Medium Voltage Protective Relay Market Size, Share & Industry Analysis, By Product Type (Electromechanical Relays, Digital Relays, and Static Relays), By Application (Generator Protection, Feeder Protection, Transmission Line Protection, Motor Protection, and Transformer Protection), By End-User (Utilities and Industrial), and Regional Forecast, 2025-2032

Medium Voltage Protective Relay Market Size and Future Outlook

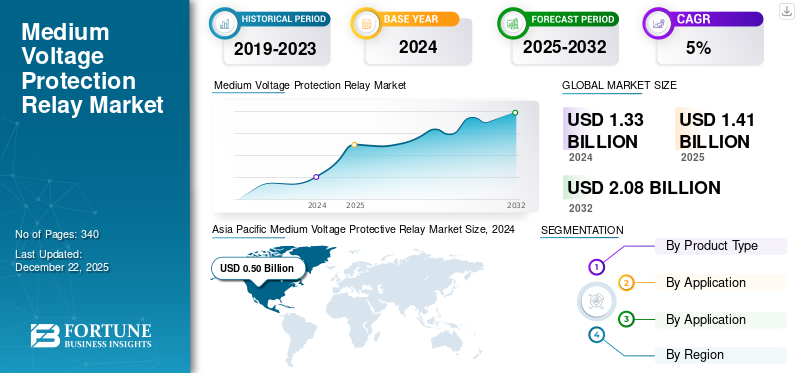

The global medium voltage protective relay market size was valued at USD 1.33 billion in 2024. The market is projected to grow from USD 1.41 billion in 2025 to USD 2.08 billion by 2032, growing at a CAGR of 5.74% during the forecast period. Asia Pacific dominated the medium voltage protective relay market with a market share of 37.5% in 2024.

A medium voltage protective relay plays a crucial role in an electrical system, as it is a switchgear device designed to detect faults and begin circuit breaker operation to separate the faulty element from the system. These relays are specifically designed for systems that are operating at medium voltage levels, typically between 1kV and 35kV, whereas high voltage is above 35kV. Medium voltage protective relays are widely used across commercial, industrial, and utility sectors for ensuring the stability and safety of electrical systems by preventing damage to the equipment and minimizing potential outages due to overloads, short circuits, ground faults, or others. These are the key factors driving the market share in the recent years.

Toshiba, a Japanese multinational conglomerate, has a huge presence in various industries, including electronics, energy, and infrastructure. It provides advanced protection and control systems designed to prevent large-scale blackouts by detecting faults and isolating affected sections to minimize impact. Leveraging over 100 years of expertise, Toshiba has developed high-performance digital protection relays using advanced microprocessors, ensuring a reliable and stable power supply. It offers comprehensive solutions for power network protection, control, and automation across all voltage levels, delivering cost-effective and durable products for global energy infrastructure.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand from the Power Generation Sector to Drive the Protection Relay Market Growth

Medium voltage protective relays have gained huge popularity in the power generation sector as they ensure the safety and reliability of power distribution systems. These protective relays make, carry, or break current under normal and certain abnormal conditions, helping to isolate faulty sections and protect the healthy sections of electrical systems. These relays are used in power generation plants to protect the transformers, generators, and other equipment from faults and overloads.

According to the International Energy Agency (IEA), the global electricity demand increased by 2.2% in 2023, with robust growth being observed in countries namely India, China, and Southeast Asia. In China and other advanced economies, the demand for electricity is driven by ongoing electrification in the residential and transportation sectors.

The share of electricity in the total energy consumption accounted for around 20% in 2023, up from 18% in 2015. According to the IEA’s Net Zero Emissions by 2050 Scenario, which focuses on limiting global warming to 1.5 °C, electricity’s share in final energy consumption will be near 30% by 2030.

Rising Popularity Across Industrial Facilities Drives Market Demand

Medium voltage protective relays are widely used in industrial facilities such as refineries and manufacturing plants to safeguard electrical equipment and machinery from damage and minimize production downtime caused by electrical faults. Additionally, rapid growth in industrial/manufacturing output across different countries is driving the popularity of these relays in the industrial facilities sector.

