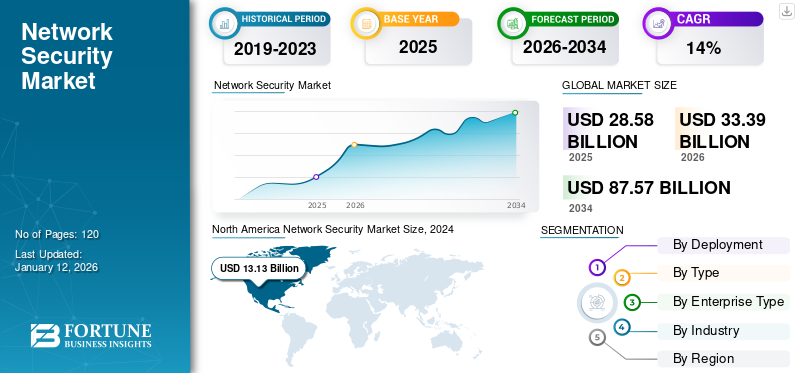

Network Security Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Type (Firewalls, Antivirus and Antimalware Software, VPN, Wireless Security, and Others), By Enterprise Type (Small & Medium Enterprises (SMEs) and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Retail, Healthcare, Government, Manufacturing, Travel and Transportation, Energy and Utilities, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

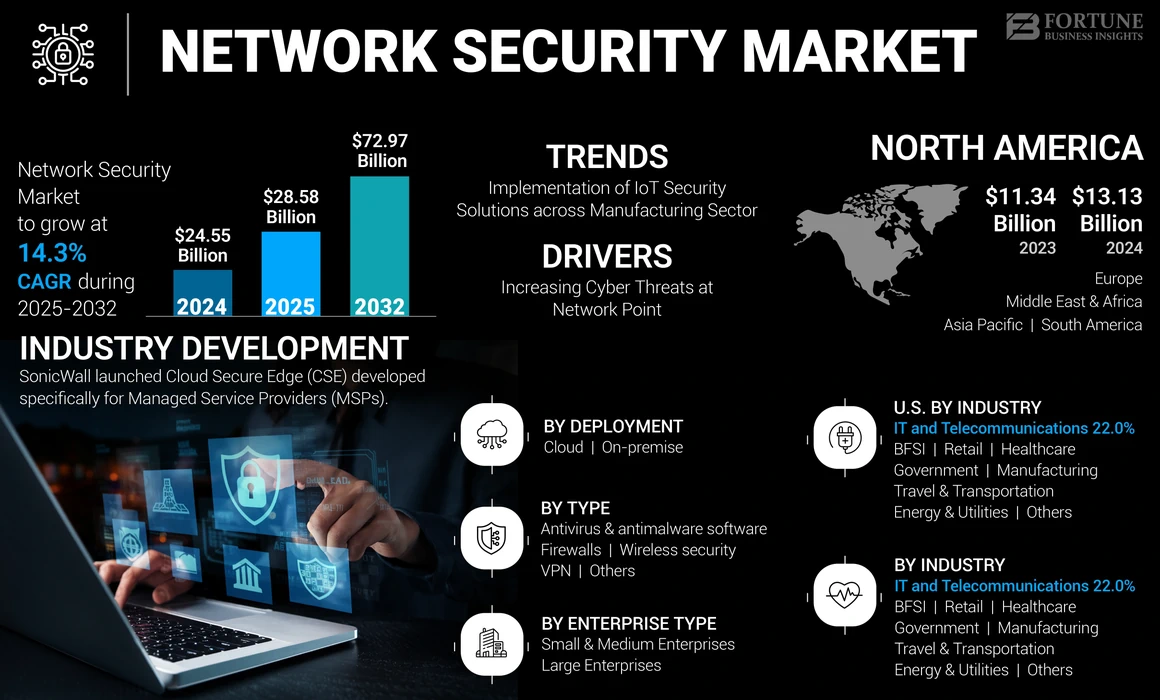

The global network security market size was valued at USD 24.55 billion in 2024. The market is projected to grow from USD 28.58 billion in 2025 to USD 72.97 billion by 2032, exhibiting a CAGR of 14.3% during the forecast period. North America dominated the global market with a share of 53.48% in 2024. Additionally, the U.S. network security market is predicted to grow significantly, reaching an estimated value of USD 24.36 billion by 2032.

Network security is a set of technologies that refers to the practice, wide range of technologies, and policies implemented to secure the confidentiality, integrity, and availability of data and its resources across the network. These solutions protect the organization’s IT network from various cyberattacks, such as phishing attacks, malware, Denial of Service (DoS) attacks, and Distributed Denial of Service (DDoS) attacks.

