North America Electrical Conduit Market Size, Share & COVID-19 Impact Analysis, By Product Type (Flexible Cable Conduit, Rigid Cable Conduit, Others), By End-user (Buildings &, Construction, Manufacturing, IT & Telecommunication, Others), and Regional Forecasts, 2025-2030

North America Electrical Conduit Market Size

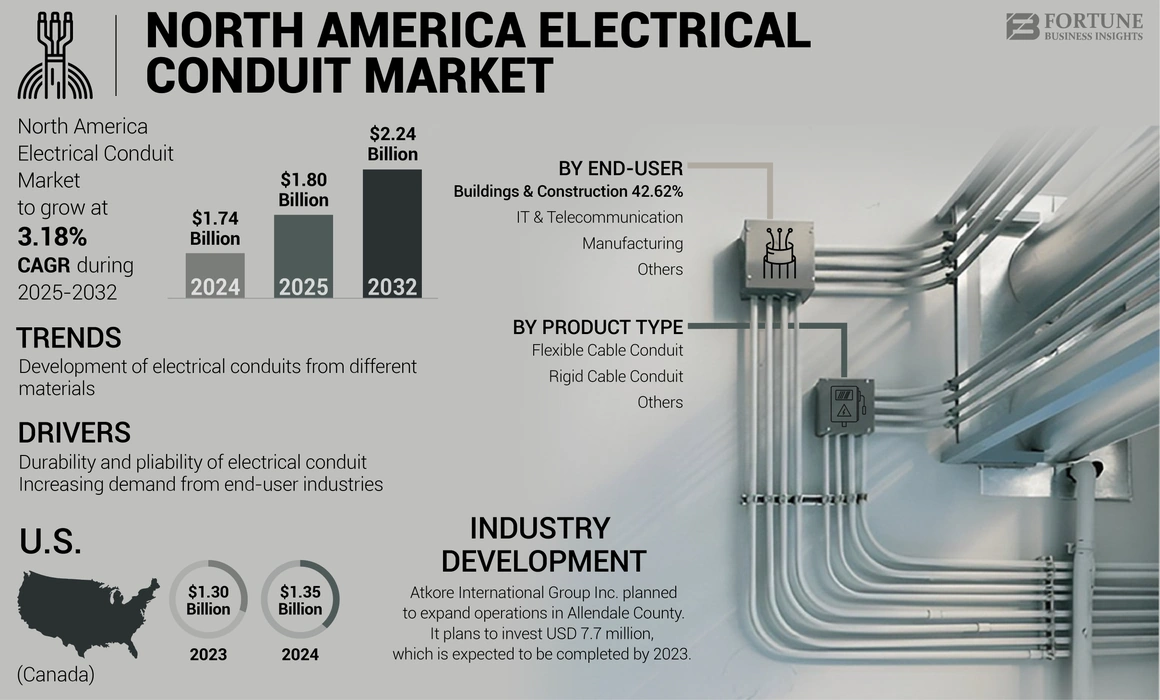

The North America electrical conduit market size was valued at USD 1.74 billion in 2024 and is projected to grow from USD 1.80 billion in 2025 to USD 2.24 billion by 2032, exhibiting a CAGR of 3.18% during the forecast period.

Electrical conduit is a cylindrical tube that is used to safeguard and route electric wirings in commercial, residential, and industrial buildings. These electric conduits are made up of metal, plastic, and fiber. Most lines are stiff, but flexible lines are widely used for multiple purposes. Electrical experts and wiremen install this electric conduit at the electrical equipment installation sites. Conduit systems are classified by their material. The electrical conduits are generally classified into flexible cable conduit, rigid cable conduit, and others.

COVID-19 IMPACT

Disruption in Supply Chain and Decline in Revenue amid Pandemic Hampered the Market Growth

Key players operating in the commercial and residential space have experienced substantial risks for their business development, owing to the emergence of a new virus, which led to the closure of commercial and industrial spaces and decline in product/service demand.

Furthermore, travel restrictions imposed by individual countries or regions impact the supplier's ability to manufacture and deliver goods on time, which could lead to manufacturers needing more time to fulfill their obligations toward customers.

Failure could harm the respective project and manufacturers' ability to secure new contracts in the future, thus leading to a decline in revenues. Subsequently, the volatility of raw material prices has also led to a slight decline in various manufacturers.

LATEST TRENDS

Download Free sample to learn more about this report.

Development of Electrical Conduits from Different Materials Spur Market Opportunities

Various composite products are being manufactured across multiple industries owing to significantly reduced production costs and less material fatigue, as composite materials don’t get rust or corrode readily. Across major industries, power generation is one of the most critical sectors for many countries. However, a problem in creating a better power transmission grid is often encountered as creating a transmission line that is non-interconnected is expensive to manufacture, install, and maintain.

The electrical transmission conduits are generally buried, which can cause the electrical conduits to deteriorate. Companies operating in the market have overcome the problem by developing a fiberglass composite conduit option that offers advantages. An advantage of composite conduits is that they have longer service life than other conduit types.

