Nebulizer Market Size, Share, & Industry Analysis, By Type (Jet Nebulizer, Ultrasonic Nebulizer, and Mesh Nebulizer), By Modality (Table-top, and Portable), By End-user (Hospitals, Clinics, and Homecare Settings), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

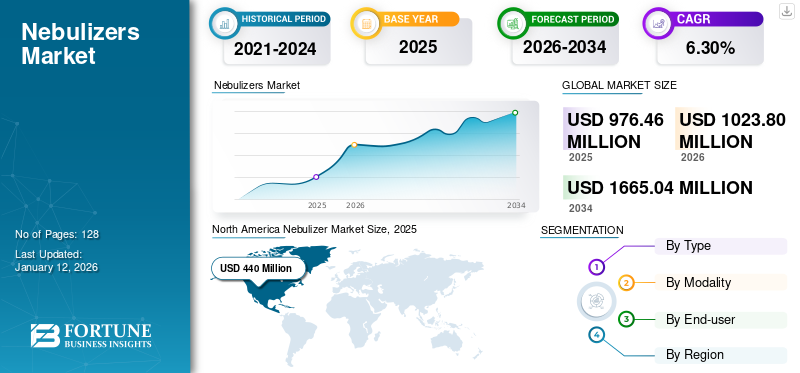

The global nebulizer market size was valued at USD 976.46 million in 2025. The market is projected to grow from USD 1,023.80 million in 2026 to USD 1,665.04 million by 2034, exhibiting a CAGR of 6.30% during the forecast period. North America dominated the nebulizer market with a market share of 45.06% in 2025.

A nebulizer is a drug delivery device that enables medication administration in the form of a mist into the lungs. These devices pump pressurized air through the liquid to form a fine mist, breathed in through a mouthpiece or mask. These machines are designed to treat asthma, asthma cystic fibrosis, COPD, and other respiratory disorders.

There is an increasing prevalence of chronic respiratory conditions including COPD, asthma, and others. Increasing air pollution, rise in smoking rates among general population, and other factors have been responsible for an increasing number of patients seeking treatment for respiratory conditions especially in emerging countries. This is driving the demand for treatment devices, including nebulizers.

- For instance, as per data published by the World Health Organization (WHO) in 2024, around 262.0 million people suffered from asthma worldwide in 2019. As per the same source, asthma caused around 455,000 deaths worldwide in the same year.

During the COVID-19 outbreak in 2020, the market experienced a significant growth in 2020. This was due to the increased cases of respiratory disorders. Furthermore, the market continued to grow at a significant rate in 2021 and 2022 due to strong demand for these devices post COVID-19.

Nebulizer Industry Landscape Overview

Nebulizer Market Size & Forecast

- 2025 Market Size: USD 976.46 million

- 2026 Market Size: USD 1,023.80 million

- 2034 Forecast Market Size: USD 1,665.04 million

- CAGR: 6.30% from 2026–2034

Market Share

- By Region: North America dominated the global nebulizer market with a 45.06% market share in 2025. The region's dominance is attributed to the high prevalence of asthma and chronic respiratory conditions, favorable reimbursement policies, and the early adoption of advanced portable nebulizers.

- By Type: Jet nebulizers accounted for the largest share in 2024 due to their clinical efficacy, cost-effectiveness, and widespread availability. However, mesh nebulizers are expected to register the highest CAGR during the forecast period owing to their technological advantages such as portability, quieter operation, and precise medication delivery.

Key Country Highlights

- United States: The U.S. remains a major contributor to market revenue, driven by a high number of asthma and COPD patients, strong insurance support through Medicare/Medicaid for nebulizer devices, and a robust pipeline of product launches. For instance, in 2021, over 25 million people were living with asthma in the U.S., highlighting sustained demand for respiratory treatment devices.

- Japan: Japan's market is expanding due to increased elderly population and high prevalence of chronic respiratory diseases. Additionally, domestic innovations and FDA approvals—such as HCmed’s Pulmogine vibrating mesh nebulizer—are bolstering demand.

