Plastic Containers Market Size, Share & Industry Analysis, By Material (PET, PP, HDPE, LDPE, and Others), By Container Type (Bottles & Jars, Pails, Tubs, Cups & Bowls, and Others), By End-Use (Beverages, Food, Pharmaceuticals & Cosmetics, FMCG, and Others), and Regional Forecast, 2026-2035

KEY MARKET INSIGHTS

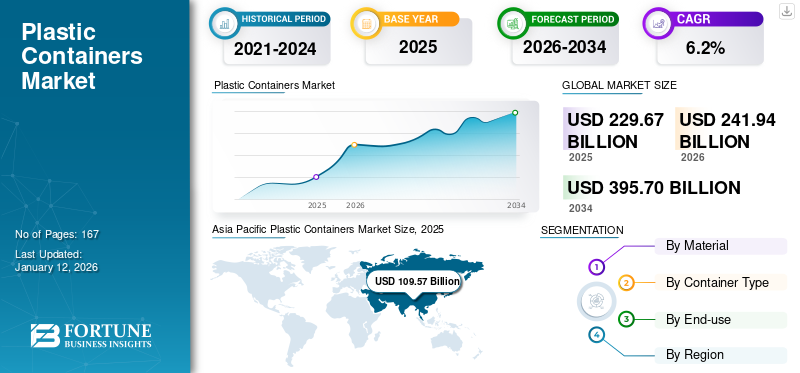

The global plastic containers market size was valued at USD 229.67 billion in 2025. The market is projected to grow from USD 241.94 billion in 2026 to USD 420.97 billion by 2035, exhibiting a CAGR of 6.3% during the forecast period. Asia Pacific dominated the plastic containers market with a market share of 48% in 2025.

Plastic containers are made of plastic resins such as polyethylene terephthalate, polypropylene, high-density polyethylene, and low-density polyethylene. These are primarily used for packaging and are available in various forms, including bottles, bottle jars, bowls, and pails. These containers are mainly utilized in packaging food, beverages, pharmaceuticals, and cosmetics. The rising demand for rigid packaging from the food and beverage manufacturers to increase the shelf-life of products and enhance the aesthetic to attract consumers will positively influence the market.

The market encompasses several major players such as Alpha Packaging, Amcor, Plastipak Packaging, and Consolidated Container Company. Broad portfolio with innovative product launch, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Sustained Beverage Growth Reinforces Global Demand for PET Containers

The global food and beverage industry remains a cornerstone driver of plastic container demand, with leading beverage companies heavily relying on PET packaging for scale and distribution.

- Coca-Cola reported sales of 33.7 billion unit cases in 2024, representing a 1% year-on-year growth in global volumes (Coca-Cola Company 2024 Annual Report). PET bottles remain central to Coca-Cola’s global packaging portfolio, underpinning the material’s position as a dominant format for beverages worldwide.

Sustained growth in non-alcoholic beverages, dairy, and bottled water segments reinforces PET container consumption. Beverage producers require packaging that balances durability, light weighting, and cost efficiency while supporting rapid distribution in diverse geographies. PET containers meet these requirements, offering extended shelf life, design flexibility, and compatibility with high-volume filling systems. This makes them the preferred choice for multinational food and beverage players, particularly in emerging markets where per capita packaged beverage consumption is rising.

MARKET RESTRAINTS

Regulatory Pressures and Sustainability Mandates Constrain Growth in Plastic Containers

The market faces a structural restraint from tightening global regulations and sustainability mandates. Policymakers worldwide are advancing frameworks that restrict certain plastic formats, impose recycled-content obligations, and require producers to finance end-of-life recovery through Extended Producer Responsibility (EPR) schemes. These measures are fundamentally reshaping the economics of rigid plastic container production.

- For instance, in the European Union, the Packaging and Packaging Waste Regulation (PPWR) mandates that all packaging should be recyclable or reusable by 2030, while also introducing minimum recycled-content thresholds for PET beverage bottles.

