Nasal Spray Market Size, Share & Industry Analysis, By Product Type (Corticosteroids, Salt Water Solutions, Topical Decongestants, Antihistamine, and Others), By Application (Nasal Allergies, Cold, Asthma, and Others), By Age Group (Pediatric and Adults), By Type (Prescription and Over-the-Counter), By Distribution Channel (Drug Stores & Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

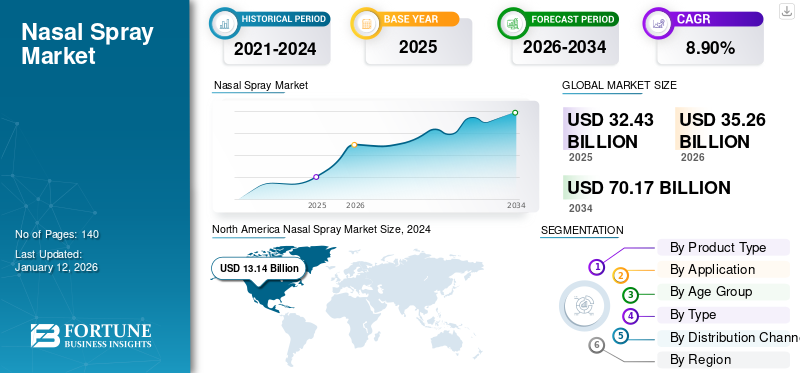

The global nasal spray market size was USD 32.43 billion in 2025. The market is projected to grow from USD 35.26 billion in 2026 to USD 70.17 billion by 2034, exhibiting a CAGR of 8.90% during the forecast period. North America dominated the nasal spray market with a market share of 44.01% in 2025.

A nasal spray is a device used for nasal drug delivery in the nasal cavities. They are used to treat conditions, such as allergic rhinitis, cold, asthma, and central nervous system disorders. The device consists of drug substances in the form of a solution of excipients. There are different types of products available in the market, such as corticosteroids, salt water solutions, topical decongestants, antihistamines, and others. Corticosteroids, also known as nasal steroids, are usually the first-line therapies for allergies. These sprays are used to treat nasal congestion, sneezing, watery eyes, and runny nose. Many of these sprays are available over-the-counter.

Rising infections, as well as allergic conditions, are majorly driving the growth of the market. Additionally, certain advantages offered by these products, such as efficient and painless drug delivery, easy availability, and better patient convenience are expected to drive market growth during the forecast period. Nevertheless, pharmaceutical and biotechnology companies have increased their investment in R&D initiatives to develop new products to treat several diseases like CNS disorders or coronavirus.

- For instance, in February 2022, GLENMARK PHARMACEUTICALS LTD. launched Nitric Oxide Nasal Spray (FabiSpray) in partnership with SaNOtize, a pharmaceutical company for the treatment of adult patients with COVID-19 in India. Such initiatives by manufacturers are projected to boost market growth in the near future.

Global Nasal Spray Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 32.43 billion

- 2026 Market Size: USD 35.26 billion

- 2034 Forecast Market Size: USD 70.17 billion

- CAGR: 8.90% from 2026–2034

Market Share:

- Region: North America dominated the market with a 44.01% share in 2025. This leadership is driven by the high prevalence of conditions such as nasal allergies, allergic rhinitis, and sinus infections, coupled with the advantages of nasal sprays, including precise, painless drug delivery and patient convenience.

- By Product Type: Corticosteroids held the largest market share in 2024. The segment's dominance is attributed to the growing prevalence of allergic rhinitis, sinusitis, and nasal polyps, as well as the easy availability and commercialization of cost-effective generic steroid spray options.

Key Country Highlights:

- Japan: As a key market in the fast-growing Asia Pacific region, growth is propelled by strategic partnerships to manufacture and launch new nasal spray products, along with a strong incidence of acute and chronic diseases that can be treated via nasal delivery.

- United States: The market is fueled by a high burden of conditions such as sinus infections, which affect an estimated 31.0 million people annually. Growth is also supported by a consistent stream of new product approvals from the U.S. FDA for various indications, including opioid overdose and acute migraine treatment.

- China: Growth is driven by the improving healthcare infrastructure and a strong incidence of acute and chronic diseases in the Asia Pacific region. Rising awareness and strategic partnerships to introduce new products are also key factors.

- Europe: The market is advanced by the higher adoption of nasal spray products for common conditions like colds and the strong presence of a large number of manufacturers in the region. This leads to a wide availability and variety of products for consumers.