- China: Rapid industrialization and air pollution have contributed to a surge in asthma and COPD cases. Combined with local innovations and launches like Pulmogine and supportive regulatory approvals, China represents a high-growth potential market, especially under initiatives such as the Healthy China 2030 plan.

- Europe: Europe is the second-largest market, supported by growing hospital admissions due to respiratory diseases. For example, the UK recorded 1.1 million hospitalizations related to respiratory disorders in 2021. Government initiatives to enhance respiratory care infrastructure, especially in the UK, Germany, and France, support ongoing demand.

Nebulizer Market Trends

Shift Toward Vibrating Mesh Nebulizers Due to the Adoption of Advanced Technology by the Market Players in their Product Offerings

The prevalence of respiratory disorders has been increasing at a significant rate worldwide which is driving the demand for effective treatment devices. To cater to the growing demand, market players have increased their focus on the development of technologically advanced devices that dispense medication at a consistent particle size and make the overall administration experience comfortable.

- In June 2020, Respira Technologies, Inc. launched the RespiRx nebulizer in the market. This new drug delivery platform is an ultra-portable handheld Vibrating Mesh Nebulizer (VMN) intended for the local and systemic treatment of patients.

Moreover, rising awareness among healthcare providers about innovative products and the increasing collaborations among players to extend their market reach are also anticipated to accelerate market growth.

Download Free sample to learn more about this report.

Nebulizer Market Growth Factors

Increasing Incidence of Respiratory Disorders to Propel Market Growth

The increasing prevalence of respiratory disorders such as asthma, chronic obstructive pulmonary disorder (COPD), and other respiratory conditions are exerting a substantial economic burden on the healthcare systems of various countries globally.

- For instance, according to the statistics published by the Asthma and Allergy Foundation of America in April 2022, approximately 25.0 million people in the U.S. had asthma.

- Similarly, according to an article published by the Greater London Authority in July 2021, around 337,500 people in London suffered from asthma attacks, with poor air quality being the reason.

There has been a rise in the prevalence of these conditions owing to various factors, including an increase in the smoking population, poor air quality, and so on.

- In 2021, according to an article published by the Physiopedia, there will be around 65.0 million people suffering from chronic obstructive pulmonary disease (COPD).

According to the Global Strategy for Diagnosis, Management, and Prevention of COPD report, the European Union spends around 6% of its total healthcare budget on managing respiratory disorders (direct costs) each year. Also, according to the report, COPD accounts for roughly 60% of the EU's total expenditure on respiratory diseases each year.

In emerging countries, the prevalence is gradually increasing, which is resulting in a large number of patients suffering from respiratory disorders. Various government initiatives toward promoting early diagnosis and treatment are leading to an increasing number of patients undergoing treatment.

Moroever, the increasing focus of market players on new product launches has also been fueling the market growth. For instance, in 2020, Omron Healthcare introduced the ‘OMRON NE C106’, a cost-effective and all-age-group compatible nebulization device in India.

Growing Demand for Home Healthcare Devices to Drive Market Growth

The rising cost of healthcare services and hospital stays has led to a preferential shift of patient treatment towards homecare settings. The increasing cost of the hospital stays for treating respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma and others emphasizes patients to take treatment in the homecare setting.

- For instance, in 2021, MDinteractive published an article that stated in the U.S., the hospitalization cost for a COPD inpatient is around USD 19,000 annually.

- Also, community homecare published an article stating that the average daily cost of a hospital stay in the U.S. for a chronic condition such as diabetes, heart and circulatory diseases, chronic obstructive pulmonary diseases, and others is around USD 6,200 as compared to USD 135 per visit for home healthcare cost.

This factor led to an increase in the adoption of breathable medical devices for home healthcare. Thus, the growing demand for effective inhaled drug delivery devices and the promotion of respiratory care devices for home use by many healthcare organizations are likely to boost the growth of this market during the forecast period.

