The residential segment is expected to lead the market, contributing 39.38% globally in 2026. Tt is held the largest magnesium oxide board market share in 2024 and is the fastest-growing application. The increasing consumer preference for green buildings and making homes fire-resistant is boosting the product adoption in the residential segment. The rapidly growing population in North America and APAC regions is also enhancing the demand for residential construction. This is likely to drive the product usage.

Magnesium Oxide Board Market Size, Share and Industry Analysis, By Product Type (Thin (<8 mm), Medium (8-15 mm), and Thick (>15 mm)), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

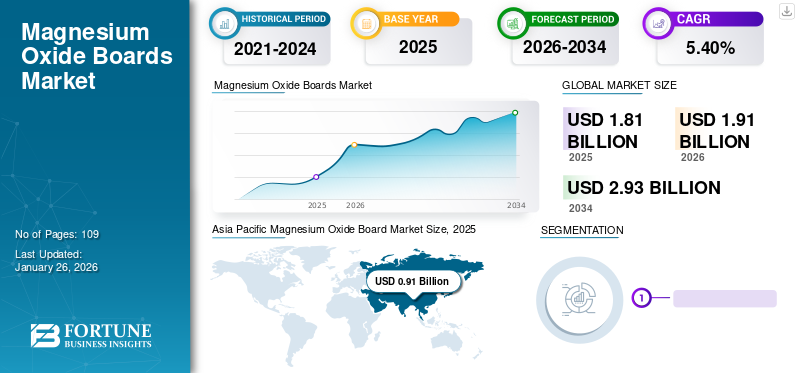

The global magnesium oxide boards market size was valued at USD 1.81 billion in 2025 and is projected to grow from USD 1.91 billion in 2026 to USD 2.93 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period. Asia Pacific dominated the magnesium oxide boards market with a market share of 51.00% in 2025. Moreover, the magnesium oxide board market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 401.92 million by 2032, driven by increasing demand in the construction industry and its superior performance characteristics.

Magnesium oxide board is a highly advanced building material that delivers higher performance as compared to conventional materials, such as gypsum, wood, and cement-based products. Magnesium oxide is a mineral cement produced under pressure and heat while manufacturing with content of magnesium and oxygen. An MgO board provides several appealing features including good fireproofing, energy efficiency during production, and waste reduction. In addition, they are resistant to rot, mildew, mold, or allergens due to their fungi-resistant property. These boards have gained significant attention from contractors due to their easy installation and lightweight nature as they are 20-30% lighter than cement-based products.

GLOBAL MAGNESIUM OXIDE BOARD MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 1.81 billion

- 2026 Market Size: USD 1.91 billion

- 2034 Forecast Market Size: USD 2.93 billion

- CAGR: 5.40% from 2026–2034

Market Share:

- Asia Pacific led in 2024 with a 50.28% share, rising from USD 821.2 million in 2023 to USD 866.1 million in 2024, driven by construction growth in China, India, and Southeast Asia.

- By application: Residential segment held the largest share in 2024, supported by green building demand, fire resistance needs, and favorable lending policies boosting housing projects.

Key Country Highlights:

- United States: Projected to reach USD 401.92 million by 2032, driven by construction industry growth and material performance advantages.

- China: Leading global producer and consumer, supported by infrastructure expansion.

- Europe: Adoption driven by housing demand, greenhouse construction, and green building initiatives.

COVID-19 IMPACT

Raw Materials for Magnesium Oxide Board Witnessed Severe Price Fluctuation Due to Supply Shortage

The COVID-19 outbreak had a detrimental impact on the building material industry. Magnesia board manufacturing companies and magnesium oxide & magnesium chloride production faced crippled demand during this period. Companies operating in the construction materials manufacturing sector had to adopt additional safety measures to safeguard their employees. Raw materials required to manufacture magnesium oxide boards experienced sharp price fluctuations due to supply shortages. Due to restrictions imposed in various countries across Asia Pacific, one of the major materials - magnesium oxide - witnessed dramatic fluctuations in its supply chain. However, increasing awareness of the utilization of environment friendly products spurred the demand for magnesium oxide board as it increases the lifespan of interior and exterior walls.

LATEST TRENDS

Download Free sample to learn more about this report.

Rise in Residential & Commercial Building Construction to Create Growth Opportunities for Market

Continuous rise in commercial & residential construction has intensified the product demand. Excellent insulation qualities, soundproof, and fire resistance are some of the significant characteristics, which might bolster the magnesium oxide board market growth.