In 2024, countries leading in manufacturing output were China with 31.6% manufacturing output, followed by the U.S. at 15.9%, Japan at 6.5%, Germany with 4.8%, India with 2.9%, South Korea accounting for 2.7%, Russia with 1.8%, Italy with 1.8%, Mexico with 1.7%, and France accounting for 1.6% of global manufacturing output.

Additionally, countries such as Brazil, Singapore, and Bangladesh have strengthened their manufacturing base, especially in the automotive, electrical, and advanced infrastructure sectors. For instance, Singapore has developed a highly sophisticated manufacturing sector, particularly in chemicals and electronics, making it the fifth-largest exporter of high-tech goods globally. Under its Manufacturing 2030 plan, the country aims to become a leading industrial hub and increase its manufacturing output by 50%. These factors are anticipated to drive the demand for these relays across industrial facilities and infrastructure projects.

MARKET RESTRAINTS

False Tripping, Environmental Factors, and Limited Fault Detection to Limit Market Growth

One of the major challenges limiting the growth of the medium voltage protective relays market is false tripping, environmental factors, and limited fault detection. False tripping refers to the unnecessary operation of the relay, causing the circuit breaker to trip unnecessarily to trip even in the absence of an actual fault. Such false tripping leads to unnecessary power outages, disrupts normal operations, and can damage the entire electrical circuit due to frequent switching cycles.

False tripping may result from several causes, including faulty current transformers (CTs), improper settings, transient conditions, and harmonic distortion. In addition, environmental factors such as extreme temperature, sub-zero temperature, humidity & moisture, and others significantly impact the performance and longevity of relays. These issues are anticipated to hamper the medium voltage protective relay market growth in the coming years.

MARKET OPPORTUNITIES

Rising Adoption of Renewable Energy Systems to Augment Market Growth

Global medium voltage protective relays find a wide range of applications in renewable energy systems, as they are the essential components of wind and solar power plants. In solar and wind power plants, these relays are used to protect the transformers, inverters, and other components from faults and facilitate efficient power generation.

The medium voltage relays help maintain stability within the grid, preventing cascading failures and rapidly responding to the fluctuations in the power generation from renewable sources. The global renewable energy generation is anticipated to reach 17,000 terawatt-hours (TWh) by 2030, registering an increase of almost 90% from 2023.

By 2030, renewable energy generation is estimated to reach approximately 45.6%, with solar PV accounting for 16.1%, and wind power contributing 13.4%.

According to the IEA, the recent advancements have been promising, and 2023 marked a record year for renewable electricity capacity additions, with about 560 GW added globally. The announcements of key policies in 2022, especially REPowerEU in the Inflation Reduction Act (IRA) in the U.S., European Union, and China’s 14th Five-Year Plan for Renewable Energy, are expected to further boost the deployment of renewable electricity during the forecast period.

MARKET CHALLENGES

Extreme Temperature and Inability to Detect Faults Pose Significant Challenges for Product Demand

Extreme temperatures in particular regions, ranging from high heat or freezing conditions, lead to the degradation of electronic components, increasing the risk of thermal runaway in solid-state relays. In contrast, freezing temperature can impair mechanical parts, leading to slow response times. Additionally, humidity and moisture can cause condensation and corrosion on circuit boards, compromising the functionality of medium voltage protective relays.

Moreover, some relays are unable to detect faults, such as high-impedance faults, which might lead to undetected failures and catastrophic breakdowns. It can even lead to delayed tripping or unnecessary outages in case the medium voltage relay is unable to differentiate between transient and permanent faults. This issue is specifically crucial in industrial settings, where limited fault detection can lead to production losses and damage to costly equipment.

MEDIUM VOLTAGE PROTECTIVE RELAY MARKET TRENDS

Rapid Urbanization and Industrialization are the Recent Market Trends

The global medium voltage protective relays market is poised to grow owing to rapid urbanization and industrialization, which has led to an increase in demand for grid reliability and the implementation of smart grid infrastructure. These relays play a crucial role in improving grid reliability by identifying and isolating the faults, thereby minimizing the disruptions to power supply and protecting critical infrastructure.

The development of smart grids with features such as load balancing, distributed energy storage, and detection of fault location facilitates efficient smart grid infrastructure. Smart grids deploy these protective relays that coordinate the capabilities and needs of all grid operators, generators, end-users, and stakeholders to ensure optimal system performance.

