Neurovascular Devices Market Size, Share & Industry Analysis, By Device Type (Stenting Systems, Embolization Devices, Neurothrombectomy Devices, and Support Devices), By Application (Cerebral Aneurysms, Ischemic Stroke, and Others), By End-user (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

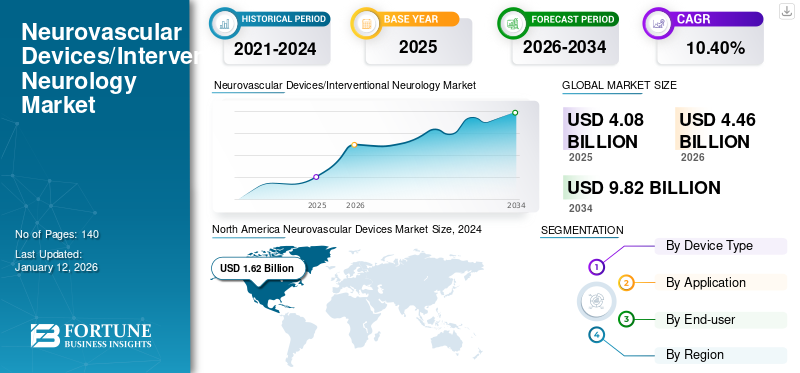

The global neurovascular devices market size was valued at USD 4.08 billion in 2025. The market is projected to grow from USD 4.46 billion in 2026 to USD 9.82 billion by 2034, exhibiting a CAGR of 10.40% during the forecast period. North America dominated the global neurovascular devices market with a market share of 43.60% in 2025.

Neurovascular devices include stenting systems, embolization devices, and neurothrombectomy devices for treating neurovascular disorders such as brain aneurysms. The increasing prevalence of these disorders among the population and rising government initiatives to create awareness regarding treatment options are expected to fuel the product demand to manage these diseases.

- According to the data published by the Centers for Disease Control and Prevention (CDC) in January 2021, around 800,000 people suffer a stroke in the U.S. annually, with more than 75% occurring in people aged 65 years and above.

- Also, as per the Brain Aneurysm Foundation in 2022, around 15.0 million people suffer strokes globally every year. It is also estimated that around 6.7 million people have an unruptured brain aneurysm, and brain aneurysm rupture occurs in around 30,000 people in the U.S. annually.

Furthermore, the increasing focus of market players on the development of new technologically advanced devices is expected to expand the availability of advanced devices for effective treatment, fueling the neurovascular devices market growth.

- For instance, in Feburary 2024, Route 92 Medical, Inc. completed the enrollment of its product HiPoint Reperfusion Catheters in the SUMMIT MAX clinical trial.

In 2020, after the sudden outbreak of COVID-19, the market experienced a slow growth in its value. This was due to restrictions in the number of patients visiting the hospitals and clinics depending upon the severity of their condition. However, the market experienced significant growth during 2021 and 2022 due to the high burden of neurovascular diseases and an increasing number of individuals taking the treatment.

Global Neurovascular Devices Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 4.08 billion

- 2026 Market Size: USD 4.46 billion

- 2034 Forecast Market Size: USD 9.82 billion

- CAGR (2026–2034): 10.40%

Market Share Analysis:

- North America held the largest share at 43.60% in 2025, driven by a high prevalence of neurovascular disorders, favorable reimbursement policies, and strong product launches.

- By Device Type, the Embolization Devices segment dominated in 2024, owing to rising cases of cerebral aneurysms and increasing product innovations.

Key Country Highlights:

- United States: Largest contributor due to high stroke prevalence (800,000 strokes annually), strong reimbursement structures, and high procedural volume.

- Germany, France, U.K.: Leading markets in Europe, supported by advanced healthcare systems, ongoing product approvals, and heightened awareness of neurovascular conditions.

- China & India: Fastest-growing markets due to the increasing geriatric population, rising stroke cases, and strategic collaborations for market penetration.

- Brazil & Mexico: Latin American markets showing steady growth with increasing awareness and product launches (e.g., Wallaby Medical's pRESET device in Brazil).

- Middle East & Africa: Gradual growth due to improved healthcare infrastructure and rising incidence of neurological diseases, though market penetration remains limited due to lack of specialized expertise.

