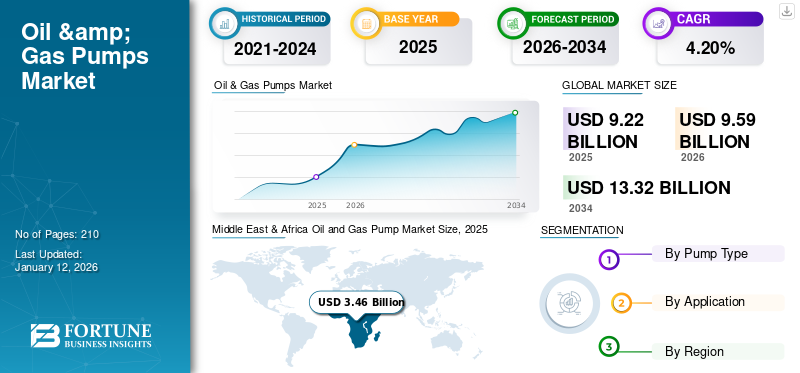

Oil and Gas Pump Market Size, Share & Industry Analysis, By Pump Type (Centrifugal Pumps, Positive Displacement Pumps, and Others), By Application (Upstream, Midstream, and Downstream), and Regional Forecast, 2026-2034

Oil and Gas Pump Market Size

The global oil and gas pump market size was valued at USD 9.22 billion in 2024 and is projected to grow from USD 9.59 billion in 2026 to USD 13.32 billion by 2034, exhibiting a CAGR of 4.20% during the forecast period. Middle East & Africa dominated the global market with a share of 37.54% in 2025. The Oil and Gas Pump market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.81 billion by 2032, driven by the need for energy efficient pumping systems in the upstream sector.

The oil and gas pump is a vital sector within the broader energy industry, playing a crucial role in the extraction, transportation, and refining of crude oil and natural gas. Oil and gas pumps are essential components used for various applications across the upstream, midstream, and downstream segments of the oil and gas value chain. Rapid industrialization and urbanization in emerging markets increase the demand for oil and gas products, driving investment in exploration, production, and transportation infrastructure. Overall, the increasing market share of oil and gas pumps is driven by a combination of rising energy demand, technological advancements, infrastructure needs, regulatory pressures, and economic factors. These elements collectively contribute to the growing necessity for efficient and reliable pump solutions in the oil and gas industry.

Lockdown measures and travel restrictions implemented to control the spread of the virus led to a sharp decline in global oil and gas demand. This decline resulted in reduced exploration and production activities, leading to lower requirements for oilfield equipment, including pumps, amid the COVID-19 pandemic.

Oil and Gas Pump Market Trends

Digitalization and IoT Integration in Pumps to Drive Market Growth

IoT sensors installed in pumps enable real-time monitoring of various parameters such as temperature, pressure, and vibration. This data can be analyzed to predict potential failures before they occur, allowing for proactive maintenance and minimizing downtime. Remote monitoring also enables operators to optimize pump performance and energy efficiency. Digitalization allows for the collection and analysis of large amounts of data from pump operations. By leveraging analytics and machine learning algorithms, oil and gas companies can gain insights into pump performance, identify inefficiencies, and optimize production processes. This data-driven approach helps in making informed decisions to improve overall operational efficiency and reduce costs.

For instance, as of May 2023, Alfa Laval has moved one step forward in the intelligent pump. They have released new condition-monitoring software with built-in analytics. It uses artificial intelligence, the new Alfa Laval Analytics, for online condition monitoring, which prevents uncertainty, reduces downtime, consequently extends the lifetime of vital assets, and helps reach sustainability goals.

Download Free sample to learn more about this report.

Oil and Gas Pump Market Growth Factors

Increasing Oil and Gas Exploration Activities to Drive the Market Growth

Oil and gas exploration involves drilling wells to locate and extract hydrocarbon reserves. Pumps are essential components in drilling operations, used for circulating drilling fluids, controlling well pressure, and transporting cuttings to the surface. As exploration activities expand, there is a corresponding increase in the demand for pumps and related equipment. With conventional oil and gas reserves becoming harder to access, there is a shift toward unconventional resources such as shale oil and gas, tight oil, and deepwater reserves. These resources often require specialized pumping equipment tailored to the unique challenges of extraction, such as high-pressure pumping systems for hydraulic fracturing (fracking) operations.

In October 2023, Sulzer expanded its flow equipment manufacturing facility in Riyadh, Saudi Arabia, to meet the region's growing need for infrastructure development. The expansion includes a new assembly and packaging facility, warehouse and staff additions, and new office space. Saudi Vision 2030 launched many multi-billion dollar infrastructure projects in the Kingdom of Saudi Arabia. Sulzer recently expanded its centrifugal pump production and testing facility in Riyadh to meet overall demand. The expanded facility has new cranes that enable the assembly, packaging, and performance testing of the largest pumps in Sulzer's product line. It also offers a full range of aftermarket services for all Sulzer and Saudi Pump Factory products, including repairs, spare parts, and refurbishment solutions.

