Medical Tourism Market Size, Share & Industry Analysis, By Healthcare Services (Medical Treatment {Cardiac Procedures, Oncology Procedures, Orthopedic & Spine Procedures, Dental Procedures, and Others}, Wellness Treatment {Cosmetic Procedures, Rejuvenation Procedures, and Others}, and Alternative Treatment), By Service Provider (Public and Private), and Regional Forecast, 2026-2034

Medical Tourism Market Size & Global Trends

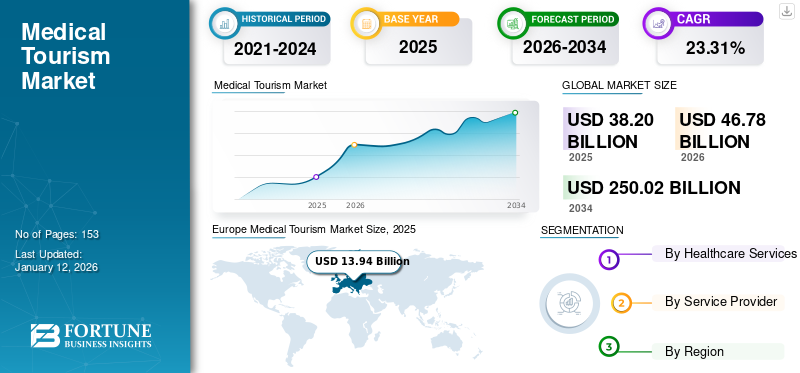

The global medical tourism market size was valued at USD 38.2 billion in 2025 and is projected to grow from USD 46.78 billion in 2026 to USD 250.02 billion by 2034, exhibiting a CAGR of 23.31% during the forecast period. Europe dominated the medical tourism market with a market share of 36.51% in 2025.

Medical tourism refers to people traveling to other countries to receive medical treatments. The increased cost savings for an individual owing to the affordable cost of treatments among the healthcare facilities in developing countries is one of the major factors supporting the growing market size.

The increasing prevalence of conditions such as cancer, cardiovascular disorders, dental disorders, and others among the population, along with rising healthcare costs in developed nations such as the U.S., the U.K., Germany, and others, are some of the factors driving the global market growth.

Some of the major players operating in the market with a wide range of services include Apollo Hospitals Group, Bumrungrad International Hospital, and others.

Global Medical Tourism Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 38.2 billion

- 2026 Market Size: USD 46.78 billion

- 2034 Forecast Market Size: USD 250.02 billion

- CAGR: 23.31% from 2026–2034

Market Share:

- Europe dominated the medical tourism market with a 36.51% share in 2025, driven by the presence of renowned medical facilities, skilled healthcare professionals, and a growing number of private clinics catering to international patients.

- By healthcare services, medical treatment is expected to retain its largest market share owing to the rising cost of treatments in developed countries and the availability of affordable, high-quality care in emerging destinations like Thailand, India, and Malaysia.

Key Country Highlights:

- United States: Advanced healthcare infrastructure, cutting-edge medical technologies, and initiatives to enhance patient safety are influencing outbound medical tourism, as patients seek cost-effective treatments abroad.

- Europe: High-quality healthcare services, a large number of internationally accredited medical facilities, and strategic efforts by countries like Turkey to attract health tourists are driving market leadership.

- China: Growing healthcare capacity, rising collaborations with international healthcare providers, and increasing government support to promote medical tourism are fostering market growth.

- Japan: Focus on premium healthcare services, wellness tourism initiatives, and efforts to streamline medical visa processes are enhancing the country's appeal to international medical tourists.

MARKET DYNAMICS

MARKET DRIVERS

Improving Healthcare Infrastructure in Emerging Nations to Boost Market Growth

The growing healthcare expenditure among countries such as India, Thailand, Malaysia, and others is resulting in improving healthcare infrastructure, along with an increasing number of healthcare facilities catering to the rising number of patients in these countries. The growing focus of these healthcare facilities to expand their bed capacity and improve the overall quality of the services to domestic and international patients is leading to an increasing number of medical tourists traveling to these countries for various medical treatments and procedures.

- In August 2023, Vejthani Hospital in Thailand launched a new hospital to accommodate the rising number of international patients seeking mental health care.

