Pipeline Integrity Management Market Size, Share & Industry Analysis, By Cause (External Interference, Corrosion, Construction Defect/Material Failure, Ground Movement), By Method (Pipeline Inspection {Visual Inspection, Non-Destructive Testing, In-Line Inspection Tools, Ultrasonic Testing}, Data Collection, Data Analysis, Risk Assessment, Maintenance & Repair, Pipeline Monitoring Systems {Real-Time Monitoring, Remote Sensing Technologies}), By Application (Onshore, Offshore), By End-use (Oil & Gas, Chemicals, & Water Transport), Regional Forecast 2026-2034

KEY MARKET INSIGHTS

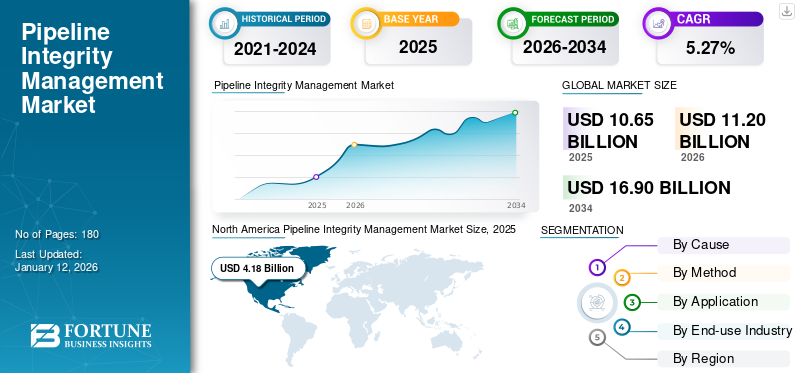

The global pipeline integrity management market size was valued at USD 10.65 billion in 2025. The market is projected to grow from USD 11.20 billion in 2026 to USD 16.90 billion by 2034, growing at a CAGR of 5.27% during the forecast period. North America dominated the pipeline integrity management market with a share of 39.25% in 2025.

Pipeline integrity management plays a vital role in the global oil & gas, chemicals, and water industry as it ensures safe & reliable pipeline operations. These pipelines include feeder pipelines, gathering pipelines, distribution pipelines, and transmission pipelines. Pipeline integrity management involves various methods, namely pipeline inspection, data collection, data analysis, maintenance & repair, monitoring systems, and others. Pipeline integrity management is crucial for preventing accidents such as cracks, corrosion, dents, external interference, ground movement, material failure, and other incidents that compromise the proper functioning of oil & gas pipelines.

Global Pipeline Integrity Management Market Overview

Market Size:

- 2025 Value: USD 10.65 billion

- 2026 Value: USD 11.20 billion

- 2034 Forecast Value: USD 16.90 billion, with a CAGR of 5.27% from 2026–2034

Market Share:

- Regional Leader: North America led the market in 2025 with a value of USD 39.25% billion, driven by a significant rise in natural gas demand, production, and supply, along with large-scale pipeline projects.

- Fastest-Growing Region: Asia Pacific is the fastest-growing region, supported by increased oil exploration activities, extensive pipeline construction, and rapid industrialization in China, India, Indonesia, Malaysia, and Australia.

- End-Use Industry Leader: The oil & gas segment dominated the market in 2024, benefiting from extensive gathering, feeder, distribution, and transmission pipelines and a growing need to prevent leaks, corrosion, and compliance failures.

Industry Trends:

- Digital Twin & AI Integration: Advanced monitoring, real-time leak detection, and predictive maintenance through AI-powered solutions and digital twin technology are becoming standard for pipeline operations.

- 5G & IoT in Pipeline Monitoring: Remote sensing, in-line inspection tools, and smart sensors enhance predictive analytics and operational safety.

- Pipeline Construction Surge: Rising global energy demand is driving significant investments in new pipeline infrastructure, especially in the U.S., China, and the Middle East.