- Asia Pacific witnessed a magnesium oxide boards market growth from USD 821.2 million in 2023 to USD 866.1 million in 2024.

The residential segment is expected to capture a major market share. This is mainly due to favorable lending policies introduced by governments across the globe, which have increased the number of residential construction projects. The spending on residential construction is also projected to grow, mainly in emerging countries due to growing population and urbanization. These factors are expected to create lucrative opportunities for market growth.

The increasing energy conservation activities and rising technological advancements to enhance commercial spaces across the world are anticipated to boost the market growth. The rising number of building codes and policies mandating the construction of energy-efficient structures is further increasing the usage of eco-friendly materials in the construction sector. These factors are likely to boost the product’s application in the construction industry during the forecast period.

DRIVING FACTORS

Growing Investment in Eco-friendly Products and Materials will Drive Market Expansion

Ecological construction refers to the usage of environmentally-friendly materials and products to construct buildings. This has augmented the demand for MgO boards, as they do not contain formaldehyde, asbestos, benzene, and other harmful radioactive elements. They also possess smokeless, non-toxic, and non-odorous characteristics.

In addition, these boards are considered sheltered and recommended by governments and regulatory bodies worldwide. Their production cycle is naturally maintained, consumes less energy, has no sewage, is energy-saving, and has less impact on the ecosystem. The unique natural pore structure of these boards helps in controlling indoor temperature during summers, and thus decreases energy consumption for cooling.

Moreover, high-quality and high-grade magnesium boards are quite reliable and stable. Due to their affordability, lightweight nature, high energy, and excellent processing characteristics, these boards are preferred by modular real estate developers. A highlight feature of this board is that it diligently consumes carbon dioxide (CO2) from the air throughout its life cycle, continuously cleaning it and improving the quality of indoor air. These factors improve the lifespan of walls and are anticipated to bolster the market growth during the forecast period.

RESTRAINING FACTORS

High Moisture Environment Affects Durability of MgO Boards

MgO boards are not a suitable roofing material for exterior facades or any other application where they are in direct contact with moisture. MgO absorbs moisture from outside air, and in some instances, the board absorbs water droplets when it comes in contact with water, which can reduce its durability. Such boards will form a layer of salty droplets on their surfaces when the Relative Humidity (RH) is higher than about 84%. This water is absorbed by the wooden structure of these boards, which can possibly lead to mold growth. Due to its organic content, boards made from MgO are susceptible to decay.

These boards will also erode quickly while coming in contact with metal flashings, fasteners, and parts made of galvanized steel, making the structure unsafe for living. They become fragmented over time due to salts' dissolution in high humidity climate. Thus, in regions with high humidity, the magnesia board demand is hampered as it may not be able to withstand the product life in humid climate.

SEGMENTATION

By Product Type Analysis

Thin Segment to be Dominant as they are Widely Used to Construct Walls and Ceilings

Based on product type, the market is segmented into thin (<8 mm), medium (8-15 mm), and thick (>15 mm). The thin (<8 mm) segment held a dominant market share in terms of revenue in 2024. The rapidly growing construction industry and rising industrialization in regions, such as North America, Europe, and Asia Pacific, are augmenting the adoption of thin boards. These boards are being widely used in walls, ceiling linings, and fascia applications.

The medium (8-15 mm) segment is expected to record a notable CAGR during 2023-2030. The rising adoption of medium-sized magnesium oxide boards in the wooden panels of kitchens, doors, and furniture is anticipated to fortify the MgO market growth.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Residential Segment to Dominate due to Growing Residential Building Construction

Based on application, the market is segmented into residential, commercial, and industrial.

The industrial segment is expected to register a significant growth rate due to rapid industrialization in China, India, and the U.S. Furthermore, growing adoption of MgO boards in manufacturing industries to avoid fire accidents is propelling the market growth. The commercial segment is expected to hold a 26% share in 2024.

REGIONAL INSIGHTS

Asia Pacific Magnesium Oxide Board Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The magnesium oxide board market size in Asia Pacific stood at USD 0.91 billion in 2025. The increased product demand from developing nations, such as China, India, and other Southeast Asian countries, is expected to drive the market expansion. Growth in construction and infrastructure activities is another key driver for the regional market. China is a major contributor to the regional market growth as it is the dominant producer and consumer in the world. The Japan market reaching USD 0.17 billion by 2026, the China market reaching USD 0.42 billion by 2026, and the India market reaching USD 0.15 billion by 2026.