Various regions and countries, namely the European Commission, China, Japan, India, U.S., and Canada, are making significant progress in the deployment of smart grids. For instance, Canada is investing USD 100 million through its Smart Grid Program to support the deployment of smart grid technologies and smart integrated systems.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The global impact of the COVID-19 pandemic hampered the market, as the overall manufacturing and utilities sectors faced significant challenges due to supply chain disruption, unavailability of workforce, and operational delays caused by lockdowns or social distancing norms.

The major companies operating in the medium voltage protective relay market, namely ABB, Schneider Electric, and Siemens, experienced a significant decline in their revenue. For instance, ABB’s electrification segment, which includes electric system components, registered a revenue decline of 6.32%. Schneider Electric’s energy management segment registered a 7.2% decline in revenue, and Siemens’ smart infrastructure segment reported a revenue decline of 5.92% during the pandemic.

Moreover, several grid modernization projects were on hold due to the reprioritization of budgets and a growing focus on maintaining existing infrastructure rather than deploying new ones. Delays in the availability of microprocessors, semiconductors, and other essential components necessary for relay manufacturing led to a decline in medium voltage protective relay market demand.

SEGMENTATION ANALYSIS

By Product Type

Digital Relays Segment Accounted for the Largest Market Share Due to Faster Response Time and Advanced Communication Capabilities

By product type, the market is trifurcated into electromechanical relays, digital relays, and static relays.

The digital relays segment dominated the medium voltage protective relay market share of 66% in 2025, as they have a wide range of settings, communication links to a remote computer, and greater accuracy. Faster response time, advanced communication capabilities, and better fault diagnostics drive the demand for digital relays. The digital relays have self-testing capabilities, support remote diagnostics, and provide seamless integration with IEC61850 communication protocols. The digital relays protect and control radial or looped distribution circuits, control auto reclosing with voltage check logic and synchronism, and can create an integrated control system with various I/O and communication options.

These relays use comprehensive event reporting, allowing operations to detect unfavorable trends, modify loads, schedule maintenance, and satisfy information requirements of supervisory systems. Moreover, the majority of the digital relays are equipped with built-in fault locators to dispatch line inspection and repair personnel efficiently. These relays analyze overcurrent protection system performance using the built-in Sequential Events Recorder (SER).

To know how our report can help streamline your business, Speak to Analyst

By Application

Feeder Protection Dominates the Market as These Relays Minimize the Disruption to Power Supply

By application, the market is divided into generator protection, feeder protection, transmission

line protection, motor protection, and transformer protection.

The feeder protection segment dominated the market as these relays used for feeder protection help isolate faulty sections of feeders, minimizing the disruption to the power supply. These relays monitor critical parameters such as frequency, voltage, and current and initiate protective actions such as tripping the circuit breaker in case of abnormal conditions. Medium voltage protective relay finds a wide range of applications in feeder protection, a trend fueled by smart grid deployment and grid modernization. These relays are widely used for feeder protection as they facilitate remote monitoring and fault detection. For instance, in Canada, extreme weather conditions have led to an increase in demand for relays used in feeder protection to prevent equipment failures and power outages. The segment is expected to dominate the market share of 38% in 2025.

In addition, as they reduce the risk of arc flash incidents and electrical shock by quickly isolating faulty circuits, ensuring power continuity, and protecting critical electrical equipment, namely switchgear, cables, and transformers. This functionality minimizes downtime and safeguards equipment from damage.

Generator protection segment is anticipated to forecast a CAGR of 9.18% during the forecast period.

By End-User

Utilities Segment Dominated the Market due to its Ability to Protect Equipment from Damage

By end-user, the market is classified into utility and industrial.

The utility sector dominated the market as these relays are used to isolate faults within the electrical power distribution system, prevent damage to equipment, and maintain the continuity of power supply by quickly tripping circuit breakers in the event of overcurrent or voltage fluctuations. The segment is expected to dominate the market share of 58% in 2025.