Similar initiatives are emerging in North America, with the U.S. states such as California legislating recycled-content requirements for plastic containers. In Asia, regulators are also tightening plastic rules, combining targeted bans on specific single-use items with stricter EPR enforcement, signaling a consistent regulatory direction across global markets.

MARKET OPPORTUNITIES

Sustainability Targets and PCR Integration Create Growth Avenues for Rigid Plastic Containers

The accelerating shift toward circular packaging systems presents a major opportunity for rigid plastic container producers. Global brand owners are embedding sustainability targets into their packaging strategies, creating a durable pull for recycled PET (rPET) and Post-Consumer Recycled HDPE (PCR-HDPE). These commitments are not peripheral; they are central to long-term corporate strategy and purchasing decisions.

- The Coca-Cola Company has pledged to use 50% recycled material in its PET bottles globally by 2030, while PepsiCo has set a similar target of 50% across its beverage portfolio. Unilever has committed to halving its use of virgin plastic by 2025, with a strong focus on PCR integration. These mandates signal sustained demand for suppliers capable of delivering high-quality, food-grade recycled resin containers that meet both brand and regulatory requirements.

MARKET CHALLENGES

Substitution Pressure from Alternatives May Hamper Market Growth

The market faces several challenges that could limit its growth despite rising demand. A key issue is the threat from alternatives such as paper & aluminum. Aluminum cans massively outperform PET bottles in terms of circularity, which is why brands lean into cans when they want quick, defensible footprint wins. Moreover, paper bottles are not mainstream, but visible trials create switching pressure on plastics in brand portfolios and retailer aisles.

- According to the Aluminum Association’s 2024 KPI report, in the U.S., cans have 71% recycled content vs 3–10% for PET, 96.7% closed-loop circularity vs 34% for PET, and a far higher material value in recycling streams (USD 1,338/ton vs USD 215/ton for PET).

PLASTIC CONTAINERS MARKET TRENDS

Surging Demand for Plastic Containers in Cosmetics & Personal Care Industry is the Leading Market Trend

Packaging of cosmetics & personal care products is made out of plastic due to its convenience and hygienic qualities. Polypropylene is mainly used to form bottles and jars that help in the packaging and storing of creams, powders, and other cosmetic products. Additionally, the compact and portable packaging offered by these containers protects the packed product from air, light, moisture, dust, and dirt. The escalating consumer preference for skin care products has driven the growth of the cosmetics & personal care industry. This is projected to impel the market during the forecast period.

Download Free sample to learn more about this report.

Segmentation Analysis

By Material

Packaging Consumers Higher Preference for Polyethylene Terephthalate (PET) makes it Dominant

Based on material, the market is segmented into Polyethylene Terephthalate (PET), Polypropylene (PP), High-density Polyethylene (HDPE), Low-density Polyethylene (LDPE), and others.

The PET segment is anticipated to hold the dominant plastic containers market share during the forecast period. PET is a lightweight and durable plastic resin. This form of polyester is closely similar to glass in transparency. It is preferred for packaging food products and beverages due to its barrier properties against water vapor, gases, oils, alcohols, and dilute acids.

High-Density Polyethylene (HDPE) is a sturdy, rigid, durable, and cost-effective resin. This material exhibits good stress and crack resistance, as well as high melt strength. The use of this resin in a mildly stiff impact-resistant bottle offers an excellent moisture barrier. The containers made from this material are mainly used in personal care, beverages, food, and chemical industries.

To know how our report can help streamline your business, Speak to Analyst

By Container Type

Bottle & Jar Containers are anticipated to Exhibit Fastest-growth Owing to its High Adoption in End-use Industries

In terms of container type, the market is classified into bottles & jars, pails, tubs, cups & bowls, and others.

The bottles & jars segment is the leading contributor to the market and is the fastest-growing container type. The demand for bottles & jars is increasing due to their use in packaging for the pharmaceutical, food, and beverage industries. Plastic bottles & jars are cost-effective, leakage-free, and lightweight. Hence, they are considered the best substitutes for metal and glass bottles & jars. Therefore, the increasing demand for rigid packaging from food and beverage industry will boost the segment growth.