Other benefits that composite conduit offer include the following:

- High corrosion resistance

- Exceptional impact and crush resistance

For example, in September 2021, Atkore’s FRE Composites fiberglass conduit has recently experienced a surge in demand owing to its more efficient cost compared to other conduit material types. The fiberglass conduit also possesses lighter weight and high durability, which result in major adoption in various projects.

The advantages of composite-made conduit make this type of conduit a better choice for electrical projects than other conduit types. Composite pipes can reduce the cost of these projects and allow energy companies to protect their power transmission infrastructure more effectively.

DRIVING FACTORS

Durability & Pliability of Electrical Conduit Likely to Drive Market Growth

PVCs and flexible electrical conduit pose better durability and flexibility for wire protection at indoor & outdoor spots of buildings and other application spaces. For instance, the Carlon P&C Flex non-metallic corrugated conduit offered by ABB makes power and communication installations faster and easier by offering maximum installation flexibility. The corrugated design is flexible enough to billet any degree of bending requirement. Unlike rigid tubing, it has a tight bend radius, making this product ideal for shallow trenches.

With increased energy consumption propelled by massive industrialization, urbanization has aroused the need for high-standard and efficient electrical equipment and wiring devices. For context, as per the EIA, in 2021, the U.S. consumed 97 quadrillion of Btu of energy. Such high demand for electricity/energy needs high-performance conductors and wires, which requires durable and premium electrical conduits to manage the electrical wire system of the large building and industrial units, which is likely to increase the demand for PVCs and flexible electrical conduits.

Furthermore, with the increasing shift toward renewable power generation, there has been a growth in offshore renewable energy technologies such as offshore wave & tidal, offshore wind farms, and others, which is likely to create significant demand for electrical conduit as cable protection is one of the most critical factors for the renewable energy industry.

Increasing Demand from End-user Industries to Favor Market Growth

An electrical conduit serves the purpose of protecting and routing electrical cables. Depending on the intended use, they can be made from various materials such as plastic, metal, fiber, and others. Qualified electricians usually install them at the installation site of the electrical equipment.

Leading industries such as construction, building & infrastructure, I.T. & telecom, where these conduits are widely used to protect and route electrical wiring of the building or structure from moisture, dust, chemical vapors, and impact. The growth in construction and infrastructural activities surges the product demand.

In addition, data centers are essential for I.T. services, communication, and networks. Data centers are heavily dependent on data storage and the routing of traffic through Them. As Big Data grows, data centers are now in high demand, and the advent of Big Data contributes to the exponential growth rate of high-quality and reliable data centers.

Enterprises prefer cloud storage to reduce costs and eliminate the hassle of maintaining data centers that would cost billions of dollars. For instance, fiber optic electrical wire projects get benefits from lower weight, less installation costs, superior pressure, and impact resistance. In data centers, project administrators are finding electrical conduits to be worthier than PVC.

RESTRAINING FACTORS

Volatility in Raw Material Prices and Supply to Hinder Market Growth

The primary raw materials for manufacturing electrical conduits are rubber and plastic-based ingredients such as PVC grains, and metals. An increase in raw materials prices, especially metals, directly impacts the conduits manufacturer’s profit margin, restraining the North America electrical conduit market growth.

Moreover, disruption in the import, export, and outsourcing of these conduits has also resulted in the closure of manufacturing plants, resulting in the slowdown of the market growth. For example, in October 2022, Zekelman Industries plans to close its steel conduit manufacturing facility in Long Beach, California. The company also stated that steel conduit imports from Mexico have surged despite an understanding linked to the U.S.-Mexico-Canada Agreement, resulting in lower product demand.

Additionally, per the U.S. Census Bureau, the expected quantity of conduits made from steel imported from Mexico will increase from 11,960 tons in 2017 to an estimated 69,641 tons in 2022, an increase of 480%.

SEGMENTATION

By Product Type Analysis

Flexible Cable Conduit to Hold Dominant Market Share Due to its Flexibility and Adoption in Critical Applications

Based on product type, the market has been segmented into flexible cable conduit, rigid cable conduit, and others.

Flexible cable conduit segment holds the dominating share. Factors such as long service life, easy installation, and high protection of conductors from moisture, corrosion, impact, and chemicals make it one of the most preferred choices for contractors in residential and commercial applications.

Followed by flexible electrical conduit, rigid cable electrical conduit augment holds the dominant market share. Its lightweight property provides better protection in severe corrosive areas.

Subsequently, other segments, which generally constitute intermediate conduit and non-metallic conduit will also experience significant growth in the forthcoming years owing to its increase in its adoption in new construction as intermediate conduit is lighter and more accessible than rigid conduits.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Buildings & Construction Industry to Dominate the Market Due to Increase in Infrastructural Development

Based on end-user, the market is classified into buildings & construction, manufacturing, IT & telecommunication, and others.

