Point-of-Care Coagulation (POCC) Testing Devices Market Size, Share & Industry Analysis, By Device Type (Anticoagulation Monitoring Devices {Prothrombin Time/International Normalized Ratio (PT/INR) Testing Devices, Activated Clotting Time (ACT), and Activated Partial Thromboplastin Time (aPPT)}, Platelet Function Monitoring Devices, Viscoelastic Coagulation Monitoring Devices {Thromboelastography (TEG) and Rotational Thromboelastometry (ROTEM)}, and Others), By End User (Hospitals & Clinics, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

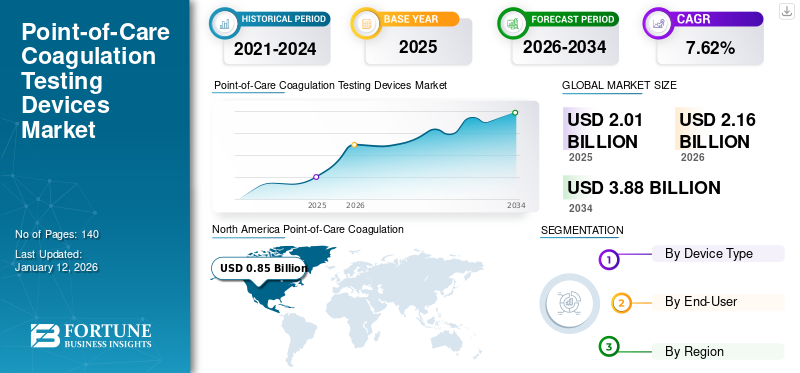

The global point-of-care coagulation (POCC) testing devices market size was valued at USD 2.01 billion in 2025 and is projected to grow from USD 2.16 billion in 2026 to USD 3.88 billion by 2034, exhibiting a CAGR of 7.62% during the forecast period. The adoption of POCC devices is expanding as healthcare providers seek faster and more accurate coagulation monitoring solutions. North America dominated the point-of-care coagulation (POCC) testing devices market with a market share of 42.38% in 2025

Point-of-care coagulation testing (POCCT) allows clinicians to evaluate a patient's coagulation status in real time rapidly. Coagulation testing is important in medical diagnostics for monitoring blood clotting in patients with conditions such as hemophilia, deep vein thrombosis and those undergoing surgery. These POCC testing devices are used to monitor patients receiving low, moderate, or intensive anticoagulation in invasive or operative clinical procedures that use heparin therapy.

Moreover, the market is semi-consolidated with the presence of key players, such as F. Hoffmann-La Roche Ltd., Abbott, and Siemens Healthineers AG, among others. The majority of market players started enhancing their brand image and customer reach in the market by participating in medical conferences.

- For example, in September 2022, F. Hoffmann-La Roche Ltd. participated in the World CB & CDx Summit held in Boston, U.S. During the event, the company showcased its diagnostic products to create product awareness in the market.

Regular monitoring of anticoagulation therapy among patients has been plagued with a relatively high incidence of adverse reactions, including hemorrhage or thrombosis. These conditions can occur due to the complexity of anticoagulants or adverse reactions to any drug.

In various healthcare settings, point-of-care coagulation tests are preferred over conventional analyzers to determine the stages of blood coagulation in patients with bleeding disorders. These diagnostic tools provide rapid and precise hemostatic function results during the preoperative and postoperative phases.

Moreover, cases of severe bleeding mostly occur after trauma and during surgery, which requires adequate coagulation management. For this purpose, point-of-care (POC) tests allow a fast assessment of the hemostasis and provide important guidance when using a coagulation algorithm. These advantageous factors drive the demand for POC diagnostic devices. Furthermore, the growing focus of market players on optimizing existing products through integrating novel technologies is contributing to market growth.

Global Point-of-Care Coagulation Testing Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.01 billion

- 2026 Market Size: USD 2.16 billion

- 2034 Forecast Market Size: USD 3.88 billion

- CAGR: 7.62% from 2026–2034

Market Share:

- North America dominated the point-of-care coagulation testing devices market with a 42.38% share in 2025, driven by the strong presence of key manufacturers, increasing prevalence of bleeding disorders, and regulatory approvals for advanced coagulation monitoring solutions.

- By device type, anticoagulation monitoring devices held the largest market share in 2026, owing to rising demand for real-time hemostatic assessments during surgeries and the growing number of regulatory approvals for portable and accurate testing systems.

Key Country Highlights:

- United States: Market growth is driven by the increasing prevalence of bleeding disorders and a high number of hospital-based surgical procedures requiring advanced coagulation monitoring solutions.

