Platelet Rich Plasma Market Size, Share & Industry Analysis, By Product (Pure Platelet Rich Plasma (Pure PRP), Leukocyte-rich Platelet Rich Plasma (L-PRP), Platelet Rich Fibrin (PRF), and Others), By Application (Orthopedics, Neurology, Cosmetics, Wound Care, and Others), By End User (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

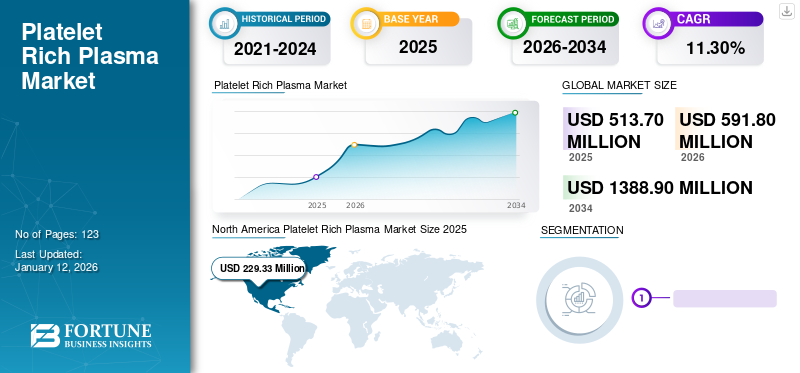

The global platelet rich plasma market size was valued at USD 513.7 million in 2025 and is projected to grow from USD 591.8 million in 2026 to USD 1,388.90 million by 2034, exhibiting a CAGR of 11.30% during the forecast period. North America dominated the global market with a share of 44.60% in 2025.

Platelet Rich Plasma (PRP) therapy is a type of regenerative medicine that induces the natural growth factors found in blood cells to heal the damaged tissues. The rising prevalence of several orthopedic & neurological diseases and injuries is projected to fuel the platelet rich plasma market growth during the forecast period. Also, the growing adoption of such therapies in cosmetic procedures is another driving factor for the market.

Moreover, increasing strategic initiatives by key players to launch and supply advanced products across the globe are expected to drive the market growth.

- In May 2022, Estar Medical signed an exclusive long-term marketing and distribution agreement with Aesthetic Management Partners (AMP), LLC to sell products in the U.S. market. Such strategic initiatives are expected to bolster the market expansion.

Global Platelet Rich Plasma Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 513.7 million

- 2026 Market Size: USD 591.8 million

- 2034 Forecast Market Size: USD 1,388.90 million

- CAGR: 11.30% from 2026–2034

Market Share:

- North America dominated the global platelet rich plasma market with a 44.60% share in 2025. This dominance is attributed to strong healthcare infrastructure, robust product adoption, and significant FDA approvals.

- By product type, Pure Platelet Rich Plasma (Pure PRP) held a significant share in 2024 due to its extensive use in reconstructive care and recent FDA-approved product launches.

Key Country Highlights:

- Japan: Demand is driven by growing adoption in regenerative medicine and advanced wound care, coupled with a rising elderly population requiring orthopedic and cosmetic treatments.

- United States: The market growth is supported by rising sports injuries, orthopedic and neurological diseases, and strategic partnerships such as Estar Medical’s distribution agreement with AMP, LLC. The FDA’s regulatory framework and strong healthcare infrastructure further foster product adoption.

- China: Increasing awareness of PRP therapies, combined with a high prevalence of musculoskeletal disorders and initiatives promoting regenerative medicine, propel the market. Additionally, growing dental and cosmetic applications contribute to demand.

- Europe: Market expansion is backed by the increasing prevalence of rheumatoid arthritis and orthopedic diseases, along with growing adoption of PRP therapies. Regulatory support and growing reimbursement awareness are also key drivers.

COVID-19 IMPACT

Limited Patient Visits to Hospitals and Clinics during Pandemic Negatively Impacted Market Growth

In 2020, the COVID-19 pandemic had a negative impact on the global market. A slower growth trend was observed in this year due to travel restrictions and disruptions in the supply chains of major companies in the market. The patient visits for orthopedic, wound care, cosmetic, and neurological treatments were deeply impacted due to lockdown restrictions, which resulted in a lesser number of treatments during 2020.

- According to an article published by the National Institutes of Health (NIH) in 2020, a survey was conducted with 46 respondents that included Medical Doctors (MDs) and nurses. It was found that the COVID-19 pandemic affected wound care visits, and about 60.9% patients missed their appointments and did not maintain any contact with their specialists in Italy. Such scenarios significantly reduced the usage of this treatment and impacted the sales of related products.

