Network Slicing Market Size, Share & Industry Analysis, By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By End-user (Healthcare, Government, Transportation & Logistics, Energy & Utilities, Manufacturing, Media & Entertainment, Financial Services, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

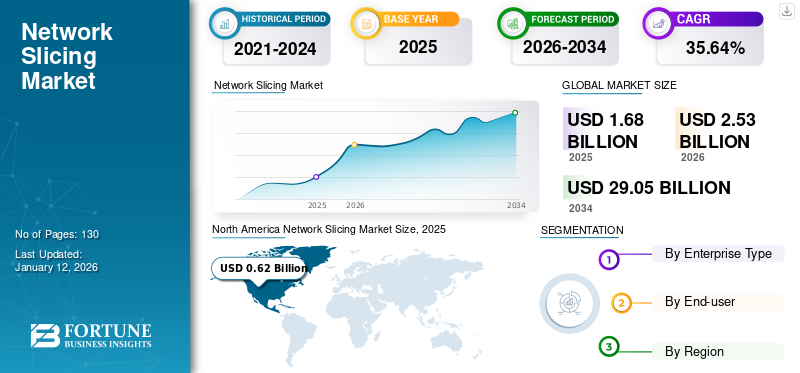

The global network slicing market was valued at USD 1.68 billion in 2025. The market is projected to be worth USD 2.53 billion in 2026 and reach USD 29.05 billion by 2034, exhibiting a CAGR of 35.64% during the forecast period.

Network slicing is a method of producing multiple virtualized and logical networks over a shared multi-domain structure. With Software-Defined Networking (SDN), Network Functions Virtualization (NFV), automation, analytics, and orchestration, mobile network operators can speedily produce network slices to aid a group of users, specific applications, services, or networks. This platform allows a single network to provide various services based on the user's necessities. In addition, it aids network operators in minimizing capital expenditure (CAPEX) and operating expenses (OPEX), along with enhanced functioning efficiency for the delivery of network services.

Increasing adoption of 5G-enabled network slicing in multiple sectors, such as BFSI, retail, healthcare, and e-commerce, is also contributing positively to market growth. In addition, organizations and businesses can cost-effectively customize networks managed by service-level agreements to meet their specific needs. Network function management (NFV), analytics, orchestration, software-defined networking (SDN), and automation enable the creation of network slices that support specific services, applications, or user groups. It also allows efficient use and management of services, maximizing return on investment (ROI). Each slice has its management, architecture, and security to support specific use cases. It can span multiple network domains, such as core, transport, and access provided by numerous carriers. Use cases include enhanced mobile broadband, large-scale machine-like communications, and ultra-reliable low-latency communications. These use cases enable video-centric applications and require MNOs to have mobile edge computing power and generate less traffic.

The COVID-19 pandemic increased the demand for broadband services with the support of rising mobile networking and remote access services in the telecom, IT, healthcare, and retail industries. As organizations have initiated to reopen, communications service suppliers are focusing on 5G rollouts and increasing investments in this platform.

Download Free sample to learn more about this report.

Network Slicing Market Trends

Increasing Demand for IoT Solutions to Propel the Market

Widespread acceptance of IoT and developments in Machine-to-Machine (M2M) communication networks are renovating several industries by connecting all systems, appliances, and devices. The necessities for IoT applications can be considered low-latency, high-power applications (mobile video surveillance) and long-range, low-latency, low-powered IoT applications (smart factories and smart cities), which require network slicing for these applications to work effectively.

Further, the advancement of the 5G technology is anticipated to gain speed in assisting these specific requirements for emerging IoT applications, characterized as mission-critical applications and machine-type communication, boosting the need for such solutions during the forecast period.

Therefore, the above factors will boost the market during the forecast period.

Network Slicing Market Growth Factors

Increasing Demand for Next-generation 5G Networks and Proliferation of SDN and NFV to Drive Market Growth

5G networks have improved bandwidth and speed compared to previous mobile networks. It also allows for the creation of virtual networks, which can be customized to meet specific needs for latency, security, bandwidth, reliability, service levels, and coverage. Hence, this platform is expected to play a key role in the 5G market growth.

Furthermore, SDN and NFV technologies automate modern networks through software. They are driving the digital transformation of network infrastructure across the telecommunications industry. NFV virtualized network functions such as routing, load balancing, and firewalls. SDN allows network administrators to provide services across hardware components. NFV and SDN are necessary for network slicing and make it possible for networks to be quickly and easily configured to meet the needs of various applications and services.

Hence, the factors mentioned above are expected to propel the market growth.

RESTRAINING FACTORS

Security Breaches Leading to Massive Operational and Financial Loss to Hamper the Market Growth

CIOs are largely concerned with network slicing security, which can lead to a huge loss for service providers and businesses. Further, the new network infrastructure has been designed with the help of NFV, SDN, and cloud-native architecture. These network functions are disaggregated from infrastructure and placed across regional, local, and central data centers. Moreover, in a cloud-driven 5G network, most network functions are deployed over private and public cloud infrastructure. However, the security issues associated with the solution hampered the market growth.

Network Slicing Market Segmentation Analysis

By Enterprise Type Analysis

Large Enterprises Segment to Dominate Supported by Escalating Product Demand

According to enterprise type, the market is bifurcated into large enterprises and small & medium enterprises. Large enterprise segment will lead the market during the forecast period. The Large enterprise segment is expected to lead the market, contributing 68.86% globally in 2026. due to the initial adoption of the solution. In addition, large enterprises' use of 5G networks and the Internet of Things (IoT) increased the need for this platform to provide improved services to customers without any disturbance.

