North America Sump Pump Market Size, Share & COVID-19 Impact Analysis, By Type (Submersible Sump Pumps, Submersible Sewage Pumps, and Others), By Application (Residential, Commercial, and Industrial), By Channel (Retail, Online, and Wholesale), and Regional Forecast, 2025-2032

North America Sump Pump Market Size

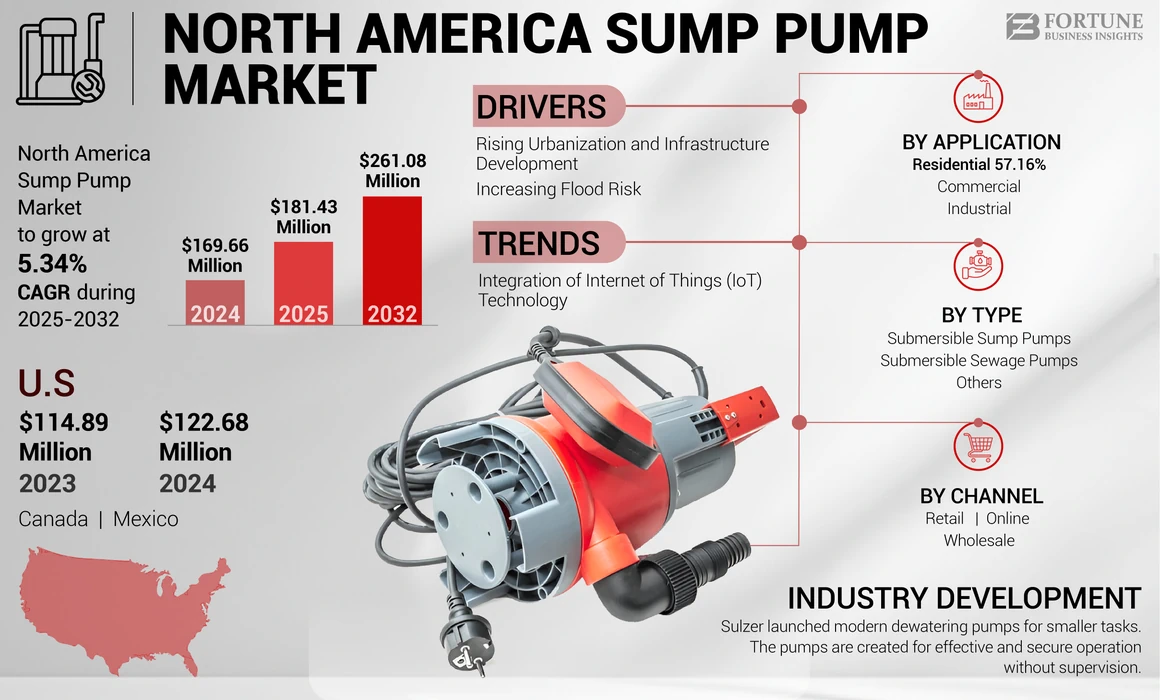

The North America sump pump market size was valued at USD 169.66 million in 2024. The market is projected to grow from USD 181.43 million in 2025 to USD 261.08 million by 2032, exhibiting a CAGR of 5.34% during the forecast period.

A sump pump is a device used to remove water that has accumulated in a sump basin, commonly found in basements. Pumps are usually activated by a float switch or pressure sensor. When the water level in the sump basin rises, the float switch triggers the pump to turn on.

The North America market was witnessing advancements in technology, including the development of smart pumps that could be remotely monitored and controlled through mobile apps. These smart features offered homeowners greater convenience and the ability to respond quickly to potential flooding situations. With changing weather patterns and an increasing number of severe weather events, there was a growing awareness of the risk of flooding among homeowners. This heightened awareness drove demand for pumps as a preventive measure to protect basements and crawl spaces from water damage. As awareness of environmental issues, such as climate change and energy consumption, increases, consumers are becoming more conscious of their carbon footprint. Energy-efficient pumps align with this trend as they help reduce overall energy consumption.

