Poultry Diagnostics Market Size, Share & Industry Analysis, By Product (Instruments, Consumables & Kits), By Technology (Enzyme-linked Immunosorbent Assay (ELISA), Polymerase Chain Reaction (PCR), Immunofluorescent Assay, Hemagglutination Assay, and Others), By Disease Indication (Avian Salmonellosis, Avian Influenza, Newcastle Disease, Mycoplasma, Infectious Bursal Disease, and Others), By End-user (Veterinary Hospitals & Clinics, Veterinary Diagnostics Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

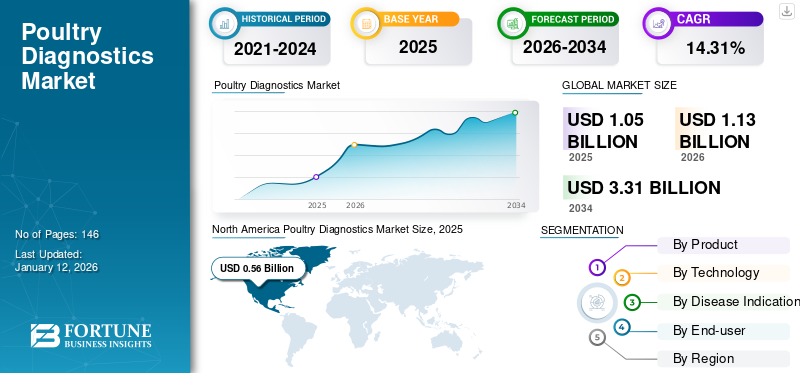

The global poultry diagnostics market size was valued at USD 1.05 billion in 2025. The market is projected to grow from USD 1.13 billion in 2026 to USD 3.31 billion by 2034, exhibiting a CAGR of 14.31% during the forecast period. North America dominated the poultry diagnostics market with a market share of 53.02% in 2025.

Poultry diagnostic tests are essential for disease surveillance and to support the cost-effective and targeted deployment of control measures for poultry diseases. Some of the most prevalent diseases observed among poultry population include avian influenza, Newcastle disease, infectious bronchitis, colibacillosis, mycoplasmosis, chicken anemia, avian reovirus, and others.

The increasing prevalence of these diseases drives the demand for its diagnostic products. For instance, in July 2022, the U.S. Department of Agriculture (USDA) reported 40.09 billion birds in 36 U.S. states were infected with highly pathogenic avian influenza (HPAI). Out of the 382 flocks that tested positive for the virus, 186 were commercial, and 196 were backyard flocks.

Moreover, the increasing demand for poultry-derived products across the globe depicts the growing awareness regarding poultry health among poultry farmers. Many government and non-government organizations are investing actively to extend veterinary care for poultry farmers by introducing policies and programs to increase poultry production.

- According to an article published by the WATTPoultry in April 2023, Italy received USD 29.5 million (EUR 27.2 billion) from the European Commission (EC) agricultural reserve to support the poultry sector affected by highly pathogenic avian influenza in 2021.

This growing investment in increasing awareness about poultry health will further increase the diagnosis rate of poultry diseases.

Furthermore, the global market was negatively impacted by the COVID-19 pandemic. The disruptions in the supply chains affected the availability of diagnostic kits, reagents, and other necessary supplies for poultry disease diagnosis. However, a resumption in the operations of veterinary hospitals, clinics, and diagnostics laboratories was witnessed as the COVID-19 restrictions were eased. The market players were actively focusing on upscaling their research and development activities, leading to increasing sales of the products. These factors are anticipated to drive the market growth during the forecast period.

Global Poultry Diagnostics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.05 billion

- 2026 Market Size: USD 1.13 billion

- 2034 Forecast Market Size: USD 3.31 billion

- CAGR: 14.31% from 2026–2034

Market Share:

- North America dominated the poultry diagnostics market with a 53.02% share in 2025, driven by the strong presence of key players, increasing government biosecurity investments, and high adoption of advanced diagnostic technologies.

- By product, Consumables & Kits are expected to retain the largest market share, owing to their increasing consumption in rapid diagnostic testing, accessibility in rural settings, and cost-effectiveness compared to laboratory instruments.

Key Country Highlights:

- United States: Growing government investments in poultry biosecurity programs and strong distribution networks of leading diagnostic companies are driving market growth.