The resurgence in hospital and ASC visits for such treatments due to increasing injuries and disorders helped the market bounce back to the pre-pandemic level in 2022. Such a scenario has stabilized the market and might bring it to the pre-pandemic growth level from 2023 to 2030.

LATEST TRENDS

Increased Treatment Applications in Cosmetic Rejuvenation Procedures

In recent years, one of the most significant trends in the market is the growing application of such therapies in cosmetic rejuvenation procedures. Furthermore, these therapies have robust applications in orthopedics, neurology, cosmetics, and wound care management fields. The common areas for cosmetic applications of these products include wrinkle reduction, plumping up sagging skin, deep crease reduction, complexion improvement, and acne scar reduction. The growing demand for cosmetic procedures, coupled with the strong efficacy of these products, is expected to drive the growth of the market.

- North America witnessed a growth from USD 171.8 Million in 2023 to USD 198.5 Million in 2024.

- For instance, according to an article published by the National Institutes of Health (NIH) in 2020, the PRP treatment or a combination of these therapies had beneficial effects in terms of cosmetic improvements and treatment of some skin diseases.

Download Free sample to learn more about this report.

PLATELET RICH PLASMA MARKET GROWTH FACTORS

Increasing Sports and Musculoskeletal Injuries to Boost Market Growth Prospects

Platelet rich plasma (PRP) products are witnessing stronger adoption among patients suffering from musculoskeletal or sports injuries. These injuries or disorders particularly affect the muscles, nerves, tendons, joints, cartilage, and spinal discs. For instance, PRP is injected into the damaged Anterior Cruciate Ligament (ACL), which stimulates cell migration and a process whereby new blood vessels form from the existing blood vessels. This intensifies the healing process. The rising cases of sports injuries will eventually increase the demand for such treatments across the globe.

- For instance, according to an article published by Courier-Journal in 2023, approximately 30 million children and teens participate in some form of organized sports. Among them, more than 3.5 million injuries are reported yearly in the U.S. Such high injury rates are expected to drive the market during the forecast timeframe.

Rising Application of Such Treatments in Chronic Disorders to Favor Market Expansion

The market is witnessing robust advancements in regenerative medicines across the globe. The application areas for these therapies includes skin rejuvenation, orthopedic, pain, hair loss, diabetes, varicose veins, and dental implant placement. Such vast application areas promote the utilization of these medical devices as well, thereby contributing to the market growth.

- For instance, according to statistics published by the World Health Organization (WHO) in 2022, approximately 528 million people worldwide were living with osteoarthritis in 2019. The prevalence of osteoarthritis has increased to 113.0% in 2019, as compared to 1990. Additionally, about 73% of people living with osteoarthritis are older than 55 years, and 60% of them are females. Such a rise in the prevalence of these chronic diseases is expected to drive the adoption of such treatments and products during the forecast timeframe.

RESTRAINING FACTORS

High Costs and Limited Reimbursement Facilities to Deter Market Expansion

Despite the growing adoption of these treatments, the market might be hampered due to several factors including pricing pressure, reimbursement facilities, and regulatory scenario. The increasing pricing pressure and limited reimbursement support are some of the key factors that are anticipated to limit the growth of the market.

- As per a news article in Medical News Today (2021), the cost of a single PRP treatment ranges from USD 500 to 2,500. Also, repetitive treatments are required in various cases. Such a high cost associated with this therapy is obstructing the product adoption among the population.

The awareness regarding these products is increasing and they have vast applications in treating chronic disorders. However, the cost associated with these therapies is quite high. Also, suitable reimbursement facilities are not available for such procedures. Thus, such scenario is expected to restrict the market growth during the forecast period. For instance, according to an article published by the National Institutes of Health (NIH) in 2020, the absence of formal indications and labeling for these therapies have led insurance and Medicare programs to offer limited reimbursement for this treatment.

SEGMENTATION

By Product Analysis

New Product Launches for Reconstructive Care to Boost Utilization of Pure PRP

In terms of product, the market is segmented into Pure Platelet Rich Plasma (Pure PRP), Leukocyte-Rich Platelet Rich Plasma (L-PRP), Platelet Rich Fibrin (PRF), and others. The Pure Platelet Rich Plasma (Pure PRP) segment held a significant market with a share of 60.88% in 2026. The segment’s growth is attributed to the robust utilization of this product and recent launches of reconstructive care in the market.

- For instance, in July 2020, EmCyte Corporation received the FDA approval for its product named PureBMC. It is a platelet or cell-concentrating system.

