Orthobiologics Market Size, Share & Industry Analysis, By Product Type (Viscosupplements, Bone Growth Factors, Demineralized Bone Matrix (DBM), Synthetic Bone Substitutes, Cellular Allograft, Allografts, and Others), By Application (Spinal Fusion, Maxillofacial & Dental, Soft Tissue Repair, Reconstructive & Fracture Surgery, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

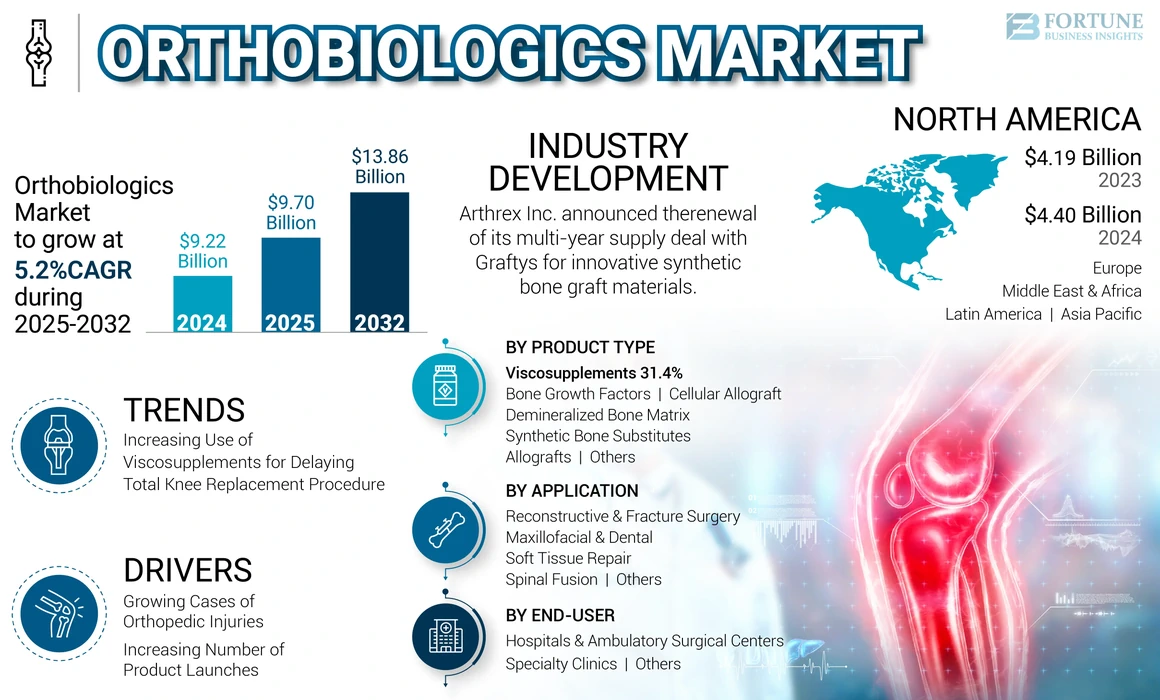

The global orthobiologics market size was valued at USD 9.22 billion in 2024. The market is projected to grow from USD 9.70 billion in 2025 to USD 13.86 billion by 2032, exhibiting a CAGR of 5.2% during the forecast period. North America dominated the orthobiologics market with a market share of 47.78% in 2024.

Orthobiologics and regenerative medicine are often made from substances that are naturally found in the body and used to help injuries heal more quickly. These products are used in orthopedic procedures to improve the healing of broken bones, injured muscles, ligaments, and tendons.

One of the most significant factors driving the use of orthobiologics is the increasing prevalence of several bone diseases, such as bone tumors (malignant and benign) and bone infections (osteomyelitis). Apart from these, several other incidents and medical conditions require the administration of biologics. These conditions include different types of traumas - complex and simple, bone lesions, and also bone fractures. In such conditions, orthopedic biologic products often act as an optimum treatment solution for the repair of bone defects, thereby, supporting the global market growth. Furthermore, the market is expected to grow during the forecast period owing to the increasing use of stem cell-based allografts in various orthopedic procedures.