The network security measures include application delivery platforms, user authentication, transport layer security, access control, DDoS protection, and firewalls to protect the organizations from malware and various cyber-attacks. Increasing adoption of cloud-computing solutions across various industries provides remote access to the team, which significantly creates data privacy and security issues. This factor leads to a boost in the demand for adopting security solutions to protect the underlying network infrastructure.

Similarly, increasing investment by organizations in the development of zero-trust security solutions to protect the data, applications, and devices against various threats propel the growth of the market over the forecast period. For instance,

- In September 2023, Zscaler, Inc. entered into a partnership with CrowdStrike and Imprivata to develop new zero-trust security solutions for healthcare companies. This partnership aims to provide security to the medical institutions against ransomware threats by using the high traceability and visibility capabilities of the Zero Trust Security (ZTS) solutions.

The COVID-19 situation compelled enterprises worldwide to prioritize e-learning and remote working platforms. According to Check Point Software Technologies Ltd, in 2021, 81% of businesses implemented remote working for their workforces, and 74% planned to do so indefinitely.

With the growing popularity of remote working, business networks have seen increased access requests. This factor resulted in increased traffic levels, thereby raising the quantity of data encryption traffic coming to the company network. As a result, the need for an advanced network security solution is anticipated to grow. Furthermore, these solutions are projected to gain popularity in specific businesses even after the crisis.

IMPACT of GENERATIVE AI

Gen AI Integrated Network Security Solutions Improve Performance of Network Infrastructure of Various Enterprises

Generative AI works as a game-changing technology in network security. It significantly helps to boost the ability to identify ransomware, phishing, malware, and other cyber threats in an efficient manner. Integrating generative AI, along with network security solutions, can have transformative effects on developing offensive and defensive capabilities for managing enterprise security operations. The growing usage of generative models, such as Generative Adversarial Networks (GAN), helps analyze huge amounts of data in order to detect various patterns and anomalies of cyber-attacks. These deep learning models can effectively identify unknown threats and attacks and aim to scan network-related issues and free human resources for more complex issues.

According to IBM’s Cost of a Data Breach Report 2023, only 28% of enterprises use automation and AI to manage their security operations of the enterprises, whereas 33% of organizations use it only limitedly. Integrating gen AI with security solutions helps analyse the network traffic while transferring the data packets and recognize different types of attacks, such as malware, phishing, and many more, to ensure data privacy and quality.

Gen AI-driven network automation systems can enable self-driving networks, where AI systems analyze and solve network issues automatically, minimize the need for manual intervention, and improve overall network reliability. Hence, the increasing integration of Gen AI with network security solutions is projected to enhance the performance of companies' network infrastructure.

Network Security Market Trends

Implementation of IoT Security Solutions across Manufacturing Sector to Create New Market Opportunities

Internet of Things (IoT) security solutions are increasingly becoming important in the manufacturing sector in terms of assisting with product development and enhancements. The growing number of connected devices in manufacturing necessitates advanced security measures to protect these devices from cyber threats. Developing tailored security solutions for IoT ecosystems can address the unique challenges posed by these devices.

The number of industrial IoT connections is anticipated to record a valuation of 36.8 billion by 2025, with smart manufacturing accounting for 60% of those connections. Thus, securing data and devices has become more challenging for manufacturers due to exponential growth of Internet of Things (IoT) devices.

The use of Secure Access Service Edge (SASE) architecture aids manufacturers by uniting security and network connectivity. This architecture centralizes policy and access control to protect data and enhance threat detection. Hence, by considering these factors, the implementation of IoT security solutions across the manufacturing sector aims to generate new market opportunities for growth over the forecast period.

Download Free sample to learn more about this report.

Network Security Market Growth Factors

Increasing Cyber Threats at Network Point to Boost Demand for Network Security Solutions

Cyber-attacks have become more sophisticated and complex, targeting various network points such as endpoints, gateways, and cloud environments. Advanced Persistent Threats (APTs), ransomware, and zero-day exploits require advanced detection and prevention mechanisms, driving the need for robust network security solutions. The exponential growth in data generation and network traffic, driven by digital transformation, IoT, and cloud computing, has expanded the attack surface. More data in transit increases the potential for interception and exploitation, necessitating comprehensive network security measures to ensure data integrity and confidentiality.

Stricter regulatory requirements, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., mandate organizations to implement stringent security controls to protect sensitive information. Non-compliance can result in several financial penalties, further encouraging investment in security solutions.

The escalation of cyber threats targeting network points has made robust network security solutions essential for organizations. As cyber-attacks become more sophisticated and frequent, the need for advanced security measures to protect data and ensure compliance continues to grow, driving the demand for comprehensive network security solutions.

RESTRAINING FACTORS

Low Security Budgets by Companies Likely to Hamper The Market Growth

Multiple businesses face challenges in dealing with the lack of authentic data security and threats. Companies are still failing to allocate the necessary funds. Also, the initial setup cost of this software is high, and it requires consistent examination, which is expected to hamper its adoption for a short period. The wide range of security tools, each with its interface and functionality, makes integration and management intricate.

Despite the high cost of solutions and rising number of attacks, small and medium businesses may adopt affordable security solutions based on their needs and operations.

Network Security Market Segmentation Analysis

By Deployment Analysis

Rising Adoption of Advanced Technologies will Boost Demand for Cloud-based Solutions

By deployment, the market is divided into cloud and on-premise.

The cloud-based segment is projected to grow with the highest CAGR over the forecast period. Rising adoption of cloud-based infrastructure across different industry verticals, such as IT & telecom, BFSI, and healthcare, generates demand for cloud network security solutions and services to protect applications, data, and systems. This factor boosts the demand for cloud-based security solutions over the forecast period.

The on-premise segment held the highest market share in 2024 and is expected to show moderate growth during the forecast period. Because on-premise software is expensive to install and maintain, companies majorly prefer cloud-based solutions over on-premise solutions. This is due to the cost efficiency, scalability, and flexibility of cloud solutions compared to on-premise. Thus, the adoption of cloud-based software is high compared to on-premise over the forecast period.

By Enterprise Type Analysis

Small & Medium Enterprises to Boost Market Growth Due to Increasing Investments in Security Solutions

By enterprise type, the market is divided into Small & Medium Enterprises (SMEs) and large enterprises.

Small and Medium Enterprises (SMEs) are expected to grow with the highest Compound Annual Growth Rate (CAGR) over the forecast period. Small and medium enterprises are targeted by hackers to disrupt their growth. As a result, they experience significant financial losses, and their private data is exploited. Therefore, SMEs also require secure networks. Startups are investing in security solutions with the support of government programs and funds. The usage of this antivirus software by small and medium-sized businesses is expected to increase gradually in the future. It will also further accelerate the network security market growth. Also, growing security awareness and increased cyberattacks will encourage small and medium-sized businesses to adopt innovative security solutions, further strengthening the market potential.

Furthermore, large enterprises dominated the market in terms of share in 2024. The large enterprises segment is expected to hold a large share of the market. Large enterprises have witnessed a growing number of cyberattacks in the last few years, so they reserve a larger portion of the budget for security.

By Type Analysis

Firewall to Gain Traction Backed by Increasing Adoption of Solutions

On the basis of type, the market is segmented into firewalls, antivirus and antimalware software, VPN, wireless security, and others (data loss prevention, and intrusion prevention systems).

Among these, the firewall held the largest market share in 2024 and is expected to grow with the highest CAGR over the forecast period. The adoption of firewall security is rising across every industry, thus contributing to the highest revenue share. A firewall monitors the incoming and outgoing files to the IP address, authentic source, and ports & protocols. Firewall services and software act as barriers and prevent unauthorized access to data.

With recent security improvements, the acceptance of intrusion prevention solutions is growing. These solutions have the capacity to block threats rather than just detect them.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

IT and Telecommunication Dominates Market Owing to Increase in Data Breaches and Network Attacks

By industry, the market is categorized into BFSI, IT and telecommunications, retail, healthcare, government, manufacturing, travel and transportation, energy and utilities, and others.

The IT and telecommunications segment is predicted to gain the largest market share, followed by healthcare and BFSI sectors. The IT industry stores a significant quantity of private data from its shareholders which need to be monitored and analyzed. Thus, this factor boost the demand for adoption of network security solutions in order to manage the malicious network traffic of the organization. Hence, by considering these factors the IT & telecommunication industry holds largest network security market share in year 2024. Furthermore, the growing popularity of mobile banking raises the potential for network attacks and data breaches in the BFSI sector. This factor will result in the implementation of security solutions.

The manufacturing industry is expected to grow with maximum CAGR over the forecast period. This is due to the increasing usage of IoT devices, web applications, and other software to deliver confidential information to customers and vendors present across the globe. This integration of devices generates high risks of cyberattacks over the network. This factor propels the demand for network security solutions across the manufacturing sector to secure the entire infrastructure.

REGIONAL INSIGHTS

North America Network Security Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Request for Customization to gain extensive market insights.

North America dominated with maximum network security market share in 2023 due to the rising implementation of firewall, VPN, and other security solutions by large enterprises across the region. Furthermore, the U.S. has the highest growth rate in terms of software adoption. Top industries, such as healthcare, BFSI, and retail, heavily utilize various software to protect their data. The U.S. is modernizing the current software while also creating security solutions. It has submitted the most protection patents in the market. Canada is also anticipated to witness a steady adoption of security solutions.

For instance, In April 2023, recommendations were issued to prevent cyberattacks against the growing number of digital infrastructures through a joint effort between the U.S., the U.K., Australia, Canada, and New Zealand.

To know how our report can help streamline your business, Speak to Analyst

Europe is also developing with a steady growth rate in the market. Most organizations in the U.K. provide safe network solutions, professional cyber services, and information risk assessment & management. Similarly, Germany is seeing consistent market expansion. Increasing usage of advanced digital technologies by implementing ICT security measures and procedures boosts the demand for security components and services.

Asia Pacific is also expected to grow steadily during the forecast period. China is developing at a notable pace in the market and investing in the research & development of security software. The Chinese government is also pushing citizens to incorporate digitization into their daily lives. As a result, there would be an increased need for secure networks, which will drive market expansion. Furthermore, according to researcher’s survey, in 2023 47% of communication service providers (CSPs) in India prefer firewall and other security applications, 33% aims to enhance the investments in malware and ransomware protection services, and 30% priorities to adopt DDoS attack detection and monitoring solutions to deliver a reliable, high quality, and secure network services to the customers present across the globe. Similarly, governments in numerous nations are enacting security laws and regulations to avoid data breaches.

Due to rising investments in the Middle East & Africa, security solutions have begun to gain traction in these regions. Saudi Arabia has invested heavily in establishing committees to deal with security risks, such as the Saudi Research and Innovation Network and SAFCSP.

The Government of South America is creating a security infrastructure to counteract attacks and data breaches. The majority of organizations in the region are concentrating on implementing network and endpoint security policies.

KEY INDUSTRY PLAYERS

Technological Developments by Leading Companies to Aid Market Proliferation

Companies operating in the market mainly include Allot Ltd., Cisco Systems, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Trend Micro Incorporated, Palo Alto Networks, and Juniper Networks, Inc. These firms are focusing on bringing innovations in network security solutions. To enhance their operations throughout the world, the market players are using various strategic methods, such as partnerships, product launches, investments, acquisitions, and mergers.

List of Top Network Security Companies:

- Allot Ltd. (Israel)

- Cisco Systems, Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Trend Micro Incorporated (Japan)

- Palo Alto Networks (U.S.)

- Juniper Networks, Inc. (U.S.)

- Broadcom (U.S.)

- SonicWall (U.S.)

- Trellix (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: SonicWall launched Cloud Secure Edge (CSE), an innovative suite of Zero-Trust Network Access (ZTNA) offerings developed specifically for Managed Service Providers (MSPs). It is a cost-effective and flexible solution which provides remote access and internet access to organizations to connect with their employees and third-party users securely from any device and location.

- July 2024: Fortinet, Inc. introduced a hardware-as-a-service offering that keep the latest firewall technology updated. The FortiGate-as-a-Service (FGaaS) enables customers to choose the hardware they want and FortiGate next-gen firewalls. The company will manage and configure the device for the customer’s service.

- July 2024: Cisco Systems, Inc. launched an AI-enabled firewall that autonomously updates and manages itself, focused on streamlining cyber-defense for its enterprise clients.

- March 2024: Juniper Networks introduced a novel Juniper Partner Advantage (JPA) Program enabled with AI-Native Networking Solutions. This solution will help partners by using AI technology for IT operations to provide networking services for increased agility and reliability.

- September 2023: Check Point Software Technologies Ltd. acquired Perimeter 81, a Security Service Edge (SSE) company. Through this acquisition, Check Point Software aims to expand its portfolio and provide quick and secure access to remote sites, users, and data centers.

REPORT COVERAGE

The study on the market includes prominent areas globally to gain enhanced knowledge of the industry verticals. Moreover, the research offers insights into the most recent endeavors and industry developments and an analysis of high-tech solutions being adopted promptly worldwide. It also highlights some of the growth-stimulating limitations and elements, allowing the reader to obtain a comprehensive understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.3% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment

By Type

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to record a valuation of USD 72.97 billion by 2032.

In 2024, the market stood at USD 24.55 billion.

The market is projected to grow at a CAGR of 14.3% during the forecast period.

Manufacturing is likely to lead the market with the highest CAGR over the forecast period.

Increasing cyber threats at network points to drive the market growth.

Allot Ltd., Cisco Systems, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Trend Micro Incorporated, Palo Alto Networks, and Juniper Networks, Inc. are the top players in the market.

North America held the largest market share in 2024.

Asia Pacific is expected to grow with the highest CAGR over the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us