Point of Care Diagnostics Market Size, Share & Industry Analysis, By Product (Blood Glucose Monitoring, Infectious Disease Testing, Cardiometabolic Disease Testing, Pregnancy & Fertility Testing, Hematology Testing, and Others), By Sample (Blood, Nasal and Oropharyngeal Swabs, Urine, and Others), By End-User (Hospital Bedside, Physician’s Office Lab, Urgent Care & Retail Clinics, and Home & Self testing), and Regional Forecast, 2026-2034

Point of Care Diagnostics Market Size & Share

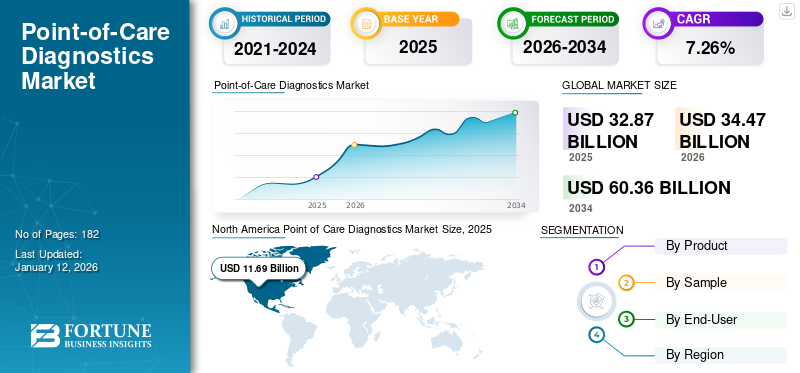

The global point of care diagnostics market size was valued at USD 32.87 billion in 2025 and is projected to grow from USD 34.47 billion in 2026 to USD 60.36 billion by 2034, exhibiting a CAGR of 7.26% during the forecast period. North America dominated the point of care diagnostics market with a market share of 35.6% in 2025.

Point of care testing (POCT) refers to testing conducted close to the site of patient care where treatment is provided. Various factors such as extensively increasing prevalence of chronic conditions coupled with the ability of point-of-care diagnostics to offer quick and accurate disease detection within a minimal turnaround time is expected to drive the market growth during the forecast period. For instance, according to data published by the Centers for Disease Control and Prevention (CDC), the prevalence of diabetes grew by an estimated 3.6% in the U.S. from 2021 to 2023.

Additionally, the rising focus of the players operating in the market on developing and introducing products with advanced technology promotes the growth of product adoption. Beneficial features in various testing kits, including infectious diseases testing kits, urinalysis testing kits, and hematology testing kits, is another significant factor contributing to the growing demand of the devices in the market among the healthcare providers and patients.

Key players in the market include F. Hoffmann-La Roche Ltd., Abbott, Thermo Fisher Scientific Inc., and BD. These players are emphasizing on extensive investments for technological advancements coupled with research & development activities to maintain their market share.

MARKET DYNAMICS

Market Drivers

Increasing Adoption of Multiplex-POC Platform Due to Rapid Turnaround Time and High Sensitivity Drives the Market Growth

The global point of care diagnostics market growth is considerably attributed to the rising adoption of multiplex testing platforms. This technology allows simultaneous identification and detection of multiple pathogens or biomarkers from a single sample, substantially reducing testing time and enhancing diagnostic accuracy. In addition, healthcare facilities, mainly with resource limitations, are increasingly implementing these advanced platforms to manage multiple disease burdens efficiently.

Also, market players and researchers are continually engaged in enhancing the capabilities of these diagnostics platforms, which are further projected to encourage their adoption, leading to market growth.

- For instance, in June 2025, a team of researchers at NYU Abu Dhabi announced a breakthrough in a paper-based diagnostic device that enables the detection of infectious diseases including COVID-19 under 10 minutes. Further, according to researchers, this new technology can offer an affordable and rapid solution for on-site screening of infectious diseases.

In addition, multiplex diagnostics offer considerable economic benefits by reducing sample processing and turnaround times, thus lessening operational costs and resource requirements. The adoption of these diagnostics aligns with global healthcare initiatives focused on decentralizing diagnostic capabilities, which is particularly beneficial for remote regions and community healthcare centers.