The COVID-19 pandemic hindered the sales of orthobiologic products due to decreased patient volume. The reallocation of healthcare resources, declining number of patient visits to emergency care & outpatient settings, disruptions in supply chains, and other major factors affected the demand for orthobiologic products across the world, especially during the first half of 2020. In terms of revenue, the market witnessed a decline of 10.6% in 2020. In 2021, the patient volume bounced back owing to the factors, such as higher vaccination coverage among the general population, implementation of strong guidelines & COVID-19 protocols in public places, and reduction in restrictions for travel. This led to an increase in the demand for orthobiologic products in 2021 and 2022.

Furthermore, in 2022, the resumption of orthopedic surgeries and patient visits to hospitals for the treatment of dental and sports injuries had enabled the full recovery of the market, thereby reaching to pre-pandemic levels. The market is also expected to record a steady CAGR during the forecast period. For example, Johnson & Johnson Services, Inc. recorded net sales of USD 94,943 million in 2022, which is an increase of 1.2% as compared to 2021. The growth was due to the increased sales of orthopedic products, including orthobiologics, which showed the market’s recovery to the pre-pandemic level in 2022.

Global Orthobiologics Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 9.22 billion

- 2025 Market Size: USD 9.70 billion

- 2032 Forecast Market Size: USD 13.86 billion

- CAGR: 5.2% from 2025–2032

Market Share:

- Region: North America dominated the market with a 47.78% share in 2024. This leadership is driven by the rapid adoption of biologics for bone-related injuries, a surge in the launch of synthetic products by key players, a large patient population, and a high volume of orthopedic surgeries.

- By Product Type: Viscosupplements held the largest market share in 2024. The segment's dominance is due to the increasing prevalence of knee osteoarthritis and degenerative arthritis, particularly among the growing geriatric population, and improvements in reimbursement policies for these treatments.

Key Country Highlights:

- Japan: The market is driven by the introduction of advanced orthobiologic products from major global companies, such as Medtronic's launch of its Grafton Demineralized Bone Matrix (DBM) for spinal and orthopedic procedures.

- United States: The market is fueled by a very large patient pool, with over 6.8 million individuals seeking medical attention for orthopedic injuries annually. Growth is also supported by the launch of new products, including fully synthetic bone graft substitutes and DMSO-free viable cellular bone allografts.

- China: As a key country in the fastest-growing Asia Pacific region, the market is expanding due to a vast potential patient base, rising prevalence of bone diseases, and the under-penetration of advanced orthobiologic products, creating significant growth opportunities.

- Europe: Growth is supported by significant R&D investment and positive clinical trial outcomes for new products. For instance, a clinical investigation for ARTEBONE bone graft substitute across Finland and Poland showed no product-related complications, boosting confidence and potential adoption.

Orthobiologics Market Trends

Increasing Use of Viscosupplements for Delaying Total Knee Replacement Procedure to Boost Product Adoption

Viscosupplements are used for the treatment of osteoarthritis. They play an important role in recovering the rheological properties of the synovial fluid, improving function, achieving analgesia, and regenerating the joint cartilage articular. The regeneration property of viscosupplements also aids in postponing surgery due to sports injuries or can lead to better recovery of adult cartilage, diminishing the need for surgery.

The adoption of viscosupplements has increased over the past few years due to their high effectiveness in delaying total knee replacement procedures.

- For instance, according to a research study published by Springer Nature Switzerland AG in 2019, the median time to total knee replacement surgery was delayed by more than 1 year in patients receiving one dose of hyaluronic acid injection.

Moreover, an increasing number of patients suffering from osteoarthritis across the world is one of the major contributors to the increased demand for viscosupplements.

Download Free sample to learn more about this report.

Orthobiologics Market Growth Factors

Growing Cases of Orthopedic Injuries to Boost Market Progress

A rapid rise in the incidence of orthopedic injuries and musculoskeletal diseases leading to agonizing physical pain and limited mobility is the primary factor likely to drive the demand for orthobiologic products during the forecast period.

- For instance, according to statistics by the American Academy of Orthopedic Surgeons, more than 6.8 million patients with orthopedic injuries receive medical attention every year in the U.S. alone. Such a large patient pool requiring treatment for orthopedic injuries is expected to boost the orthobiologics market growth in the coming years.