- Europe: The launch of advanced coagulation analyzers by key players in medium and large hospitals is supporting the adoption of POCC testing devices across the region.

- China: Regulatory approvals for POCC devices and the rising focus of market players on expanding product availability are key factors accelerating market growth.

- Japan: Increasing adoption of home-use coagulation monitoring devices due to the rising geriatric population with bleeding disorders is fueling demand for point-of-care solutions.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Patient Pool with Bleeding Disorders to Boost Demand for These Devices, Propelling Market Growth

The rising patient population suffering from bleeding disorders, including hemophilia, venous thromboembolism, and others, is driving the demand for point-of-care coagulation testing devices.

- For example, according to data provided by the National Institute for Health and Care Excellence in March 2024, 9,316 people in the U.K. were living with hemophilia A as of 2022. Also, according to the same source, 2,069 people in the U.K. were living with hemophilia B in 2022, of whom 374 had severe and 351 had moderate disease.

In addition, a significant increase has been observed in the number of geriatric patients suffering from bleeding disorders due to changing hemostatic balance among people with the growing age, further generating the demand for portable and easy-to-use testing devices. Also, the launch of advanced point-of-care diagnostic devices by market players is further boosting the adoption of these testing devices globally.

Other Driving Factors:

Technological Advancements in POCC Testing Devices

The launch of advanced point-of-care devices by market players that are easy to handle and operate is boosting their adoption globally. This will subsequently propel the market's growth during the forecast period.

- For example, in January 2023, Cipla announced the launch of Cippoint, a point-of-care testing device that offers various testing parameters, including diabetes, fertility, infectious diseases, cardiac markers, inflammation, metabolic markers, and coagulation markers.

Rising Demand for Home Healthcare Solutions

The main factor driving market growth during the forecast period is the growing focus of market players on the development and launch of point-of-care coagulation (POCC) devices that patients can easily use at home without professional assistance.

- For example, in April 2024, Haemonetics Corporation announced that it had received the U.S. Food and Drug Administration (FDA) approval for its TEG 6s hemostasis analyzer system Global Hemostasis-HN assay cartridge. This newly developed cartridge expanded Haemonetics' TEG 6s viscoelastic testing capabilities to fully heparinized patients in adult cardiovascular surgeries/procedures and liver transplants in laboratory and point-of-care settings.

Improvement in Healthcare Infrastructure in Emerging Markets

Expanding healthcare services in developing economies drives the POC coagulation testing devices market. The developing countries are heavily investing in expanding healthcare infrastructure to address the needs of the unserved population.

MARKET RESTRAINTS

High Cost of Point-of-Care Coagulation (POCC) Testing Devices May Restrict their Adoption in Emerging Countries

Despite the distinct benefits offered by point-of-care coagulation (POCC) testing devices as compared to conventional coagulation analyzers, certain factors are limiting the growth of the global market. One of the major factors restricting the market growth is the lower adoption of point-of-care coagulation testing devices in emerging countries. This is due to the high cost of the device as compared to the laboratory assay tests and the lack of favorable reimbursement policies to provide coverage to the patients.

- For instance, Medtronic offers a point-of-care coagulation (POCC) testing system named ACT Plus Automated Coagulation Timer, costing around USD 7,026.6.

The above costs, combined with additional costs of battery and maintenance, increase the overall annual costs of point-of-care coagulation (POCC) testing devices. Along with the high cost of these testing devices, stringent government regulations and limited reimbursement policies in different regions for home-based POCC testing devices are hindering point-of-care coagulation (POCC) testing devices market growth throughout the forecast period.

MARKET OPPORTUNITIES

Expansion in Emerging Markets

In untapped regions such as Latin America, Asia Pacific, and the Middle East & Africa, there is a growth opportunity for the market players to expand their business in the POC coagulation testing devices market.

- For example, Brazil’s SUS (Unified Health System) is free of cost at the point of service for any person, including foreigners. The SUS provides services ranging from primary care to complex procedures and offers emergency care for people who suffer accidents through the Mobile Emergency Care Service (SAMU). Expanding diagnostic services can create an opportunity for POC coagulation testing devices in community health centers and small clinics.

MARKET CHALLENGES

Competition from Traditional Laboratory Testing is Considered Major Challenge for Market Players

Traditional laboratory tests are preferred more in various clinical settings due to their established reliability and complete testing capabilities. Due to this reason, many healthcare professionals may be hesitant to adopt novel POC testing devices, predominantly in critical care environments where precision is most important.