- Europe: Rising government initiatives to enhance poultry health standards, introduction of new diagnostic tools for veterinarians, and strict compliance regulations are propelling market adoption.

- China: Increasing prevalence of poultry diseases, surge in poultry farming activities, and collaborations between diagnostic companies and poultry farms are driving market demand.

- Japan: Advancements in point-of-care diagnostic solutions for remote poultry farms and increasing veterinary collaborations are enhancing disease surveillance and diagnosis rates.

Poultry Diagnostics Market Trends

Growing Preference for Point-of-Care Diagnostics in Emerging Regions to Boost Market Growth

In low-and middle-income countries, remote and rural communities are extremely affected by infectious animal diseases due to their close association with livestock and limited access to animal health personnel. Point‐of‐care tests (POCTs) for rapid diagnosis of infectious diseases in non‐laboratory settings can significantly disrupt traditional animal health surveillance standards in these regions.

Point-of-care diagnostic solutions for poultry farms especially in the remote locations provide a cost-effective and efficient way to diagnose diseases quickly without the need for traditional laboratory testing. These products offer convenience, fast results, and affordability, resulting in potential savings on future medical costs associated with disease progression. Poultry diagnostics play a crucial role in improving the health outcomes and economic viability of small-scale farmers, communities, and government services with limited resources.

The traditional diagnosis of avian influenza virus (AIV) in poultry consists of laboratory-intensive processes, including culture techniques followed by real-time polymerase chain reaction (RT-PCR) and enzyme-linked immunosorbent assays (ELISA). These laboratory-focused methods take days to diagnose AIV infection and require manual labor from experienced personnel.

Rapid detection kits for influenza viruses can visually signal the presence of the influenza virus by detecting viral proteins. Thus, the higher convenience and benefits offered by point-of-care tests compared to laboratory testing are increasing POC-based test kit adoption in emerging regions.

Download Free sample to learn more about this report.

Poultry Diagnostics Market Growth Factors

Rising Prevalence of Poultry Diseases is Anticipated to Drive the Market Growth

One of the critical factors driving the market growth is the rising prevalence of diseases among the poultry population, which is surging the demand for its diagnosis. This surge in demand for diagnosis will increase the demand for poultry diagnostics products, leading to market growth.

- According to a study published by the Infection, Genetics, and Evolution Journal in November 2022, different levels of avian influenza seroprevalence were reported in different backyards, commercial poultry, and wild birds in Bangladesh. The prevalence of household chicken across Bangladesh was 13.8%, 15.0% in layer poultry, and 12.5% in broiler chickens.

- According to data published between April to June 2023 by the European Centre for Disease Prevention and Control (ECDC), 98 domestic and 634 wild birds were infected with the avian influenza A (H5N1) virus.

Moreover, the market players are actively investing in their research and development activities to analyze different diseases affecting poultry, especially chickens. These companies are making strategic mergers and acquisitions to strengthen their portfolio in veterinary care. The strategic initiatives by the market players to increase their product awareness and adoption rate contribute to the global poultry diagnostics market growth.

- In July 2022, Vimian collaborated with Evonik Industries AG, a company specializing in animal nutrition. The collaboration was aimed to combine INDICAL’s veterinary diagnostic capabilities with Evonik’s Precision Livestock Farming portfolio to analyze the flock’s pathogen status and acquire greater control.

Increasing Government Initiatives for Poultry Health is anticipated to Spur Market Growth

The increasing initiatives made by the government authorities to increase awareness related to diagnosing poultry diseases to improve poultry health are driving market growth. These initiatives include introducing programs, schemes, disease surveillance programs, and policies to increase awareness related to poultry diseases.

- For instance, Poultry Disease Management Agency (PDMA) engages national and local governments on disease control issues in the South African poultry industry. They aim to protect the national flock through surveillance, monitoring, and management of diseases that threaten the health of the flock and food security.

Furthermore, some poultry clinics collaborate with research institutes to support and educate poultry farmers about the importance of timely diagnosing poultry diseases. These strategic initiatives also help to train and educate veterinarians and diagnosticians about poultry health.

- According to a news article published by The Western Producer in November 2021, the Poultry Health Service partnered with the Faculty of Veterinary Medicine to provide poultry diagnostic services and expand research opportunities along with providing training to the next generation of veterinarians and diagnosticians who will be poultry practitioners in Alberta, Canada.