COVID-19 IMPACT

Drop in Sales of Nasa Spray Products During the COVID-19 Pandemic Impeded Market Growth

In 2020, the COVID-19 pandemic disrupted the export and import of healthcare products globally. Furthermore, some of the market players witnessed a decline in their revenues for products due to weaker cold and flu season as a result of the pandemic and social distancing.

- For instance, GSK plc witnessed a decline of 8.3% in 2020 as compared to 2019 for its Avamys/ Veramyst nasal spray product. In addition, AstraZeneca witnessed a decline of 32.1% in 2020 as compared to 2019 for its Pulmicort nasal spray product.

However, in 2021, the sales for these products improved, although they were below the sales from 2019. Moreover, in 2022, the market witnessed a rapid growth in its revenue and is projected to grow at a significant growth rate over the forecast period due to a number of product launches in the market.

Nasal Spray Market Trends

Increasing Funding by Private Organizations for R&D Activities to Propel Market Growth

Pharmaceutical companies are involved in developing new medicines to prevent and treat life-threatening infectious viruses, which are some of the key market trends. Various private organizations are increasingly providing funds for these research activities carried out by pharma companies. Such strategic initiatives boost the market growth.

For instance, in April 2022, SK Bioscience, a vaccine manufacturing company, announced that it has partnered with IAVI (International AIDS Vaccine Initiative), a nonprofit research organization, for the development of an antiviral nasal spray based on a protein developed by David Baker at the University of Washington. SK Bioscience also noted that it received a USD 2.2 million grant from the Bill & Melinda Gates Foundation to IAVI for the project. This funding will be used for the production of this product, and process development is already underway. Hence, such initiatives are the key trends of the market.

Furthermore, increasing healthcare spending and improved healthcare infrastructure are factors influencing the global nasal spray market trends.

Download Free sample to learn more about this report.

Nasal Spray Market Growth Factors

Increasing Prevalence of Respiratory Disorders to Surge Market Growth

Occupational lung diseases, chronic obstructive pulmonary disease (COPD), asthma, and pulmonary hypertension are a few of the most common chronic respiratory diseases. These diseases affect the airways and other structures of the lungs. Factors such as tobacco smoking, air pollution, chemicals, dust, and lower respiratory infections during childhood are factors attributing towards the increasing prevalence of chronic respiratory diseases.

- For instance, according to the data published by the Centers for Disease Control and Prevention, the prevalence of asthma increased from 7.4% in 2001 to 7.7% in 2021.

However, there are various forms of treatments, such as these products, that can help open the air passages, improve shortness of breath, and help control symptoms. Thus, with the increasing prevalence of chronic respiratory diseases, the demand for these products is projected to increase, thereby significantly contributing to the expansion of the global nasal spray market.

Strong Pipeline of Potential Candidates and their Expected Product Launches is Anticipated to Drive Market Growth

A large number of companies, such as GSK plc, Viatris Inc., Emergent Devices, Inc., Cipla, Inc., and many more, are operating in the global market. These companies are focused on launching new products in the market to substantially increase access to this life-saving medicine as well as to help combat endemic crisis. An increasing number of product approvals from federal agencies to treat infectious and allergic conditions is significantly contributing to the nasal spray market growth.

- For instance, in March 2023, Amneal Pharmaceuticals, Inc. announced the approval of naloxone hydrochloride nasal spray, a generic version of Narcan from the U.S. FDA, to treat known or suspected opioid overdose emergencies.

- In addition, in March 2023, Pfizer, Inc. announced that it had received approval from the U.S. FDA for ZAVZPRET, the first and only calcitonin gene-related peptide (CGRP) receptor antagonist nasal spray for acute migraine treatment in adults.

Such an increase in the number of product approvals and launches in these products will enhance the global demand for nasal sprays.

RESTRAINING FACTORS

Side Effects Associated with these Products May Hinder Market Growth

Different types of these products can cause different side effects. However, certain factors, such as the increased risk of recurrent respiratory and CNS depression as well as increased risk of cardiovascular effects and reported cases of adverse reactions due to these products, such as nasal dryness, nasal inflammation, and nasal congestion, are restraining the growth of the global market. The most common side effects associated with these drugs include cataracts, a burning sensation in the nose, a bitter taste in the mouth, and dry mouth. Furthermore, the use of compounded drugs, which the FDA does not approve, can create a risk for patients.

For instance, in February 2022, the U.S. FDA raised concerns about the high risk of risk of misuse, adverse events, and abuse associated with compounded ketamine nasal spray for home use.

The regulatory authority claims that healthcare specialists should be aware of the risk factors associated with compounded ketamine nasal spray. Such factors might hamper market growth to a certain extent.