Lack of Awareness and Training Regarding Use of POCC Testing Devices Among Healthcare Professionals

The limited awareness among healthcare professionals regarding the appropriate use of POCC testing devices can lead to inadequate use and misinterpretation of results, leading to unacceptable patient care. Due to the above-mentioned facts, proper training is essential for healthcare professionals to understand how to operate these devices.

MARKET TRENDS

Gradual Shift of Patients Toward Home Healthcare Devices

The rising financial burden of healthcare services and hospital admissions has led to the shift of patients toward managing diseases such as hemophilia, von Willebrand disease, and other bleeding disorders in homecare settings. Moreover, companies are investing in developing user-friendly point-of-care devices for monitoring coagulation disorders in patients' homes.

This resulted in the launch of POC coagulation devices that are technologically advanced, portable, easy to use, and suitable for home care and emergency settings. Patients can effortlessly use these devices without needing professional assistance.

- For instance, in November 2021, CoaguSense Inc., a subsidiary of i-SENS, Inc., incorporated a novel direct micromechanical clot-detection technology supported by the MedM remote care platform into its Coag-Sense PT/INR Monitoring System home testing system. The device shows the prothrombin time results in less than 60 seconds without the need for lookup tables or curve-fitting algorithms. Hence, market players' introduction of such advanced devices is expected to boost the adoption of home-use point-of-care coagulation testing devices during the forecast period.

Other Prominent Market Trends:

Technological Advancements in Point-of-Care Coagulation (POCC) Testing Devices

The increasing focus of market players on the launch of technologically advanced point-of-care coagulation (POCC) testing devices is considered a significant market trend. These devices can be connected to smartphones, allowing patients and healthcare providers to rapidly monitor coagulation parameters such as prothrombin time (PT) and international normalized ratio (INR), with results sent directly to a smartphone application.

- For example, Universal Biosensors introduced the Xprecia Prime coagulation analyzer in 2022. This new and improved coagulation monitoring device is for healthcare professionals. This device can be connected to smartphones and tablets to manage anticoagulant therapy.

Rise in Launch of Self-monitoring Coagulation Testing Devices

The growing focus of market players on developing and launching patient-friendly POCC testing devices that enable individuals to perform tests, such as INR (International Normalized Ratio) at their homes, is considered a substantial market trend.

- For example, in May 2024, Universal Biosensors launched the Xprecia Prime 4U coagulation analyzer. This device allows patients to monitor their PT/INR (International Normalized Ratio) independently.

Furthermore, the increased patient preference for home monitoring to avoid frequent visits to healthcare facilities, especially for chronic diseases, is considered a significant market trend.

Real-time Data Sharing and Cloud-based Solutions for Remote Monitoring

The POCC testing devices are integrated with cloud platforms that allow real-time data storage and sharing, enabling remote access to healthcare providers.

- For example, the CoaguChek INRange system provided by F. Hoffmann-La Roche Ltd. integrates with the cloud-based portal, allowing patients to share INR (International Normalized Ratio) instant results with their healthcare providers, facilitating better anticoagulation therapy management.

Furthermore, directly integrating POC coagulation testing devices with electronic health records (EHR) systems ensures seamless documentation and reduces manual entry errors.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic had a negative impact on the growth of the POC coagulation testing devices market in 2020. Key players operating in the market reported declining revenues due to the pandemic.

- For instance, in FY 2020, Siemens Healthineers AG generated a revenue of USD 4,246.8 million in 2020 from its diagnostic segment. The company experienced a decline of -5.1% in its revenue generated by the diagnostics segment in 2020 compared to revenue generated in 2019.

Also, access to healthcare facilities and hemophilia treatment centers (HTCs) was reduced, and elective surgeries were postponed until FY 2020. Moreover, the market regained normalcy during the post-pandemic years due to the resumption of all the services.

Furthermore, the market witnessed considerable growth in 2022, 2023, and 2024 due to an increase in new product launches that can be used directly at patient's homes and healthcare facilities to monitor anticoagulant drug therapy.

SEGMENTATION ANALYSIS

By Device Type

Increasing Regulatory Approvals for Anticoagulation Monitoring Devices to Spur Segment Growth

The market is segmented by device type into anticoagulation monitoring devices, platelet function monitoring devices, viscoelastic coagulation monitoring devices, and others.

The anticoagulation monitoring devices segment dominated the market by accounting for 79.64% market share in 2026 for the major proportion of the global point-of-care coagulation (POCC) testing devices market. The segment's dominance is attributed to the increasing regulatory approvals for anticoagulation monitoring devices, which can be used to diagnose blood clotting-related disorders.