Thus, the growing healthcare infrastructure, along with the overall lower cost of treatments with high-quality medical services in these countries, is expected to attract more international patients to visit these countries for medical and wellness treatments.

MARKET RESTRAINTS

Certain Ethical and Regulatory Challenges to Hinder Market Growth

The challenges associated with transparency of the services, total cost of treatments, qualifications of healthcare professionals, and language barrier leading to miscommunication between the patients and healthcare providers, among others, can result in decreased patient satisfaction and poorer health outcomes.

MARKET OPPORTUNITIES

Surge in Number of Inbound Medical Tourists in Emerging Countries to Present Lucrative Opportunity

The growing awareness regarding the available treatment options at an affordable cost and similar quality of care and services in emerging countries such as Brazil, India, Thailand, and Malaysia, among others, is leading to a rising number of medical tourists traveling from developed countries such as the U.S., U.K., Germany, and others to emerging nations.

Some of the major factors favoring the preferential shift toward traveling to emerging nations among medical tourists include the lower cost of treatments, high-quality service provision, and skilled professionals, among others.

- According to 2022 data published by the Indian Ministry of Tourism, the number of inbound medical tourists visiting India was 610,000 in 2023, witnessing a growth of around 28.1% compared to the previous year.

MARKET CHALLENGES

Limitations Related to Regular Follow-ups and Post-Operative Care to Hamper Market Growth

Medical tourists traveling to other countries for medical treatments may face problems with the continuity of care. The patients may develop complications post-procedure, for which follow-up care can be expensive. The lack of reimbursement for follow-up care can be another major barrier expected to limit the market growth.

Other Challenges

Health Risks Associated with Infection and Complication Among Patients

The higher chances of acquiring infections, including wound care infections, bloodstream infections, donor-derived infections, and others, as well as other complications among the patients receiving medical care from other countries, are a few other challenges that are expected to hinder the global medical tourism market growth.

MEDICAL TOURISM MARKET TRENDS

Rising Awareness Regarding Wellness Treatment Among Population is Latest Trend

The medical tourism industry has mainly been comprised of patients seeking medical treatments in other countries in the past few years. However, one of the main trends in the industry is the shift toward wellness and preventive care.

Patients are seeking medical treatments for conditions and illnesses and are also focusing on procedures and treatments to help maintain their health and prevent future health issues. The rising awareness regarding preventive care among the population is a major factor boosting the trend.

The strategic expansion of the business lines of travel and tourism platforms, along with new entrants in the market to include medical tourism as their service portfolio, is expected to be another upcoming trend. This trend is anticipated to drive the market growth in the future owing to easy accessibility of the travel service provisions.

- In September 2024, EaseMyTrip acquired Dubai-based Pflege Home Healthcare and Rollins International with the aim of entering the medical tourism industry and enhancing its service portfolio. The strategic expansion will make this tourism more accessible for domestic and international travelers.

Other Trends:

Technological Advancements: There is a growing adoption of technology-driven applications and platforms across the globe, including telemedicine, telehealth, and others, which is resulting in increasing accessibility of medical care and services.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic negatively impacted the global market in 2020. The lockdown restrictions and cancellation of several elective procedures among the patient population were the significant factors leading to the reduced number of medical tourists visiting other countries.

The pandemic caused a shortage of medical supplies, including drugs and vaccines. Also, it caused supply chain disruption in medical devices, which was another major factor in the disruption of the number of procedures conducted in healthcare settings during COVID-19.

Some of the major players operating in the market also witnessed a significant decline in revenues during the pandemic owing to the reduced number of international patient visits for medical treatments and therapies.

- In 2020, Bumrungrad International Hospital generated a revenue of USD 0.18 million from its international patient’s segment, witnessing a decline of 48.0% as compared to 2019.

However, the upliftment of lockdown restrictions in the countries in 2021 led to an increased flow of international patients for medical treatments, including dental procedures, cardiac procedures, and cosmetic surgeries.

Segmentation Analysis

By Healthcare Services

Rising Number of Medical Tourists Travelling for Medical Treatment Boosted Segment Growth

On the basis of healthcare services, the market is segmented into medical treatment, wellness treatment, and alternative treatment.