COVID-19 IMPACT

Increased Focus on Home Improvement Projects and Lockdowns and Restrictions During the Pandemic Had a Mixed Impact on the Market

The COVID-19 pandemic negatively and positively affected the North America sump pump market growth. Below are some of the pandemic effects on the market: With people spending more time at home due to lockdowns and remote work arrangements, there was an increased focus on home improvement and renovation projects. This led to a higher demand for installations as homeowners sought to protect their basements and properties from potential water damage. In addition, the pandemic emphasized the importance of having a safe and secure living environment. Homeowners, recognizing that their homes could become multi-functional spaces, become more aware of potential vulnerabilities, such as flooding and water damage, driving interest in pump installations. Furthermore, lockdowns and restrictions led to disruptions in supply chains and construction activities. This affected the availability of pump components and installation services, potentially causing delays for both consumers and professionals.

Moreover, uncertainty in the real estate market due to the pandemic might have impacted the demand for pumps. Homeowners selling their properties might have been less inclined to invest in costly home improvement projects, such as pump installations.

North America Sump Pump Market Trends

Integration of Internet of Things (IoT) Technology into Sump Pump Systems to Drive the Market Growth

Integrating IoT (Internet of Things) technology into pump systems has the potential to significantly impact and drive the growth of the North American market. IoT-enabled pumps allow homeowners to monitor and control their pump systems remotely through smartphones or other devices. This provides real-time information about the pump's performance, water levels, and potential issues. Some of the vendors who provide IoT-based pumps are Liberty Pumps, Zoeller Pump Company, Superior Pumps and others.

Users can receive alerts and notifications, enabling them to take immediate action to prevent flooding or other problems. IoT technology enables the collection and analysis of data from operations. Manufacturers and homeowners can gain valuable insights into the usage patterns, water levels, pump efficiency, and potential maintenance needs. This data-driven approach can lead to optimized pump performance and longer lifespan. IoT-enabled pumps can employ predictive analytics to anticipate maintenance needs based on collected data. This helps homeowners perform maintenance tasks proactively, reducing the risk of unexpected breakdowns and improving the overall reliability of the system. In the construction industry, especially for basements and below-grade structures, waterproofing is a critical consideration. Pumps play a vital role in this by removing excess water from the sump pit, preventing water accumulation that could lead to structural damage.

North America is the highest regional market for consumer IoT (Internet of Things) in 2022, adding up to around 22.9 billion USD. IoT technology allows for more precise control over pump operation. By analyzing data on water levels and usage patterns, IoT-enabled pumps can adjust their operation to optimize energy consumption, leading to cost savings for homeowners. The convenience of being able to monitor and control a pump remotely adds significant value to homeowners. The peace of mind that comes with real-time notifications and control contributes to a positive user experience.

Download Free sample to learn more about this report.

North America Sump Pump Market Growth Factors

Rising Urbanization and Infrastructure Development is Propelling Market Growth

Urbanization involves the expansion of constructed environments, which often leads to an increase in impervious surfaces, such as roads, sidewalks, and buildings. These surfaces prevent natural drainage and can result in more surface water runoff during heavy rainfall. These pumps become crucial in managing this excess water and preventing flooding. As cities grow, natural drainage systems, such as rivers, streams, and wetlands can be disrupted or replaced by concrete structures. This disruption can lead to inadequate drainage during storms, making an essential tool for managing the excess water. Urban areas typically have a higher concentration of buildings with basements. Heavy rainfall and improper drainage in urban settings can easily lead to basement flooding, making pumps an important solution to prevent property damage.

Urbanization can strain municipal drainage and sewer systems, leading to overwhelmed systems during heavy rainfall events. Sump pumps alleviate the burden on these systems by managing water at the property level. The most urbanized region comprises North America (with 82% of its population residing in urban areas in the year 2018). Urban areas often have higher population densities, which means more people and property are at risk during flooding events. Pumps provide localized protection against water intrusion. Wastewater treatment plants and facilities often have areas prone to flooding, such as pump rooms, basements, or equipment pits. Pumps may be installed in these locations to prevent water accumulation and protect critical infrastructure from water damage.

Increasing Flood Risk is Expected to Drive Market Growth

Changing weather patterns, intensified storms, and rising sea levels due to climate change have led to a higher frequency and severity of flooding events across North America. As a result, homeowners and property owners are recognizing the need to protect their properties from water damage proactively. Greater media coverage of flood-related incidents and their consequences has increased public awareness of the potential risks posed by flooding. This awareness drives individuals and communities to seek effective flood prevention measures, including pump installations. As per NOAA’s National Centers for Environmental Information (NCEI), record and assess weather and climate events with the most remarkable social and economic impacts. As per the NCEI data, over 70 % of water-connected events, such as hurricanes and floods, exceeded USD 1 billion in total losses and have accounted for more than 75% of losses, which is roughly USD 1.18 trillion from crucial flood events in less than three decades in the U.S. due to which sumps pumps are highly utilized in the homes.