Moreover, a substantial rise in the incidence of osteoporosis categorized by low bone-to-mass density ratio and physical weakening of bone tissues, is responsible for the increasing prevalence of hip and backbone fractures. This factor is anticipated to propel the market growth in the coming years. Furthermore, the increasing number of road accidents, leading to trauma, boosts the utilization of orthobiologics in several procedures, driving the market growth.

Therefore, the rising incidence of osteoporosis and increasing sports injuries among the U.S. population is expected to drive the market growth.

Increasing Number of Product Launches to Enhance Market Growth

The growing incidence of bone disorders has augmented the demand for orthobiologics products across the globe. The high demand for these solutions has encouraged the market players to introduce various types of products, such as allograft, bone growth factors, and synthetic bone substitutes.

- For instance, in January 2020, Royal Biologics announced the launch of MAGNUS, a Dimethyl Sulfoxide (DMSO)-free viable cellular bone allograft.

Moreover, some market players are focusing on the launch of antibiotic-eluting bone void fillers to treat bone diseases, thereby spurring the market growth. Furthermore, a strong pipeline of these products planned by market players is expected to contribute to the market growth in the long run.

- In April 2020, Biocomposites announced that its product, STIMULAN, received a new CE Mark approval for the purpose of mixing antibiotics, such as vancomycin, tobramycin, and gentamicin in bone void fillers. This antibiotic mix can be used as a treatment option in the management of infected soft tissue and bones.

Such a strong focus of companies on the introduction of new products for bone void filling is anticipated to drive the market growth over the analysis period.

RESTRAINING FACTORS

Issues Associated With Bone Morphogenetic Proteins and Clinical Limitations of Several Orthobiologics to Limit Market Growth

Medtronic’s INFUSE is the only bone morphogenetic protein available in the market. This product gained significant popularity after it received the U.S. FDA approval in 2002 for its use in spinal fusion procedures.

However, several years after the approval of INFUSE, Medtronic has been facing increased scrutiny for its BMP. The reasons associated with this scrutiny are the off-label use of INFUSE and serious complications associated with the product.

- For instance, INFUSE can lead to serious side-effects, such as infection, urinary problems, bone & nerve injury, male sterility, and possible increased risk of cancer. Such side-effects associated with this product are expected to hamper its sales, thereby limiting the overall market growth.

Moreover, bone graft substitutes have some clinical limitations, such as adverse tissue reaction, incomplete or lack of bone formation, and infection of soft tissue & bone. These disadvantages are expected to limit the demand for orthobiologics products during the forecast period.

Orthobiologics Market Segmentation Analysis

By Product Type Analysis

Viscosupplements Gained a Significant Traction Due to Growing Incidence of Orthopedic Disorders

Based on product, this market is divided into viscosupplements, bone growth factors, Demineralized Bone Matrix (DBM), synthetic bone substitutes, cellular allograft, allografts, and others.

The viscosupplements segment accounted for a dominant share of the global market in 2024. This is primarily due to the increasing prevalence of knee osteoarthritis and degenerative arthritis, specifically among the rising geriatric population. Enhancements in reimbursement policies regarding approvals on viscosupplements are supporting the growth of this segment. Recent market approvals and the entry of new manufacturers are some of the other factors supporting the dominance of the segment.

The synthetic bone substitutes segment is anticipated to register the highest growth rate during the forecast timeline. The segment’s high growth is due to the increasing adoption of synthetic bone grafts in developed geographies, such as the U.S. and Europe. Moreover, the gradual shift of healthcare professionals from traditional bone grafts to their synthetic substitutes and rising focus of manufacturers on the launch of new products is expected to further propel the segment’s growth.

- For instance, in January 2020, OrthoPediatrics Corp. launched QuickPack, a fully synthetic bone graft substitute in the U.S. The product has a high-viscosity, calcium phosphate cement that closely mimics the mineral phase of a natural bone.