- For example, in April 2019, CoaguSense Inc. announced the U.S. Food and Drug Administration (FDA) approval of its second-generation prothrombin time/international normalized ratio (PT/INR) monitoring system (Coag-Sense PT2 meter). This product was designed to monitor patients who were on Coumadin (warfarin) therapy.

The viscoelastic coagulation monitoring devices segment is projected to grow at the highest CAGR throughout the forecast period. The highest growth rate of this segment is largely attributed to the efficiency of these devices in providing information related to the blood clots in all stages of coagulation, which is important for successful hemostasis. Also, the increasing focus of market players on receiving regulatory approvals leads to the higher availability of these devices worldwide, which is an additional factor driving segmental growth.

- For instance, in July 2022, Werfen announced the 510(k) clearance of the ROTEM sigma Thromboelastometry system by the U.S. Food and Drug Administration (FDA). This product provides real-time, rapid, and actionable results at the point of care (POC) settings to guide bleeding management. This product is commercially available in Europe, Australia, Asia, Latin America, and Africa at the point of care (POC) to guide bleeding management.

On the other hand, the platelet function monitoring devices segment is expected to grow at a moderate CAGR during the forecast period. This growth is due to the high burden of blood clotting disorders worldwide. Also, the growth is attributed to the expanding application of these devices in various healthcare settings for conditions such as inherited bleeding disorders, cardiovascular intensive care, trauma coagulopathy, liver transplantation, and obstetric care.

- For example, according to the American Heart Association 2021 fact sheet, the global prevalence of intracerebral hemorrhage in 2019 was 20.7 million, and subarachnoid hemorrhage was 8.4 million. Therefore, the rising prevalence of blood clotting disorders necessitates the demand for effective diagnosis with the help of coagulation testing devices, driving segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By End User

Hospital & Clinics Segment Led Due to Growing Number of Hospitalizations

In terms of end user, the market is divided into hospitals & clinics, homecare settings, and others.

The hospitals & clinics segment dominated the global point-of-care coagulation (POCC) testing devices market share of 63.85% in 2026. Coagulation testing helps surgeons make real-time decisions about administering blood products and anticoagulants during complex surgeries, such as cardiac bypass or organ transplants. Therefore, the increasing number of complex surgeries performed in hospitals and clinics increases the demand for POCC testing devices, boosting segmental growth.

- For example, in October 2021, Trivitron Healthcare launched a new line of coagulation analyzer products manufactured by Diagon Ltd. The new products include the COAG Line automated, semi-automated, and POC systems manufactured by Diagon Hungary to reduce bleeding risk in extensive surgeries and check the efficacy of hemostatic therapies and anticoagulant drugs.

Furthermore, the homecare settings segment is expected to grow at the highest CAGR during the forecast period owing to the increased patient preference for home monitoring to avoid frequent visits to healthcare facilities, especially for chronic conditions. For example, the shift toward home-based coagulation testing is evident in devices such as Coag-Sense PT2 (PT/INR Monitoring System), which allows patients on anticoagulant therapy to test their INR at home.

POINT-OF-CARE COAGULATION (POCC) TESTING DEVICES MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America:

North America Point-of-Care Coagulation (POCC) Testing Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the point-of-care coagulation (POCC) testing devices market share in 2025, accounting for USD 0.85 billion of the global market. The segment's dominance is attributed to the fact that many players in this region provide POCC testing devices. Moreover, the increasing prevalence of bleeding disorders is another factor driving market growth in this region. For example, HemoSonics, LLC., Haemonetics Corporation, and Abbott are some of the major players operating in the U.S. and involved in providing Point-of-Care Coagulation (POCC) testing devices. The U.S. market is projected to reach USD 0.87 billion by 2026.

In addition, the growing focus of market players on receiving regulatory approvals to introduce novel products in the U.S. is an additional factor driving point-of-care coagulation (POCC) testing devices market growth throughout the forecast period.

Asia Pacific:

The point-of-care coagulation testing devices market in Asia is expected to grow at the highest CAGR from 2025-2032. This is mainly due to the rising number of patients who have hemophilia, Von Willebrand Disease, and other bleeding disorders. This, combined with the shifting focus of key companies on expanding their presence in emerging countries, such as China and India, is anticipated to boost the growth in this region further. The Japan market is projected to reach USD 0.12 billion by 2026, the China market is projected to reach USD 0.16 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

- In August 2023, Universal Biosensors announced that it had received approval from the Central Drugs Standard Control Organisation (CDSCO) to sell Xprecia Prime in the Indian market.