Additionally, with the government organizations, many non-government organizations are collaborating with market players to advance veterinary care and diagnostic services, including poultry.

- For instance, Zoetis received a grant of USD 15.3 billion from the Bill & Melinda Gates Foundation to improve livestock health and productivity of dairy, beef, poultry, and fish farmers in seven additional Sub-Saharan African nations.

These government initiatives and suggestions are introduced to educate poultry farmers and veterinarians regarding poultry health and poultry diagnostics. This is anticipated to drive the adoption rate of these poultry diagnostic products during the forecast period.

RESTRAINING FACTORS

Lack of Awareness about Poultry Health to Hamper the Market Growth

Despite the increasing prevalence, initiatives, and support from government authorities for poultry health, certain factors, such as a lack of awareness about poultry health, hamper the market growth. But there is still a lack of accessibility and availability of poultry care in certain emerging regions.

- According to an article published in the Animal Journal in December 2020, there was a lack of awareness about poultry diseases and poultry health care conditions in Turkey. The poultry farmers had relatively little knowledge about backyard poultry flock size and how they are managed in the urban areas of Turkey.

Furthermore, the lack of awareness about government veterinary services and free vaccination programs offered to poultry farmers to maintain poultry health leads to lower adoption of disease prevention and control by poultry farmers.

Addressing the knowledge gap is essential for fostering trust in the diagnostic solutions and promoting proactive poultry health management practices, ultimately driving the growth of the market.

Poultry Diagnostics Market Segmentation Analysis

By Product Analysis

Increasing Rapid Diagnostic Kits Consumption to Drive Consumables & Kits Segment Growth

Based on product, the global market is divided into instruments and consumables & kits.

The consumables & kits segment dominated the market share of 78.78% in 2026. The dominance is attributed to the increasing consumption of rapid diagnostic kits for poultry diseases globally. The kits offer benefits, such as reducing the number of veterinary care visits, providing quick results, being portable, and being comparatively more accessible across the community and rural settings.

Instruments are used in laboratory settings and need trained professionals to operate and obtain results from the sample. Moreover, they are comparatively more expensive than consumables & kits. The instruments provide accurate results compared to kits and are a traditionally preferred model for testing in veterinary care, further anticipating the segment's growth at a higher CAGR.

To know how our report can help streamline your business, Speak to Analyst

By Technology Analysis

ELISA Segment Dominated the Market Due to Its Multiple Applications

By technology, the global market is segmented into Enzyme-Linked Immunosorbent Assay (ELISA), Polymerase Chain Reaction (PCR), immunofluorescent assay, hemagglutination assay, and others.

Enzyme-Linked Immunosorbent Assay (ELISA) segment dominated the global poultry diagnostics market share of 36.01% in 2026. The segment’s growth is attributed to its multiple applications in detecting poultry diseases. Moreover, most of the companies in the market offer a wide range of product offerings for ELISA tests increasing the availability and accessibility of this technology globally, subsequently driving the segment’s growth. For instance, ProFLOK and FluDETECT are a range of test kits of Zoetis Services LLC., which works on ELISA technology for the detection of Infectious bursal disease (IBD), Infectious bronchitis virus (IBV), Newcastle disease virus (NDV), Avian Influenza Virus (AIV), Avian Reovirus, and others.

The Polymerase Chain Reaction (PCR) segment held the second-largest market share during the forecast period. The PCR test amplifies DNA to detectable levels to specifically identify disease agents. This increases the preference for this technology for rapidly detecting difficult pathogens and increasing research and development activities and partnerships between market players to launch new products in poultry diagnostics, further driving its adoption during the forecast period.

- For instance, in January 2024, Alveo Technologies, Inc. partnered with x-OvO, Royal GD, and Pharmsure to introduce a fast and precise multiplex panel for testing all key strains of avian influenza, with an initial emphasis on Group A, H5, H7, and H9, to be deployed in the field.

Hemagglutination assay and immunofluorescent assay held a comparatively lower share in 2024. These technologies have limited applications in detecting poultry diseases. These technologies commonly detect Newcastle disease virus and infectious bronchitis virus antibodies. However, the increasing prevalence of these diseases will drive the adoption rate of these diagnostic technologies.

