Photobook and Album Market Size, Share & Industry Analysis, By Product Type (Flush Mount, Lay Flat, and Standard), By Size (Square, Portrait, and Landscape), By Occasion (Wedding, Birthdays, Anniversary, and Others), By Sales Channel (Direct and Indirect), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

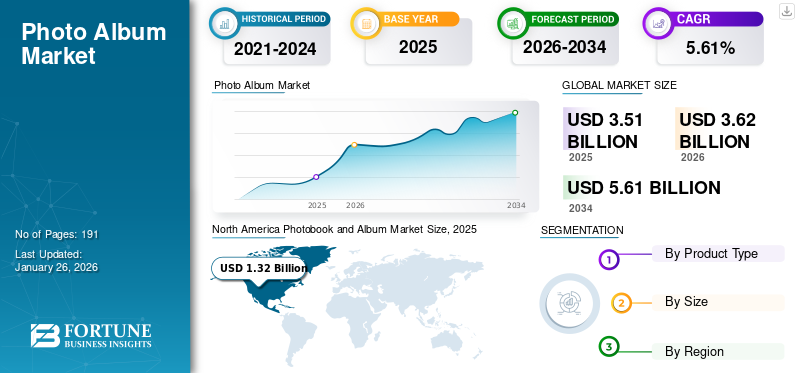

The global photobook and album market size was valued at USD 3.51 billion in 2025. The market is projected to grow from USD 3.62 billion in 2026 to USD 5.61 billion by 2034, exhibiting a CAGR of 5.61% during the forecast period. North America dominated the photobook and album market with a market share of 37.60% in 2025.

The increasing use of photo albums by wildlife photographers, fashion designers, artists, and other professionals to showcase their creativity and portfolios is expected to drive global demand photobooks and albums in the coming years. Furthermore, the tradition of married couples preserving wedding albums as cherished mementos is fueling the growth of the market in countries such as Japan, India, Singapore, and U.S. For instance, PlanetArt, LLC, a subsidiary of CLARANOVA S.E., reported a 21.0% rise in total sales, reaching USD 445.63 million during the 2020-21 financial year.

E-commerce platforms experiences popularity due to their ability to offer personalized gifting. As people sough convenience and contactless shopping experiences from the safety of their houses, there has been a significant increase in number of orders for customized photo products.

Photobook and Album Market Trends

Trend for “Year in Review” and “Baby’s First Year” to Fuel Market Growth

The “Baby’s First Year” and “Year in Review” photobook trends are gaining significant traction in the market as parents are increasingly eager to capture each milestone of their babies. Parents are willing to spend on customized books, showcasing moments such as first smiles, steps, and other developmental achievements. Modern platforms make it easy to design these albums with monthly highlights, personal messages, and creative layouts, turning fleeting memories into cherished keepsakes. Similarly, “Year in Review” photobooks, which summarize family adventures, achievements, and everyday moments through a calendar year, are witnessing a surge in demand among families. These photobooks allow individuals to reflect on growth and togetherness, creating tangible stories from digital images and fostering lasting traditions year after year.

Market Dynamics

MARKET DRIVERS

Rising Demand for Smartphones to Surge Product Demand

Proliferation of smartphones to capture their special life moments in photographs. This increases the consumers' necessity to buy photo albums to store such photographs, favoring the photobook market growth. According to data presented by the GSM Association, the smartphone adoption rate in the Asia Pacific region reached 74% in 2021, compared to 64% in 2020. Furthermore, growing popularity of Snapchat, Instagram, and other photo-capturing applications among smartphone users will increase the number of digital photographs, thereby supporting the product demand. According to the data published by the U.S. Bureau of Labor Statistics (BLS), there are 12,700 new photographer employment opportunities every year in the U.S.

Consistent Launch of Photo-Themed Promotional Initiatives to Uplift Market Growth

Regular introduction of photo capturing-related campaigns, such as themed challenges, contests, and social events, plays a crucial role in supporting the photobook and album market growth. These campaigns entice individuals to actively participate and engage in photography, leading to a larger pool of personal photos and memories that people want to preserve. Companies leverage such campaigns to promote the idea of storing captured moments in tangible formats such as albums and photobooks. This not only increases consumer interest and awareness but also drives demand for physical photo printed products. For instance, initiatives such as Shutterfly’s “Make It a Thing” campaign have successfully motivated consumers to create and print more albums, ultimately uplifting market revenues and accelerating global product adoption.

MARKET RESTRAINTS

Advancement in Cloud Storage Technology to Limit Product Demand

Advancements in cloud storage technology impedes the market growth trajectory by providing consumers with low-cost, convenient, and easily accessible digital alternatives compared to physical albums. Cloud platforms allows users to store, organize, and share vast quantities of photos instantly, eliminating the need for printing and physical storage. The ease of backing up and accessing images anytime upon from multiple devices reduces the perceived value and necessity of tangible photobooks, thereby dampening consumer demand and posing a key market restraint.

MARKET OPPORTUNITY

Integration of Personalization with Digital Innovation to Present Market Growth Opportunity

As consumers increasingly seek unique, memory-driven products, companies can leverage AI-powered design tools and app-based ordering platforms to simplify customization and make photobook creation more engaging. By allowing users to auto-curate images from their smartphones, cloud storage, or social media, brands can reduce the time and effort traditionally required to design albums, thus broadening appeal beyond hobbyists to everyday users. In addition, linking photobooks with emerging technologies such as augmented reality (AR) offers an innovative growth path. For instance, embedding QR codes or NFC tags in albums that play videos, slideshows, or voice messages when scanned can turn a traditional photobook into an interactive experience.

Segmentation Analysis

By Product Type

Flash Mount Segment to Hold the Most Significant Market Share Due to Its Superior Quality

The global market analysis based on product types is categorized into standard, lay flat, and flush mount.

The flush mount product type holds the leading market share owing to the superior quality and durability of such albums over other product types, accounting for a 68.77% market share in 2026. Additionally, higher prices of such artisans' albums result in larger product revenues from this segment. Besides, rising consumer demand for photo albums of high-definition quality print and matte & glossy finish will further accelerate the segmental growth.

In the case of lay flat albums, users can better lay out a photo across two pages in a panorama. Such a factor is mainly supporting the lay flat segment growth.

Growing awareness regarding the availability of photo albums among lower-income population mainly supports the standard segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By Size

Landscape Segment to Hold a Leading Market Position Owing to Better Storage of Wedding Photographs

The market is segregated into portrait, landscape, and square, by size.

The landscape segment holds the most significant market share as users can better store their wedding & family photographs by the landscape size of the album. Additionally, users can get a higher visualization impact while viewing such landscape-sized albums over other product sizes. Such a factor results in the landscape segment generating considerable product revenues.

School students mainly use portrait-style albums to store their school memories. Therefore, students' growing popularity of the yearly school albums supports the portrait segmental growth. Besides, users can better customize the size of their squared photographs by square-sized albums over other product sizes. Such a factor is mainly supporting the product demand from this segment.

By Occasion

Wedding Segment to Hold a Leading Market Position Owing to Growing Spending on Luxurious and Extravagant Weddings

The market is segregated into wedding, birthdays, anniversary, and others, based on occasion.

The weddings segment holds the most significant market share. Individuals seek personalized wedding experiences with high-quality albums to capture and share their special moments. Photobooks and albums especially flush mount design serves as an elegant option that enhances the visual appeal of marriage photographs. Moreover, the growing trend of pre-wedding as well as multiple individual ceremonies such as mehendi, haldi, sangeet, among others in the wedding itself has created numerous potential growth opportunities in the segment supplementing its growth.

The others segment is anticipated to grow at the second fastest CAGR over the forecast period. The segment includes number of small occasion such as graduations, family reunions, holidays, get-togethers, baby showers, baby's first year, retirement parties, or year in review. Growing trend of celebrating milestones and the emotional value of preserving memories in a tangible format is likely to garner segment growth over the future years.

By Sales Channel

Wedding Segment to Hold a Leading Market Position Owing to Growing Spending on Luxurious and Extravagant Weddings

The market report is segregated into direct and indirect, by sales channel.

The direct sales holds a significant market share. Photographers work closely with clients to curate unique photobooks or albums and allows for a high degree of customization and a personalized touch which in turn supports the segment’s expansion. Moreover, clients are more willing to pay a premium for tailor-made, professional albums.

The indirect sales are expected to grow steadily over the assessment period. Additionally, advancements in printing technology and user friendly online platforms have made it easier to design and order photobooks online, enabling e-commerce channels to lure broad consumer base. Furthermore, retailers and major e-commerce platforms can reach consumers globally, offering convenience and a variety of pricing options, appealing to those seeking standard rather than premium or event-specific albums.

PHOTOBOOK & ALBUM MARKET REGIONAL OUTLOOK

The global market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Photobook and Album Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The North America market size reached USD 1.32 billion in 2025. The North America region dominates the global photobook and album market share as a large percentage of the population is involved in photography, blogging, and journalism activities, favoring the region's photobook and album sales. According to statistical data presented by the U.S. Bureau of Labor Statistics, in 2020, the number of professional photographers in the U.S. reached 110,500. Additionally, growing gift-giving trends further support the demand for gift card and album products among the region's population. The U.S. market is projected to reach USD 1.23 Billion by 2026.

Download Free sample to learn more about this report.

Asia Pacific

Asia Pacific is estimated to grow faster in the global market due to the rising number of smartphone, camera, and tablet device users in China and India, thereby supporting the products' demand in the region. According to the surveyed data presented by the China Academy of Information & Communications Technology (CAICT), in March 2021, 5G smartphone shipments in China reached 27.5 million units. In addition, regular distribution of free samples of albums by companies such as Canvera Digital Technologies Pvt. Ltd., Pro Lab, and others in India, Bangladesh, and Indonesia is further influencing people toward ordering image albums. Besides, growing consumer trends of buying classic wedding albums in India and Bangladesh further support the regional market growth. The Japan market is projected to reach USD 0.31 Billion by 2026, the China market is projected to reach USD 0.22 Billion by 2026, and the India market is projected to reach USD 0.2 Billion by 2026.

Europe

Europe holds a second largest market share on account of the significant consumption of a variety of photo printing products among the population in countries such as Germany, Belgium, France, and U.K. For instance, in 2020, Cewe, a leading European photobook and album player, reported 11.8% rise in its turnover from photofinishing products and reached USD 758.87 million. Besides, growing travel and leisure trends among the region's populations are expected to further fuel the demand for photobook and album products. The UK market is projected to reach USD 0.11 Billion by 2026, while the Germany market is projected to reach USD 0.4 Billion by 2026.

South America

Brazil and Argentina's rising middle-income population mainly support the South America market growth.

Middle East & Africa

Kingdom of Saudi Arabia witness’s strong tradition of gifting high-quality albums during major life events and celebrations. Additionally, the growing number of photo studios in Saudi Arabia and the UAE is driving the product demand in the Middle East & Africa region.

COMPETITIVE LANDSCAPE

Key Market Players

Companies to Focus on Mergers, Acquisitions, and Partnerships to Gain Competitive Edge

Mergers, acquisitions, and partnerships allow companies to diversify their product offerings by integrating complementary services or technologies related to photobooks and albums. Various regional and international key market players consistently develop advanced strategies for a competitive advantage. Many companies are forming mergers & acquisitions and partnership & collaboration strategies to foster market growth. For instance, in January 2020, Siemens Gamesa acquired Senvion's European Service assets and Intellectual Property (IP). This led to the addition of an approximately 9 GW service fleet and operations in 13 countries.

List of Top Photobook and Album Companies

- Shutterfly LLC. (U.S.)

- Mixbook (U.S.)

- Reischling Press, Inc. (U.S.)

- PikPerfect (Switzerland)

- Folio Albums Ltd. (U.K.)

- Moleskine S.p.A. (Italy)

- nPhoto (Poland)

- Canvera Digital Technologies Pvt. Ltd. (India)

- Albelli BV (Netherland)

- Kolo (U.S.)

- Midwest Photographic Resource Center Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2022 - allcop Bambus Service GmbH & Co. KG, a European photofinishing products maker, took over OMANA GmbH to increase its presence in the European personalized photo printing products industry.

- March 2022 - ORWO Net GmbH, in partnership with Singaporean photobook platform Photobook.AI, launched Pixelnet Fotos, a print-on-demand photo products application in Germany. This partnership agreement will enable OEWO to expand its business in the mass-customization photobook products segment.

- November 2021 - Ibasho, a Japanese photography-related exhibition organizer, launched six new photobook publications in its ‘IBASHO & the (M)’ editions,’ a photography exhibition in Japan.

- November 2021 – Photobook Worldwide partnered with Netcore cloud, an intelligent provider of full-stack solutions to offer personalized photo albums, home décor items, and image-printed gifts to its customers in Asia.

- January 2021 - OnceUpon, a Sweden-based photobook maker, partnered with Verdane and Spintop to secure an investment of USD 10.68 million. This strategic partnership will help the company expand its European product portfolio and geographical presence.

REPORT COVERAGE

The report provides detailed photobook and album market trends and focuses on major aspects such as leading companies, product/service types, and other product attributes. Besides, the research report offers insights into the market trends, competitive landscape, and highlights major industry developments. In addition to the aspects mentioned above, the market analysis encompasses several factors that contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.61% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Size

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was valued at USD 3.51 billion in 2025.

The global market is likely to record a CAGR of 5.61% over the forecast period.

The flush mount segment leads the market due to the flush mount album's superior quality and durability compared to other product types.

The market size in North America was valued at USD 1.32 billion in 2025.

key growth factors include rising smartphone penetration that increases consumers' necessity for printing captured photographs driving market expansion. In addition, increasing demand for premium quality albums will uplift product revenues.

Some of the prominent manufacturing companies in the market are Shutterfly LLC., Mixbook, and PikPerfect.

North America dominated the photobook and album market with a market share of 37.60% in 2025.

Rising advancements in digital storage technology allow people to store photographs in a digital format, lowering the demand for photo cards and albums.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us