Homeowners and property owners are increasingly concerned about preserving the value of their investments. Basement flooding and water damage can significantly decrease property values. This type of pumps are a preventive measure that helps maintain property values by reducing the risk of water damage. As urban areas expand and natural drainage systems are disrupted by construction and development, the risk of flooding can increase. Pumps become essential tools to manage excess water and prevent flooding in these environments.

RESTRAINING FACTORS

Complex Installation Process to Restrain the North America Sump Pump Market Growth

A complex installation process often requires professional assistance, which can increase the overall cost of installing a pump system. Homeowners may be deterred by the additional expenses associated with hiring professionals for installation. Complex installations can be time-consuming and labor-intensive. Homeowners may not want to invest significant time and effort into a project that they perceive as difficult, especially if they have other priorities. Some pump installations might require modifications to the property, such as drilling holes in the basement floor or walls. Homeowners might be hesitant to make these modifications, especially if they are concerned about the impact on the property's structure.

Dealing with a complex installation process that leads to frustration, stress, or unsuccessful attempts can negatively impact the homeowner's experience. This can result in homeowners giving up on the idea of installing a pump. Incorrect installation can lead to ineffective pump operation or even damage to the property. Homeowners might be concerned about making mistakes during installation that could have negative consequences. Homeowners with busy schedules might find it difficult to allocate the time needed for a complex installation. This can delay or deter the decision to install a system. The average price of installing a sump pump is around USD 1,400, though the cost may range around USD 500 to USD 4,000 depending upon the specifics of the home; thus, the high price and complex installation restrain the North America market.

North America Sump Pump Market Segmentation Analysis

By Type Analysis

Technological Advancements to Drive Submersible Sump Pumps Segment Growth

Based on type, the market is categorized into submersible sump pumps and submersible sewage pumps, and others. It is further divided into (sewage effluent pumps and sewage grinder pumps).

Since submersible pumps are installed within the sump pit, they do not require additional space in the basement or crawl space. This is particularly beneficial for homes with limited space. Submersible sump pumps is the dominating technological segment. Submersible pumps are benefiting from technological advancements, including features such as remote monitoring and smart controls, which make them more attractive to tech-savvy consumers.

Submersible sewage pumps is the second dominating segment and are generally less prone to clogging and blockages, resulting in lower maintenance requirements compared to non-submersible alternatives. The submerged motor design contributes to the prevention of debris and solid particles from interfering with the pump's operation.

By Application Analysis

Rising Incidence of Weather-Related Events to Propel Residential Segment Growth

Based on application, the market is trifurcated into residential, commercial, and others.

The residential segment is expected to dominate the North America market share during the forecast period. The increasing incidence of heavy rainfall, storms, and other weather-related events due to climate change has elevated the risk of flooding in residential areas. Homeowners are more likely to invest in flood prevention measures; such as pumps to safeguard their homes. The availability of user-friendly kits and installation guides makes it easier for homeowners to install pumps themselves. This accessibility encourages residential property owners to take preventive measures.

Commercial segment is the second largest dominating segment in the North America sump pump market. The dominance of the commercial segment in the North American market suggests that commercial establishments, such as office buildings, industrial facilities, and other non-residential structures, are crucial users of sump pump systems. Commercial buildings often house critical infrastructure, valuable equipment, and important documents. These pumps are important in preventing water damage and flooding in basements or lower levels, preventing to protect these assets.

To know how our report can help streamline your business, Speak to Analyst

By Channel Analysis

Retail Dominates the Wide Variety of Sump Pump Brands and Models which Drives the Market Growth

By channel, the market is divided into retail, online, and wholesale.

Retail is the dominating segment. Retail stores provide a convenient and accessible way for consumers to purchase pump systems. They can physically see the products, ask questions, and make informed decisions about the features that best suit their needs. Retail stores offer immediate product availability. Consumers who need a sump pump system urgently, especially in anticipation of severe weather events, can easily purchase and install systems without waiting for shipping.

Online segment is the second dominating segment. Online platforms provide a convenient way for consumers to access a wide range of products, including this type of pumps, from the comfort of their homes. This ease of access can contribute to the development of the online segment.