Nasal Spray Market Segmentation Analysis

By Product Type Analysis

Growing Purchase of Salt Water Solutions Products Led the Salt Water Solutions Segment Growth

Based on product type, the market is segmented into corticosteroids, salt water solutions, topical decongestants, antihistamines, and others.

The corticosteroids segment led the market accounting for 42.71% market share in 2026. The corticosteroid nasal sprays are used in the treatment of allergic rhinitis (hay fever), sinusitis, and nasal polyps. The growing prevalence of these diseases, along with the easy availability and commercialization of cost-effective generic steroid sprays, drives segment growth.

- For instance, according to the data published in Frontiers Media S.A. Journal in April 2022, Allergic rhinitis (AR) affects around 400 million people globally. The research also stated that prevalence of AR has increased over the years, owing to the increased urbanization and environmental pollutants.

Moreover, the saltwater solutions segment is projected to account for the fastest growth rate during the forecast period. The salt water solutions products do not contain any medication, so they can easily be purchased without requiring a prescription, thus driving the segment's growth.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Nasal Allergies Segment Dominated the Market Owing to the New Product Approvals in the Industry

Based on application, the market is segmented into nasal allergies, cold, asthma, and others.

The nasal allergies segment dominated the market accounting for 45.57% market share in 2026. The increase in the patient pool suffering from allergies is the major factor responsible for segmental growth. Furthermore, product approvals and new product launches, coupled with the need for nasal allergy treatments due to patient comfort and ease, are projected to boost the segmental growth in the upcoming years.

- For instance, in May 2023, Bausch Health Companies Inc. announced that Health Canada approved its product RYALTRIS nasal spray to treat nasal allergies in adolescents, children, and adults.

Moreover, the asthma segment is projected to grow at the fastest growth rate during the forecast period, owing to the growing incidences of respiratory diseases along with the demand for cost-effective treatment options.

The other segment is projected to grow at a significant growth rate during the forecast period, owing to the growing prevalence of various conditions.

By Age Group Analysis

Adults Segment Dominated the Market Owing to a Higher Patient Volume

Based on the age group, the market is segmented into pediatric and adults.

The adults segment is expected to lead the market, contributing 72.57% globally in 2026, owing to the high prevalence of respiratory diseases in patients over 45 years and the growing emphasis of key players on launching new products for adults.

The pediatric segment is estimated to grow at the fastest growth rate during the projected period owing to the new product launches in the market for children who suffer from nasal congestion due to colds or allergies. For instance, in November 2022, Bayer AG launched Afrin Nasal spray for children to treat nasal congestion that works fast and lasts up to 12 hours.

By Type Analysis

Prescription Segment Held the Highest Share Owing to the Novel New Product Launches

Based on the type, the market is segmented into prescription and over-the-counter.

In 2026, the prescription segment is projected to lead the market with a 61.81% share, owing to the growing launches of generic equivalents of key prescription drugs. In addition, pharmaceutical companies are constantly engaged in the development and approval of new products.

Furthermore, the over-the-counter segment is anticipated to grow at a significant growth rate over 2025-2032. The rise in the online sales of over-the-counter products and the growing number of private-label OTC products are anticipated to drive the market growth.

By Distribution Channel Analysis

Growing Number of Drug Stores & Retail Pharmacies Propelled the Drug Stores & Retail Pharmacies Segment Growth

By distribution channel, the market is segmented into drug stores & retail pharmacies, hospital pharmacies, and online pharmacies.

In 2024, the drug stores & retail pharmacies segment accounted for the highest revenue share due to growth in the number of drug stores & retail pharmacies offering nasal spray products. For instance, according to a August 2022 report by Pharmacy Times, 88.9% of the U.S. population, lives within a distance of 5 miles from a community pharmacy. Such trends drive the segmental growth in the forecast period. In addition, hospital pharmacies accounted for the second-highest market share due to the availability of different types of these products.

Moreover, the online pharmacies segment is projected to grow at a lucrative CAGR owing to the internet penetration in the developing market and discounts offered by online pharmacies.

REGIONAL INSIGHTS

By region, the global market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Nasal Spray Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

By region, North America dominated the global market and accounted for USD 15.50 billion in 2026. The dominance of the region is attributed to the growth in nasal allergies, allergic rhinitis, and structural blockages. Certain advantages, such as precise drug delivery, painless procedures, and patient convenience, are actively driving the global nasal spray market share. According to the American College of Allergy, Asthma & Immunology, a sinus infection is a major health problem in the U.S. Also, each year, an estimated 31.0 million people fall prey to sinus infection. The U.S. market is projected to reach USD 5.49 billion by 2026.