Driving Factors:

- Rising Oil & Gas Demand: Growing global consumption of crude oil and natural gas increases the need for safe, efficient, and regulated pipeline systems.

- Aging Infrastructure: Corrosion-related incidents, averaging 52 cases per year in the U.S., necessitate frequent inspections and repairs.

- Stringent Regulatory Standards: Federal and state regulations, such as PHMSA’s pipeline safety programs and NAPSR’s initiatives, enforce strict operational safety compliance.

- Technological Advancements: Adoption of AI, advanced inspection tools, and cathodic protection systems to improve pipeline longevity and minimize risks.

- Investment in Risk Mitigation: Increased funding for upgrading legacy pipelines and implementing real-time monitoring systems.

The increasing demand for crude oil & natural gas globally is driving the pipeline integrity management market size. For instance, as stated by the International Energy Agency, the share of oil in the total energy supply accounted for 30% in 2022. The global top 5 countries supplying oil were the U.S., China, India, Russia, and Saudi Arabia. Also, as per the World Energy & Climate Statistics, in 2023, the U.S. accounted for a 25% share in global gas production, which was a 0.7% increase compared to 2022. In addition, the American Petroleum Institute (API) has developed several standards, including API 1160, which guides the development & integration of pipeline integrity management programs.

MARKET DYNAMICS

MARKET DRIVERS

Rising Incidences of Pipeline Corrosion Owing to Aging Infrastructure is Driving Market Growth

The aging pipeline infrastructure globally is leading to external corrosion, which accounts for 8% of pipeline incidents, and internal corrosion, which accounts for approximately 12% of pipeline incidents. Without proper maintenance and monitoring, corrosion can lead to leaks and pipeline ruptures. In such cases, periodic inspections, including In-Line Inspection (ILI) tools, hydrostatic pressure testing, and direct assessment, plays a vital role. For instance, according to the Pipeline and Hazardous Materials Safety Administration (PHMSA), every year, on average, 52 corrosion-related incidents occur, and corrosion accounts for around 18% of pipeline incidents in the U.S. alone.

Moreover, the IEA emphasizes that this aging infrastructure is driving substantial investments in pipeline integrity management services. For instance, risk assessment, which is the fundamental aspect of pipeline integrity management, analyzes various factors such as material fatigue, corrosion, third-party interference, and others that can identify potential threats in the pipelines and prioritize maintenance efforts. In addition, some of the effective pipeline mitigation strategies to address corrosion-related issues include the use of coatings, advanced monitoring software, namely AC Mitigation PowerTool, cathodic protection systems, and others. Regular inspections, including hydrostatic testing & in-line inspections, are crucial to identify the potential issues in pipelines before they lead to hazards. Thus, this factor drives pipeline integrity management market growth across different regions.

Increase in Regulatory Standards to Ensure Pipeline Integrity Management

The expansion of oil & gas production, transmission & distribution activities has led to a rise in the demand for pipeline integrity services to mitigate the threats. Several regulations have been laid that focus on the construction, operation, and maintenance of pipelines. Also, comprehensive federal and state laws, regulators, rules and regulations, and operators all work together to ensure pipelines are safe. For instance, the U.S. Department of Transportation's Pipelines and Hazardous Materials Safety Administration (PHMSA) issues pipeline safety regulations that address construction, operation, and maintenance, inspects pipeline operators and enforces against violations of pipeline safety laws and regulations.

The National Association of Pipeline Safety Representatives (NAPSR) signifies state pipeline regulatory agencies and advances fit-for-purpose regulations to improve pipeline safety.

Moreover, the Natural Gas Distribution Infrastructure Safety and Modernization (NGDISM) Grant Program offers USD 1 billion spread over five years to enhance the safety of high-risk, leak-prone, legacy natural gas distribution infrastructure with a specific emphasis on benefiting disadvantaged rural and urban communities, among other considerations.