RESTRAINING FACTORS

Clinical Limitations Associated with the Use of Nebulizers has been Limiting its Adoption

The rising prevalence of respiratory disorders has been fueling the demand for nebulizing devices. However, there are certain concerns on the safety profile of respiratory devices for transmission of the infection. Factors such as the risk of infection transfer from the tubing of nebulizers to the patient's lungs or the transmission of infection from the unsterile chambers of the devices are further limiting the recommendations given by healthcare professionals for the use of these devices.

- For instance, according to an article published by the Canadian Medical Association Journal in March 2020, the risk of transmission of infection increased during nebulizer treatments due to its potential to generate a high volume of respiratory aerosols, which increases the risk of spreading the disease.

Therefore, due to these factors in recent years, some centers have shifted from using nebulizer to metered dose inhalers (pMDI) with valved holding chambers. The metered dose inhalers are small, portable, and easy to carry, offering clinical and operational benefits in the treatment of asthma.

Cost and the increasing availability of alternate options for treatment are also limiting the growth of the segment. The demand for nebulizer is likely to face competition with a growing acceptance of substitute devices for treating respiratory disorders by patients. There is an increasing preference from healthcare providers for inhalers, including metered-dose inhalers for asthma treatment. The clinical and operational benefits of MDIs in treating asthma and the lower cost of these devices have witnessed a preferential shift of patients from nebulization devices to inhalers. Moreover, limited reimbursement policies in developing economies and the higher costs of mesh nebulizers will likely hamper the nebulizer market growth during the forecast period.

Nebulizer Market Segmentation Analysis

By Type Analysis

Clinically Approved Advanced Product Introduction is Leading to the Dominance of Jet Nebulizer Segment

Based on type, the market is segmented into jet nebulizer, mesh nebulizer, and ultrasonic nebulizer.

The jet nebulizer segment dominated the market share of 50.04% in 2026. Nebulization devices based on jet technology for delivering aerosolized medications have been used traditionally. The clinically proven technological advantages of jet devices and comparatively lower costs have been instrumental in higher adoption of these devices globally. Furthermore, the emergence of domestic manufacturers offering new and low-cost devices in this segment, especially in emerging countries, is fueling segmental growth.

The mesh nebulizer segment is expected to register a comparatively higher CAGR during the forecast period. Technological superiorities of mesh technology in aerosol drug delivery, along with R&D advances made by the manufacturers, have led to a growing preference for these devices by patients and healthcare providers in developed countries. Also, the approval from the regulatory authorities of the developed countries contributes to the growth of the segment. For instance, in July 2021, HCmed received approval from the U.S. FDA for Pulmogine, a portable vibrating mesh nebulizer designed to deliver medication directly into the airways. However, comparatively lower penetration of these devices in emerging countries owing to high cost has limited the segment’s growth to a certain extent.

The ultrasonic nebulizer segment is anticipated to have steady growth. Limitations offered by ultrasound devices to aerosolized viscous solutions and drugs, along with other clinical and technological limitations, have witnessed limited preference for these devices, especially in emerging countries. Moreover, a significantly higher cost of the device is responsible for lower demand in emerging and developed countries.

To know how our report can help streamline your business, Speak to Analyst

By Modality Analysis

Table-top Segment to Dominate Owing to Unique Characteristics of Portable Nebulizer Segment and its Convenient Use at Home

On the basis of modality, the market is segmented into portable and table-top.

The table-top segment dominated the market share of 64.43% in 2026 and is expected to grow at a substantial CAGR during the forecast period. The segment’s dominance is attributed to the increase in the usage of table-top nebulizers due to the availability of reimbursement policies in developed markets, with operational benefits offered by these devices. For example, according to the U.S. Centers for Medicare and Medicaid Services (CMS), nebulizers are covered under the Durable Medical Equipment (DME) benefit by Medicaid. Also, the presence of a large number of players with a strong table-top device portfolio is contributing to the higher share of the segment in the market. Moreover, the cost-effectiveness of these devices as compared to the portable devices has also been fueling its demand in the market.

The portable nebulizer segment is anticipated to witness a significant CAGR during the forecast period. The growth of the segment is attributed to the advanced feautres offered by these devices such as compact size, easy usability at home, and others. Moreover, the increasing focus of market players on new product launches has also been fueling the segment growth.

- For instance, in November 2019, Drive DeVilbiss International announced the launch of the iGo2 Portable Oxygen Concentrator (POC), the first patented technology that automatically adjusts the dose of oxygen according to patients breathing rate.

By End-user Analysis

Homecare Settings to Dominate Backed by Preferential Shift of Patients towards Medical Devices

The market is segmented into hospitals, clinics, and homecare settings in terms of end-user.

The hospitals segment dominated the global market share of 43.84% in 2025 in 2026. Higher demand for these devices from hospital settings, especially driven by the higher number of inpatient admissions with comorbid conditions, has been pivotal in higher demand for table-top and portable devices from these settings globally. For instance, according to the statistics published by GOV.UK, in June 2022, in England, the emergency admissions of children for bronchiolitis increased to 68.3% in 2021 compared to 60.8% in 2014. Due to these factors homecare settings segment by end-user has been dominating the market.

The clinics segment has witnessed a lackluster demand for nebulizers, owing to the comparatively lower preference of patients toward receiving nebulization in clinics compared to hospitals. This factor is augmented by the shift of patients toward home settings, which has further limited the demand for these devices in clinics.

The shift of patients toward home settings and the introduction of new and portable devices, with comparatively lower costs have been pivotal in surging the demand for these devices from homecare settings.

REGIONAL INSIGHTS

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Nebulizer Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 440 million in 2025 and is anticipated to continue to dominate the global market during the forecast period. A higher prevalence of asthma, other chronic respiratory conditions, and the rising adoption of advanced portable ones in the region have been instrumental in a higher market share of North America. According to the statistics published by the Asthma and Allergy Foundation of America in 2021, around 25.0 million people in the U.S. were living with asthma. Moreover, adequate reimbursement policies for these devices in the region are likely to boost the market growth in the region. The U.S. market is projected to reach USD 434.84 billion by 2026.

Europe

Europe is the second-most dominant region in terms of revenue and nebulizer market share. Primary reason attributed to the growth of the market in Europe is the rising prevalence of respiratory diseases, contributing to increasing demand for these devices in the Europe market. For instance, according to the statistics published by GOV.UK in 2021, 1.1 million hospital admissions of respiratory disorders were recorded in the U.K. Thus, the rising prevalence of respiratory diseases across the region is contributing to the growth of the segment. The UK market is projected to reach USD 40.11 billion by 2026, while the Germany market is projected to reach USD 55.89 billion by 2026.

Asia Pacific

The market in Asia Pacific is driven by the rising prevalence of chronic respiratory diseases, improving healthcare infrastructure and the growing number of medical device companies developing inhaled drug delivery devices to treat asthma and COPD. For example, in October 2020, HCmed Innovations Co., Ltd., announced the launch of Pulmogine in the China market. Also, in July 2021, HCmed Innovations Co., Ltd. received approval from the U.S. Food and Drug Administration (FDA) for this product. The product is a vibrating mesh nebulizer equipped with Micro Synchronized Delivery Technology (MSDT). The Japan market is projected to reach USD 74 billion by 2026, the China market is projected to reach USD 48.85 billion by 2026, and the India market is projected to reach USD 41.06 billion by 2026.

Latin America and Middle East & Africa

On the other side, the market in Latin America and the Middle East & Africa is likely to grow at a slower pace. The rapid rise in the prevalence of asthma and COPD is likely to accelerate the demand for these devices for managing chronic respiratory diseases in the respective regions in the forthcoming years.

List of Key Companies in Nebulizer Market

Increasing Focus of Market Players on Innovations and Collaborations to Strengthen their Market Position

The global market is fragmented, with players, such as Omron Healthcare, Inc., Koninklijke Philips N.V., and PARI Respiratory Equipment, Inc. accounting for a significant share in 2023. The players focus on developing innovative devices and emphasize strategic partnerships and collaborations to strengthen their position in the market.

- For instance, in March 2021, PARI Pharma GmbH received authorization for the LAMIRA nebulizer system to deliver ARIKAYCE (amikacin liposome inhalation suspension) in Japan. The system includes a customization medication reservoir that holds 8.4 ml dose and a specifically tailored aerosol head for aerosolization of ARIKAYCE with a valved aerosol chamber.

- In March 2021, AireHealth collaborated with LucidAct Incto integrateLucidAct Provider Portal with AireHealth’s digital health solution to support remote management of chronic obstructive pulmonary disease (COPD), and other chronic respiratory conditions.

Moreover, the market is further characterized by many small manufacturers in emerging nations focusing on developing relatively lower-cost devices. Other key players offering a wide range of devices involve DeVilbiss Healthcare LLC, BRIGGS HEALTHCARE, GF HEALTH PRODUCTS, INC., Trudell Medical International, Allied Healthcare Products, Inc., Teleflex Medical, Inc., and others

LIST OF KEY COMPANIES PROFILED:

- OMRON Healthcare, Inc. (Japan)

- Koninklijke Philips N.V. (Netherlands)

- PARI Respiratory Equipment, Inc. (U.S.)

- DeVilbiss Healthcare LLC (U.S.)

- Briggs Healthcare (U.S.)

- GF HEALTH PRODUCTS, INC. (U.S.)

- Trudell Medical International (Canada)

- Allied Healthcare Products, Inc. (U.S.)

- Teleflex Medical, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2021 – Aerogen collaborated with Nuance Pharma and entered into an agreement to develop a non-invasive approach for treating Respiratory Distress Syndrome (RDS). This agreement also grants Nuance to commercialize AeroFact, an innovative therapy that combines pulmonary surfactant drug with proprietary vibrating mesh technology.

- July 2021 – PARI GmbH collaborated with TWT Digital Health (TWT) and developed the PARI Connect app. This app can be used to plan inhalations, take medications, or make doctor’s appointments and also enables the user to observe all the facts of their therapy. The app also communicates via Bluetooth with the eTrack controller, a control unit for PARI’s eFlow Technology nebulizer.

- October 2020 – OMRON Healthcare, Inc. expanded the range of prescription-grade nebulizers. These systems are compact, quiet, and portable and provide greater ease to patients to manage asthma and chronic obstructive pulmonary disease (COPD).

- July 2020 – OMRON Healthcare Inc., the leading Japanese player in home healthcare, announced the launch of OMRON NE C106. It is an addition to their compressor nebulizer portfolio. The company is continuously innovating in the area of respiratory medication delivery.

- April 2020 - Asclepius Meditec Co. Ltd., a China-based medical device company, announced the development of AMS-H-03, an advanced hydrogen-oxygen nebulizer to relieve the shortage of ventilators in China for the treatment of COVID-19 patients.

REPORT COVERAGE

The global nebulizer market report provides a detailed analysis of the market and focuses on key aspects such as technological advancements, the prevalence of asthma, and COPD. Besides this, the report offers insights into the market trends and highlights key industry developments such as mergers, partnerships, acquisitions, and the impact of COVID-19 on the market. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.30% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type

|

|

By Modality

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1,023.80 million in 2026 and is projected to reach USD 1,665.04 million by 2034.

In 2025, North America stood at USD 440 million.

Registering a CAGR of 6.30%, the market will exhibit steady growth over the forecast period (2026-2034).

The jet nebulizer segment is expected to lead this market during the forecast period.

The rising incidence of chronic respiratory diseases, increasing adoption of homecare medical devices, and growing advancements in these devices are some key factors driving the market.

Omron Healthcare, Inc., Koninklijke Philips N.V., and PARI Respiratory Equipment, Inc. are among the top players in the market.

North America dominated the nebulizer market with a market share of 45.06% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us