By End-Use

Higher Adoption of Plastic Containers by Beverages Industry to Enable Dominance of the Segment

Based on end-use, the market is classified into beverages, food, pharmaceuticals & cosmetics, FMCG, and others.

Beverages is the leading end-use segment in the market as containers are used in the form of bottles & jars. These containers ensure safety and longer shelf-life, protecting from leakage, moisture, and chemicals. The increasing demand for ready-to-drink beverages, including carbonated soft drinks, juices, and milk & dairy drinks, has fueled the growth of plastic bottles around the globe.

The plastic resins used in the pharmaceuticals & cosmetics industry are polyethylene and polypropylene. These resins are used to manufacture bottles, jars, and tubes. The containers are chemically inert and resistant to corrosion, which helps protect skincare and medicine products from chemicals and moisture and avoids leakage. Hence, growth in the pharmaceuticals & cosmetics industry will increase the demand for plastic containers.

The food segment is expected to grow at a CAGR of 6.0% over the forecast period.

Plastic Containers Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Plastic Containers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

In 2025, Asia Pacific’s market size reached USD 109.57 billion and surged to USD 116.15 billion in 2026 while maintaining its dominant position. The growth in this region is attributed to the developing beverage industry, which further increases the demand for plastic bottles to preserve bottled water and carbonated drinks. The bottles used for beverages are primarily made up of polyethylene terephthalate material. Hence, rising consumer spending on carbonated beverages will surge this region's plastic containers market growth. China’s market size is anticipated to hit USD 62.49 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

In North America, the U.S. is the leading contributor due to the growing food and pharmaceutical industry. In the food industry, rigid plastic bottles & jars are used to protect food and beverages from leakage. In comparison, the product is mostly used in the pharmaceutical industry due to its lightweight and durable properties. The market in North America is estimated to reach USD 41.88 billion in 2026 and secure the position of the third-largest region in the market. In the region, the U.S. is estimated to reach USD 36.03 billion in 2026.

Europe

Europe is projected to record the third-highest growth rate of 5.8% over the forecast period and reach a valuation of USD 45.19 billion in 2026. The region’s market growth is bolstered by the growing FMCG and automotive industries. FMCG products, such as detergents, cleaners, and other products, are available in liquid form. The presence of major premium car manufacturers steers high demand for automotive fluids such as automotive lubricants, oils, coolants, and other fluids. Backed by these factors, in 2026 Germany will generate a revenue of USD 11.33 billion. In 2025 Italy will generate a revenue at USD 7.94 billion, and France at USD 6.89 billion.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa regions are estimated to witness moderate growth. The market in Latin America is expected to reach USD 25.48 billion by 2026 driven by the beverage industry's growth. For example, the Brazilian beer market is the third largest across the globe, and the acquisition of Brasil Krin by Heineken has significantly increased the demand in the country. In the Middle East & Africa, Saudi Arabia is set to attain a strong valuation of USD 13.24 billion in 2026 fueled by expansion of the food & beverage industry in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Wide Range of Product Offerings coupled with Strong Distribution Network of Key Companies supports their Leading Position

The plastic containers market is highly fragmented with key players focusing on product innovation, strategic partnerships, and geographic expansion. ALPLA, Alpha Packaging, Amcor, Plastipak Packaging, and Consolidated Container Company are some of the leading companies. A comprehensive range of products, a global presence through a strong distribution network, and collaborations with end-use industries are a few characteristics that support their dominance.

Other prominent players in the market include Polycon Industries, Inc., Greiner Packaging, and Altium Packaging. These companies are undertaking various strategic initiatives, such as investments in R&D and partnerships with other companies to enhance their market presence.

LIST OF KEY PLASTIC CONTAINERS COMPANIES PROFILED

- ALPLA (Austria)

- Pretium Packaging (U.S.)

- Amcor Plc (Switzerland)

- Plastipak Packaging (U.S.)

- Graham Packaging (U.S.)