MARKET RESTRAINTS

Technological Constraints and Limited Resources Expected to Hamper Market Development

The pipeline integrity management industry faces several technological limitations and resource limitations when it comes to data accuracy and insufficiency in data availability. For instance, Magnetic Flux Leakage (MFL) and Ultrasonic Testing (UT), which helps in the detection & sizing of pipeline defects, face limitations in detecting & sizing metal loss defects.

The accuracy of MFL is impacted by factors such as wall thickness, pipeline diameter, and the presence of liners or coatings. Even with UT, there is a significant risk of liftoff & mechanical removal of sensors due to pipe issues. The introduction of hydrogen as a new liquid and the impacts of anthropogenic climate change impacts the pipeline integrity management services.

MARKET OPPORTUNITIES

Technological Advancements, Including Artificial Intelligence and Digital Twins, are Expected to Boost Market Opportunities

Artificial Intelligence (AI) and digital twin technology are revolutionizing the pipeline integrity management sector by ensuring safety & providing precise navigation of the pipeline's internal environment. Real-time technologies are being implemented for sensing leaks, corrosion, erosion, and others. For instance, Emerson's PipelineManagerTM pipeline monitoring software performs real-time transient modeling using a fully thermodynamic, first principles physical model (a digital twin of the pipeline) by acquiring the data from a Supervisory Control and Data Acquisition (SCADA) system for detecting the leaks. This transient modeling method also has innovation, including look-ahead modeling.

The look-ahead modeling can forecast the future operation of the pipeline based on its current operating state. In addition, the digital twin technology presents significant growth opportunities for market players for optimal operational performance & enhanced decision-making. Solution providers such as Emerson are actively working to develop a digital twin for the pipeline by leveraging the expertise and capability of existing disparate software applications for leak detection, pipeline integrity management, scheduling and commercial management, and pipeline modeling. The use of high-performance inspection systems monitors pipeline conditions such as cracks, dents, metal loss, wall thickness, and others. These factors are anticipated to generate excellent opportunities for the market players.

MARKET CHALLENGES

Technological Integration Complexity and Cost Constraint is a Challenge for Emerging Industry Players

The oil and gas maintenance services sector is experiencing technological integration challenges that primarily reshape operational strategies. The oil & gas and chemical companies are facing issues with the integration of pipeline integrity management solutions owing to rapid technological advancements and the high cost of integrity management solutions. For instance, the lack of system compatibility, workforce skill gaps, and high investment costs involved in inspection, monitoring, and maintenance services are impacting the pipeline integrity management market share.

In addition, the cost of pipeline integrity management solutions vary significantly based on location, pipeline length, complexity, inspection, and level of software integration, which increases the cost of these integrity solutions. Also, the harsh weather conditions can further upsurge the complexity and cost. Advanced inspection technologies, such as in-line inspection tools, are more expensive compared to traditional inspection methods. The use of outdated pipeline integrity management technologies hampers the safety and efficiency of pipeline systems. These factors affect the maintenance and repair services of pipeline integrity management.

PIPELINE INTEGRITY MANAGEMENT MARKET TRENDS

Significant Rise in Pipeline Construction Across Different Countries Creates a New Market Trend

The global energy landscape is expected to grow, experiencing significant transformation owing to rising energy demand. According to the U.S. Energy Information Administration, the global energy demand is estimated to increase by 50%, including the demand for oil & gas. This has led to an increase in the number of new oil & gas pipelines being constructed globally. The top 5 countries with the highest pipeline length include the U.S. (2,225,032 km), Russia (259,913 km), Canada (100,000 km), China (86,921 km), and Ukraine (45,957 km).

In 2021, Canada Action stated that there were a total of 641 crude oil pipelines globally, comprising 491 operating, 53 proposed, 54 canceled, 18 under construction, 17 shelved, and eight retired projects. Also, there were a total of 1,773 natural gas pipelines globally, including 1,308 operating, 219 proposed, 110 canceled, 87 under construction, 40 shelved, and nine retired. According to the pipeline construction forecast for 2021 and beyond, the length of a crude oil pipeline in the U.S. is estimated to be 2,699 km, and the length of a natural gas pipeline is estimated to be 5,200 km. In the Middle East, the length of crude oil & natural gas pipelines is estimated to be 3,812 km, including 1,179 km of oil pipelines and 2,633 km of natural gas pipelines.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly disrupted the pipeline integrity management market owing to the significant drop in the demand for natural gas. The demand for natural gas declined by around 3% to 5% in 2020. Also, major natural gas importing markets, namely Europe & Asia, faced an economic downturn owing to the COVID-19 pandemic that impacted the LNG demand. The shutdown of oil wells led to a decline in production that affected the oil demand, production, and supply. All these factors negatively impacted the demand for pipeline integrity management owing to interrupted supply chains and delays in the construction of approved projects.

SEGMENTATION ANALYSIS

By Cause

External Interference Segment Dominates due to its Impact on Pipeline Integrity Management

Based on cause, the market is segmented into external interference, corrosion, construction defect/material failure, ground movement, and others.

External interference is the leading segment in pipeline integrity management owing to the impact of external conditions, namely temperature, vibration, noise, and strain that hampers the integrity of pipelines. The External Interference segment is forecast to represent 32.20% of total market share in 2026. These conditions lead to defects in the form of dents, gouges, cracks, perforations, and others. The external interference must be continuously monitored as they can lead to explosions, fires, production losses, human & livestock casualties, and many others.

The widely used pipeline integrity management method for dealing with external interference includes In-Line Inspection (ILI), which identifies potential threats such as metal loss, cracking & crack-line anomalies, and geometric deformations. In addition, caliper & geometric in-line inspection Pipeline Integrity Gauges (PIGs) carry electro-mechanical signals to examine the geometric properties of pipelines, including buckling, measuring dents, and other geometric deformations.

The in-line inspection methods used for determining the external corrosion provide high-resolution sampling inspection of ferrous & non-ferrous materials such as HDPE, which has a high sensitivity to pitting in carbon steel. For instance, the PIG launchers & receivers by Dexon facilitate the insertion and retrieval of PIGs without hampering the product flow.

By Method

Pipeline Inspection Segment Dominates the Market as it Identifies Flaws, Weaknesses, and Susceptibilities that Can Cause Pipeline Failures.

Based on method, the market is sub-segmented into pipeline inspection, data collection, data analysis, risk assessment, maintenance & repair, pipeline monitoring systems, and others.

Pipeline inspection is a leading segment in pipeline integrity management, and it comprises several methods, such as visual inspection, non-destructive testing, in-line inspection (ILI) tools, ultrasonic testing, and others. The Pipeline Inspection segment is poised to account for 26.34% of the market share in 2026. Pipeline inspection helps prevent failures that have significant consequences on the natural & human environment, including the risk of explosion, environmental damage, and other hazards. The Non-Destructive Testing (NDT) segment is projected to dominate the market with a share of 7.81% in 2026.

In-line inspection is one of the most popular methods that help in addressing problems such as corrosion or erosion on external & internal surfaces that are detected & recorded by inspecting the condition of pipeline walls by in-line inspection process. For instance, in-line inspection involves the use of smart cleaners (intelligent pigs) that can detect the damage's size, type, and position. For instance, in October 2024, NDT Global, in partnership with Aramco, developed a new 56-inch ultrasonic inline inspection tool for large-diameter pipelines. This in-line inspection tool can efficiently navigate complex pipeline networks while delivering precise crack and metal loss detection.

To know how our report can help streamline your business, Speak to Analyst

By Application

Onshore Segment Dominates as Majority of Oil & Gas is Generated from Onshore Sites

Based on application, the market is bifurcated into onshore and offshore.

Onshore is a leading segment in pipeline integrity management as it has several advantages over offshore production, such as easier access, lower costs, and reduced environmental risk. Also, the infrastructure required for drilling rigs & transportation is easier to set up on land, owing to which, inspection, monitoring, risk assessment, and other activities become easy. For instance, monitoring the environmental impact and emergency response monitoring is effective in the onshore segment.

The onshore pipelines span across diverse terrains where the risk of leaks, cracks, and third-party damage is high. Also, for these onshore pipelines, the operators can implement timely & preventive measures as they transmit large amounts of oil & gas. Some of the largest onshore oil & gas pipelines include the West-East Gas Pipeline, considered the longest natural gas pipeline that spans over 8,707 kilometers. Also the Yamal-Europe Pipeline is another long gas pipeline that spans 4,196 kilometers.

By End-use Industry

Oil & Gas Segment Dominates as Pipeline Integrity Management Helps to Prevent Oil & Gas Leaks

Based on end-use industry, the market is classified into oil & gas, chemicals, and water transport.

The pipeline integrity management solutions are widely used in the oil & gas sector owing to the presence of extensive oil & gas pipelines that span across different countries & regions. For instance, gathering pipelines, feeder pipelines, distribution pipelines, and transmission pipelines ensure seamless transmission of oil & gas that minimizes the risk of incidents, complies with regulations and prevents environmental damage by addressing leaks, corrosion, and other defects.

The National Energy Board regulates more than 73,000 km of pipelines throughout Canada, and there are an estimated 840,000 km of pipelines in Canada. Among these, 250,000 km comprises gathering lines, 25,000 km comprises feeder lines, 117,000 km are large-diameter transmission lines, and 450,000 km are local distribution lines.

The oil & gas industry is prone to accidents owing to the hazardous nature of fluids that the pipelines transport via more than 2 million miles of pipelines. Infosys has stated that over the last two decades, more than 10,000 reportable incidents have been recorded in the U.S. alone that have led to 2000 injuries and deaths along with damage to property worth more than USD 5 billion. These factors have led to an increase in operational efficiency thereby driving the demand for pipeline integrity management services across the oil & gas industry.

PIPELINE INTEGRITY MANAGEMENT MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America

North America Pipeline Integrity Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Significant Rise in Demand, Production, and Supply of Natural Gas

The demand and production of natural gas has increased significantly in North America owing to its growing applications in generating electricity and for heating & cooking purposes. For instance, in North America, natural gas is used to manufacture glass, paper, bricks, iron, and steel. In addition, natural gas is used as a raw material for the production of fertilizer, hydrogen, and petrochemical products. Also, in the U.S., natural gas accounts for around 30% of energy demand. Pipeline integrity management plays a major role in pipeline inspection, maintenance, risk-based management, corrosion prevention, and project management. These factors are driving oil and gas refinery maintenance services market growth in North America.

U.S.

Large Number of Natural Gas & Pipeline Projects Drive Demand in the Country

The U.S. has an extensive & integrated network of natural gas and oil pipelines. As stated by the U.S. Energy Information Administration (EIA), the pipeline network in the U.S. has approximately 3 million miles of mainline and other pipelines that link natural gas production and distribution. Also, in 2023, four new petroleum liquids pipeline projects were completed in the U.S. For instance, the South Bend Pipeline is a 150,000-barrel-per-day (b/d) pipeline project that was completed in 2023. This project is developed by Bridger Pipeline, LLC, which transports crude oil about 137 miles from Johnsons Corner, North Dakota, to Baker, Montana. According to WorldAtlas, the U.S. accounts for 65% of the total pipeline length in the world. The U.S. market is projected to reach USD 3.34 billion by 2026.

Asia Pacific

Increasing Oil Exploration Activities has led to an Increase in Demand for Pipeline Integrity Management Solutions

Asia Pacific demonstrates the most dynamic pipeline management market, characterized by an increase in oil exploration activities & construction of new pipelines in the countries, namely China, Indonesia, India, Malaysia, and Australia. For instance, according to the Global Gas Infrastructure, in India, around 14,500 km of gas pipeline is under construction. In addition, Asia Pacific accounts for 10%-15% of global oil & gas demand and is the second largest consumer of oil & gas. The rapid industrialization & urbanization in the region require extensive pipeline networks, which has led to an increase in demand for robust pipeline integrity management solutions to prevent pipeline failures & ensure continuous supply of oil & gas. The India market is projected to reach USD 0.75 billion by 2026.

China

Increase in the Construction of Oil & Gas Pipelines

China is one of the leading countries that has accelerated the expansion of oil & gas pipeline infrastructure, as 17,800 km of gas pipelines are under construction at an estimated cost of around USD 21.9 billion. According to the International Energy Agency (IEA), oil accounted for 17.9% of total energy supply in 2022. Also, the share of domestic crude oil production was 29.3% in 2022. The demand for pipeline integrity management solutions is driven by the large volume of oil being produced, refined, and transmitted. The China market is projected to reach USD 0.89 billion by 2026.

Europe

Stringent Regulations on Pipeline Safety

Stringent regulations on the safety of pipelines to avoid the risk of pipeline incidents have led to strict regulations that ensure pipeline safety via regular inspection, monitoring, and risk assessment. Several oil & gas associations govern pipeline integrity & safety in Europe. For instance, the European Industrial Gases Association (EIGA) is one of the leading associations that governs the integrity of pipeline systems via various methods such as cathodic protection, in-line inspection, prescriptive integrity management program, and others. In Europe, several factors contribute to the susceptibility of pipelines, such as external corrosion, which includes field coating type, factory coating type, cathodic protection system compliance, and others. The UK market is projected to reach USD 0.32 billion by 2026, while the Germany market is projected to reach USD 0.26 billion by 2026.

Latin America

Aging Infrastructure and Significant Risks of Cracks, Corrosion, and Leaks

Latin America has the world's second-largest hydrocarbon reserves, with major oil & gas production rising in Brazil, Guyana, and other areas. In 2022, Latin America and the Caribbean produced over 8 million barrels of oil per day (mb/d). The leading oil producers in the region were Mexico, Brazil, Venezuela, Colombia, and Argentina. Also, the region accounted for over 5% of natural gas production. However, the region's aging infrastructure, with a large number of pipelines installed a decade ago, has increased the risk of corrosion, leaks, ruptures, and explosions. This is majorly owing to material deterioration & potential damage due to external factors such as environmental contamination and safety hazards. All these factors have led to an increase in demand for pipeline integrity management services in Latin America.

Middle East & Africa

Growing Investments in Pipeline Integrity Solutions Owing to Presence of the World's Leading Oil Producers Drives Market Growth

This region is experiencing growth in pipeline integrity management services driven by the presence of significant oil & gas reserves that are primarily concentrated in the countries, namely Iran, Saudi Arabia, Iraq, UAE, Nigeria, and others. In addition, the length of crude oil & natural gas pipelines being constructed in the region is increasing rapidly. For instance, according to Global Energy Monitor, the Middle East & Africa accounted for 49% of global oil transmission pipelines that are under construction. Also, the GCC (Gulf Cooperation Council) is increasingly investing in pipeline integrity technology & services. Owing to these factors, the Middle East & Africa pipeline integrity management market is anticipated to grow in the coming years.

List of Key Companies in Pipeline Integrity Management Market

Enbridge, and TransCanada to Lead With their Brand Stability and Wide Customer Reach

The global market has observed different players aiming towards delivering an optimal solution for pipeline integrity management. The players are involved in rigorous research and developments to enhance the management systems performance characteristics to improve the efficiency of the pipeline and identify the failures at the earliest to minimize the financial loss and negative impact on the environment. These major players are always looking to be satisfying all the rules and regulations of the governing body managing the pipeline structures. As the market is vast and has many players from around the globe, each one aims to magnify its reach to customers and attract contracts from pipeline operators.