North America

The market in North America is experiencing steady growth due to the ever-expanding construction industry, technological innovations, and rapid urbanization. In addition, rising living standards are increasing the need for house remodeling projects. In North America, factors, such as growing commercial real estate investments, higher consumer spending, and increased industrial activity, are driving the market growth in the region. In addition, government regulations supporting the use of eco-friendly materials will boost the regional market growth. The U.S. market reaching USD 0.29 billion by 2026.

Europe

The construction industry plays a vital role in Europe, accounting for 9% of its economy while providing 18 million direct jobs. The outlook of the region’s residential construction market remained positive in 2022. The rising demand for housing in the U.K. has boosted the product adoption due to reduction in stamp duty on new home sales. In Europe, growing demand for greenhouses, rising population, and increasing construction activities will drive the market expansion. The UK market reaching USD 0.10 billion by 2026 and the Germany market reaching USD 0.13 billion by 2026.

Latin America

The market in Latin America will likely grow moderately during the forecast period. There has been a notable increase in the need for new eco-friendly products, such as magnesium oxide board, which offers thermal insulation, has an energy efficient production process, and is toxin-free. Due to changing trends and growing urbanization in Latin America, the increased construction of commercial buildings, such as multiplexes and retail malls, has contributed to the market growth in the region.

Middle East & Africa

The Middle East & Africa market is majorly driven by rising residential applications. The growing construction of luxury or innovative buildings and easy availability of decorative materials, such as magnesium oxide boards in various sizes, textures, thicknesses, and colors, can increase the scope of their applications. In addition, the rising development and usage of energy-efficient and eco-friendly materials is expected to support the product demand in the region during the forecast period.

KEY INDUSTRY PLAYERS

Companies to Innovate their Product Range to Boost Market Share

The key companies in the market are striving to offer better and vast-ranged product portfolios to cater to the end-user demands. For instance, EARCONS ACOUSTIC BUILDING SYSTEM PRIVATE LIMITED provides magnesium oxide boards under the brand ‘Mag-Aco’ in different thicknesses, finishes, colors, and textures. Mag-Aco offers resistance against mildew, mold, and fire, and has high strength. Certain companies are promoting the beneficial properties of magnesia boards. For example, Foreverboard California, Inc. produces magnesium oxide drywalls (MgO drywalls) under the brand name FOREVERBOARD. These drywalls are a distinctive combination of lightweight and strength due to strong bonds between oxygen and magnesium atoms. The company claims that the product can replace backer boards, MDF boards, gypsum wallboards, ceiling tiles, and OSB boards.

LIST OF KEY COMPANIES PROFILED:

- Magnum Board Products, LLC. (U.S.)

- Ambient Bamboo Products Inc. (U.S.)

- GemtreeBoard (China)

- KUNSHAN ROCKMAX BUILDING MATERIAL CO.,LTD (China)

- Suparna Building Materials (China)

- Ukrmagnesit (Ukraine)

- RPV Industries (India)

- North American MgO LLC (U.S.)

- Foreverboard California, Inc. (U.S.)

- MgOBoards Factory (Saudi Arabia)

- EARCONS ACOUSTIC BUILDING SYSTEM PRIVATE LIMITED (India)

REPORT COVERAGE

An Infographic Representation of Magnesium Oxide Boards Market

To get information on various segments, share your queries with us

The research report provides detailed market analysis and focuses on crucial aspects such as leading companies, product types, and applications. Also, it provides quantitative data regarding value, market analysis, research methodology for market data, and insights into market trends and highlights vital industry developments and competitive landscape. In addition to the abovementioned factors, the report encompasses various factors contributing to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.4% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type, Application, and Geography |

|

By Product Type |

|

|

By Application |

|

|

By Geography |

|

Frequently Asked Questions

Fortune Business Insights says that the global market size is projected to grow from USD 1.91 billion in 2026 to USD 2.93 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period.

Growing at a CAGR of 5.4%, the market will exhibit rapid growth in the forecast period (2026-2034).

The residential segment is expected to lead the market in 2024.

The residential segment is expected to lead the market during the forecast period.

Increasing demand from construction industry is the key factor driving the market.

China held the highest share of the market in 205.

Magnum Board Products, LLC., GemtreeBoard, RPV Industries, and Foreverboard California, Inc. are the leading players in the market.

Growing investment in eco-friendly products and materials and rise in residential and commercial construction are anticipated to boost the product consumption.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Chemicals & Materials

Clients

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic