Oil Water Separator Market Size, Share & Industry Analysis, By Technology (Gravity, Sponge, Coalescing, Centrifuge, and Others), By End-User (Industrial, Marine, Aerospace, Power Generation, Defense, and Others), and Regional Forecast, 2024-2032

Oil Water Separator Market Size

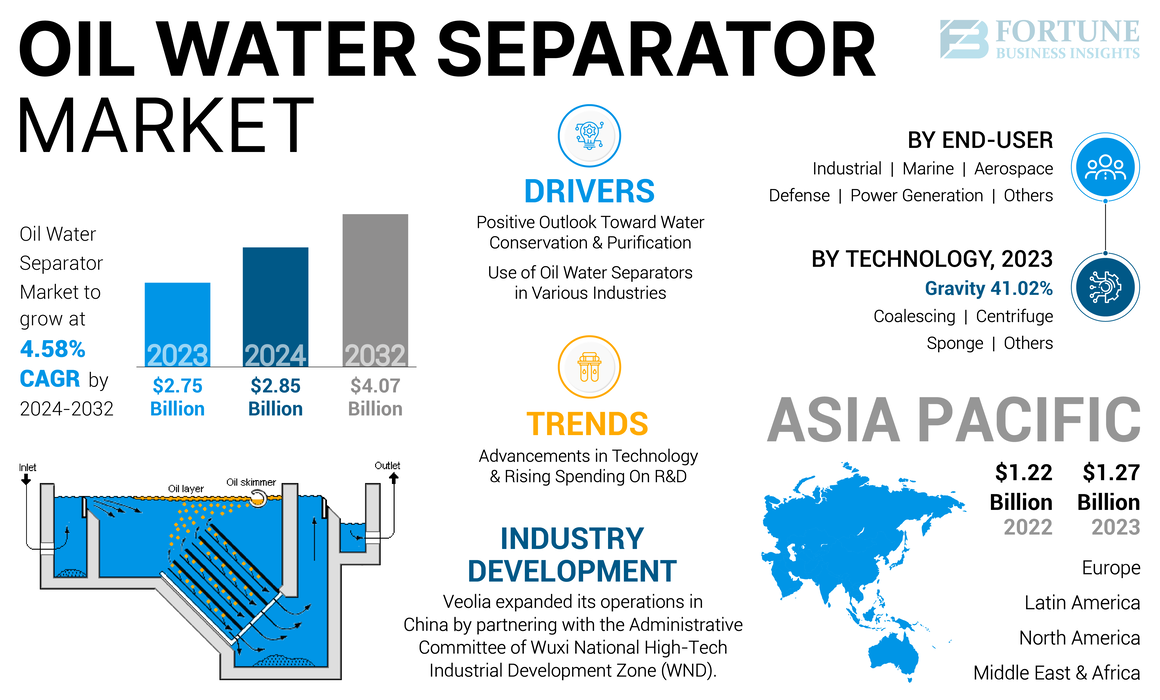

The global oil water separator market size was valued at USD 2.85 billion in 2024. The market is projected to be worth USD 2.96 billion in 2025 and reach USD 4.07 billion by 2032, exhibiting a CAGR of 4.65% during the forecast period.

An oil water separator is a device designed to remove oil and other hydrocarbons from water and is typically used in industrial and municipal wastewater treatment. It employs various technologies, such as gravity separation or coalescing to efficiently separate oil from water. This ensures compliance with environmental regulations and prevents water pollution. Governments worldwide are investing heavily in environmental technologies, as part of broader efforts to combat pollution and promote sustainable practices. Such investments are often channeled into research and development, subsidizing the cost of advanced technologies, and supporting infrastructure improvements. For instance, government-funded projects to upgrade wastewater treatment facilities frequently include the integration of sophisticated oil water separation systems. This financial backing accelerates technological advancements and reduces the overall cost of these systems, making them more accessible to various industries.

The global impact of the COVID-19 pandemic on the oil water separator market was moderate as it hampered many end-use industries' growth due to supply chain disruptions and caused hindrance in activities due to social distancing norms. Furthermore, China, the U.S., and India are some of the significant countries that are processing and deploying technology. These countries underwent various regional and national level shutdowns of industrial operations to contain the spread of this viral infection, which led to a fall in the demand for separator technologies.