The market is primarily dominated by buildings & construction applications due to wide adoption to provide adequate protection for homes, buildings, and commercial spaces from electrocution. With increased construction activities and infrastructural development, the buildings & construction segment is likely to maintain its dominating market share during the forecast period.

Furthermore, the use of electrical conduit to provide fiber optic cables with superior protection and versatility in the I.T. and telecom industry is resulting in its wide adoption. Growth in the digital industry and digitalization is resulting in the fast growth of this type of conduit across the I.T. & telecommunication industries.

Subsequently, other major industries include data centers, food & beverages, and healthcare, which will also experience significant growth during the forecast period. Factors such as increase in data center usage and cloud computing are resulting in the adoption of electrical conduit due to its lightweight, easy installation, and secure cable management.

REGIONAL INSIGHTS

U.S. to Dominate the Market Owing to the Presence of Key Players and Growing Industrial Activities

Based on country analysis, the U.S. dominated the North America electrical conduit market share in 2024. Factors such as increasing investment in power transmission & distribution and the construction sector are expected to drive the U.S. market during the forecast period. Additionally, increasing usage of consumer electronics is likely to boost the adoption of these conduits in I.T. and telecommunication in the U.S., which will eventually fuel the growth of the U.S. market during the forecast period.

Furthermore, as Canada’s economy and population continue to rise, the need for infrastructure and housing also continues to expand. This has positioned the construction industry for solid growth in the coming years, which will likely drive the market growth in Canada.

KEY INDUSTRY PLAYERS

Key Participants are Concentrating to Enhance their Business Capacities to Deliver Efficient Products

The market’s competitive landscape is considerably fragmented, with various players operating at the domestic, regional, and global levels. The market participants are significantly focusing on developing electrical conduits with enhanced operational characteristics to fortify their foothold in the industry.

Atkore International Group Inc. is expected to generate significant market share due to its increasing focus on the merger & acquisition of various companies operating in the market. Besides, ABB Group has also exhibited significant potential and is striving to expand its horizons by successfully delivering its electrical conduits & other products for a wide range of applications.

Other key participants operating in the market include WL Plastics, IPEX Inc., Champion Fiberglass, and many other small, medium, and prominent players. These organizations continuously focus on expanding their product offering and reach across the market.

List of Key Companies Profiled:

- Atkore International Group Inc. (U.S.)

- ABB (Switzerland)

- Eaton Corporation (Ireland)

- Legrand (France)

- IPEX Inc. (Canada)

- CANTEX Inc. (U.S.)

- Champion Fiberglass, Inc. (U.S.)

- PECO (U.S.)

- Electri-Flex Company (U.S.)

- WL Plastics (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 – Atkore International Group Inc. completed the acquisition of Elite Polymer Solutions, one of the leading manufacturers of High-Density Polyethylene (HDPE) tubing conduits, serving the telecom, utilities, and transport industry. This acquisition strengthens Atkore's HDPE pipe product portfolio while expanding its national footprint, enabling the company to serve the increased demand for underground protection in the electrical, utility, and telecommunications industries.

- October 2022 - Atkore International Group Inc. planned to expand operations in Allendale County. The company plans to invest USD 7.7 million, which is expected to be completed by 2023. Furthermore, adding HDPE manufacturing lines will help support the company’s growth, better serve its customers, and enable new opportunities.

- September 2022 - PFLITSCH and ABB formed an alliance to enhance cable protection safety and reliability. PFLITSCH selected ABB to design a combined product of cable assemblies, cable glands, accessories & specialized protection systems that integrate into high and low-voltage wiring and meet customers' needs across various applications.

- August 2022 – Effective July 1, 2022, Electric Sales Unlimited (ESU) joined the Champion Fiberglass team of manufacturer representatives. Based in California, ESU provides after-sales service and depots for distributors, fabricators, and spec influencers. Its main applications include commercial, industrial, and utilities spaces.

- November 2021 - IPEX Inc. announced the expansion of its new warehousing and distribution capabilities as a critical part of its North American growth strategy and customer service focus. The newest Distribution Center (DC) is in Charlotte, North Carolina and is now fully operational.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research reports present a comprehensive industry assessment by offering valuable insights, facts, industry-related information, and historical data. Several research methodologies and approaches are adopted to make meaningful assumptions and views to formulate the market report.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 3.18% from 2025 to 2032 |

|

Segmentation |

By Product Type, End-user, and Country |

|

Segmentation |

By Product Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights study shows that the North America market was USD 1.74 billion in 2024.

The North America market is projected to grow at a CAGR of 3.18% over the forecast period.

The market size of U.S. stood at USD 1.35 billion in 2024.

Flexible cable conduit dominates the North America market based on product type.

The North America market is expected to reach USD 2.19 billion by 2030.

The key market driver is increase in wire & cable protection demand and the durability of electrical conduit.

The top players in the market are Atkore International Inc., Legrand, and ABB, Cantex Inc.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us