Market Restraints

Challenges Associated with Result Consistency and Reliability may Limit the Market Growth

The consistency and reliability of results obtained from POC devices are among the major restraints hampering market growth. Despite significant technological advancements, variability in test performance across different platforms is predicted to deter market growth. Such inconsistencies often result from device calibration issues, operator errors, and inadequate quality controls, consequently leading to inconsistencies in results.

Furthermore, stringent regulatory requirements and varying standards across regions compound these challenges, as manufacturers must ensure rigorous validation and quality assurance protocols, which increase production timelines and costs. Especially smaller healthcare facilities, which often lack extensive quality control infrastructure, find managing these inconsistencies challenging.

Market Opportunities

Expansion of Connected and Remote Patient Monitoring via IoT Integration Offers Lucrative Market Opportunities

The incorporation of advanced technologies such as Internet-of-Things (IoT) into point-of-care diagnostics platforms is projected to offer a substantial opportunity for market growth. This integration allows seamless data transfer from POC devices to electronic health records (EHR) systems and cloud-based platforms, facilitating real-time patient monitoring, analytics, and remote patient management.

- For instance, in April 2025, binx health announced a strategic partnership with WellStreet Urgent Care in order to improve the patients’ treatment access for sexually transmitted infections and advanced Point-of-Care technologies throughout WellStreet care locations. The program is implemented with the help of binx.io.

Moreover, connected POC diagnostics empower telehealth services by providing reliable and timely patient data remotely, which is especially beneficial in rural and underserved regions with limited healthcare infrastructure. The demand for such connected solutions surged during the COVID-19 pandemic, highlighting the value of remote patient monitoring in maintaining patient care continuity while minimizing infection risks.

Market Challenges

Variation in Regulatory Compliance Across Geographies to Offer a Substantial Challenge

A significant challenge within the point-of-care diagnostics market is navigating the complex regulatory landscape across various geographic regions. POC diagnostic manufacturers face stringent and varying regulatory standards and approval processes from bodies such as the FDA (U.S.), EMA (Europe), CFDA (China), and others. Each region enforces distinct compliance requirements, documentation protocols, and validation criteria, posing considerable hurdles for market entry, especially for new and innovative diagnostic platforms.

In addition, rapid changes in regulatory requirements, such as increased scrutiny following public health crises such as pandemic, further complicates the compliance. These variations limit companies aiming for global expansion, as each market necessitates tailored regulatory strategies and specialized teams dedicated to compliance management. Smaller market participants often struggle to allocate sufficient resources to navigate these regulatory hurdles, limiting their ability to innovate or expand geographically.

- For instance, in July 2023, the World Health Organization (WHO) announced the launch of updated guidelines for testing of sexually transmitted diseases. The guidance focuses on providing cost-efficient disease detection along with improved data collection.

Consequently, overcoming regulatory complexities through robust quality assurance frameworks, standardized validation processes, and a clear understanding of evolving compliance landscapes remains a critical challenge for the sustained growth and innovation within the market.

POINT OF CARE DIAGNOSTICS MARKET TRENDS

Rising Adoption of CRISPR-based Point-of-Care Diagnostic Tools is an Emerging Market

An emerging trend in the market is the adoption and commercialization of CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats)-based diagnostic technologies. This type of diagnostics has rapidly gained attention due to its speed, specificity, and ease of use, significantly improving upon traditional nucleic acid amplification techniques. These tools allow rapid identification of pathogens with high sensitivity, requiring minimal sample preparation and making them highly suitable for POC settings.

In addition, the growing number of research collaborations and partnerships between biotechnology companies and academic institutions further accelerates innovation and commercialization of CRISPR diagnostics.

- For instance, in August 2023, CrisprBits announced a strategic collaboration with Molbio Diagnostics with an aim to identify and commercialize a CRISPR-based point of care diagnostics.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

Blood Glucose Monitoring Segment Registered Largest Share Due to Rise in Diabetes Prevalence

Based on product, the market is segmented into blood glucose monitoring, infectious disease testing, cardiometabolic disease testing, pregnancy & fertility testing, hematology testing, and others.

The blood glucose monitoring segment dominated the global market with a share of 54.93% in 2026. The rising prevalence of diabetes among the population, along with a growing focus of the market players on developing and introducing products with advanced features and technology, are some of the major factors supporting the segment growth.

- In February 2024, Dexcom, Inc. launched Dexcom ONE+, the latest Continuous Glucose Monitoring (CGM), with an aim to bring powerful, new diabetes management technology to patients in the Netherlands.