The others segment includes virus neutralization assay, agar gel immunodiffusion assay, lateral flow immuno-chromatographic assay, and many more. These assays' preference is comparatively less due to the necessity of performing in proper laboratory settings.

By Disease Indication Analysis

High Outbreaks of Avian Influenza Led to its Dominance in the Market

Based on disease indication, the global market is classified into avian salmonellosis, avian influenza, Newcastle disease, mycoplasma, infectious bursal diseases, and others.

The avian influenza segment dominated the market share of 42.09% in 2026. Avian influenza is the most prevalent disease among the poultry population, and its frequent outbreaks increase the demand for frequent diagnosis. As of July 5, 2022, the U.S. Department of Agriculture (USDA) reported 40.09 billion birds in 36 U.S. states to be infected with highly pathogenic avian influenza (HPAI).

The infectious bursal diseases segment held the second-largest market share in 2024. It is another highly contagious viral infection affecting young chickens and turkeys. The increasing prevalence of infectious bursal disease in key countries with high poultry populations is the primary factor driving the segment’s growth in global poultry diagnostics market. According to a study published by the Frontiers in December 2021, the prevalence of infectious bursal disease virus (IBDV) in the important poultry-raising areas of China from 2019 to 2020 was studied. According to the test results, 61.9% of the chicken flocks were shown to be positive for IBDV.

Avian salmonellosis, mycoplasma, and Newcastle disease segments are expected to grow steadily during 2025-2032. Avian salmonellosis and mycoplasma are common diseases affecting the poultry population and need laboratory testing for identification. With the need for testing and diagnosis, market players are increasingly focused on launching more tools and systems for the detection of Salmonella in poultry farms, eventually helping to expand the market during the forecast period.

- For instance, in November 2023, Ancera introduced a new software called Salmonella System Monitoring (SSM) to provide enhanced and timely information on Salmonella across the poultry supply chain.

This limits the diagnosis of these diseases in emerging regions as they lack well-established laboratory settings.

Newcastle disease is another virulent disease affecting the poultry population. The frequent outbreaks of the disease in most of Asia, Africa, Mexico, and some countries of South America are surging the demand for its timely diagnosis. The other segment includes avian pasteurellosis, avian encephalomyelitis, avian reovirus, and many more.

By End-user Analysis

Higher Preference for Veterinary Diagnostics Laboratories in Developed Regions Led to Segment’s Dominance in 2024

The global market is classified by end-user into veterinary hospitals & clinics, veterinary diagnostics laboratories, and others.

The veterinary diagnostics laboratories segment dominated the global market share of 52.90% in 2026, generating the highest revenue. The dominance is attributed to the increased number of diagnostic laboratories in high-income countries and other well-resourced settings with well-trained healthcare professionals offering veterinary care.

The veterinary hospitals & clinics segment generated notable revenue in 2024. The segment held a lower share compared to the veterinary diagnostics centers. In emerging and underdeveloped countries, a lack of dedicated veterinary laboratories increased the preference for veterinary hospitals & clinics for diagnosing poultry diseases. Furthermore, the limited access of these hospitals & clinics to laboratory testing increased their preference for home-based or point-of-care test kits, driving the segment’s growth in emerging and underdeveloped regions. According to a study published by Poultry Science in June 2021, 31.63% of respondents witnessed that their sick chickens had access to poultry diagnostic services in Ethiopia, while the rest did not. Furthermore, only 14.52% reported their chickens getting diagnosed through laboratory methods.

The other segment includes research institutes and industry-owned laboratories. The segment is anticipated to grow at a comparatively lower CAGR due to the limited availability and accessibility of these settings.

REGIONAL INSIGHTS

In terms of region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America Poultry Diagnostics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 0.56 billion in 2025 and USD 0.6 billion in 2026. The growth is attributed to the strong presence of market players across the region, which are focused on receiving research grants from public or private organizations to expand their footprints and increase the accessibility of their offerings. In November 2022, the government of Canada invested up to USD 1.5 billion through Canadian Agricultural Partnership to increase biosecurity efforts for reducing the spread of the highly pathogenic avian influenza. This investment was provided to eligible non-supply-managed poultry operations and related agri-businesses nationwide. The U.S. market is projected to reach USD 0.55 billion by 2026.