Oil Water Separator Market Trends

Advancements in Technology and Rising Spending on R&D to Create New Market Opportunities

A significant area of advancement is the incorporation of smart technologies and automation into separator systems. The use of advanced sensors, artificial intelligence, and data analytics allows for real-time monitoring and optimization of the separator’s performance. These technologies enhance accuracy and responsiveness, lower energy consumption, and improve the separation process for more effective oil removal. Additionally, automation reduces the need for manual intervention, resulting in cost savings and greater operational reliability.

Technological advancements in filtration, such as the development of high-efficiency membrane filters and coalescing plate separators improve the accuracy and efficiency of oil water separation processes. These technologies offer better oil removal rates, lower energy consumption, and reduced maintenance requirements. The development of ultra-filtration membranes has enabled separators to achieve higher separation efficiencies, making them suitable for applications requiring very low oil content in treated water.

To know how our report can help streamline your business, Speak to Analyst

Oil Water Separator Market Growth Factors

Positive Outlook Toward Water Conservation and Purification to Drive Market Growth

Growing awareness of environmental issues is driving industries and municipalities to adopt sustainable water management practices. Oil pollution carries significant threats to aquatic ecosystems and freshwater resources. Public and private sectors are increasingly prioritizing water conservation and purification to protect these resources. This shift toward sustainability is boosting the demand, which plays a crucial role in treating wastewater and preventing oil contamination.

The maritime industry provides a compelling example of how a positive outlook toward water conservation and purification drives the market growth. Ships generate oily bilge water as a byproduct of their operations, which must be treated before discharge to comply with the International Maritime Organization (IMO) regulations. The IMO's International Convention for the Prevention of Pollution from Ships (MARPOL) sets strict limits on the oil content in bilge water that can be discharged into the sea. This has led to the widespread adoption of separators in the maritime industry to ensure compliance.

Governments are taking the necessary action to address pressing water scarcity and contamination concerns. This is manifesting in the adoption of stricter regulations and policies that promote efficient water use and effective wastewater treatment. For example, the U.S. Clean Water Act has set stringent standards for pollutant discharges into waterways, prompting industries to adopt cutting-edge water purification technologies. Similarly, the European Union's Water Framework Directive is driving efforts to achieve excellent water quality and availability throughout the region, encouraging member states to invest in innovative water conservation initiatives.

Use of Oil Water Separators in Various Industries is Major Factor Driving Market Growth

Oil water separators are a crucial component in industries, such as maritime, oil & gas, manufacturing, and wastewater treatment, playing a vital role in maintaining environmental compliance, protecting water resources, and ensuring operational efficiency. As industrial activities continue to expand, the generation of industrial wastewater containing oils, hydrocarbons, and other contaminants also increases. Separators for oil and water are essential for treating this wastewater, removing oil and pollutants before discharge or reuse. The demand for effective wastewater treatment and pollution control is becoming increasingly critical in sectors, such as oil & gas, petrochemicals, refineries, automotive, and manufacturing.

Manufacturing processes often produce oily wastewater that requires treatment before discharge. Oil water separators enable manufacturers to comply with wastewater discharge regulations and reduce their environmental impact. For instance, automotive manufacturing plants use oil water separators to treat wastewater from painting and assembly lines, ensuring the removal of oil and grease before discharge.

The rising demand for oil water separators is driven by regulatory compliance, industry-specific separator market by application, and technological advancements. The maritime, oil & gas, manufacturing, and wastewater treatment sectors demonstrate the critical role of oil water separators in maintaining environmental standards and operational efficiency. As industries continue to prioritize environmental protection and regulatory compliance, the demand for oil water separators is expected to continue to grow further augmenting the oil water separator market growth.

RESTRAINING FACTORS

High Initial Investment of Oil Water Separator to Restrain Market Growth

Oil water separators, especially advanced systems, such as coalescing plate separators, centrifugal separators, and membrane filtration units, require significant capital expenditure. These costs encompass the acquisition of the equipment and its installation and integration into existing processes. For instance, large-scale industrial applications may necessitate custom installations, further increasing the initial investment.

Beyond the initial purchase, oil water separators also incur operational and maintenance expenses. These include energy consumption, regular servicing, replacement of parts, and need for skilled personnel to operate and maintain the systems. While these costs vary depending on the technology and application, they add to the total cost of ownership, making it a substantial financial commitment.

The high cost barrier can lead to delayed or deferred investment in oil water separation technologies. Industries might opt for less effective, lower-cost solutions that do not fully comply with environmental regulations or adequately protect water resources. This can result in increased environmental risks and potential legal liabilities.

Oil Water Separator Market Segmentation Analysis

By Technology Analysis

Gravity Technology is Dominating Market Due to its High Efficiency and Wide Availability

Based on technology, the market is segmented into gravity, sponge, coalescing, centrifuge, and others. Gravity is the dominating segment in the market and held the largest oil water separator market share in 2023. Gravity oil water separators operate on the principle of density differences between oil and water. These separators are particularly effective in removing free-floating oils from wastewater, increasing their use in industries, such as petrochemicals, automotive, and food processing. The simplicity of their design, coupled with low operational and maintenance costs, contributes to their popularity. This segment is foreseen to attain 41.59% of the market share in 2025.

Coalescing separators is growing as it is favored for their high capacity, ease of installation, and low maintenance requirements. They are widely used in various sectors, including marine, food & beverage, and chemical, where the demand for efficient wastewater treatment is rising. The growing awareness of environmental sustainability and need for advanced separation technologies have driven the adoption of coalescing separators. This segment is predicted to record a significant CAGR of 22.41% during the forecast period (2025-2032).

Asia Pacific Oil Water Separator Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

By End-User Analysis

Industrial Segment Dominates Due Rising Waste Water Management Activity

Based on end-user, the global market is segmented into industrial, marine, aerospace, power generation, defense, and others. Industrial is the dominant segment in the market. The segment’s dominance is primarily due to the high volume of oily wastewater produced across various industries. Sectors, such as petrochemicals, automotive, food processing, and metal manufacturing generate significant amounts of wastewater that require treatment to remove oil and other contaminants before discharge. This segment dominated the market with a share of 41.44% in 2024.

Marine is the second-largest segment in the market due to the implementation of stringent regulations regarding the disposal of bilge water and oily wastewater from ships. The International Maritime Organization (IMO) and various national regulations impose strict limits on the amount of oil that can be discharged into the sea, necessitating the use of effective separation technologies on vessels.

REGIONAL INSIGHTS

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America and the Middle East & Africa.

Asia Pacific dominated the global market share with a valuation of USD 1.27 billion in 2023 and USD 1.32 billion in 2024. The region, particularly China and India, have observed rapid industrialization and urbanization. The substantial growth of industries, such as oil & gas, chemical manufacturing, and automotive has increased the demand for efficient wastewater treatment solutions, including oil water separators. For example, China's extensive industrial sector and India’s expanding manufacturing base require robust systems to manage oily wastewater to comply with environmental regulations. India is foreseen to grow with a valuation of USD 0.32 billion in 2025, while Japan is projected to be valued at USD 0.13 billion in the same year.

Governments in Asia Pacific are increasingly implementing stringent environmental regulations to address pollution and water conservation issues. For instance, China's Water Pollution Prevention and Control Action Plan mandates industries to treat wastewater before discharge, driving the demand. Similarly, India's National Green Tribunal (NGT) enforces strict guidelines on wastewater treatment, encouraging the adoption of advanced separation technologies. The Chinese market is anticipated to hold USD 0.65 billion in 2025.

Europe is the second leading region poised to be valued at USD 0.61 billion in 2025, exhibiting a CAGR of 4.64% during the forecast period (2025-2032). Europe has a well-established framework of environmental regulations that necessitate efficient wastewater management. The U.K. market continues to expand, projected to reach a market value of USD 0.10 billion in 2025. The European Union’s Water Framework Directive and the Industrial Emissions Directive impose strict limits on pollutants, including oil, in wastewater. Industries across Europe are required to adopt high-efficiency separators to meet these stringent standards. For example, Germany’s strict environmental policies ensure that industries comply with rigorous wastewater treatment requirements. Germany is likely to hit USD 0.16 billion in 2025, while France is set to gain USD 0.09 billion in 2025.