Small & medium enterprises segment is projected to witness an average growth rate throughout the projected period as companies have recently implemented this platform for their productivity and cost-effectiveness.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Data Generation of Employees to Boost the Healthcare Segment

As per our study, healthcare holds the highest share of the global market with a share of 21.82% in 2026. due to increasing applications such as remote monitoring of patients and elders who require continuous tracking. Additionally, remote surgery is one of the most critical IoT healthcare applications requiring communication services with ultra-reliability and low latency, which boosts the segment's share.

The media & entertainment segment is expected to grow at the highest CAGR during the forecast period. More latency causes experiencing dizziness (cyber-sickness) and disorientation to users while using VR/AR devices. Hence, the Motion-to-Photon (MTP) latency, achieved through network slicing, is essential to keep less than 20ms. Moreover, national broadcasters have started to experience the benefits of this solution and 5G for the remote broadcasting of major events, thereby fueling segmental growth.

REGIONAL INSIGHTS

As per our report, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Network Slicing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2024, North America dominated the market by holding 36.8% of the global market share. North America dominated the global market in 2025, with a market size of USD 0.62 billion. North America is a technologically advanced region comprising many countries that readily accept new technological advancements. Additionally, the region is an early adopter of 5G services in augmented reality, virtual reality, autonomous driving, and artificial intelligence. Moreover, government initiatives to improve 5G telecom infrastructure in the region significantly fuel the market. The U.S. market is projected to reach USD 0.56 billion by 2026. For instance,

- In February 2019, the Federal Communication Commission (FCC) declared an approach to facilitate 5G technology in America.

To know how our report can help streamline your business, Speak to Analyst

The Asia Pacific will grow at the highest CAGR during the forecast period owing to several growing economies, such as Japan, China, and India, which are likely to record high growth in the market. Additionally, they own an established technological infrastructure, supporting the implementation of these solutions across all industry verticals. Further, the widespread acceptance of mobile devices across developing countries such as China, India, and Japan is projected to boost the market. Moreover, increasing collaborations and partnerships among regional companies to provide better solutions are driving the Asia Pacific network slicing market share. The Japan market is projected to reach USD 0.13 billion by 2026, the China market is projected to reach USD 0.17 billion by 2026, and the India market is projected to reach USD 0.11 billion by 2026.

Europe holds the second highest share in the global market owing to rising concern of handling enormous data, improving operational efficiencies, and evolving digital technologies such as 5G, cloud, mobile platforms, and Big Data. Moreover, new product launches in the region are expected to boost the market share. For instance, in September 2022, Orange Belgium deployed standalone 5G over a cloud-native architecture to offer better services to its customers. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.15 billion by 2026.

The Middle East & Africa and South America are expected to grow steadily during the forecast period owing to increasing footprints of key companies. Further, increase in acceptance of the cloud in the region is expected to boost the market growth.

Key Industry Players

Key Players Launch New Products to Strengthen Market Positioning

Major players in the market are developing new and advanced solutions for customers. They also focus on improving their existing product portfolio to provide flexible solutions with unique characteristics. Additionally, the organizations aim for collaboration, partnerships, and acquisitions to strengthen their product offerings.

List of Top Network Slicing Companies Profiled:

- Samsung (South Korea)

- Nanjing ZTE Software Co. Ltd. (China)

- Intel Corporation (U.S.)

- Amdocs, Inc. (U.S.)

- Nokia Corporation (Finland)

- Telefonaktiebolaget LM Ericsson (Sweden)

- VMware, Inc. (U.S.)

- Mavenir Systems, Inc. (U.S.)

- Affirmed Networks (U.S.)

- Tambora Systems Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Ericsson, BT Bunch, and Qualcomm Advances, Inc. have effectively illustrated end-to-end enterprise and consumer 5G network slicing. This is empowered by Ericsson's 5G Center and Radio Access Network Technology to Organize innovation within the UK.

- August 2023: T-Mobile launched 5G network slicing beta for engineers. The beta enables engineers to supercharge video calling applications by giving upgraded arrange conditions, steady uplink and downlink speeds, lower idleness, and expanded unwavering quality, all through T-Mobile's 5G SA (Standalone) arrangement.

- June 2023: Nokia reported that it has effectively trialled an inventive modern arrangement that empowers Android smartphone clients to buy and actuate network slices on-demand from their administrator. The move, which is accessible to Android 14 clients, will permit conclusion clients to improve their encounters over a wide range of applications, such as gaming, broadcasting, spilling, and social media.

- July 2022: Ericsson collaborated with Telefonica to reveal its end-to-end, automated network slicing in 5G standalone in Madrid.

- June 2022: Amdocs and A1 Telekom Austria Group achieved a 5G network slicing proof of concept. This proof of concept determines the capability of Amdocs’ service and network offering to fuel on-demand connectivity and next-generation experiences for enterprises and consumers through the management, deployment, and monetization of 5G network slices.

REPORT COVERAGE

The research report comprises prominent areas worldwide to get a better knowledge of the industry. In addition, the study provides insights into the most recent market trends and an analysis of technologies being adopted globally. It also highlights some of the growth-stimulating restrictions and elements, enabling the reader to gain a detailed understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 35.64% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 29.05 billion by 2034.

In 2025, the market stood at USD 2.53 billion.

The market is projected to grow at a CAGR of 35.64% in the forecast period (2026-2034).

By end-user, the media & entertainment segment is likely to lead the market.

Increasing demand for next-generation 5G networks and proliferation of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) to drive the market.

Samsung, Nanjing ZTE Software Co. Ltd., Intel Corporation, Amdocs, Inc., Nokia Corporation, Telefonaktiebolaget LM Ericsson, VMware, Inc., Mavenir Systems, Inc., Affirmed Networks, and Tambora Systems Ltd. are the top players in the market.

North America is expected to hold the highest market share.

Large enterprises segment is expected to grow with the highest CAGR by enterprise type.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us