LIST OF KEY COMPANIES PROFILED

- Baker Hughes (United States)

- Enbridge (Canada)

- GE (United States)

- Schneider Electric (France)

- TC Energy (Canada)

- AVEVA (United Kingdom)

- Applus+ (Spain)

- NDT (United Kingdom)

- ROSEN (Switzerland)

- Infosys (India)

- Emerson (United States)

- DNV GL (Norway)

- Larsen & Toubro (India)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Saipem, a leading engineering service for the energy and infrastructure sectors, and AVEVA, a global leader in industrial software, have signed a Memorandum of Understanding (MoU) to co-develop advanced solutions based on Artificial Intelligence (AI) and machine learning to support the engineering design and construction of energy and infrastructure facilities.

- February 2024: PipeSense, the leading U.S.-based pipeline integrity solutions provider, announced the launch of tailored pipeline solutions with the integration of Artificial Intelligence (AI). With AI-based solutions, the company offers tailored solutions to tackle the operational challenges faced by onshore & offshore pipelines. The acquisition from ProFlex, coupled with external investments, has led to significant investments in leak-detection technologies such as the identification of pipeline blockages, real-time pig tracking, hydro test leak detection, and others.

- October 2024: PipeSense and EnControl collaborated to combat the gas pipeline leaks. Supporting EnControl, the well-known third-party control room company to the oil, gas, and hydrogen industries, PipeSense implemented its specialized 'PipeSentry' solutions to two separate natural gas systems in the American Midwest and one natural gas liquid system in the South.

- October 2022: TC Energy Corporation announced a USD 23.9 million investment in a Renewable Natural Gas (RNG) production facility near the Jack Daniel Distillery in Lynchburg, TN. The project is being developed by 3 Rivers Energy Partners, LLC, also an owner of Lynchburg Renewable Fuels.

- May 2022: MISTRAS Group announced the innovative technological advancement to its integrated pipeline & integrity solutions. Along with member-company Onstream Pipeline Inspection and brands New Century Software and Integrity Plus, MISTRAS continues to provide cutting-edge technology to help maximize pipeline safety and compliance. MISTRAS member company Onstream Pipeline Inspection has innovated its flagship ILI tool, the TriStream MFL, to detect metal loss in lines up to 36 inches in diameter.

Investment Analysis and Opportunities

- In October 2024, BP Energy Partners, LLC, announced growth investment in Novitech, Inc., a leader in data analytics and pipeline inspection technology. This transaction signifies the first investment in BPEP's Fund III. Novitech's Micron technology offers critical flaw detection capabilities, including cracking, for both liquids and natural gas pipelines in a single run.

- In August 2024, IT Pipes, a leader in pipeline inspection software, secured USD 20 million in equity financing from Miramar Equity Partners and Trilogy Search Partners. With this investment, the IT Pipes will boost innovation for municipalities, leading to continued growth and enhanced client offerings. This funding will enhance the customer service experience, scale the operations of IT Pipes, and lead to the development of new products, such as advanced AI-based condition assessment technology for handling underground infrastructure.

REPORT COVERAGE

The global report provides a detailed pipeline integrity management market analysis. It focuses on key market aspects, such as major market players, as well as leading pipeline inspection methods. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.27% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Cause

By Method

By Application

By End-use Industry

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 10.65 billion in 2025.

The market is likely to grow at a CAGR of 5.27% over the forecast period (2026-2034).

By industry, the oil & gas sector leads the market.

The market size stood at USD 4.18 billion in 2025.

Growing demand for oil & gas and construction of new oil & gas pipelines, as well as technological advancements in pipeline integrity solutions, are driving market growth.

Some of the top players in the market are Baker Hughes, Enbridge, GE, Schneider Electric, TC Energy, and others.

The global market size is expected to reach USD 16.90 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us