The Platelet Rich Fibrin (PRF) segment is projected to capture a substantial market share over the forecast period. It is a second-generation platelet concentrate and comprises of a fibrin matrix containing numerous growth factors. Its strong application in oral surgery is promoting the segment’s growth.

- The leukocyte-rich Pletelet Rich Plasma (L-PRP) segment is expected to hold a 12.1% share in 2024.

Similarly, the Leukocyte-Rich Platelet Rich Plasma (L-PRP) and others segments captured a suitable market share in 2024. Several product launches and growing demand for these products will contribute to the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Incidence of Various Types of Injuries to Drive Product Application in Wound Care

Based on application, the market is segmented into orthopedics, neurology, cosmetics, wound care, and others. The wound care segment held a dominant share contributing 34.49% globally in 2026. This is due to the rising cases of multiple injuries in various countries and frequent product launches by key players in the market.

- According to an article published by Eurostat in 2023, about 70% of all accidents at work in the European Union caused wounds and superficial injuries, dislocations, sprains and strains, or concussions and internal injuries in 2020. PRP treatments have strong application in wound care, which will boost the segment’s growth.

The orthopedics segment held a significant market share in 2024. These treatments accelerate the healing of damaged joints, ligaments, tendons, and muscles. The growing prevalence of orthopedic disorders, including arthritis, osteoarthritis, rheumatoid arthritis, and bursitis, and strong utilization of PRP products for these medical conditions is augmenting the product demand in the market.

The cosmetic segment held a suitable share of the market. This is attributed to the growing adoption of PRP products to address multiple beauty-related issues across the globe. The neurology and others segments also held a suitable market share. The neurological application of PRP treatment is that it encourages the repair and regeneration of nerve tissues. Similarly, the others segment includes otolaryngology, cardiovascular surgery, and dental applications. The increasing demand for and adoption of PRP products are propelling the segment’s growth. For instance, according to the IMC Press Journal published in 2022, the topical application of autologous PRP on saphenoug vein harvest site might reduce the rate of surgical site infections, which will particularly benefit the diabetic patients.

By End User Analysis

Large Number of Hospitals Providing Such Treatments to Boost Patient Visits

In terms of end user, the global market is segmented into hospitals & ASCs, specialty clinics, and others. The hospitals & ASCs segment held a dominant platelet rich plasma market with a share of 74.43% in 2026. The growth of the segment is attributed to the fact that patients suffering from chronic and acute wounds prefer to go to hospitals and clinics for treatment. Also, the increasing number of hospitals providing such treatments in developing countries, such as India is propelling the segment’s expansion.

- In December 2022, Visakha Institute of Medical Sciences became the first government hospital in Andhra Pradesh, India to offer PRP therapy.

The specialty clinics segment is expected to grow at a lucrative rate over the forecast period. The growing number of cosmetic procedures in specialty clinics for treating skin aging issues and alopecia has contributed to the segment’s growth.

The others segment is projected to account for a suitable market share by 2030. PRP products are also available in the form of kits which can be used at home. The growing adoption of such kits for home use is propelling the segment’s expansion.

REGIONAL INSIGHTS

Regarding geography, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Platelet Rich Plasma Market Size 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America generated a revenue of USD 265.15 million in the global market in 2026. The strong presence of market players and significant FDA approvals for these products are major contributors to the region's dominance in the global market. Also, robust healthcare infrastructure and strong product adoption amongst the population for multiple applications are favoring the regional market’s growth. The U.S. market is projected to reach USD 219.50 billion by 2026.

Europe

Europe held a substantial share of the global market. The prevalence of orthopedic and neurological diseases and adoption of PRP products are increasing. This scenario is ultimately resulting in the growth of the regional market. The UK market is projected to reach USD 34.6 billion by 2026, while the Germany market is projected to reach USD 43.1 billion by 2026.

- As per the Zeitschrift für Rheumatologie article published in 2023, the estimated prevalence of Rheumatoid Arthritis (RA) in the German adult population ranged from 0.8-1.2%, which equated to approximately 560,000 to 830,000 individuals in 2021.

Asia Pacific

Asia Pacific is projected to record the highest CAGR during the forecast period. The growing prevalence of orthopedic diseases and sports injuries is propelling the product’s adoption among the regional population. Similarly, rising awareness regarding the benefits of PRP products has also contributed to the regional market’s growth. The Japan market is projected to reach USD 35.6 billion by 2026, the China market is projected to reach USD 30.2 billion by 2026, and the India market is projected to reach USD 19.3 billion by 2026.