Neurovascular Devices Market Trends

Increasing Focus of Market Players on Adoption of Advanced Technology to Enhance Efficiency of their Product Offerings

Leading global and regional players have been constantly investing in R&D to focus on underpenetrated areas of neurovascular interventions and introduce new products in the market. The development of new embolic coils, aspiration catheters based on advanced technologies, and revascularization devices for ischemic strokes are some of the leading examples of strong shift toward advanced neurovascular devices.

Furthermore, market players have been emphasizing on conducting clinical studies to create strong clinical efficiency of their pipeline devices.

- For instance, Penumbra, Inc. is conducting a clinical trial called CHEETAH for its Indigo System CAT RX Aspiration Catheter to establish the performance and efficiency of these devices in clot retrieval. In November 2021, the company announced that the catheter achieved the primary endpoint in the Cheetah clinical study.

- In addition, NeuroVasc Technologies is conducting a clinical trial for its novel stent-retriever. In June 2022, the company announced the first patient treated in a clinical trial to evaluate its NeuroVasc Envi-SR novel stent-retriever for the endovascular treatment of ischemic stroke.

Ischemic strokes have been traditionally treated with alternative therapies, and a limited number of patients qualify for mechanical thrombectomy. Market players have identified the unmet needs and are focusing on introducing advanced devices to cater to the growing demand.

Download Free sample to learn more about this report.

Neurovascular Devices Market Growth Factors

Rising Incidence of Neurovascular Conditions to Surge the Demand for Neurovascular Devices

The increasing prevalence of neurovascular conditions such as stroke, cerebral aneurysms, and others is one of the significant factors contributing to the rising patient population globally. The prevalence of these neurovascular conditions is higher in the geriatric population.

- According to data published by the World Health Organization (WHO) in 2022, the risk of stroke increased by 50% from the last 17 years globally. Moreover, 1 out 4 individuals are expected to suffer from stroke during their lifetime.

- Moreover, as per a study published by Elsevier B.V., in 2023, the prevalence of stroke in elderly population was around 7.4% globally.

The prevalence of neurovascular disorders has been increasing significantly due to the rising geriatric population, sedentary lifestyle, and other factors. Rising burden of the disease along with increasing healthcare expenditure and rising awareness about the effective treatment has been fueling the number individuals undergoing neurovascular treatment, positively impacting the market. Furthermore, this has been facilitated by the reimbursement policies being laid down in various countries, which has fueled the preference toward these procedures, thereby driving the growth of the global market.

Increasing Government Initiatives to Create Awareness of Neurovascular Diseases to Fuel Market Augmentation

Neurological disorders requiring interventional treatment are among the conditions that do not show physical symptoms in the early stages. This has been a significant reason for the critical nature of these conditions. This has generated a need to establish a well-developed plan for efficient and timely diagnosis of these conditions.

Various global & national agencies and public & non-profit organizations have been actively focusing on establishing such plans to effectively and timely manage neurological conditions that require intervention.

- For instance, in May 2021, a declaration for the Stroke Action Plan was signed by the Ukrainian MoH for Europe to fight against stroke. This action was supported by the European Stroke Organization (ESO).

- Additionally, in 2019, the national plan for stroke was launched by the Ukraine’s Ministry of Health (MoH) to implement changes, ensure investments, and achieve technical excellence.

Such initiatives undertaken by hospitals, healthcare systems, associations/societies, and government health departments to improve diagnosis are projected to present a large patient pool undergoing treatment. This combined with developing healthcare infrastructure in emerging countries and introducing technologically advanced products for neurovascular interventional procedures is anticipated to surge the demand and adoption of these devices.

RESTRAINING FACTORS

Limitations Associated with the Use of Neurovascular Devices May Limit its Adoption Globally

Several government and private agencies are striving to establish clinical plans and guidelines and implement various initiatives to promote early and efficient diagnosis of patients suffering from neurological disorders.

However, despite the efforts of these organizations, there are many cases of delayed diagnosis or misdiagnosis of brain aneurysms due to the failure to conduct brain imaging scans, lack of expertise among the physicians and errors, especially in emergency departments.

- For instance, according to data published by the Brain Aneurysm Foundation in 2022, in the U.S., almost one of every four patients with brain aneurysms is misdiagnosed or receives a delayed diagnosis.

Moreover, the rate of delayed diagnosis or misdiagnosis is considerably higher in developing countries such as India and China. The delay in these countries is mainly attributed to the factors such as limited awareness among the general population toward neurological disorders, limited access to well-developed healthcare infrastructure, and lack of established guidelines and plan of action by governing bodies.

Such factors are expected to limit the market growth during the forecast period.

Neurovascular Devices Market Segmentation Analysis

By Device Type Analysis

Embolization Devices Segment to Lead Owing to Growing Product Launches by Market Players

Based on device type, the market is segmented into stenting systems, embolization devices, neurothrombectomy devices, and support devices.

The embolization devices segment dominated the market accounting for 45.29% market share in 2026. The segment’s dominance is attributed to the high number of patients getting treatment for cerebral aneurysms. In addition, an increasing number of new devices, such as the POD Embolization Anchoring Device (Penumbra Inc.), among others with advanced features, fueled the demand for this segment during neurovascular intervention procedures.

The neurothrombectomy devices segment is expected to register a significant CAGR during the forecast period. The rising prevalence of acute ischemic stroke and the increasing number of product launches by prominent players are resulting in the growing demand for the neurothrombectomy devices segment.

- For instance, in April 2019, Medtronic announced the launch of the Solitaire X Revascularization Device in the U.S. to remove blood clots in the brain.

Moreover, the stenting systems segment is expected to account for a significant market share owing to the growing end-user preference for minimally invasive neurological procedures.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Cerebral Aneurysms Segment is Projected to Dominate Owing to the Growing Number of Patients

Based on application, the market is segmented into cerebral aneurysms, ischemic stroke, and others. The cerebral aneurysms segment dominated the market in 2024, owing to the growing prevalence of cerebral aneurysms globally and the availability of new devices for treating the condition.

- For instance, due to the clinically proven efficiency of these procedures in treating the condition, embolization and thrombectomy are among the most preferred procedures for treating cerebral aneurysms. This has been pivotal in the higher demand for devices in the treatment of cerebral aneurysm in the global market.

Ischemic stroke segment is expected to grow at a higher CAGR owing to the increasing incidence of ischemic stroke globally.

- For instance, as per the Center for Disease Control and Prevention (CDC) in 2020, ischemic stroke was by far the most common type of stroke, accounting for about 87.0% of all strokes.

The others segment is expected to grow in the market owing to the increasing prevalence of hypertension, alcohol consumption, and smoking among the population, which boosts the others segment.

By End-user Analysis

Hospitals Segment is Projected to Dominate Owing to the Higher Adoption of Cutting-edge Technologies in Hospitals

Based on end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospitals segment is projected to dominate the market with a share of 72.20% in 2026. The dominance is due to increasing hospitalizations of patients suffering with neurovascular diseases and the comparatively higher adoption of cutting-edge technology-based neurovascular solutions in hospitals.

- According to various national hospital databases in the U.S., the U.K., and other countries, neurovascular conditions were among the leading causes of inpatient admissions in these countries during 2014-2019.

Specialty clinics segment accounted for a significant share of the market in 2024. The segment is expected to grow at a significant CAGR during the forecast period owing to increasing number of specialty clinics in developed countries and the developing healthcare infrastructure and facilities in emerging countries such as China, India, and Brazil.

REGIONAL INSIGHTS

North America Neurovascular Devices Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

On the basis of region, North America accounted for the highest neurovascular devices market share and generated a revenue of USD 1.96 billion in 2026. The region is anticipated to dominate the market in the coming years owing to the growing prevalence of various neurological disorders and higher diagnosis and treatment rates. Moreover, growing healthcare expenditure supporting neurological care in the region and adequate reimbursement for various neurological disorders will promote the adoption of advanced, novel treatment options in the region. For example, private and government health insurers, such as Medicare, Medicaid, and others, provide favorable reimbursement policies for neurovascular products, including all embolic and liquid coils. The U.S. market is projected to reach USD 1.88 billion by 2026.

On the other hand, Europe is likely to hold a substantial share of the market. The growth is mainly attributed to the increasing importance of the proper management of neurovascular conditions, rising product launches intended for the treatment of neurovascular diseases, and growing efforts by prominent players operating in the market to expand their geographical presence. In addition, new product approvals are primarily contributing to the market growth. The UK market is projected to reach USD 0.16 billion by 2026, while the Germany market is projected to reach USD 0.35 billion by 2026.

- For instance, in April 2019, Medtronic received approval for extended applications of its Pipeline Flex embolization devices, which were earlier limited for use in adults suffering from cerebral aneurysms.

The market in Asia Pacific is expected to grow at a significant CAGR during the forecast period due to the increasing prevalence of geriatric population likely to develop various neurovascular conditions. Growing strategic initiatives by key players to expand the penetration of various devices in the regional market and rising awareness regarding new and recent treatments among the patient population are some factors influencing the market growth. The Japan market is projected to reach USD 0.53 billion by 2026, the China market is projected to reach USD 0.22 billion by 2026, and the India market is projected to reach USD 0.85 billion by 2026.

- For instance, in January 2021, Genesis Medtech collaborated with Penumbra, Inc. to expand the neurovascular market in China.

Further, Latin America is expected to grow at a moderate growth rate during the forecast period. Increasing awareness regarding the diseases among the general population, rising prevalence of various brain-related disorders, and rising technological advancements by key players to introduce new devices in the region are some of the major factors responsible for the market growth in the region.

- For instance, in August 2022, Wallaby Medical announced the launch of pRESET thrombectomy device in Brazil.

Similarly, growing collaboration and partnerships among key players to expand their geographical presence and improving healthcare infrastructure are a few factors driving the market growth in Latin America and the Middle East & Africa.

List of Key Companies in Neurovascular Devices Market

Stryker to Lead the Market with Strong Product Portfolio

Market players such as Stryker, Medtronic, Terumo Corporation, and Penumbra Inc. accounted for a major portion of the market share in 2024. The strong presence of these companies is due to their focus on launching technologically advanced medical devices to strengthen its neurovascular product portfolio. Furthermore, the company’s increasing emphasis on opening R&D to enhance its product development is also responsible for its market dominance.

- For instance, in December 2022, Stryker announced the launch of a state-of-the-art Neurovascular R&D lab with advanced technology to accelerate stroke care innovation.

With strategic mergers and acquisitions, Medtronic is increasing its focus on approving and introducing devices globally. This strong emphasis on R&D to develop and launch devices for various neurological conditions to cater to the rising population's rising demand is expected to contribute to the company’s market share.

- In May 2019, Medtronic announced the launch of Phenom 21 Catheter, a 160cm long microcatheter used to deliver all sizes of Solitaire X. This revascularization device is used to treat acute ischemic stroke.

The growing investment of other players in research & development activities for developing advanced technologies for the condition is resulting in increased demand for devices for the treatment of neurovascular diseases. These factors are expected to increase these companies' market share in the future.

- In June 2022, NeuroVasc Technologies, Inc. announced the first patient treated in a clinical trial to evaluate its novel stent-retriever intended to treat acute ischemic stroke.

LIST OF KEY COMPANIES PROFILED:

- Medtronic (U.S.)

- Penumbra, Inc. (U.S.)

- Stryker (U.S.)

- Johnson and Johnson Services, Inc. (CERENOVUS) (U.S.)

- MicroPort Scientific Corporation (China)

- Acandis GmbH (Germany)

- MicroVention, Inc. (U.S.)

- NeuroVasc Technologies, Inc. (U.S.)

- ASAHI INTECC CO., LTD. (Japan)

- Perflow Medical Ltd. (Israel)

KEY INDUSTRY DEVELOPMENTS

- January 2023 – Penumbra, Inc. launched its U.S. Food and Drug Administration (FDA) approved Lightning Flash, a mechanical thrombectomy system.

- November 2022 – iVascular expanded its product offerings for neurovascular disease treatment with the launch of CE-marked iNdeep microcatheter, iNtercept retriever device, iNedit balloon distal access catheter, and iNstroke 4Fr and 6Fr aspiration catheter.

- October 2022 - Medtronic announced the launch of Neurovascular Co-Lab Platform designed to accelerate urgently needed innovation in stroke care and treatment.

- September 2022 - Penumbra, Inc. announced the launch of RED reperfusion catheters for stroke care in Europe.

- June 2022 - MicroPort Scientific Corporation completed the first commercial implantation with its independently developed Numen Coil Embolization System (Numen) in the U.S.

REPORT COVERAGE

The market research report covers a detailed analysis and overview. It focuses on key aspects such as competitive landscape, device type, application, end-user, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.40% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Device Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 4.46 billion in 2026 and is projected to reach USD 9.82 billion by 2034.

The market is expected to exhibit a CAGR of 10.40% during the forecast period (2026-2034).

The embolization devices segment is set to lead the market by device type.

The key factors driving the market are rising incidence of neurovascular conditions, increasing demand for minimally invasive procedures, and increasing research & development activities by the major market players.

Medtronic, Stryker, and Penumbra, Inc. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us