These relays are designed to operate at medium voltage levels, which are common in power distribution systems. For instance, North America's utility sector, which encompasses electricity generation and distribution, is increasingly focused on transitioning to renewable energy sources. This shift is driving investments in infrastructure upgrades, including the adoption of advanced protective relays such as digital relays with enhanced diagnostics capabilities, faster response time, and improved diagnostic capabilities.

The utility industry is growing at a faster pace owing to the increasing transition toward renewable energy sources and growing emphasis on energy security. Some of the leading companies in the European utility industry are EDF, Enel, Iberdrola, and E.ON. The increase in power generation has led to an increase in demand for protective relays to safeguard the electrical grid from potential damage and faults such as short circuits, overcurrent, and electrical abnormalities.

The industrial segment is anticipated to exhibit a CAGR of 6.14% during the forecast period.

MEDIUM VOLTAGE PROTECTIVE RELAY MARKET REGIONAL OUTLOOK

The medium voltage protective relay market by region has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Asia Pacific

Asia Pacific Medium Voltage Protective Relay Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rapid Investments in Grid Infrastructure Drive the Demand for Medium Voltage Protective Relays

The Asia Pacific region accounted for the dominant market value of USD 0.50 billion in 2024 and it is anticipated to show the fastest growth during the forecast period. The Asia Pacific region is well-known as a global manufacturing hub, owing to the presence of countries such as China, India, and Southeast Asia. The region is also embracing automation technology in order to stay competitive and maintain its manufacturing standards. Rapid investments in grid infrastructure in Asian countries are anticipated to boost the demand for medium voltage protective relays. For instance, in 2022, China invested USD 166 billion in its transmission grid to achieve net zero targets. In 2022, India launched a USD 38 billion scheme to support power distribution companies and improve distribution infrastructure.

Governments in the region are assisting businesses in adopting industrial automation and advanced manufacturing technologies through policies, incentives, and investments. These initiatives foster a favorable environment for the adoption of these relays across different industrial sectors. For instance, the Make in India initiative was adopted by the country, which supports the development of industries such as automobile, defense manufacturing, food processing, and pharmaceuticals.

China

Increase in Manufacturing Output and Rapid Urbanization Drive the Demand for Product

China leads the world in terms of energy production and manufacturing output. In 2024, China’s manufacturing output was 31.63%, largely due to rapid urbanization and globalization. The major exports from China comprise consumer goods, namely electronics, garments, and textiles. Its manufacturing output continues to attract significant foreign investment, and the country remains the preferred destination for multinational companies owing to its vast and skilled labor force capable of producing a wide range of goods at competitive costs, efficient supply chain, and advanced infrastructure. The market value in China is expected to be USD 0.19 billion in 2025.

On the other hand, India is projecting to hit USD 0.12 billion and Japan is likely to hold USD 0.08 billion in 2025.

The rapid expansion of transmission and distribution networks owing to growing electricity demand has led to the integration of advanced protective relays to ensure the safety and reliability of energy and power infrastructure. In December 2024, China’s industrial production registered a 6.2% year-on-year increase, making it the world’s leading manufacturing powerhouse.

Moreover, China is the leading country in solar and wind power generation, and its solar power capacity skyrocketed in 2023 owing to the rapid acceleration of clean power generation. In 2023, China’s installed solar capacity was 55% higher compared to 2022, and its wind power capacity rose by 21% in 2023 compared to 2022. Additionally, China accounted for 63% of solar additions globally and 65% of wind additions globally.

North America

Renewable Energy Integration and Aging Electrical Infrastructure Drive Market Growth

North America is anticipated to account for the second-highest market size of USD 0.33 billion in 2025, exhibiting the second-fastest growing CAGR of 5.97% during the forecast period. Renewable energy integration, stringent safety standards, and industrial growth drive the demand for protective relays. In the region, aging electrical infrastructure, with the majority of power transmission lines being decades old, requires upgrades and improvements to improve grid reliability and stability. This, in turn, is driving the medium voltage protective relays market growth in North America.

In late 2021, the United States Department of Energy (DOE) proposed a USD 10.5 billion program for smart grids and other upgrades to strengthen the electricity grid. This included USD 2.5 billion for grid resilience, USD 3 billion for smart grid development, and USD 5 billion for grid innovation.

U.S.