- Winpak LTD. (Canada)

- Greiner Packaging (Austria)

- Huhtamaki (Finland)

- Visy (Australia)

- Zhuhai Zhongfu Industrial Co., Ltd (China)

- Polycon Industries, Inc. (U.S.)

- W. Plastics (U.S.)

- Silgan Holdings, Inc. (U.S.)

- CKS Packaging, Inc. (U.S.)

- Altium Packaging (U.S.)

- Polytainers, Inc. (Canada)

- Airlite Plastics Co. (U.S.)

- Reynolds Consumer Products LLC (U.S.)

- Sealed Air (U.S.)

- Fortex Fortiflex (Puerto Rico)

KEY INDUSTRY DEVELOPMENTS

- May 2025 - Amcor finalized its all-stock merger with Berry Global, creating an expanded consumer and healthcare packaging leader with broader material science capabilities, innovation scale, and operational synergies that deliver USD 650 million in annual cost and growth benefits.

- October 2024 - Silgan Holdings Inc. completed the acquisition of Weener Plastics, strengthening its position in sustainable rigid packaging and differentiated dispensing solutions for personal care, food, and healthcare. The integration enhances Silgan’s global footprint and technology capabilities, reinforcing its market leadership in plastic closures and custom packaging.

- July 2023 - Huhtamaki committed approx. USD 30 million to increase manufacturing capacity in Paris, Texas, enhancing output of containers, trays, and folding cartons to meet rising foodservice demand across the U.S. South and Midwest.

- September 2022 - Greiner Packaging expanded its recycling capabilities by acquiring ALWAG, a Serbian PET flake producer. This acquisition adds a recycling facility to Greiner's operations, enhancing its circular economy initiatives and securing a reliable supply of recycled PET for packaging applications.

- November 2021 - ALPLA announced a major investment to expand PET recycling capacity at its joint venture IMER plant in Mexico. The upgrade increased production of food-grade rPET for rigid bottles and containers, reinforcing ALPLA’s closed-loop supply for North American beverage customers.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2035 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2035 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.3% from 2026-2035 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material, Container Type, End-use, and Region |

|

By Material |

· Polyethylene Terephthalate · Polypropylene · HDPE · LDPE · Others |

|

By Container Type |

· Bottles & Jars · Pails · Tubs · Cups & Bowls · Others |

|

By End-use |

· Beverages · Food · Pharmaceuticals & Cosmetics · FMCG · Others |

|

By Geography |

· North America (By Material, Container Type, End-use, and Country) o U.S. (By Material) o Canada (By Material) · Europe ( By Material, Container Type, End-use, and Country/Sub-region) o Germany (By Material) o U.K. (By Material) o France (By Material) o Italy (By Material) o Spain (By Material) o Rest of Europe (By Material) · Asia Pacific (By Material, Container Type, End-use, and Country/Sub-region) o China (By Material) o Japan (By Material) o India (By Material) o South Korea (By Material) o Southeast Asia (By Material) o Rest of Asia Pacific (By Material) · Latin America (By Material, Container Type, End-use, and Country/Sub-region) o Brazil (By Material) o Mexico (By Material) o Rest of Latin America (By Material) · Middle East & Africa ( By Material, Container Type, End-use, and Country/Sub-region) o Saudi Arabia (By Material) o Turkey (By Material) o UAE (By Material) o Rest of the Middle East & Africa (By Material) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 241.94 billion in 2026 and is projected to reach USD 420.97 billion by 2035.

In 2026, the market value stood at USD 116.15 billion.

The market is expected to exhibit a CAGR of 6.3% during the forecast period of 2026-2035.

The Polyethylene terephthalate (PET) segment is expected to lead the market by material.

The increasing demand from food & beverage sector is driving the market.

ALPLA, Alpha Packaging, Amcor, Plastipak Packaging, and Consolidated Container Company, are some of the prominent players in the market.

Asia Pacific dominated the plastic containers market with a market share of 48% in 2025.

Rising demand from FMCG sector is expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us