The demineralized bone matrix (DBM) segment held a significant market share in 2024 and is expected to grow during the forecast timeframe. Demineralized bone matrix possesses additional osteoinductive properties over regular allograft due to the enhanced bioavailability of growth factors following the demineralization process. As a result, the DBM putties and gels are being increasingly used in spinal fusion surgery in countries such as the U.S. These additional properties of demineralized bone matrix (DBM) are expected to boost the market growth in the coming years.

The cellular allograft segment accounted for a substantial market share in 2023 owing to the benefits such as improved clinical outcomes and faster healing compared to traditional allografts. Moreover, the increasing demand for minimally invasive surgery, especially in spinal and joint surgeries, increases the adoption of cellular allografts, driving the market growth.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Orthobiologics to be Widely Used in Spinal Fusion Due to Increasing Number of Spinal Surgeries

Based on application, the market is divided into spinal fusion, maxillofacial & dental, soft tissue repair, reconstructive & fracture surgery, and others.

The spinal fusion segment dominated the global market in 2024. The segment’s robust growth is due to the increasing number of spinal fusion surgeries being performed across the globe. Moreover, key companies with extensive portfolios of orthobiologics products for spinal fusion applications, coupled with increasing approvals for new products for spinal fusion procedures, is expected to boost the segment’s growth in the coming years.

- For instance, in May 2021, Prosidyan received the CE mark certification for its fibergaft bone graft substitutes, which are intended for spinal fusion procedures.

In 2022, the reconstructive & fracture surgery segment accounted for the second-largest market share and is anticipated to record a moderate CAGR during the forecast timeline. The segment’s growth is majorly due to increasing number of fracture cases globally due to surge in the prevalence of osteoporosis.

By End-user Analysis

Hospitals & ASCs to Increase the Use of Orthobiologics Due to Large Patient Volumes

Based on end-user, the market is divided into Hospitals & ASCs, specialty clinics, and others.

Based on end-user, the hospitals & ASCs segment held a dominant market share in 2024. The segment’s dominance is due to the high volume of patient admissions and robust increase in orthopedic procedures being conducted in hospitals across the globe. Furthermore, growth in the number of hospitals across the developed and developing countries and rising prevalence of joint complications and spinal disorders is driving the segment’s growth.

The specialty clinics segment is anticipated to record a lucrative growth rate in the coming years. The increasing need for specialty care and growing number of specialty clinics across the developed markets for efficient management and treatment of bone defects are anticipated to contribute to the segment’s strong growth.

REGIONAL INSIGHTS

North America Orthobiologics Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In terms of regions, North America accounted for the biggest share in the global market in 2024 and was valued at USD 4.40 billion. The rapid adoption of biologics for bone-related injuries and disorders, coupled with surge in the launch of synthetic products by key market players, is expected to propel the market growth in the region. Moreover, a large patient population suffering from bone injuries and rising orthopedic surgeries in the U.S. are estimated to contribute to the market’s growth in North America.

Europe held the second-largest market share in 2023 and is projected to record a substantial CAGR during the forecast period. The increasing rollout of favorable health reimbursement policies for bone graft procedures, significant R&D investment & research activities, and rising focus of companies on the introduction of new products are expected to increase the demand for orthobiologic products during the forecast years.

- For instance, in February 2020, BBS-Bioactive Bone Substitutes initiated a clinical investigation across clinical centers in Finland and Poland. In this study, ARTEBONE was used as a bone graft substitute in the ankle and subtler joint fusions. ARTEBONE showed no concerns related to safety and product-related complications. Such positive results from the research activities are expected to boost the market growth in Europe.

Factors, such as a vast potential patient pool, rising prevalence of bone diseases, and under-penetration of the product in this region are expected to help the market record the highest CAGR in Asia Pacific.

The markets in Latin America and the Middle East & Africa are anticipated to display a moderate growth rate due to the ongoing adoption of novel biologics, increasing awareness related to biologics used for orthopedic procedures, and growing focus on improving the healthcare infrastructure across these regions.

List of Key Companies in Orthobiologics Market

Robust Product Portfolios of Leading Market Players to Enhance Their Market Position

In terms of the competitive landscape, the market reflects a fragmented structure. Some of the major players, such as Medtronic, Depuy Synthes, Zimmer Biomet, and Stryker accounted for a significant orthobiologics market share in 2024.