REGIONAL INSIGHTS

The U.S. holds the highest North America sump pump market share. The U.S. had a highest market share in the North America. These pumps are majorly used in areas prone to flooding to remove excess water from basements and lower levels of buildings. The U.S. has experienced its fair share of flood-prone areas due to various factors, such as heavy rainfall, hurricanes, and geographical conditions.

In April 2021, Liberty Pumps added modern models of condensate, drain pumps, and sumps to its large lineup. The modern LCU-PR series plenum-rated condensate pumps are authorized for installation entirely in plenums. They are created for the removal of condensate from refrigeration, air conditioning, and dehumidification installed in plenum and air handling applications having restricted space. The LCU-PR series pumps encounter UL standard 2043 for plenum applications and are obtainable in both 115 and 230 volts. They have also introduced the PC441-10A pump combo system, which is a totally pre-assembled primary pump and the 441-10A backup pump, which is obtainable in various primary pump models.

Canada is also one of the major markets in the North American market and is the second leading country in the region. Many buildings in Canada, especially those with basements, are designed with pump systems to prevent water infiltration. This practice is particularly common in regions with high water tables or potential flooding risks.

Key Industry Players

Wayne Pumps Leads the Market by Offering Wide Range of IoT Enabled Sump Pumps Products

Major market players, such as Wayne Pumps, providing a total line of pumps that are created for sump and battery backup systems, sewage pumps, and others. Wayne Pumps have made it exceptionally simple to gain full system prevention by installing a total, pre-assembled combination system, which is pre-plumbed and drop-in ready for an easy install.

In August 2021, Wayne created and released its newest IoT intelligent product, the Wayne Basement Guardian HALO smart sump pump. It is world’s first smart home. Alexa is an adaptable device that provides homeowners with real-time control of and details about the function of their basement pump.

List of Top North America Sump Pump Companies:

- Zoeller Pump Company (U.S.)

- Wayne Pumps (U.S.)

- Liberty Pumps (U.S.)

- Superior Pumps (U.S.)

- Glentronics (U.S.)

- Grundfos (U.S.)

- Franklin Electric (U.S.)

- RIDGID (U.S.)

- Pentair (U.S.)

- Tsurumi Pump (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2022 - Glentronics Inc. developed the PS-C50. The newest combo system from Pro Series pumps promotes higher pumping capacity with the same considerable reliability and quality contractors. The C-50 has industry-dominating monitoring features and is both simple and quick to position, even in small pits

- September 2022 - Sulzer launched modern dewatering pumps for smaller tasks. The pumps are created for effective and secure operation without supervision. The float switch offers automatic level control and ensures water levels are managed accurately while the built-in sensors prevent the motor from overheating.

- May 2022 - Pedrollo Group acquired a majority share of a Superior Pump. Through the acquisition of a major stake in Superior Pump, Gruppo Pedrollo is approaching two strategic objectives to build up through established, historical player existence in North America and to expand the whole product range of the Group to a large and combined consumer base.

- July 2021 - Pentair, a global provider of water treatment and sustainable solutions, provided its versatile pump controller to help lower the possibility of flooding at home. The Pentair Sump controller is a smart, connected apparatus that provides confidence and ease to homeowners by offering real-time pump alerts through the Pentair Home app and operating the sump pump when water increases due to weather events.

- April 2021 - the Warman SSB-A submersible pump from Weir Minerals offers a versatile pump and robust solution for sludge and slurry removal. Engineered for abrasive applications and for controlling solid particles, the pump’s applications comprise mine dewatering, cleaning up sumps, and removing mill scale together with moving slurry, coal-pile run-off, or dirty water with a solids content of up to 60% by volume.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.34% from 2025 to 2032 |

|

Value |

Value (USD Million) and Volume (Thousand Units) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Channel

|

|

|

By Country

|

Frequently Asked Questions

The Fortune Business Insights study shows that the market was USD 169.66 million in 2024.

The North America market is projected to grow at a CAGR of 5.34% during the forecast period.

The market size of the U.S. stood at USD 122.68 Million in 2024.

Based on the application, the residential application is expected to lead the market.

The North America market size is expected to reach USD 261.08 million by 2032.

Rising urbanization and infrastructure development is propelling market growth.

The top players in the market are Zoeller Pump Company, Liberty Pumps, Glentronics, and Pentair, are the top players actively operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us