Europe:

Europe market for point-of-care coagulation (POCC) testing devices held the second-largest share in 2024, owing to the introduction of advanced coagulation testing devices in the market. The UK market is projected to reach USD 0.11 billion by 2026, while the Germany market is projected to reach USD 0.13 billion by 2026.

- For example, in July 2021, Sysmex Europe announced the launch of two new automated blood coagulation analyzers, CN-3500 and CN-6500, in specific countries of the Europe region. The company targeted medium- and large-scale hospitals, commercial labs, and other healthcare facilities.

Latin America and Middle East & Africa:

Furthermore, the POCC testing devices market in Latin America and the Middle East & Africa are expected to grow steadily throughout the forecast period. This is attributable to their developing healthcare infrastructure for point-of-care coagulation (POCC) testing devices.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increasing Focus of Market Players on Strategic Alliances to Enhance their Product Offerings is Responsible for Companies’ Revenue Growth

The global point-of-care coagulation (POCC) testing devices market reflects a semi-consolidated market with the presence of several players. Companies such as F. Hoffmann-La Roche Ltd., Abbott, Siemens Healthineers AG, and others accounted for a significant share of the overall point-of-care coagulation testing devices market in 2024. The dominance of these players is attributed to their strong operating network and robust portfolio for point-of-care coagulation (POCC) devices. These companies are focused on making strategic alliances to expand their market presence.

- In February 2023, Siemens Healthineers AG signed a global OEM agreement on hemostasis products with Sysmex Corporation. As per the agreement, each company started supplying the other with its products in the diagnostic field of hemostasis on an original equipment manufacturing agreement (OEM) basis.

In addition, other players operating in the market include Helena Laboratories Corporation, Werfen, Haemonetics Corporation, HemoSonics, LLC, Inc., Medtronic, and Koninklijke Philips N.V. Furthermore, these companies are focused on receiving regulatory approvals to introduce products in the market had contributed to the market growth.

- In November 2022, HemoSonics, LLC. received the U.S. Food and Drug Administration (FDA) clearance for its Quantra Hemostasis system with a QStat cartridge.

LIST OF KEY COMPANIES PROFILED:

- Werfen (Spain)

- Helena Laboratories Corporation (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthcare AG (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- HemoSonics, LLC (U.S.)

- Haemonetics Corporation (U.S.)

- i-SENS, Inc. (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- August 2024 - Hoffmann-La Roche Ltd. acquired LumiraDx's point of care technology, having all necessary antitrust and regulatory clearances. F. Hoffmann-La Roche Ltd. made this acquisition to integrate LumiraDx’s innovative multi-assay point-of-care platform into its global organization and enhance its diagnostics portfolio.

- October 2023 - Universal Biosensors (UBI) received approval to sell Xprecia Prime 4U directly to patients for self-testing in Europe. Xprecia Prime is a portable coagulation testing device designed for fast and reliable blood clotting testing.

- July 2022 - Werfen announced the launch of a new ROTEM sigma Thromboelastometry system at the American Association for Clinical Chemistry (AACC) 2022 event. This product delivers real-time, rapid, and actionable results at the point of care (POC) settings to guide bleeding management.

- January 2022 - Werfen received 510(k) clearance for GEM Hemochron 100 whole blood hemostasis system from the U.S. Food and Drug Administration (FDA). GEM Hemochron 100 system delivers fast, actionable activated clotting time (ACT) that results in minutes, informs patient-management decisions, and helps improve workflow at the point of care (POC).

- May 2021 – Perosphere Technologies Inc. received the European Commission's CE mark for its Point-of-Care (PoC) Coagulometer System.

- January 2021 – F. Hoffmann-La Roche Ltd announced the collaboration with Sysmex Corporation. This deal aimed to provide high-quality hematology solutions to improve the efficacy of testing globally.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The point-of-care coagulation (POCC) testing devices market analysis report provides a detailed competitive landscape and market insights. It focuses on key aspects such as company profiles, device types, and end-users. In addition to the point-of-care coagulation (POCC) testing devices market size, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the advanced market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth rate |

CAGR of 7.62% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Device Type

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.16 billion in 2026 and is projected to record a valuation of USD 3.88 billion by 2034.

In 2025, North America stood at USD 0.85 billion.

The market is expected to exhibit steady growth at a CAGR of 7.62% during the forecast period.

Based on device type, the anticoagulation monitoring devices segment held a leading position in the market in 2026.

F. Hoffmann-La Roche Ltd., Abbott, and Siemens Healthcare GmbH are the top players in the market.

The rising prevalence of bleeding disorders and the introduction of advanced point-of-care products for coagulation monitoring are the key factors driving the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us