The medtronic segment captured the highest market share in 2024 owing to its strong product portfolio of bone graft substitutes. Moreover, its constant focus on the launch of new orthobiologic products to expand its geographical footprint is expected to contribute to its dominance in the market.

- For instance, in February 2019, Medtronic announced the introduction of its Grafton Demineralized Bone Matrix (DBM) in Japan. This bone graft was intended for use in spinal and orthopedic procedures.

Moreover, other market players, such as Stryker Corporation, SeaSpine Holdings Corporation, Anika Therapeutics, Inc., Globus Medical, Integra LifeSciences, and Bioventus are consistently focusing on strategic initiatives to gain a major market share in the upcoming years.

- In January 2020, SeaSpine announced a distribution and licensing agreement with restor3D, Inc. The materials science technology offered by restor3D is expected to provide both clinical and economic advantages to the orthobiologic portfolio of SeaSpine, thereby spurring its growth in the market.

LIST OF KEY COMPANIES PROFILED:

- Medtronic (Ireland)

- Zimmer Biomet (U.S.)

- DePuy Synthes (Johnson & Johnson Services, Inc.) (U.S.)

- Stryker (U.S.)

- Anika Therapeutics, Inc. (U.S.)

- SeaSpine (U.S.)

- Bioventus (U.S.)

- RTI Surgical (U.S.)

- MTF Biologics (U.S.)

- Arthrex, Inc. (U.S.)

- Smith & Nephew (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 - Orthofix Medical Inc. announced the full commercial launch and 510(k) clearance of OsteoCove, an advanced bioactive synthetic graft for use in orthopedic and spinal procedures.

- June 2023 - Anika Therapeutics, Inc. announced that it had received an additional 510(k) clearance from the U.S. FDA for its Tactoset Injectable Bone Substitute.

- March 2023 - LifeNet Health announced the U.S. launch of ViviGen MIS, the first and only viable bone matrix to provide lineage-committed bone cells. This novel delivery system has been used effectively in MIS spine procedures.

- October 2022 - Orthofix Medical Inc. announced the launch of the first implant of Legacy Demineralized Bone Matrix (DBM) for filling voids or gaps in traumatic injuries and bony defects in the spine, pelvis, or extremities.

- August 2022 - Arthrex Inc., along with Graftys, announced the renewal of its multi-year supply agreement for advanced synthetic bone graft materials.

- March 2022 - MTF Biologics and Bone Biologics Corporation partnered with each other. The partnership aimed to sell the former’s Demineralized Bone Matrix (DBM) in the market.

- October 2021 - AlloSource announced the launch of AlloMend Extra-Large (XL) Acellular Dermal Matrix (ADM), the latest product added to its AlloMend product range. The introduction of this product was expected to increase its dermal graft portfolio.

- July 2020 - Spine Wave announced the successful market release of Tempest Allograft Bone Matrix and its entry into the spinal biologics market.

- October 2020- Orthofix Medical Inc. announced the launch of the O-Genesis graft delivery system and the AlloQuent structural allograft Q-Pack.

REPORT COVERAGE

An Infographic Representation of Orthobiologics Market

To get information on various segments, share your queries with us

The market report provides in-depth analysis of the market. It focuses on key aspects, such as product types, application areas, and end-users. Besides this, it offers insights into the impact of the COVID-19 pandemic on the market, market trends, and the prevalence of orthopedic disorders. Additionally, the report consists of several factors that are contributing to the market growth.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.2% from 2025-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Product Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 9.22 billion in 2024 and is projected to reach USD 13.86 billion by 2032.

In 2024, the North America market value stood at USD 4.40 billion.

The market is projected to record a CAGR of 5.2% during the forecast period of 2025-2032.

By product type, the viscosupplements segment will lead the market.

The increasing prevalence of orthopedic disorders, rising reconstructive surgeries, and growing product launches by key market players are the major factors supporting the market growth.

Medtronic, Depuy Synthes, Zimmer Biomet, and Stryker Corporation are the major players in the market.

North America dominated the market share in 2024.

Some of the major trends in the market include the increased presence of key players in newer application areas, surge in orthopedic conditions, and new product launches.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic