Pet Food Market Size, Share & Industry Analysis, By Animal Type (Dogs, Cats, and Others), By Form (Dry Pet Food, Wet Pet Food, and Snacks & Treats), By Price Range (Economic, Medium, and Premium), By Packaging (Pouches, Cans, Bags, and Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online Channel, and Others), By Source (Animal and Plant), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

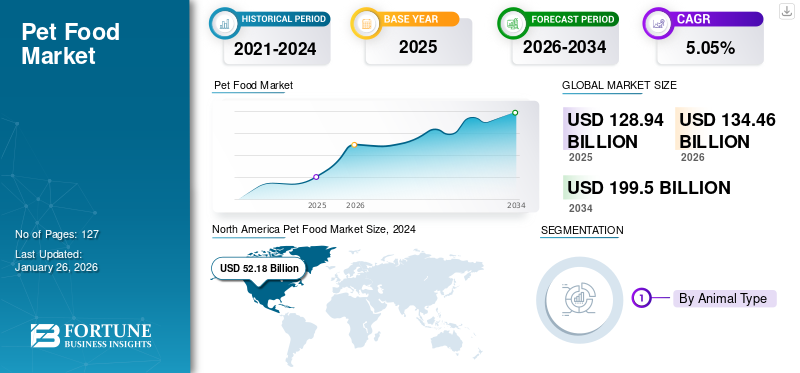

The global pet food market size was valued at USD 128.94 billion in 2025. The market is projected to grow from USD 134.46 billion in 2026 to USD 199.50 billion by 2034, exhibiting a CAGR of 5.05% during the forecast period. North America dominated the pet food market with a market share of 41.71% in 2025.

Pet food products are available in different forms in the global market, such as dry, wet, and snack treats. These products can be animal-based or plant-based. Sales of these products occur through several distribution channels, such as hypermarkets/supermarkets, specialty stores, online channels, and others. With the rising pet population globally, the market has experienced significant growth in recent years. In addition, due to the increasing trend of pet humanization, the market is expected to show rapid growth during the forecast period.

Nestle Purina Petcare, Colgate-Palmolive, The J.M. Smucker Company, Hill's Pet Nutrition, Inc., and Mars Inc. are a few of the key players in the industry, shaping the industry landscape by introducing new products and pet food solutions.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Pet Ownership Globally is Driving Market Growth

Pet ownership has been steadily increasing globally in recent years, especially in emerging economies. The rapid demographic changes, rising income levels, and the pandemic are some of the significant factors fueling this growth. For instance, according to the Pet Health of Animals Organization, around 2 million people adopted a pet during the COVID-19 lockdown in the U.K., and about 1 million people adopted pets in Australia during the same period.

The growth of pet ownership has been particularly evident in emerging economies, such as Latin America, Asia Pacific, the Middle East & Africa, and Eastern Europe. This rapid increase in pet adoption/ownership is largely due to the expansion of the middle-class population, which positively influences pet ownership in these regions. Furthermore, disposable income is one of the significant factors that drives pet ownership. Hence, the fast-advancing countries in Asia Pacific and Eastern Europe have been recording rapid growth in pet ownership. In addition, according to the Pet Health of Animals Organization, from 2014 to 2019, China recorded a 113% growth in pet ownership. In contrast, South Korea recorded a 50% growth in pet ownership.

Rapid Growth in Pet Humanization is Driving the Global Market Growth

The global market has observed a significant shift in pet ownership culture in recent years. One notable cultural change is the increasing pet humanization, where a companion animal is considered a family member or human by its owner. This trend has boosted demand for premium products for pets, as individuals are more willing to spend on healthy, high-quality food products for their pets. The rising pet humanization is largely driven by millennials. For instance, as per the Pet Health of Animals Organization, around one-fourth of pet owners are millennials in the U.S. Pumpkin Pet Insurance, an insurance company for pets based in the U.S., notes that many millennial couples prefer to adopt a pet before having a child. As pet ownership becomes a training wheel before parenthood, pet owners have become more health-conscious toward their pets and are looking for healthy food products for pets. Premium food products have recorded rapid growth in recent years and are expected to continue driving market growth.

MARKET RESTRAINTS

Stringent Regulations Implemented by Governments to Restrain Market Growth

Food products made for pets are highly regulated, especially in developed countries, such as the U.S. and other European countries. In these developed markets, examinations on animal feeds are highly stringent throughout the supply chains, from the ingredients utilized in production to sales and marketing. Thus, strict regulations related to commercialization can be a significant restraining factor, as they increase the cost of developing new products and contribute to great similarity between products, therefore intensifying market competition. Moreover, lower acceptance of premium or high-priced products in some developing markets can hinder market growth.

MARKET Opportunities

Key Players Focus on Production Expansion to Drive Market Growth

Over the last couple of years, the demand for pet food and care products has grown across the world, creating continuous opportunities for industry players. As a result, companies are forecasting positive product demand in the upcoming years and investing sufficient funds to expand production capacity to meet future market demand. Expansion of production capacity will play a key role in shaping the evolving industry landscape and driving global pet food market growth. For instance, in September 2025, Pet Factory, one of the emerging pet food distributors in Europe, invested USD 23 million to open a new state-of-the-art production facility to produce the pet food. The 9,000 sq m production plant, designed to meet the highest European standards, incorporates advanced technology from Germany and the Netherlands and holds IFS, ISO 14001, and ISO 22000 certifications.

Pet Food Market Trends

Personalization of Pet Food to Propel Market Growth

In recent times, owing to the rising trend of pet humanization, pet owners are becoming more conscious of the ingredients in pet food. Thus, pet owners are more interested in controlling what their pets consume and how often. This increasing consciousness is driven by the growing knowledge of diseases. Thus, customized and personalized products have shown promising growth, with demand for products that are designed to address specific concerns or conditions, such as obesity, skin and coat, and others.

Personalized pet food development is a key trend in the pet food market in the current time period. For instance, in July 2023, Petcurean, a Canada-based premium pet food manufacturer, launched new customized food products under its Go! Solutions brand. These include Sensitivities Limited Ingredient Grain-Free Insect for dogs with sensitivities and allergies, and Go! Solutions Skin + Coat Care, designed to improve skin health and coat texture.

SEGMENTATION ANALYSIS

By Animal Type

Growing Launch of Dog Treats Propels the Dog Segment Growth

Based on animal type, the market is classified into dogs, cats, and others.

Dogs segment led the market accounting for 59.15% market share in 2026. For instance, as per the Health for Animals Organization, dogs are the most common pet animal globally. Out of three, one house has a dog as a pet. Moreover, the high expenditure associated with the maintenance and well-being of dogs is driving demand for plant-based and higher-quality dog food, supported by rising awareness among pet owners of diseases about food-related diseases. The launch of dog treats and nutrition-rich food products is another significant factor contributing to the segment's growth.

Cats are the second-leading segment in the global market. Furthermore, cat ownership is expected to increase across the globe at a notable pace, as cats are relatively low-maintenance and highly compatible with human lifestyles.

To know how our report can help streamline your business, Speak to Analyst

By Form

Higher Demand for Dry Pet Food Among Dog Owners to Fuel Segment Growth

Based on form, the market is segmented into dry pet food, wet pet food, and snacks & treats.

Dry pet food segment will account for 68.14% market share in 2026. The dry form is the most preferred option by pet owners, especially among dog owners, owing to its higher convenience and shelf-life compared to wet food. Furthermore, dry food is favored for its health benefits associated with dry dog food, such as promoting healthy oral health in dogs. In addition, dry dog food is cost-effective compared to wet food, contributing to its significantly higher share in the global market.

The snack & treats segment is emerging as an attractive option for various pets due to their delicious taste and higher quality. This segment is expected to grow significantly in the forthcoming years owing to the active participation of market players in launching a variety of multipurpose and healthy snacks and treat options for dogs, cats, and other pets.

By Price Range

Affordability and Accessibility of Medium Price Range Products Boosted the Segment Growth

Based on price range, the market is segmented into economy, medium, and premium.

The medium segment held the highest market share in 2024. These products appeal to the majority of pet owners who seek quality but remain price-conscious. Since medium-priced products are widely available and affordable to a larger consumer base, the segment continues to dominate the market.

The premium category is expected to witness fastest-growth during the forecast period. Key players are developing new products with premium ingredients and innovative flavors, appealing to pet owners who are increasingly health-conscious about their pets. Furthermore, the rising consumers' purchasing power is shifting purchasing behavior toward premium, high-quality products.

By Packaging

Bags Packaging Segment Dominated due to its Affordability

Based on packaging, the market is segmented into pouches, cans, bags, and others.

The bag packaging segment held the highest market share in the global pet food market. Bags are cost-effective, available in multiple sizes, including small trial packs and bulk quantities, and provide longer shelf stability, which makes them the default packaging choice across mainstream retail. Their ability to store large volumes conveniently, combined with improvements in resealable zippers and recyclable materials, is expected to help maintain their strong market share during the forecast period.

The pouches segment is anticipated to hold the highest growth rate during the forecast period 2025-2032. Rising consumer preference for single-serve wet food, ready-to-eat formulations, and premium convenience packs has made pouches especially popular in urban markets. Flexible packaging offers advantages such as lightweight transportation, lower shipping costs, and improved portion control. Moreover, sustainability-focused innovation, such as recyclable mono-material pouches introduced from leading suppliers, have further boosted consumer acceptance.

By Distribution Channel

Higher Convenience Associated with Supermarkets/Hypermarkets Fuels Segment Growth

By distribution channel, the market is categorized into supermarket/hypermarket, specialty stores, online channel, and others.

The supermarket/hypermarket segment led the market accounting for 44.69% market share in 2026. This dominance is attributed to consumers’ higher preference for supermarkets/hypermarkets, as they offer increased convenience and wide range of brands and price options.

The unique arrangement in specialty pet stores contributes to convenience. In addition, specialty stores do offer significant choices with the availability of exotic, custom-designed, and premium food products for pet animals within these stores, which are expected to boost the growth of the segment further.

The online channel is expected to witness significant growth during the forecast period, attributed to the increasing inclination of millennials toward online purchasing. The high convenience offered by online channels, such as doorstep delivery, along with rising collaborations of industry giants with retail e-commerce players, are expected to fuel the segment’s growth. For instance, in February 2023, Nestle announced that Purina PetCare was one of the significantly growing segments, with e-commerce and specialty store sales holding the highest growth rate.

By Source

Animal Segment Dominates Owing to its Increased Popularity and Wide Availability

On the basis of source, the market is segmented into animal and plant.

The animal segment is expected to account for 75.18% of the market in 2026. Traditionally, an animal-based ingredients have been extensively used to manufacture pet foods. Fish meal, poultry meal, and animal meal are widely used to manufacture cat and dog foods across the globe. The popularity of animal-sourced feed is due to its strong nutrient profile and the easy availability of raw materials.

The growing popularity of plant-based products and vegetarianism among pet owners is expected to propel the growth of plant-sourced pet food in the forthcoming years.

PET FOOD REGIONAL MARKET OUTLOOK

Based on region, the market is studied across North America, Europe, Asia Pacific, South America, and the rest of the world.

North America Pet Food Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 53.78 billion in 2025 and USD 55.51 billion in 2026. The dominance of the region is attributed to the significant share of pet owners in the U.S. For instance, as per the American Pet Products Association (APPA) survey, about 85 million U.S. households, which constitute approximately 67% of U.S. households, own a pet. Furthermore, the country has witnessed significant growth in pet humanization, which has fueled the demand for nutritious and natural pet foods products. The U.S. market is projected to reach USD 49.28 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

In Europe, the pet food market has grown significantly due to the rising pet humanization and increased spending on sustainable and safe pet food. The U.K. is one of the largest markets in Europe, followed by Germany and France, for pet food and treats. For instance, as per the Mars Petcare State of the Pet Nation, 72% of the U.K.'s pet owners consider themselves pet parents. The UK market is projected to reach USD 6.53 billion by 2026, while the Germany market is projected to reach USD 5.58 billion by 2026.

The rapid growth in pet adoption/ownership in developing markets, such as China, India, South Korea, Japan, and others, has made Asia Pacific one of the fastest-growing regions in the global market, followed by South America. In addition, Japan is one of the leading importers of prepared dog and cat food worldwide. The Japan market is projected to reach USD 5.42 billion by 2026, the China market is projected to reach USD 3.41 billion by 2026, and the India market is projected to reach USD 0.68 billion by 2026.

Brazil is the second-largest market in the world after the U.S. The dominance of Brazil in the South American market is due to high pet ownership, a growing focus on pet health, and increased spending on natural, high-quality pet foods. Additionally, Brazil has one of the most diverse pet populations in the world. Hence, small families, childless couples, and singles living in apartments often prefer birds and fish, along with dogs and cats as pets.

The rising adoption of companion animals and a higher focus on quality products are driving the pet food market growth in the Middle East & Africa. The growing middle-class population across Africa further supports the development of the regional market.

Competitive Landscape

Key Industry Players

Key Players Focus on Mergers and Acquisitions to Stay Competitive

The global pet food market is consolidated, with a strong presence of five significant players. Combined, Mars Incorporated, Nestle S.A., The J.M. Smucker Company, Colgate-Palmolive Company, and General Mills, Inc. hold more than 60% of the global pet food market share. Mars Incorporated is one of the key players in the global market, and across several other regional markets. The companies have been adopting strategies, such as innovative product launches, brand strengthening, mergers and acquisitions, and online distribution of their products to increase their customer base and lead the global market. In the past few years, Mars Incorporated has acquired several reputed brands, such as Natura and Eukanuba. Moreover, it has actively involved itself in online retail sales by collaborating with e-commerce giants, such as Alibaba Group.

List of Top Pet Food Companies Profiled

- Mars Incorporated (U.S.)

- Nestle S.A. (Switzerland)

- The J.M. Smucker Company (U.S.)

- Colgate-Palmolive Company (U.S.)

- General Mills, Inc. (U.S.)

- Diamond Pet Foods (U.S.)

- Heristo AG (Germany)

- Tiernahrung Deuerer GmbH (Germany)

- Merrick Pet Care, Inc. (U.S.)

- WellPet LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: Natura Plus Ultra Pet Food, a French brand, invested in expanding its production capabilities and product range in its production factory in south-western France.

- October 2024: AFB International, a global pet care & pet food solution manufacturer, opened its new Asia Pacific regional headquarters and manufacturing facility in Samut Prakan, Thailand.

- October 2023: Scientific Remedies, one of the well-known animal health companies, announced its collaboration with Affinity Petcare, one of the known pet food companies based in Spain, with the launch of its all-new brand, Affinity Advance, in India.

- December 2022: Mankind Pharma announced that it had entered the pet food market by launching its all-new PetStar dog food. The product comes in several forms, including dry, wet, and treats. The company created a pet care ecosystem and started with pet food.

- September 2021: Freshpet (FRPT), a well-known fresh dog food company, announced the launch of its all-new vegetarian dog food, Spring & Sprout. With the launch of this new product, the company aimed to increase its market share in the U.S. and Europe's rapidly growing plant-based markets.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, market analysis by animal type, form, distribution channel, source, price range, and distribution channel. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.05% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Animal Type · Dogs · Cats · Others |

|

By Form · Dry Pet Food · Wet Pet Food · Snacks & Treats |

|

|

By Price Range · Economy · Medium · Premium |

|

|

By Packaging · Pouches · Cans · Bags · Others |

|

|

By Distribution Channel · Supermarket/Hypermarket · Specialty Stores · Online Channel · Others |

|

|

By Source · Animal · Plant |

|

|

By Region North America (By Animal Type, Form, Price Range, Packaging, Distribution Channel, Source, and Country) · U.S. (By Animal Type) · Canada (By Animal Type) · Mexico (By Animal Type) Europe (By Animal Type, Form, Price Range, Packaging, Distribution Channel, Source, and Country) · U.K. (By Animal Type) · France (By Animal Type) · Germany (By Animal Type) · Italy (By Animal Type) · Spain (By Animal Type) · Russia (By Animal Type) · Rest of Europe (By Animal Type) Asia Pacific (By Animal Type, Form, Price Range, Packaging, Distribution Channel, Source, and Country) · China (By Animal Type) · India (By Animal Type) · Japan (By Animal Type) · Australia (By Animal Type) · Rest of Asia Pacific (By Animal Type) South America (By Animal Type, Form, Price Range, Packaging, Distribution Channel, Source, and Country) · Brazil (By Animal Type) · Argentina (By Animal Type) · Rest of South America (By Animal Type) Middle East & Africa (By Animal Type, Form, Price Range, Packaging, Distribution Channel, Source, and Country) · Saudi Arabia (By Animal Type) · South Africa (By Animal Type) · Rest of Middle East & Africa (By Animal Type) |

Frequently Asked Questions

The Fortune Business Insights study shows that the global pet food market size was USD 134.46 billion in 2026.

The global pet food market is likely to grow at a CAGR of 5.05% over the forecast period (2026-2034).

The dog segment is the leading type segment in the global market.

Increasing pet ownership globally is a key factor driving market growth.

Mars Incorporated, Nestle S.A., The J.M. Smucker Company, Colgate-Palmolive Company, and General Mills, Inc. are the major players in the market.

North America dominates the market.

The stringent regulations toward pet food products may restrain product deployment.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us