The pregnancy & fertility testing segment is anticipated to expand at a significant growth rate during the forecast period. The segment's growth can be attributed to the rising fertility issues and awareness about sexual health. The rising adoption of various testing kits and products, especially in developed countries such as the U.S., Germany, and the U.K., among others, is another major factor contributing to the segment growth.

The hematology testing, infectious disease testing, and other segments are also anticipated to grow during the forecast period owing to the growing prevalence of various infectious diseases and chronic conditions such as HIV and cancer, among others, and a higher rate of screening and early diagnosis of these conditions, among other factors.

To know how our report can help streamline your business, Speak to Analyst

By Sample

Application of Blood Sample in Various Disease Diagnosis Contribute Segment Growth

Based on the sample, the market is divided into blood, nasal and oropharyngeal swabs, urine, and others.

The blood segment dominated the market in with a share of 77.05% in 2026. It is expected to grow at a significant CAGR during the forecast period. Blood tests can help doctors effectively diagnose the patient for various diseases, including HIV/AIDS, coronary artery disease, and the functioning of organs such as the kidney, liver, and thyroid. Hence, the application of blood tests to diagnose various diseases, and their efficiency has been boosting the segment growth.

The urine segment is expected to grow at a significant CAGR during the forecast period due to the increasing prevalence of disorders related to kidney function among the population.

- According to 2023 data published by the CDC, approximately 35.5 million adults in the U.S. are estimated to have Chronic Kidney Disease (CKD), which accounts for 1 in 7 adults in the country.

By End-User

Adoption of Advanced Instruments to Spur the Hospital Bedside Segment Growth

By end-user, the market for point of care diagnostics is segregated into hospital bedside, physician's office lab, urgent care & retail clinics, and home & self-testing.

The hospital bedside segment dominated the market in with a share of 40.50% in 2026. The rising adoption of advanced POC testing devices and instruments in hospitals across developed countries, improvement in healthcare infrastructure, and rising investments by public and private sectors in emerging countries owing to growth in healthcare expenditure are some of the vital factors fueling the segment’s growth.

The urgent care & retail clinics segment is expected to witness the highest CAGR during the forecast period. The shift from primary care centers to urgent care clinics for diagnosis of various diseases and the growing number of urgent care centers in many developed countries are likely to boost the demand for the segment.

- According to 2023 data published by The Urgent Care Association, there were approximately 14,075 urgent care centers in the U.S. by the end of 2022, witnessing a growth of around 22.6% as compared to 2019.

The home & self-testing segment is projected to grow at a nominal rate during the forecast period. The growth of this segment is attributed to the rising adoption of home test kits and devices among patients, along with the growing number of product launches supporting home testing.

POINT OF CARE DIAGNOSTICS MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

North America

North America Point of Care Diagnostics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America to Dominate the Market Owing to the Growing Number of Product Approvals

North America dominated the market and generated a revenue of USD 11.69 billion in 2025. The intense penetration of advanced point of care diagnostics to detect various chronic and infectious diseases, the growing funding environment, and availability of favorable reimbursement policies are likely to boost the market growth in the region.

- For instance, in June 2022, Visby Medical announced expansion of the Series E Round to get an additional USD 35 million fund, totaling over USD 135 million raised in the same round. The funding was used to scale up the production capacity of at-home diagnostic tests for antimicrobial resistance panels and advanced respiratory health tests.

In the U.S., presence of market players coupled with a growing number of product approvals is expected to boost market growth during the forecast period. In addition, heavy investments for new product developments and in R&D are also projected to influence the market growth.The U.S. market is valued at USD 10.7 billion by 2026.

Europe

Europe's market for point of care diagnostics captured a notable share in 2024 and is anticipated to grow at a steady CAGR during the forecast period. Key players in Europe are focusing on launching rapid diagnostics tests for the time-efficient diagnosis of infectious diseases. The UK market is valued at USD 2.23 billion by 2026, while the Germany market is valued at USD 2.46 billion by 2026.

- For instance, in July 2021, QuantuMDx launched its Q-POC, a rapid, PCR point-of-care diagnostic system in Europe.

Asia Pacific

The Asia Pacific market is expected to expand at a significant CAGR during the forecast period. The increasing prevalence of infectious diseases and chronic ailments across the region is likely to propel the adoption of point-of-care diagnostic tests. The Japan market is valued at USD 1.42 billion by 2026, the China market is valued at USD 1.43 billion by 2026, and the India market is valued at USD 1.87 billion by 2026.

