc. (U.S.)

- Mitsubishi Heavy Industries Machine Tools Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Nidec Machine Tool Corporation introduced two new models of double-column machining centers named MV16BxII and MV12BxII in the last quarter of 2023 that offer enhanced productivity, and eco-friendly machines.

- August 2023: Okuma America Corporation announced next-gen machine control for CNC machine tools with enhanced user experience and high-speed operations for end users.

- July 2023: Methods Machine Tools hosted a 2-day Machine fest in Massachusetts for machine tools that would showcase an entire portfolio of 3- and 5-axis conventional and CNC machines along with integrated solutions and support services.

- March 2023: Yasda Precision Machining Tools came into agreement with Methods Machine Tools as a supplier for precision machining centers across the U.S. in order to expand its presence across the geography.

- August 2022: RoboJob, an automated solutions provider has released Turn-Assist 200i and 270i a semi-collaborative engineered automation system for turning centers that help operators for convenient cutting operations.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2024 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 8.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By Product

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 90.88 billion in 2025.

Fortune Business Insights says that the market will reach USD 189.06 billion by 2034.

Growing at a CAGR of 8.90%, the market will exhibit strong growth during the forecast period.

Precise manufacturing and technology integrated solutions to surge the market demand.

The top companies in the market are Yamazaki Mazak Corporation, Doosan Machine Tools Co., Ltd., Trumpf, and AMADA MACHINE TOOLS CO., LTD.

Asia Pacific dominated the global market with a share of 58.00% in 2025.

Metal forming machines are expected to hold the highest CAGR in the market.

Automotive segment to hold the largest market revenue share during the forecast period.

High demand for precision manufacturing to further boost adoption of CNC machines over the upcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us