Microgrid Market Size, Share & Industry Analysis, By Capacity (Less than 5 MW, 5 MW - 10 MW, 10 MW - 20 MW, 20 MW - 50 MW, and Above 50 MW), By Power Source (Diesel Generators, Natural Gas, Solar PV, CHP, and Others), By Application (Educational Institutes, Remote Areas, Military, Utility Distribution, Commercial & Industrial, and Others), and Regional Forecast, 2026-2034

Microgrid Market Size

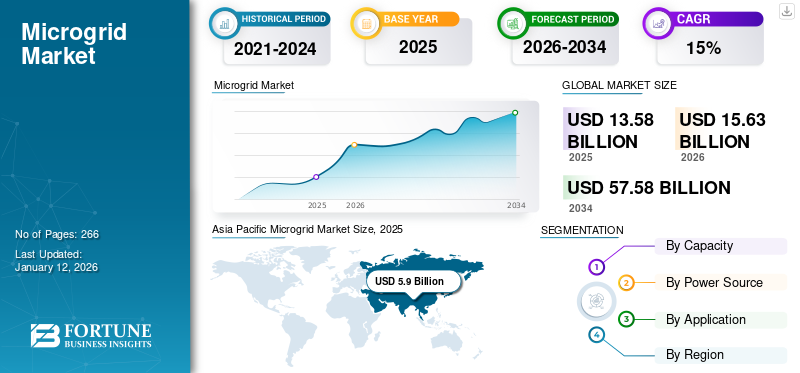

The global microgrid market size was valued at USD 13.58 billion in 2025 and is projected to grow from USD 15.63 billion in 2026 to USD 57.58 billion by 2034, exhibiting a CAGR of 17.70% during the forecast period. Asia Pacific dominated the global market with a share of 31.35% in 2025.

Some of the major factors contributing to the growth of the market include increasing emphasis on decarbonization by end-users and governments, increasing use of microgrids for rural electrification, and the need for a growing supply of reliable and uninterrupted power. Additionally, increasing cyber-attacks on energy infrastructure and government initiatives to encourage the development will drive the industry's growth in the near future. The considerable impact of COVID-19 observed on the microgrid market growth due to supply chain disruption of raw materials and hindrance in activities due to social distancing norms. Due to several other factors, such as lack of skilled professionals to operate the technology along with the shutdown of manufacturing units around the world, the market had registered a downfall in revenue.

Global Microgrid Market Overview

Market Size:

- 2025 Value: USD 13.58 billion

- 2026 Value: USD 15.63 billion

- 2034 Forecast Value: USD 57.58 billion, with a CAGR of 17.70% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific, holding 31.35% share in 2025

- Fastest‑Growing Region: Asia Pacific is also the fastest-expanding region, driven by renewable energy adoption, infrastructure upgrades, and strong policy support (e.g. China, India)

- End‑User Leader: Although granular vertical breakdowns form part of the paid report, industrial and commercial microgrids show highest adoption for energy autonomy and resilience needs

Industry Trends:

- High resilience and reliability demand: Organizations increasingly prefer microgrids to ensure continuous power during grid failures.

- Integration of renewables and storage: Microgrids are utilizing solar, wind, and batteries to optimize the local energy mix.

- Supportive policy frameworks: Governments are offering incentives and mandates that accelerate deployment.

- Emergence of Microgrid‑as‑a‑Service (MaaS): Providers offer turnkey services—engineering, operation & maintenance, software—to lower barriers to adoption

Driving Factors:

- Rising need for energy resilience and autonomy, especially for remote, industrial, commercial, and critical infrastructure users.

- Declining costs of distributed renewables and energy storage, making microgrids both practical and cost-effective.

- Favorable regulatory and incentive structures that promote localized energy systems.

- Innovative business models like MaaS, which reduce upfront capital and simplify adoption.

- Growing corporate sustainability and electrification goals, aligned with ESG mandates and renewable energy targets.

Associations, such as the Solar Energy Industries Association (SEIA), Advanced Energy Economy (AEE), Institute for Local Self-Reliance (ILSR), and Alliance for Rural Electrification (ARE), are taking steps to put microgrid projects back on rails. The clean energy and microgrid development proposals by these associations came at a time when nearly 100,000 advanced energy workers in the U.S. are unemployed. However, proposals to bolster distributed power are emerging as the U.S. government formulates a stimulus package in response to COVID-19-induced unemployment.

Microgrid Market Trends

Growing Requirement of Clean Energy is Promoting the Adoption of Smart Grids Initiatives

Future power grids must be flexible, accessible, reliable, and economically viable to achieve the goals of the smart grid initiative. With the rising initiatives in reducing greenhouse gas (GHG) emissions, research on various configurations or architectures of microgrid systems is gaining attention to control equipment malfunctioning. Additionally, growing environmental concerns and adopting renewable energy are creating a lucrative opportunity for the market.

This is happening alongside the increasing penetration of Renewable Energy Sources (RES) such as solar, wind, and other micro-sources. The growing demand for combined or hybrid integrated grid networks is expected to drive the hybrid microgrid network globally. The majority of installations are united with CHP systems, including other technologies such as solar PV and energy storage. CHP is most often used to supply baseload power and thermal energy for continuous microgrids.

Although there is a substantial amount of deliberate deployments for CHP-based microgrids, solar presently leads the way for deliberate capacity of microgrids. Most operational grids system are located in the Northeast, with a large portion also positioned in California, Hawaii, and Alaska.

Thunderstorms and unpredicted weather in Northeastern states similar to Massachusetts and New York have raised the demand for better-quality resistance devices to a power cut that microgrids provide. California anticipates more installations as the PUC answers to the new microgrid bill. Microgrids in Hawaii and Alaska are usually mandatory for islands and remote communities or off-grid. On the west coast, renewable energy policy has driven California microgrids.

Rising Government Initiative for Providing Reliable and Efficient Power Supply Spurs Product Demand

Microgrid technology is becoming increasingly cost-effective and provides a reliable and efficient power supply for various verticals. Governments have made investments in microgrids from different countries. For example, in June 2020, the Australian government supported 17 projects with over USD 19 million in grants under the first round of the Regional and Remote Communities Reliability Fund. In October 2019, the federal government launched Australia's USD 50 million funding program. Of this amount, USD 20 million in funding has been allocated for feasibility studies in the country. Such government initiatives are expected to provide growth opportunities for the market over the forecast period.

Download Free sample to learn more about this report.

Microgrid Market Growth Factors

Increasing Demand for Energy Resilience and Reliability to Drive Microgrid Market Growth

Microgrids offer enhanced energy resilience and reliability by incorporating the local energy generation, storage, and distribution capabilities. They can operate autonomously or in conjunction with the main grid, thereby providing backup power during grid outages or disruptions caused by natural disaster, extreme weather events, or infrastructure failure. The growing need for reliable energy supply, particularly in regions prone to power outages or with unreliable grid infrastructure, is a significant driver of the global microgrid market. As businesses, communities, and big infrastructure sectors seek to mitigate the impact of power disruptions and ensure continuous operations, the demand for microgrids will increase. Additionally, the increasing frequency and severity of extreme weather events, coupled with aging grid infrastructure, will further accelerate the market’s growth.

Government Initiatives to Reduce Carbon Footprint and Offer Reliable Power Supply Will Promote Utilization of Microgrids

The demand for energy storage systems is increasing due to high demand for a constant and secure power supply globally. This is why governments are introducing various initiatives to lower the carbon footprint, which is likely to propel the demand for energy storage systems. Several other factors, such as extensive industrialization, and the introduction of IoT in microgrid connectivity to manage and control distributed energy resources, have spurred the demand for the product. Utilities generally consider these systems as a primary block for a smart grid and focus on R&D as a severe focus area.

For instance, according to SmartGrid Consortium (NYS), the New York government has been implementing microgrids. Consequently, 20 projects were nominated from an extensive candidate list of New York. Detailed analysis of these projects is based on various parameters, including regulations, energy delivery, technology, and development.

RESTRAINING FACTORS

Monumental Installation and High Costs of Maintenance are Hindering the Market

The initial cost of these system is significantly higher than that of conventional power grids, typically between 25% and 30%. The infrastructure costs include everything from deploying communication systems to installing smart meters and maintaining them. In addition, the installation of smart meters costs about 50% more than the installation of electricity meters. The Distributed Energy Resources (DERs) used in microgrids are also more expensive than those used in traditional power plants.

Building a new microgrid or transforming a current system into a hybrid system can cost around 10,000 or even hundreds of millions. The most expensive generation assets include batteries, solar photovoltaic collections, and combined heat and power systems. Additionally, a significant amount of capital is required for grid automation and control systems that can intelligently monitor and manage all components, controlling the microgrid power efficiently. These systems can store and convert energy and provide improved reliability and power quality over traditional grids, their costs are enormous. This factor is limiting the growth of the market.

Microgrid Market Segmentation Analysis

By Capacity Analysis

Less Energy Cost of above 50 MW will Amplify Market Growth

Based on capacity, the market is segmented into less than 5 MW, 5 MW -10 MW, 10 MW- 20 MW, 20 MW -50 MW, and above 50 MW, with a market share of 38% in 2026. The above 50 MW segment holds a dominant share of the market due to low electrification rate of grid connectivity compared to the other capacity segments. The components used in every system are the same irrespective of their capacity, for example, solar panel, charge controller, battery, which can absorb more charge and result in the long run.

By Power Source Analysis

Rising Application of CHP Bolstered the CHP Segment

By power source, the market is segregated into diesel generators, natural gas, solar PV, CHP, and others. The CHP segment holds a dominant market share as it saves total energy costs for consumers. The Solar PV segment dominates the market contributing 42.74% globally in 2026.

Natural gas holds a significant market share due to its versatility and abundant characteristics which power microgrids with relatively less impact on the environment. Natural gas is available adequately and adaptable to many different functions, propelling the demand for CHP in the global market.

The energy storage system in a microgrid can operate in control mode but only a single power source is permitted when it is remotely operated. In other words, if links with the grid are cut-off, the grid can work under a single source when diesel generators are the most suitable option.

By Application Analysis

High Utilization in Educational Institute Will Lead to Domination of Segment

Based on application, the market is segmented into educational institutes, remote areas, military, utility distribution, commercial & industrial, and others. A paradigm shift toward adopting safe and reliable power generation units and the continued adoption of innovative technologies to ensure a resilient power supply against grid instability surge the demand for microgrids in educational institutions.

To know how our report can help streamline your business, Speak to Analyst

Commercial and industrial industries comprise significant heating and cooling demands with good cost reduction opportunities and the potential to reduce emissions, accounting for 27.96% market share in 2026. They are usually large areas and may double up as emergency shelters during extreme events such as cyclones, forest fires, and earthquakes, which is expected to grow the market for commercial & industrial rapidly.

REGIONAL INSIGHTS

The global market has been analyzed across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Microgrid Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Currently, most of the world's microgrids are in Asia Pacific, with most of the capacity being in the People's Republic of China and Japan. There is a high demand for robust and continuous network connectivity to provide seamless support to large enterprises, facilitating the outlook for the Asia Pacific microgrid market share. The regional government's initiatives have driven the construction of innovative yet dependable telecom infrastructure, which is impacting the market. International Data Corporation (IDC) states that spending on Asia Pacific telecommunications and pay-TV services jumped from USD 5.9 billion in 2025 to USD 6.84 billion in 2026. Asia Pacific spending has also increased, reaching USD 1,566 billion in 2021, up by 1.6% yearly. The Japan market is forecast to reach USD 0.12 billion by 2026, the China market is set to reach USD 4.01 billion by 2026, and the India market is likely to reach USD 0.99 billion by 2026.

Europe

In the European market, microgrids play a vital role in the electricity ecosystem of the future, with decarbonization, digitalization, decentralization, and non-wires solutions being its key attributes. It helps transform industries from all sectors, increasing production capacities; this increases the dependence on the continuous power supply to keep the system running. A few seconds of a power outage can interrupt industrial processes and cause significant economic loss. Microgrids also relate to the transportation sector, which consumes over 30% of primary energy. Electrifying only a small percentage of this would translate to significant capacity in the coming years. The UK market is estimated to reach USD 0.28 billion by 2026, while the Germany market is anticipated to reach USD 0.39 billion by 2026.

North America

North America is likely to maintain its significant hold in the global market due to the availability of reliable, stable, and affordable power. Rising attention to technological advancement by key manufacturers, scaling up existing infrastructure with advanced systems, and increasing demand for a stable and secure global power supply are some factors attributable to the market growth. The U.S. market is expected to reach USD 3.38 billion by 2026.

Latin America

The Latin American market has gained momentum in recent years. Advanced technologies such as IoT, Big Data, and AI are increasingly deployed in the region. The introduction of the cloud is also accelerating rapidly in this area. In addition to setting up microgrids and local power generation, the operators are procuring redundant power infrastructure.

Middle East & Africa

In the Middle East & Africa, increasing investment in the commercial sector with several ambitious government visions in the region, such as Saudi Vision 2030, Turkey Vision 2023, and South Africa Vision 2030, would drive significant development activities to advance power demand backup solutions.

Key Industry Players

ABB and Eaton Lead with Wide Product Profile and Established Brand Name to Capture Market

The market has several players focused on providing microgrids. Market players are developing various technological advancements, with the adoption of AI platforms and leveraging solar energy and battery storage to support the facility. The majority of market players focus on these technologies. A growing commodity and energy market will create profitable opportunities for mining companies as the mining industry expands.

LIST OF TOP MICROGRID COMPANIES:

- ABB (Switzerland)

- Eaton Corp (Ireland)

- Honeywell (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- Spirae, LLC (Colorado)

- Power Analytics Corporation (U.S.)

- Toshiba Corporation (Japan)

- GE (U.S.)

- HOMER Energy (Colorado)

- S&C Electric (Chicago)

- Caterpillar (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023, ABB entered a strategic partnership with Direct Energy Partners (DEP), a start-up using digital technology to accelerate the adoption of Direct Current (DC) microgrids. The partnership involved a minority investment in Direct Energy Partners through ABB’s venture capital unit, ABB Technology Ventures (ATV).

- September 2023, The Canadian government announced plans to invest more than CAD 175 million (USD 130 million) in 12 clean energy projects across Alberta, including a microgrid that aims to provide a reliable electricity supply to the Montana First Nation. The funding would come from Canada’s Smart Renewables and Electrification Pathways Program (SREPs), which will invest up to CAD 4.5 billion (USD 3.31 billion) in smart renewable energy and grid modernization projects by 2035.

- May 2022, Caterpillar purchased Tangent Energy Solutions, an energy-as-a-service (EaaS) company that enables Caterpillar to work directly with utilities and energy providers to deliver distributed energy resources. Tangent Energy's proprietary software solution is a DERMS platform that monitors, manages, and monetizes onsite energy assets, including natural gas and renewable energy generation, storage, and microgrids.

- October 2021, Global equipment manufacturer Caterpillar supplied hybrid energy solutions technology, including 7.5MW of battery storage, to the microgrid running a gold mine in the Democratic Republic of the Congo. Regional Caterpillar distributor Tartaric has approved the project for customer Barrick Gold Corporation. The new grid stabilizing equipment reduces the need for spinning reserve at the site, decreasing diesel consumption annually by around 3 million liters and reducing carbon dioxide emissions.

- November 2021, GE Digital and Florida Power & Light Company (FPL) announced the opening of the new cutting-edge Microgrid Control Lab at the University of Central Florida. The lab will work as a state-of-the-art research facility and control room for engineering faculty and students. FPL and GE Digital are co-sponsoring the lab at UCF, which will feature control center equipment and software that students will use to simulate and test real-life grid control operations and find ways to optimize and keep the future grid secure. Innovative research space to help America’s future engineers learn about critical issues and opportunities facing energy companies to ensure grid stability and reliability

REPORT COVERAGE

The research report highlights regional and country-level analysis to understand the user better. Furthermore, the reports provide insights into the latest market trends and market analysis of technologies deployed rapidly globally. It further highlights some drivers and restraints, helping the reader gain in-depth knowledge about the industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Capacity

|

|

By Power Source

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 13.58 billion in 2025 and is projected to reach USD 57.58 billion by 2034.

In 2025, the Asia Pacific market was valued at USD 5.9 billion.

The market is likely to record a CAGR of 17.70%, exhibiting substantial growth during the forecast period of 2026-2034.

In the forecast period, educational institutes segment is expected to maintain its position as the dominant application segment.

ABB and Eaton Corp. are some of the key players operating across the industry.

Asia Pacific dominated the market in terms of share 43.41% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us