Upgradation of Existing Power Grids Drives Product Demand in the Country

The U.S. market size is estimated to hit USD 0.25 billion in 2025. The upgradation of existing power grids, the rapid development of smart grids, industrialization, and rising focus on ensuring safety and preventing damage to electrical equipment are driving the demand for medium voltage protective relays in the U.S. In 2024, the U.S. ranked second in the world in electricity production, accounting for 15% of the global market share. Also, in terms of manufacturing output, the U.S. accounted for a share of 15.9% globally in 2024.

The U.S. is modernizing its grid infrastructure to make it more resilient & smarter with the implementation of cutting-edge technologies, to boost energy infrastructure, and to ensure secure, reliable, and clean sources of energy.

The upgradation of grid infrastructure necessitates the use of medium voltage relays to reduce the impact of frequency and voltage disruptions, to reduce the storm impacts, and to restore services faster in case of power outages. In 2022, the U.S. launched the Grid Resilience Innovative Partnership (GRIP) Programme, which offers USD 10.5 billion in funding to boost and upgrade the country’s electrical grids.

Europe

Strong Emphasis on Energy Efficiency and Sustainability Drives Market Growth

Europe region is to be anticipated the third-largest market with USD 0.28 billion in 2025. In Europe, there is a strong emphasis on energy efficiency and sustainability that has led to rapid developments in the renewable energy sector, driving the medium voltage protective relay market demand. According to the European Environment Agency, in 2023, the share of renewable energy in the European Union’s energy use accounted for 24.5%. Government initiatives supporting advanced manufacturing technologies, research and development for automation, and provision of financial benefits for adopting energy-efficient solutions are also expected to contribute to the growth of the medium voltage protective relays market in Europe. The market value in U.K. is expected to be USD 0.05 billion in 2025.

On the other hand, Germany is projecting to hit USD 0.06 billion and France is likely to hold USD 0.02 billion in 2025.

Latin America

Infrastructural Developments and Upgradation of Power Grids Fuels Product Demand

Ongoing infrastructural development across Latin America, such as transportation and manufacturing facilities, creates opportunities for the medium voltage protective relays market. These relays are integral to modern infrastructure systems requiring reliable and efficient power distribution solutions. Brazil and Mexico are actively investing in upgrading their power grids, which necessitates the installation of advanced medium voltage protective relays, as these relays can efficiently deal with fluctuating power generated by these sources.

Middle East & Africa

Collaborative Efforts Among Governments to Boost Medium Voltage Protective Relay Demand

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 0.20 billion in 2025. Governments across the rest of the Middle East and Africa are proactively encouraging the adoption of automation processes in diverse industries, creating a conducive atmosphere for businesses to invest in industrial process automation solutions. Furthermore, the growing collaborative efforts between governments, regulators, and associations for economic expansion are further fueling the region's automation and manufacturing sectors. A notable example is Saudi Arabia’s national industry strategy, which aims to triple the country’s manufacturing sector contribution to GDP by 2030. Giants such as Pirelli, Hyundai, Schneider Electric, and Emerson are opening factories in the country to boost domestic production. The GCC market size is expected to hit USD 0.10 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Product Development and Technological Advancements to Meet Various Energy Demands

The global medium voltage protective relay market is characterized by intense competition driven by significant product development and technological advancements. Major players such as Siemens, Hitachi Energy, and others are competing through advanced product developments. For instance, in August 2024, Hitachi Energy launched the new Relion REF6, a multi-application protection and control relay designed for medium-voltage power distribution grids. The Relion REF6 is equipped with enhanced flexibility, modularity, security, and an intuitive user interface, which makes this relay extremely suitable for emerging power quality requirements across industrial and utility applications. REF650 offers cost efficiency as it has a single–device modular design that facilitates long-term deployment with flexible and scalable features. Additionally, REF650 is certified to the latest industry standards (IEC 61850 Ed 2.1), with PCM600 3.1, compatible across vendors.

List of the Key Medium Voltage Protective Relay Companies Profiled:

- ABB (Switzerland)

- Siemens (Germany)

- Eaton (U.S.)

- General Electric (U.S.)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- Rockwell Automation, Inc. (U.S.)