Growing Interest in Unconventional Resources is the Major Factor Driving Market Growth

Unconventional resource extraction techniques, particularly hydraulic fracturing, rely heavily on pumping systems. Hydraulic fracturing involves injecting a mixture of water, sand, and chemicals at high pressure into underground formations to create fractures and release hydrocarbons trapped in tight rock formations. Specialized pumps are required to generate the high pressures necessary for effective fracking operations. Unconventional resource extraction environments can be highly demanding, with extreme temperatures, high pressures, and abrasive fluids. Pumping equipment used in these operations must be robust, reliable, and capable of withstanding harsh operating conditions. Manufacturers develop specialized pumps designed to handle the challenges posed by unconventional reservoirs, such as abrasion-resistant materials, high-pressure capabilities, and advanced seal designs.

In May 2023, Xylem, a leading global supplier of water technology, and its regional partner, Tiba Manzalawi Group, were excited to announce the launch of their new joint venture. This Xylem Egypt plant will offer world-leading class waste solutions and brands to the region.

Xylem works closely with local partners to provide the best international water solutions that meet local requirements. As the Egyptian market grew, establishing a local manufacturing facility became a reality, and Xylem partnered with Tiba Manzalaw to make the plant a reality.

RESTRAINING FACTORS

Shift Toward Renewable Energy Hinders the Oil and Gas Pump Demand

The shift toward renewable energy is negatively impacting the demand for oil and gas. As several countries continue to reduce their carbon emissions and fight climate change, there has been significant growth in the renewable energy sector, such as wind, solar, hydroelectric power, and others.

For instance, according to the International Energy Agency, in 2023, there was a 50% increase in the renewable energy capacity integrated into global energy systems, totaling nearly 510 gigawatts (GW). Solar photovoltaic (PV) systems constituted three-quarters of the total additions worldwide.

Furthermore, according to BP Statistical Review, the oil refining capacity declined by ~0.4% in 2021 compared to 2020. This shift is consequently hampering the demand for oilfield services and equipment required for the oil and gas sector.

Oil and Gas Pump Market Segmentation Analysis

By Pump Type Analysis

Centrifugal Pumps Segment to Lead Due to Efficiency and Versatility in Handling Various Fluid Types

Based on pump type, the global market for oil and gas pump is segmented into centrifugal pumps, positive displacement pumps, and others.

The centrifugal pumps segment is expected to dominate the global oil and gas pump market with share of 52.43% in 2026. Centrifugal pumps are highly versatile and can handle a wide range of fluids, including crude oil, natural gas liquids (NGLs), water, and various chemicals used in oil and gas production and processing operations. Their ability to efficiently handle different fluid types and operating conditions makes them well-suited for various applications across the oil and gas value chain, including fluid transfer, circulation, injection, and boosting.

The positive displacement pumps is also one of the leading segments. The growing trend of extracting oil and gas from shale formations often involves injecting fluids at high pressure. Positive displacement pumps are well-suited for this application. These pumps provide consistent and precise flow rates, making them ideal for tasks such as injecting chemicals or precisely metering oil during production.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Heavy Reliance of Pipelines on Pumps to Bolster the Midstream Segment Growth

Based on application, the global market is segmented into upstream, midstream, and downstream.

The midstream is the dominating segment in the oil and gas pump market with share of 37.82% in 2026. Midstream operations are all about transporting oil and gas from production sites to refineries or processing plants. This extensive network of pipelines and gathering systems relies heavily on pumps to keep the flow going.

The downstream segment has substantial growth in the oil and gas pump market. Downstream operations comprise activities such as refining crude oil into different end-use products such as diesel, gasoline, and jet fuel and processing natural gas into liquefied natural gas and other products. These refining and processing activities comprise numerous stages, each requiring pumping systems for different uses.

As demand for oil and gas continues to rise globally, driven by factors such as population and economic growth, there is a rising need to boost upstream activities and discover new reserves. One major factor behind the usage of oil and gas pumps in upstream operations is the need for different pumps to ease the extraction process. These pumps are important for tasks such as lifting natural gas or crude oil from underground reservoirs to the surface and for injecting fluids into wells to improve production rates via techniques such as hydraulic fracturing.

REGIONAL INSIGHTS

The global market for oil and gas pump is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

Middle East & Africa

Middle East & Africa Oil and Gas Pump Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The Middle East & Africa has the major share in the global oil and gas sector market with valuation of USD 3.46 billion in 2025. This consequently drives the oil and gas pump market growth. This dominance comes basically from the region's abundant reserves of crude oil and natural gas, which are among the highest in the world. Countries such as Saudi Arabia, the UAE, Qatar, Iran, and others possess vast reserves that account for a vital share of the world's total oil & gas reserves.