Europe accounted for the second-highest market share in 2024 owing to the higher adoption of these products for the treatment of common cold and the presence of a large number of manufacturers in this region. In addition, the rising awareness about these products among the European population is driving the market growth in this region. The UK market is projected to reach USD 1.32 billion by 2026, and the Germany market is projected to reach USD 1.79 billion by 2026.

The Asia Pacific market is expected to be the fastest-growing market during the forecast period, owing to the growing strategic partnerships to manufacture nasal spray products in the region. For instance, in November 2022, NUANCE BIOTECH announced a partnership with DKSH Holding Ltd. to launch BentrioTM Nasal Spray in Macau and Hong Kong. This partnership focuses on expanding its medical device products in the Asia Pacific region, thereby boosting the market growth in the region. Furthermore, the strong incidence of acute and chronic diseases in the region coupled with improving healthcare infrastructure is expected to drive the regional growth.

The Japan market is projected to reach USD 1.54 billion by 2026, the China market is projected to reach USD 2.3 billion by 2026, and the India market is projected to reach USD 1.58 billion by 2026.

Latin America and the Middle East & Africa also hold huge potential for growth, owing to a robust increase in cases of nasal allergies. Combined with this, growing healthcare expenditure, as well as wide availability of products, is strongly driving the market growth in these regions.

Key Industry Players

Increasing Number of Product Approvals by GSK plc and Bayer AG to Support Their Dominance

The competitive landscape of the global market includes some of the dominant key players, such as GlaxoSmithKline plc (GSK plc), Johnson & Johnson Services, Inc., Viatris Inc., Emergent Devices, Inc., and Bayer AG, which accounts for the majority of the market share. The dominance is mainly attributed to the increasing number of product approvals and launches. For instance, in August 2020, the Janssen Pharmaceutical Companies of Johnson & Johnson announced U.S. FDA approval of SPRAVATO (esketamine) CIII nasal spray to treat depressive symptoms in adults.

Johnson & Johnson Services, Inc. is one of the largest healthcare companies globally. The company offers several of these products under its consumer health segments. As a key strategy, it markets its product to the general public and sells its products on online portals and retail outlets throughout the world.

Furthermore, GSK plc is the leading international pharmaceutical company with a diversified product portfolio, a well-established brand presence, and a widespread geographic presence. Other major players in the global market include Cipla, Inc., AptarGroup, Inc., Assertio Therapeutics, Inc., The Procter & Gamble Company, Oyster Point Pharma, Inc., and many more.

List of Top Nasal Spray Companies:

- GSK plc (U.K.)

- Viatris Inc. (U.S.)

- Emergent Devices, Inc. (U.S.)

- Cipla, Inc. (India)

- Bayer AG (Germany)

- Aurena Laboratories (Sweden)

- Aytu Health (Innovus Pharmaceutical)

- The Procter & Gamble Company (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023 - Padagis LLC, a provider of specialty pharmaceuticals, launched the U.S. first over-the-counter (OTC) Naloxone HCl Nasal Spray. The medication is used to reverse the effects of opioid overdose rapidly.

- May 2023 - The U.S. FDA approved Opvee nasal spray, an easy-to-use product that reverses overdoses caused by fentanyl and other opioids.

- November 2021 - Amcyte Pharma, a Seattle-based novel pharmaceutical company, announced the U.S. launch of its Nasitrol nasal spray for sinus irrigation.

- October 2021 - Cipla, Inc. launched the antiviral nasal spray Naselin to protect against coronavirus respiratory tract infections.

- May 2021 - Glenmark Pharma announced the launch of Ryaltris nasal spray in India for the treatment of moderate to severe allergic rhinitis.

REPORT COVERAGE

The market report covers a detailed market analysis and overview. It focuses on key aspects such as the competitive landscape, including market share analysis, product type, application, age group, type, distribution channel, and region. Besides this, the market research report offers insights into the market drivers, market trends, market dynamics, COVID-19's impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.90% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Age Group

|

|

|

By Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 35.26 billion in 2026 to USD 70.17 billion by 2034.

In 2025, the North America market stood at USD 14.27 billion.

The market is expected to exhibit a CAGR of 8.90% during the forecast period (2026-2034).

The corticosteroids segment led the market by product type.

Rising infections, as well as allergic conditions, are majorly driving the market growth.

Johnson & Johnson Services Inc., Bayer AG, GSK plc, and Viatris, Inc. are the major players in the global market.

North America held the largest market in 2025.

The increasing number of products under development and new product launches are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us