The MEA region is the third largest market expected to be worth USD 0.42 billion in 2025. In this region, the GCC market is likely to hit USD 0.16 billion in the same year.

North America is the fourth largest market expected to be worth USD 0.36 billion in 2025. North America has established a strong market for water purification, with initiatives in clean drinking water and wastewater infrastructure, where the U.S. government has invested about USD 6 billion and, under Infrastructure Law, has invested a total of over USD 50 billion to upgrade the U.S. water infrastructure. The U.S. market is estimated to be valued at USD 0.31 billion in 2025.

KEY INDUSTRY PLAYERS

Established Players Drive Innovation and Strategic Partnerships to Develop Advanced Separators

The global market is highly fragmented, with key players and some medium-scale regional players delivering a wide range of water purification technologies at local and country levels across the value chain. Numerous companies are actively operating across different countries to cater to the specific demands of the customers.

For example, India and Israel have collaborated to create a new water technology center at IIT-Madras, which is anticipated to play a significant role in India's initiative to secure a sustainable water supply. The Center of Water Technology is set to become a center for innovation, research, and capacity-building in water technologies, with a particular emphasis on sustainable solutions for urban water supply.

List of Top Oil Water Separator Companies:

- Veolia (France)

- HydroFloTech (U.S.)

- Highland Tank (U.S.)

- Wärtsilä (Finland)

- Victor Marine Ltd. (U.K.)

- Ultraspin (Australia)

- Mercer International Inc. (U.S.)

- Parkson Corporation (U.S.)

- Schlumberger (SLB) (U.S.)

- EnekaUAB (Lithuania)

- Llalco Fluid Technology, S.L. (Spain)

- Ellis Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Veolia announced a significant expansion of its operations in China through its partnership with the Administrative Committee of Wuxi National High-Tech Industrial Development Zone (WND). The contract marks a major milestone for Veolia as it plans to increase its production capacity and introduce new products to establish cutting-edge, energy-efficient, and environmentally friendly production lines. This strategic partnership aims to drive sustainable growth and development in the country, leveraging Veolia's expertise in water technologies to support the WND's goals.

- May 2024: Veolia, through its subsidiary SIDEM, secured a USD 320 million contract to provide engineering and key technologies for the Hassyan seawater desalination plant in Dubai, UAE. The plant, commissioned by DEWA and ACWA Power, will be the second-largest reverse osmosis desalination facility in the world and the biggest one powered solely by solar energy.

- February 2024: Wärtsilä Water & Waste, part of the Wärtsilä Technology group, relaunched its STC0-23 sewage treatment plant, the smallest and most compact design in its Super Trident series. The plant is suitable for use with both gravity and vacuum waste collection systems, and employs an activated sludge system to accelerate natural biological processes.

- January 2022: Veolia, one of the leading water technology providers, released its new de-oiling technology for the management of oily wastewater produced in the oil & gas industry. It allows for higher oil and solid feeds while attaining low discharge levels (less than 1 part per million (ppm)).

- August 2021: The Water Valuation Initiative announced a new partnership with CDP, Mercer and the Water Footprint Network to develop and implement a new water reporting framework for financial institutions. This allows financial institutions to adapt their investment, insurance, lending, and underwriting practices to all waterproof futures.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product, and top market players. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 4.65% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 2.75 billion in 2023.

The market is likely to register a CAGR of 4.58% over the forecast period of 2024-2032.

Based on technology, the gravity segment is expected to lead the market.

The market size of Asia Pacific was valued at USD 1.27 billion in 2023.

A positive outlook toward water conservation and purification and the use of oil water separators in various industries are the key factors driving market growth.

Some of the top players in the market are HydroFloTech, Highland Tank, and Wartsila.

The global market size is expected to reach a valuation of USD 4.07 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us