Asia Pacific

Among all regions, the Asia Pacific is expected to be the dominating region in the market for oil and gas pump in the coming years. Growing economies such as China and India are experiencing significant industrial development, leading to a high demand for oil and gas for various applications. This translates to a massive market for pumps used in extraction, transportation, and refining. The Japan market is projected to reach USD 0.16 billion by 2026, the China market is projected to reach USD 0.84 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

Europe

The UK market is projected to reach USD 0.1 billion by 2026, and the Germany market is projected to reach USD 0.12 billion by 2026.

North America

North America has a significant share in the global oil and gas pump market. The development of technology for extracting oil and gas from shale formations has been a major driver in North America. The existing oil and gas infrastructure in the region is aging and requires upgrades and replacements. This creates a steady demand for new pumps to maintain and improve efficiency. The U.S. market is projected to reach USD 1.45 billion by 2026.

Key Industry Players

SPP Pumps Ltd and Baker Hughes Focus on Different Competitive Strategies to Strengthen Their Position

Some of the developments by players such as SPP Pumps and Baker Hughes are as follows:

In February 2024, SPP Pumps Ltd and Rodelta Pumps International BV agreed on a strategic alliance between the two brands, combining the ISO-accredited and sustainable manufacturing expertise of the former with the capabilities of RandD. Through its joint process and chemical solution division, SPP-Rodelta focuses primarily on petroleum, gas, petrochemical, biofuels, hydrogen, and coal recovery markets, supported by a network of teams operating in Europe, the Middle East, North America, and East Asia. The alliance will be responsible for the development and introduction of additional new products to the Rodelta API 610 (12th Edition) series of pumps. This API-compliant range includes the ETL series of close-coupled OH5 pumps.

In June 2021, Baker Hughes, an energy technology company, and PJSC LUKOIL, one of the largest vertically integrated oil & gas companies in the world, signed a contract to enhance their global cooperation. Both companies will focus on various things. One of the key focuses will be testing Baker Hughes’ electric submersible pumps with PJSC LUKOIL, one of the leading energy-efficient permanent magnet motors.

List of Top Oil and Gas Pump Companies:

- SPP Pumps (U.S.)

- Kirloskar Brothers Limited (India)

- PCM (U.S.)

- Ruhrpumpen Group (U.S.)

- Grundfos (Denmark)

- Sulzer Ltd (Switzerland)

- Xylem (U.S.)

- Flowserve Corporation (U.S.)

- Netzsch (Germany)

- Wastecorp Pumps (U.S.)

- National Pump and Energy (Australia)

- Atlas Copco (Sweden)

- Halliburton (U.S.)

- Baker Hughes (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – Baker Hughes secured an order from Black & Veatch to supply electric-driven liquefaction equipment, comprising centrifugal pumps, to Cedar LNG in Canada. The array of turbomachinery equipment includes four electric-propelled main refrigeration compressors, six centrifugal pumps, and two electric-driven boil-off gas compressors.

- February 2024 – ITT Inc. inked a three-year contract to supply highly engineered API-610 centrifugal pump systems and associated products along with engineered services to ExxonMobil.

- August 2023 – As demand accelerates for smart solutions to build more connected, resilient, and sustainable cities, Grundfos, the world's leading manufacturer of advanced pump solutions and water technologies, launched its new NK and NKE series in Malaysia. The new long-connection suction pumps have industry-leading energy efficiency, and the premium NKE range uses smart technology for ease of use, advanced monitoring capabilities, and better connectivity.

- December 2021 – Grundfos, one of the world's leading manufacturers of pumps and water solutions, announced the launch of its new generation of large CR pumps in India. Designed with world-class efficiency improvements to improve flow performance and pump pressure, the CR 185, 215, and 255 series are suitable for a wide range of applications such as water supply, water treatment, and almost any industrial solution, including high-pressure, hot, hazardous, flammable and aggressive liquids.

- January 2020 – GIW Industries, Inc., a subsidiary of KSB company, commissioned one of its largest ever heavy-duty centrifugal slurry pumps for operation in Canada’s oil sands, known as the Tie Bolt Construction (TBC-92). It is the largest and heaviest slurry pump available in the oil sands sector and the newest addition to a range of powerful high-pressure pumps offered by GIW.

REPORT COVERAGE

The report provides a detailed analysis of the market for oil and gas pump and focuses on key aspects such as leading companies, products, and applications. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

| Segmentation |

By Pump Type

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 9.22 billion in 2025.

The market is likely to grow at a CAGR of 4.20% over the forecast period.

The centrifugal pumps is expected to lead the pump type segment in the market during the forecast period.

The market size of the Middle East & Africa was USD 3.46 billion in 2025.

The increasing oil and gas exploration activities is set to drive the market growth.

Some of the top players in the market are SPP Pumps, Kirloskar Brothers Ltd., Flowserve Corporation, Xylem, Sulzer Ltd, and others.

The global market size is expected to reach USD 13.32 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us