- In June 2023, Sysmex Corporation announced the launch of an assay kit in Japan to identify amyloid beta accumulation in the brain, a cause of Alzheimer’s disease.

Latin America and the Middle East & Africa

The Latin America market is expected to grow at a significant CAGR during the forecast period due to the increasing healthcare expenditure and rising prevalence of chronic diseases. The Middle East & Africa regional market is anticipated to register stagnant growth during the forecast period. In the Middle East & Africa, market growth is primarily driven by an increasing number of product launches.

- For instance, in June 2025, PMcardio and Alphaiota extended their strategic partnership in order to introduce the first AI-powered heart attack diagnostic solution in Saudi Arabia.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on R&D to Boost Their Product Portfolio

The global market for point of care diagnostics is semi-consolidated with a few prominent players accounting for a majority of the global point of care diagnostics market share.

F. Hoffmann-La Roche Ltd., Abbott, and Danaher Corporation are some of the major players operating with a wide range of product portfolios. The growing R&D focus of these companies to strengthen their product portfolio with a rising number of product approvals and launches and expand their brand presence globally are some of the major factors supporting the growing market shares of these companies.

There are several new entrants in the industry trying to establish their brands with devices and products with advanced technology. The increasing focus of these companies on developing and introducing novel products is a crucial factor contributing to their market shares.

- In November 2024, NOWDiagnostics, Inc. announced its First To Know Syphilis Test in the U.S. This is the first-of-its-kind home test that provides results in just 15 minutes. The test is now available across 50 states of the U.S.

Other major players, including bioMérieux and Becton Dickinson and Company (BD), have a strong focus on developing point of care testing devices pertaining to incorporating new technologies such as nanotechnology, artificial intelligence, and others.

LIST OF KEY POINT OF CARE DIAGNOSTICS COMPANIES PROFILED

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Abbott (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Cardinal Health, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- BD (U.S.)

- bioMérieux SA (France)

- QuidelOrtho Corporation (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2024: NOWDiagnostics, Inc. received FDA approval for its Syphilis test for over-the- counter distribution in the U.S.

- July 2024: F. Hoffmann-La Roche Ltd. received CE approval for its AI-enabled blood glucose monitoring system which has capabilities to predict critical healthcare issues in diabetic population.

- October 2023: EKF Diagnostics opened its new state-of-the-art life sciences manufacturing facility in the U.S. The opening is aimed at meeting the increasing demand of its growing customer base.

- March 2023: bioLytical Laboratories Inc. received Health Canada authorization for its INSTI Multiplex HIV-1/2 Syphilis antibody testing for use in point of care settings.

- February 2023: bioMérieux received the U.S. FDA approval for its BIOFIRE SPOTFIRE respiratory panel system with the aim of expanding its POC testing product portfolio.

- January 2023: Cipla Limited launched Cippoint, a point of care device that offers testing for non-communicable, infectious diseases and various other health conditions.

- November 2022: Boditech Med Inc. received approval for domestic use of the Boditech Quick COVID-19 Ag Saliva test from the Ministry of Food and Drug Safety (MFDS). Quick COVID-19 Ag Saliva is an advanced COVID-19 Ag home test with a saliva sample that detects all COVID-19 virus variants, including the Omicron variant and produces results in 15 minutes.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product types, and leading applications of the product. Besides this, it offers insights into the point of care diagnostics market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 7.26% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Sample

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 32.87 billion in 2025 and is projected to reach USD 60.36 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 7.26% during the forecast period (2026-2034).

The growing incidence of chronic and infectious diseases and the inclination toward a decentralized healthcare system are expected to drive the market growth.

Abbott, F. Hoffman-La Roche AG, and Danaher Corporation are some of the top players in the market.

North America market for point of care diagnostics is expected to hold the largest share during the forecast period.

North America was valued at USD 11.69 billion in 2025.

IoT integration enables seamless data transfer from POC devices to electronic health records, supporting remote patient monitoring and telehealth services. This connectivity enhances diagnostic accuracy and accessibility, especially in rural healthcare setups.

Expansion of connected diagnostic platforms Rising adoption of home-based and self-testing kits Growing demand for CRISPR and AI-powered diagnostic tools Emerging markets in Asia Pacific and Latin America

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us