Among healthcare services, medical treatment dominated the market share of 55.31% in 2025. The increasing cost of medical treatments in developed countries such as the U.S., Germany, and others is one of the major factors contributing to the growing number of medical tourists traveling to other countries for medical treatments. The rising availability of various treatment options for dental, orthopedic, and cardiovascular procedures at a lower rate and high quality in countries such as Thailand, Malaysia, India, and others is another vital factor boosting the growth of the segment in the market.

- According to 2022 statistics published by the Malaysia Healthcare Travel Council (MHTC), the number of healthcare travelers visited in 2022 was around 850,000, witnessing a growth of 51.5% compared to 2021, wherein the number of healthcare travelers was around 561,000.

The wellness treatment segment is anticipated to register considerable growth during the forecast period. The growing awareness regarding various cosmetic and rejuvenation procedures among the population is an important factor resulting in a rising number of these procedures globally.

- According to a 2023 article published by the Korea Herald, the number of international patients visiting South Korea for plastic surgery and other cosmetic procedures increased from 90,494 in 2019 to 114,074 in 2023, witnessing a growth of around 26%.

The alternative treatment segment is projected to grow at a nominal rate during the study period. The increasing number of facilities providing alternative therapies, including homeopathy, medical spas, and others among the countries, is a significant factor fueling the adoption of these services among the population and fostering segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By Service Provider

Increasing Number of Private Hospitals and Facilities Promoting Medical Tourism Led to Segment Dominance

Based on service provider, the market is bifurcated into private and public.

The private segment held the largest global medical tourism market share of 68.65% in 2026. The growing efforts of private hospitals and clinics to increase the number of facilities and expand the service offerings for various treatments are some of the important factors leading to the growth of the segment.

- According to the 2024 article published by the International Travel & Health Insurance Journal (ITIJ), there are around 38,512 medical facilities in Thailand, among which nearly 65% are private hospitals and clinics.

The public segment is anticipated to register higher growth during the forecast period. The increasing focus of government bodies and national organizations to boost awareness regarding the services through strategic initiatives and campaigns are some of the major factors contributing to the growth of the segment.

MEDICAL TOURISM MARKET REGIONAL OUTLOOK

By region, the market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Medical Tourism Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Growing Number of Renowned Medical Facilities Led to Region’s Dominance

Europe led the market and was valued at USD 13.94 billion in 2025. The growing number of medical tourists visiting European countries such as France, Spain, Turkey, and others is owing to the higher quality of medical treatments in these countries. A few other factors supporting the growth of the market in the region are the growing number of skilled professionals and private clinics in the region. he UK market is projected to reach USD 2.31 billion by 2026, while the Germany market is projected to reach USD 2.82 billion by 2026.

- According to a 2024 article published by the Fine Up Clinic, the number of health tourists visiting Turkey for various medical treatments reached nearly 1.4 million in 2023. Also, the country has around 40 internationally accredited health institutions

North America

The market in North America is projected to grow at a considerable rate during the forecast period. The developed healthcare infrastructure with cutting-edge medical technology, products, and quality services in the healthcare facilities in the U.S. and Canada are some of the major factors attributable to the growing market size in the region. Also, the presence of several renowned physicians and professionals in these countries is another crucial factor leading to the growth of the market. The U.S. market is projected to reach USD 10.99 billion by 2026.

- In December 2023, the American Hospital Association (AHA) launched the Patient Safety Initiative with an aim to improve health outcomes, service quality, and patient safety. The initiative was signed by more than 1,500 hospitals in the country.

Asia Pacific

Asia Pacific is projected to grow at the fastest rate during the forecast period. The rising focus of medical facilities and government bodies among countries such as Malaysia, Thailand, South Korea, and others to promote the market by leveraging high-quality services to inbound medical tourists is expected to drive market growth. The Japan market is projected to reach USD 1.58 billion by 2026, the China market is projected to reach USD 0.64 billion by 2026, and the India market is projected to reach USD 1.38 billion by 2026.

- In June 2023, the South Korean Ministry of Health and Welfare Department announced the ‘Strategy to Facilitate Attraction of International Patients’ with an aim to improve immigration procedures and medical services provided to these patients.