- According to an article published in the International Journal of Research in Pharmaceutical Sciences (IJRPS) in 2020, a study was conducted to assess the awareness of regenerative therapy with PRP among dental students in Tamil Nadu, India. It was found that 82% of the respondents were aware of the surgical applications of this regenerative therapy.

Latin America and the Middle East & Africa

Moreover, Latin America and the Middle East & Africa markets are growing steadily due to the increasing demand for these products and initiatives by various companies to enhance their market presence in these regions. As per a study published by LA Referencia in 2021, there is an intense need to develop regulatory norms that will reduce variability and promote safety with respect to the production and use of platelet concentrates in Brazil.

KEY INDUSTRY PLAYERS

Strategic Initiatives and Growing Geographical Presence of Key Companies to Fuel Their Market Dominance

The competitive landscape of the market reflects a fragmented structure. It comprises of numerous established and emerging companies across the globe. Zimmer Biomet, Arthrex, Inc., and Stryker Corporation are some of the major players that dominated the global market share in 2022. The dominance of these players is attributed to their robust product portfolios and expanding geographical presence. Also, these companies are involved in various strategic activities and trying to expand their distribution networks, which will favor their dominance in the market.

- In October 2019, Arthrex, Inc.’s Autologous Conditioned Plasma (ACP) double syringe system received a branded packaging design from Croma-Pharma GmbH (Croma). These companies have successfully cooperated with each other while developing personalized cell therapy devices since 2017. Also, the product would be exclusively distributed in 9 European countries by Croma.

Isto Biologics, ThermoGenesis Holdings, Inc., and Exactech, Inc. are some other key players in this market. These firms are engaged in providing customized PRP therapies to fit their patients’ needs. The growing number of strategic acquisitions and partnerships is anticipated to expand their market share in the future.

LIST OF KEY COMPANIES PROFILED IN PLATELET RICH PLASMA MARKET:

- Arthrex, Inc. (U.S.)

- Isto Biologics (U.S.)

- Zimmer Biomet (U.S.)

- ThermoGenesis Holdings, Inc. (U.S.)

- Exactech, Inc. (U.S.)

- EmCyte Corporation (U.S.)

- Stryker (U.S.)

- Terumo Corporation (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022: Crown Aesthetics rebranded its product ProGen PRP Advantage to ProGen PRP Eclipse. This simple-to-use system claimed to produce consistent results to fit all of their customers' needs.

- April 2022: Isto Biologics, one of the emerging players in the market, acquired TheraCell, Inc. This acquisition would strengthen the company’s focus on offering extraordinary solutions for surgical and clinical care procedures in spine, orthopedics, and sports medicine.

- March 2022: Exactech, Inc. demonstrated its innovative products and active intelligence technologies at the American Academy of Orthopedic Surgeons (AAOS) 2022 Annual Meeting Booth in Chicago.

- July 2021: Exactech, Inc. partnered with RTI Surgical for the supply and development of its biologic products, such as bone substitutes.

- February 2021: Terumo Corporation signed an agreement with Osteopore Limited to sell and promote their respective regenerative products including PRP across Asia Pacific.

REPORT COVERAGE

The report provides a comprehensive market analysis. It highlights key segments, such as products, applications, end users, and geography. It includes key insights, such as the prevalence of major chronic diseases, technological advancements, regulatory scenarios, and key industry developments. Furthermore, it provides insights into the market dynamics, trends, competitive analysis, company profiles of key players, and the COVID-19 impact on the market. The report also comprises multiple factors that will contribute to the market’s growth during the forecast period.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.30% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Product

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global platelet rich plasma market size was valued at USD 591.8 million in 2026 and is projected to reach USD 1,388.90 million by 2034.

The platelet rich plasma market is expected to grow at a CAGR of 11.30% from 2026 to 2034, driven by increasing adoption in orthopedics, wound care, and cosmetic applications.

North America market size was valued at USD 229.33 million in 2025.

Based on product, the Pure Platelet Rich Plasma (Pure PRP) segment led the global market in 2025.

North America held the dominant share of the global market in 2025.

Growth is primarily driven by the rising incidence of sports injuries, growing use in aesthetic treatments, increasing prevalence of osteoarthritis, and advancements in regenerative medicine technologies.

Zimmer Biomet, Arthrex, Inc., and Stryker are the key players in the market.

Key applications of platelet rich plasma therapy include orthopedics, wound care, cosmetic procedures, neurology, and dental treatments. It is widely used for tissue repair, skin rejuvenation, and accelerating healing in injuries.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us