Micro Seismic Monitoring Market Size, Share & COVID-19 Impact Analysis, By Process (Data Processing, Data Interpretation, Data Acquisition, and Data Triangulation), By Component (Hardware, Software, and Services), By End-use Industry (Mining, Oil & Gas, Energy & Utilities, and Others), and Regional Forecast, 2025 – 2032

Micro Seismic Monitoring Market Size

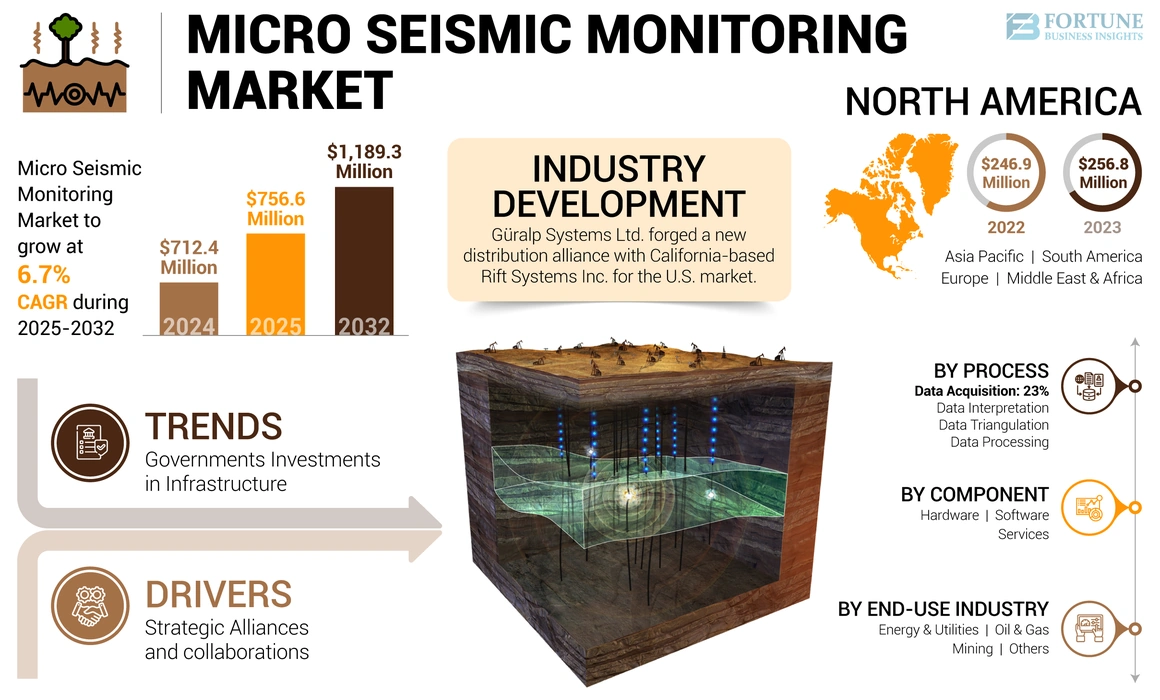

The global micro seismic monitoring market size was valued at USD 712.4 million in 2024 and is projected to grow from USD 756.6 million in 2025 to USD 1,189.3 million by 2032, exhibiting a CAGR of 6.7% during the forecast period. North America dominated the global micro seismic monitoring market with a share of 36.05% in 2024. Additionally, the U.S. micro seismic monitoring market is projected to grow significantly, reaching an estimated value of USD 246.0 million by 2032.

Micro seismic monitoring refers to the practice of utilizing sensitive seismometers to detect and analyze micro-earthquakes or small-scale seismic events. These events are typically induced by human activities, such as hydraulic fracturing, mining operations, or underground construction. By monitoring and analyzing these micro seismic events, industry stakeholders can better understand the behavior of subsurface formations, assess reservoirs or mining productivity, and ensure the safety of operations.

Global Micro Seismic Monitoring Market Overview

Market Size:

- 2024 Value: USD 712.4 million

- 2025 Value: USD 756.6 million

- 2032 Forecast Value: USD 1,189.3 million, with a CAGR of 6.7% from 2025–2032

Market Share:

- Regional Leader: North America held 36.05% market share in 2024, driven by rising investments and advanced seismic monitoring infrastructure.

- Fastest-Growing Region: Asia Pacific is expected to witness the highest CAGR due to the adoption of micro seismic monitoring in energy sectors and infrastructure.

- End-User Leader: The Oil & gas industry dominates due to the extensive use of microseismic monitoring for hydraulic fracturing and reservoir monitoring.

Industry Trends:

- Micro seismic monitoring uses passive seismic fracture mapping to provide continuous 4D seismic data.

- Growing government investments in seismic observatories and monitoring centers (e.g., India’s plans to add 100 seismological centers).

- The increasing adoption of remote monitoring solutions was accelerated by COVID-19.

Driving Factors:

- Growth in oil & gas exploration and production activities.

- Strategic alliances and collaborations among companies to provide advanced turnkey monitoring solutions.

- Increasing demand for real-time and precise seismic data in mining, oil & gas, energy, and infrastructure sectors.

- Rising investments in natural gas production are expected to reduce emissions and boost exports, mainly in North America.

- Technology advancements in sensors and data acquisition systems.

The terms ‘induced seismicity’ and ‘passive seismic monitoring’ are also frequently used to refer to micro seismic monitoring. The micro seismic fracture mapping schematic is a passive method that listens for seismic energy that is already occurring underground, in contrast to traditional 3D seismic technologies that rely on measuring acoustic reflections from an energy source. Unlike traditional 3D seismic methods, which provide discrete-time snapshots, passive wave energy methods offer a continuous 4D record of seismicity in the monitoring region. Micro seismic results offer video recordings of underground occurrences resulting from industrial operations, often provided in real time.

In the scope of study, the report includes companies providing micro seismic monitoring services to end-use industries, such as oil and gas, mining, energy & utilities, and infrastructure.

COVID-19 IMPACT

Rising Need for Remote Monitoring Solutions Accelerated Market Growth

The pandemic had a negative impact on global economic activity, presenting several challenges to the market's seamless operations. Initially, disruptions occurred in the market, including strained supply chains, reduced investments, and operational hurdles. Industries such as oil and gas, mining, and construction experienced halted or slowed activities due to lockdowns and restrictions, leading to delayed investments and decreased demand for micro seismic monitoring products and services.

However, as the pandemic progressed, the demand for remote monitoring solutions surged. By the end of fiscal year 2021, companies in the market were globally operational, showing limited effects of COVID-19 on operations. For instance, in July 2021, Nanometrics Inc. secured five additional contracts in the Duvernay and Montney shale plays from key O&G operators. The company specializes in providing various seismic monitoring service packages for diverse industries, including mining, oil and gas, and critical infrastructure.

With this, in the upcoming years, the pandemic also generated opportunities for the market, aligning with the emerging trend of integrating advanced technologies to meet the changing requirements of end-users.

Micro Seismic Monitoring Market Trends

Governments Investments in Infrastructure to Accelerate Market Growth

The market has witnessed an increasing amount of investments from governments across the globe in recent years. For instance, in January 2023, The Indian Center planned to install micro seismic observatories in the Joshimath area, which faces land subsidence cases. These installations are expected to help earth scientists monitor and record micro seismic activities.

Currently, India has 152 seismological centers, with plans to add 100 more, enhancing real-time data monitoring and collection in the coming years. Moreover, in October 2023, Tamil Nadu is expected to have new seismic observatories in Thanjavur, Tuticorin, Coimbatore, and Villupuram as part of the National Centre for Seismology’s initiative to set up 100 seismological centers nationwide. In June 2023, MicroSeismic, Inc. was awarded around USD 1 million from the Department of Energy (DOE) as part of a Phase 2 DOE SBIR Grant program, supporting clean energy development and scientific energy innovation.

These strategic investments encourage companies to develop new and advanced products, ultimately benefiting end-users by providing optimal solutions.

Download Free sample to learn more about this report.

Micro Seismic Monitoring Market Growth Factors

Strategic Alliances and collaborations to Fuel Market Growth

The market is driven by several factors, including growth in the low-cost seismometers market, substantial investments in geotechnical and environmental engineering applications, increased exploration and production activities in the oil and gas sector, and heightened awareness of safety and risk management. Additionally, companies have strategically embraced partnerships and collaborations to enhance their capabilities. This strategy enables them to integrate the strengths of their concepts and technologies with those of established partners, facilitating the development of more advanced and scalable micro seismic monitoring solutions.

For instance, in August 2023, Terra15 collaborated with MicroSeismic, Inc. (MSI) with the objective of providing an efficient turnkey monitoring solution for civil and geoscience engineering applications, utilizing distributed acoustic sensing and distributed fiber optic sensors. Through this collaboration, MSI aims to better address evolving customer needs and deliver advanced technological solutions aligned with the Department of Energy (DOE) Energy Transition. This collaboration is also expected to support geothermal stimulation, carbon sequestration, hydraulic fracturing, and karst growth and development for sinkhole detection. Therefore, these factors contribute to propelling market growth.

RESTRAINING FACTORS

Market Dynamics and Economic Shifts Affect Growth of Seismic Exploration Technologies

The demand for micro seismic monitoring systems primarily depends on the level of global oil and gas exploration activity, as the majority of market revenue depends on the O&G industry. These activities are hugely affected by prevailing oil and gas prices, with a prominence on crude oil prices and market expectations regarding potential changes in such prices. Thus, any changes in oil and gas prices or other market trends, such as sluggish growth of the global economy, could negatively impact seismic exploration activity and further create a decrease in the demand for microseismic monitoring technology. Moreover, failure to attract a skilled workforce, reliance on key suppliers for certain parts, and high initial investments can impact market growth negatively.

Micro Seismic Monitoring Market Segmentation Analysis

By Process Analysis

Growing Need for Precise Interpretation and Actionable Information to Drive Segmental Growth

Based on process, the market is divided into data processing, data interpretation, data acquisition, and data triangulation. The data processing segment holds the largest micro seismic monitoring market share owing to its capability to analyze vast amounts of seismic data to extract meaningful insights about subsurface activities. This allows for accurate identification of potential risks, optimizing reservoir performance, and enhancing overall safety in various industries, such as oil and gas.

The data acquisition segment is expected to grow with the highest CAGR during the forecast period due to the increasing demand for real-time and accurate seismic data in industries such as oil and gas for reservoir monitoring, geothermal exploration, and civil engineering projects.

To know how our report can help streamline your business, Speak to Analyst

By Component Analysis

Rising Popularity of High-Quality Sensors and Reliable Communication Modules Drives Hardware Segment Growth

Based on component, the market is divided into hardware, software, and services.

The hardware segment holds the largest share of the market owing to its versatility in capturing, processing, and transmitting seismic data. High-quality sensors, robust data acquisition systems, and reliable communication modules are crucial for accurate and real-time monitoring of microseismic events.

The services segment is expected to grow with the highest CAGR owing to the increasing demand for specialized expertise, ongoing maintenance, and data interpretation services.

By End-use Industry Analysis

Growing Reliance of Oil & Gas Industry on Hydraulic Fracturing to Drive the Oil & Gas Industry Segment Growth

Based on the end-use industry, the market is divided into mining, oil & gas, energy & utilities, and others.

The oil & gas industry segment dominates the market due to its reliance on hydraulic fracturing (fracking) techniques. Such monitoring helps assess and optimize fracking operations, enhance reservoir recovery, and ensure overall operational efficiency in the extraction process.

The energy & utilities is expected to grow with the highest CAGR attributed to increasing demand for efficient and safe extraction of oil and gas. Micro seismic monitoring helps improve the extraction process and reduce environmental risks, driving its adoption in the energy sector.

REGIONAL INSIGHTS

By geography, the market is studied across North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

North America Micro Seismic Monitoring Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

North America holds the highest market share due to rising investments in the region. An increase in investments in natural gas is anticipated in 2023 and beyond, including initiatives to lower the greenhouse gas intensity of natural gas and its related infrastructure, according to oil and gas industry analysts. The U.S. is increasing its production of natural gas to reduce carbon and methane emissions while boosting exports, particularly to Europe. The popularity of certified natural gas and carbon-neutral LNG is expected to continue in 2023. Additionally, the market for microseismic monitoring technologies has expanded due to significant technological advancements in this field.

Europe's market is being driven by the growing reservoir development projects in the region. In January 2022, Shell PLC announced the discovery of a significant offshore oil and gas well in Namibia. A preliminary analysis of the exploratory drilling suggests there could be between 250 and 300 million barrels of oil and gas in the newly discovered well. The market is expected to benefit from the reservoir development work necessary for commercial petroleum production following this discovery. Thus, the European market is anticipated to gain from the increasing exploration and production (E&P) activities in deepwater and ultra-deepwater reserves, along with the heightened efforts by oil and gas majors to access untapped resources.

Asia Pacific is expected to grow with the highest CAGR during the forecast period owing to the use of micro seismic monitoring techniques in various energy sectors. The adoption of these technologies is notably increasing in environmental and geotechnical engineering, particularly within the oil and gas exploration industry. Moreover, in Q3 2023, GlobalData's Oil and Gas Industry Deals Database reported 86 M&A deals valued at a total of USD 6.2 billion within the Asia Pacific oil and gas industry. The largest disclosed transaction was Oil and Natural Gas's USD 1.8 billion minority acquisition of ONGC Petro additions. These agreements and investments are anticipated to drive the micro seismic monitoring market growth throughout the forecast period.

The Middle East & Africa market growth can be attributed to the expanding oil and gas industry, which presents lucrative growth prospects for regional market players. With significant unexplored resources, especially in offshore West Africa. The Middle East & Africa is witnessing a rise in offshore exploration, providing opportunities for oil and gas exploration companies. Therefore, the market growth is likely to be driven by explorations activities in this region.

South America's growth is propelled by the escalating prospects within the mining industry in the region. According to UNCTAD's World Investment Report 2023, foreign direct investment (FDI) flows to Latin America and the Caribbean increased by 51% to USD 208 billion in 2022. This surge was driven by an increased demand for essential minerals and commodities. Consequently, due to these factors, the market in South America is projected to witness moderate growth in the upcoming years.

KEY INDUSTRY PLAYERS

Collaborations and Partnerships among Vendors to Propel Market Growth

Key players in the market are engaging in strategic partnerships and acquiring businesses. They adopt this strategy to enhance their product portfolios and expand their operational scale. Major global corporations are forming alliances with other players to streamline and grow their business operations. For instance,

In August 2022, Halliburton Company collaborated with TGS-NOPEC Geophysical ASA to introduce advanced and improved seismic imaging through fiber optic sensing. The collaboration integrates Halliburton’s FiberVSP and Odassea distributed acoustic sensing solutions with IGS’s seismic imaging workflows, enabling the processing of the complete seismic wavefield to create high-resolution reservoir images.

List of Top Micro Seismic Monitoring Companies:

- Geospace Technologies (U.S.)

- Baker Hughes Company (U.S.)

- Halliburton (U.S.)

- Schlumberger (U.S.)

- Güralp Systems Ltd. (U.K.)

- MicroSeismic, Inc. (U.S.)

- ESG Solutions (Deep Imaging Technologies, Inc.) (U.S.)

- Silixa Ltd (U.K.)

- OptaSense (Luna Innovations) (U.K.)

- Weir-Jones Group (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Silixa Ltd launched DScover, a different well surveillance and optimization service. It enables operators to optimize well placement and completion design by integrating analysis with improved data quality from DTS, DAS, and the new DSS measurements.

- May 2023: Güralp Systems Ltd. forged a new distribution alliance with California-based Rift Systems Inc. for the U.S. market. Rift Systems is well-equipped to provide localized support to U.S. customers, possessing a comprehensive understanding of the distinctive challenges and requirements faced by operators in the industry.

- May 2023: TGS, in collaboration with SLB and PGS, obtained funding for a multi-client 3D seismic survey covering 6,885 square km offshore Malaysia, specifically in the North Luconia Province of the Sarawak Basin.

- February 2023: MicroSeismic, Inc. introduced MicroThermal Energy, a service providing monitoring and analysis for enhanced geothermal systems (EGS). This offering, supporting initiatives such as Enhanced Geothermal Shot and Utah FORGE, measures the success of EGS stimulation and offers valuable insights to enhance heat-rock connectivity through advanced engineering analysis.

- December 2022: Weir-Jones Group broadened its offerings in the mining industry by enhancing the ShakeMonitor and MicroSeismic product lines. ShakeMonitor automatically computes natural frequencies and analyzes real-time vibrational data to identify anomalous responses caused by seismic or other disturbances.

REPORT COVERAGE

The micro seismic monitoring market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, products/services, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.7% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Process

By Component

By End-use Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 1,189.3 million by 2032.

In 2024, the market was valued at USD 712.4 million.

The market is projected to grow at a CAGR of 6.7% during the forecast period.

By process, the data processing segment holds the largest share in the market.

The increasing number of strategic alliances among enterprises is fueling market growth.

Geospace Technologies, Baker Hughes Company, Halliburton, Schlumberger, Güralp Systems Ltd., MicroSeismic, Inc., ESG Solutions, Silixa Ltd, OptaSense, and Weir-Jones Group are the top players in the market.

North America holds the highest market share.

By component, the services segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us