Latin America

The growing number of healthcare facilities providing world-class services at affordable cost in countries such as Brazil, Mexico, Argentina, and others are some of the major factors for the increasing number of medical tourists in the region. The growing healthcare spending by the governments of these countries also supports the growth of the Latin American market.

- According to the 2022 statistics published by the Government of Brazil, visitors, including medical, education, and others, spent around USD 6.9 billion in the country in 2023, which represented a staggering 41% increase over visitor spending in 2022.

Middle East & Africa

The Middle East & Africa market is anticipated to register a nominal growth during the forecast period. The rising number of medical tourists for dental and cosmetic procedures in countries such as Dubai, UAE, and others, owing to affordable healthcare costs, quality services, facilities, and others, are some of the prominent factors leading to the growth of the market in the region.

- In September 2024, the Dubai Health Authority (DHA) and the Dubai Department of Economy and Tourism (DET) signed an MoU with the aim of boosting medical tourism in Dubai by offering quality healthcare services and transparency.

COMPETITIVE LANDSCAPE

Key Market Players

Rising Focus on Service Expansion by the Prominent Players Supported their Growing Market Share

The global market is highly fragmented, with numerous players in the market with several medical services. Bumrungrad International Hospital is one of the largest hospitals in Southeast Asia, offering a large range of services to medical tourists. The growing focus of the hospital on maintaining care quality and services with international accreditations is a vital factor in fostering the growth of the hospital in the market.

- In March 2024, Bumrungrad International Hospital received its second GHA accreditation with “Excellence,” which helped the company establish its position in medical tourism.

Bangkok Chain Hospital Public Company Limited is another major hospital focused on expanding its services and accessibility to more patients, which is fueling brand awareness in the market.

- In August 2024, Bangkok Chain Hospital Public Company Limited opened a new “Kasetart Aree Radiotherapy Specialist Clinic,” a comprehensive cancer treatment center with an aim to enhance patient care and outcomes.

Similarly, there are a large number of hospitals, including KPJ Healthcare, Apollo Hospitals Group, and others, with rising initiatives toward brand development and enhancing the services for domestic and international patients visiting the facilities.

LIST OF KEY MEDICAL TOURISM COMPANIES PROFILED

- Bumrungrad International Hospital (Thailand)

- Apollo Hospitals Group (India)

- Bangkok Chain Hospital Public Company Limited (Thailand)

- Fortis Healthcare (India)

- Asian Heart Institute (India)

- KPJ Healthcare (Malaysia)

- Gleneagles Hospitals (India)

- Livonta Global (India)

KEY INDUSTRY DEVELOPMENTS

- October 2024 - KPJ Healthcare collaborated with Malaysia International Healthcare to organize an event - The Malaysia International Healthcare Megatrends 2024, held at the Kuala Lumpur Convention Centre to showcase the latest developments in medical technology and healthcare solutions.

- October 2024 – Apollo Hospitals Group achieved a major milestone in cardiac care with 500 robotic cardiac care procedures.

- September 2024 - Bumrungrad International Hospital opened a new wellness center with an aim to cater to the growing demand for wellness treatments. This helped in strengthening its brand presence.

- August 2024 - Bangkok Chain Hospital Public Company Limited opened the new “Kasetart Aree Radiotherapy Specialist Clinic,” a comprehensive cancer treatment center with an aim to enhance patient care and outcomes.

- July 2024 – Fortis Healthcare collaborated with API Rewari and hosted a CME event with the aim to raise awareness about the development in the field of neurology.

REPORT COVERAGE

The global medical tourism market report provides a detailed analysis of the market. It focuses on key aspects such as an overview of the inbound medical tourists' healthcare services, service providers, service launches, and key industry developments such as partnerships, mergers, and acquisitions. Besides this, it also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 23.31% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Healthcare Services

|

|

By Service Provider

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 46.78 billion in 2026 and is projected to record a valuation of USD 250.02 billion by 2034.

The market is projected to grow at a CAGR of 23.31% during the forecast period of 2026-2036.

Based on healthcare services, the medical treatment segment led the market in 2026.

The growing prevalence of chronic diseases and rising awareness regarding medical services at affordable costs in various countries are the key factors driving the market growth.

Bumrungrad International Hospital, Bangkok Chain Hospital Public Company Limited, and Apollo Hospitals Group are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us