- Schneider Electric (France)

- Mitsubishi Electric Corporation (Japan)

- NR Electric Co., Ltd. (China)

- Fanox (Spain)

KEY INDUSTRY DEVELOPMENTS:

August 2023- The implementation of artificial intelligence (AI) revolutionized relay protection in medium voltage switchgear, offering significant advancements in fault detection, adaptive relay protection, and overall security and resilience. Additionally, AI can be used to develop fault location algorithms to determine the location of faults accurately. Some of the leading companies that offer AI-based relay protection solutions are ABB Ltd., named Relion® AI-Assisted Protection System; Eaton, named IntelliGuard® AI-Based Relay Protection System; Schneider Electric, named Harmony HiRes Guard 4.0 AI-Based Relay Protection System for medium voltage switchgear.

February 2023- ABB introduced all-in-one protection relay REX640, widely used for advanced power generation and distribution applications, is equipped with a third functionality upgrade, which includes technological innovations, fosters safety in the modern grid, and enhances the user experience and safety. These technological advancements will boost the user experience and safety, and foster stability in the modern grid. Some of the key features of REX640 include high-speed transfer, prevention of the breakdown of the generator shaft bearing, and improved stability in the modern grid.

February 2023- Schneider Electric announced the launch of its new product lines in one of its manufacturing facilities in Bengaluru, India, to support the growing demand for protection relays and IoT gateways for digitization of power management and quality. Power quality products such as PowerLogic EVC+ facilitate the efficiency of power consumption. In contrast, the PowerLogic P3 protection relays provide a comprehensive range of protection for medium-voltage applications, including generators, motors, and transformers.

December 2022- Siemens delivered the new protection relays for distribution grids by expanding its family of Reyrolle protection devices with the launch of the 7SR46. The key application for the Reyrolle 7SR46 is to offer overcurrent and earth fault protection in medium voltage distribution transformer stations. The 7SR46 device has a compact (H104 mm x W185 mm x D79 mm) molded enclosure. The front of the device comprises an easy-to-use display and push buttons that can be used to program the relay and view fault records and instrumentation.

November 2022- Siemens expanded its family of Reyrolle protection devices with the launch of the 7SR46. The primary application of Reyrolle 7SR46 is to provide overcurrent and earth fault protection in medium voltage distribution transformer stations.

Investment Analysis and Opportunities

An investment in medium voltage (MV) protective relays looks promising due to increasing demand for reliable power systems and grid modernization efforts globally. The market is experiencing significant growth, driven by factors like renewable energy integration and urbanization, leading to higher demand for protective relay systems.

- In June 2021, Toshiba Corporation launched the GRW200, an advanced numerical feeder differential protection relay designed for metallic pilot-wire and fiber optic communication channels. It features a unique pilot-wire interface for direct connection to existing protection pilots, with an upgrade option to fiber optic. The GRW200 provides phase-segregated line differential protection, integrated channel monitoring, overcurrent guard schemes, inrush restraint, and backup protection, all within a compact 4U design. It supports redundant communication in Substation Automation Systems using IEC 61850, PRP, HSR, and RSTP, with user-friendly configuration through the GR-TIEMS software package.

- In recent years, the manufacturing sector in the Middle East registered significant growth owing to the diversification of the economy and developments in the manufacturing sector. In Saudi Arabia, the National Industrial Development and Logistics Programme aims to position the country as a logistic hub and industrial powerhouse. Since the launch of the Saudi Vision 2030 in 2016, investment in domestic manufacturing crossed USD 130 billion.

REPORT COVERAGE

The global medium voltage protective relay market report provides a detailed medium voltage protective relay market analysis. It focuses on key market aspects such as major market players, leading product type, application, and end-user. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.74% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, By Application, By End-User, and By Region |

|

Segmentation |

By Product Type

By Application

By End-User

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market stood at USD 1.33 billion in 2024.

The market is likely to grow at a CAGR of 5.74% during the forecast period.

By product type, the digital relays segment dominated the market.

The market size stood at USD 0.50 billion in 2024.

Rapid investments in smart grid infrastructure, renewable energy integration, and replacement of aging infrastructure are the key factors driving market growth.

Some of the top players in the market are ABB, Schneider Electric, Siemens, General Electric, Eaton, and others.

The global market size is expected to reach USD 2.08 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us