Asia Pacific

The Asia Pacific market is projected to grow with the highest CAGR during the forecast period. The growing poultry population across the region will surge the demand for poultry products to control and prevent the increasing incidence of key poultry diseases. According to the Our World Data, in Australia, the poultry population grew by 10.0% in 2021 from 2020. The Japan market is projected to reach USD 0.02 billion by 2026, the China market is projected to reach USD 0.04 billion by 2026, and the India market is projected to reach USD 0.01 billion by 2026.

Europe

The Europe market captured a significant market share in 2024. The growth is attributable to the increasing government initiatives to promote poultry health and production capacity across the region. For instance, the United Kingdom has the Red Tractor Assurance (RTA) scheme, which covers 75% of all UK agricultural production. The U.K. is also seeking to introduce changes to boost animal welfare, biosecurity, and compliance from poultry producers from November 2021. The UK market is projected to reach USD 0.05 billion by 2026, and the Germany market is projected to reach USD 0.06 billion by 2026.

In addition to this, in July 2023, the British Hen Welfare Trust introduced a new Poultry Vet Guide with an aim to support veterinary practitioners with new diagnostics tools for poultry.

Latin America

Latin America is expected to grow with the second-highest CAGR during the forecast period. The government authorities of these regions are actively investing in the poultry sector to increase awareness of poultry health across the regions. For instance, in June 2023, the Brazilian government issued USD 40.74 billion in funds to the Ministry of Agriculture and Livestock to support efforts to combat high pathogenic avian influenza.

Middle East and Africa

The Middle East and Africa are expected to grow slower during the forecast period. There is a lack of awareness about hygiene practices that need to be followed for the poultry population. Also, there is a lack of biosecurity practices followed by poultry farmers in these regions. These factors are increasing the prevalence of poultry diseases, but the lack of well-established healthcare settings and guidance from veterinarians for diagnosis is limiting the region’s growth.

Key Industry Players

IDEXX Laboratories, Inc. Dominated the Market in 2024 Due to Strong Product Offering

In the competitive scenario, IDEXX Laboratories, Inc. dominates the global market, offering various products for diagnosing poultry disease. The company’s poultry diagnostic products have a strong presence in key markets such as the U.S., with a broad distribution network in over 170 countries. This increases the accessibility and availability of these products and drives the adoption rate, leading to the company’s dominance at a global level.

Zoetis Services LLC holds a significant market share in the global market. The company’s single product can be used to diagnose multiple indications, which provides a competitive advantage and increases its preference over other available products. For example, ProFLOK can diagnose multiple diseases, such as infectious bursal disease, infectious bronchitis virus, Newcastle disease virus, and avian influenza virus.

Thermo Fisher Scientific Inc. captured a notable share in the global market owing to its wide range of product offerings for poultry diagnostic laboratories. Other key players in the market include Biochek, BioNote, Vimian, GD, and Innovative Diagnostics. These companies focus on upscaling their production capacity and introducing educational programs for veterinarians and poultry farmers.

LIST OF TOP POULTRY DIAGNOSTICS COMPANIES:

- IDEXX LABORATORIES, INC. (U.S.)

- Zoetis Services LLC (U.S.)

- Vimian (Sweden)

- Thermo Fisher Scientific Inc. (U.S.)

- GD (The Netherlands)

- BioChek (The Netherlands)

- BIONOTE (Korea)

- Innovative Diagnostics (France)

- MEGACOR Diagnostik GmbH (Austria)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: GD analyzed and revealed a dynamic range of infectious bronchitis virus (IBV) lineages. The investigation provided a high resolution on several factors that are responsible for the infection caused in the chicken.

- October 2022: IDvet offered ID Screen Influenza H5 indirect ELISA kit, the only diagnostic tool for monitoring and differentiating infected and vaccinated animals.

- June 2022: IDEXX LABORATORIES, INC., in collaboration with Anand Animal Health Pvt. Ltd., conducted a seminar, “Effective Control of Poultry Diseases using IDEXX ELISA System”, in North India.

- July 2022: BIONOTE collaborated with PSIvet, one of the largest veterinary buying cooperatives in the U.S. The collaboration aimed to make the availability of the Vcheck V200 analyzer and tests more affordable for PSIvet’s veterinary practitioners.

- August 2021: INDICAL BIOSCIENCE GmbH acquired Check-Points, a Dutch R&D-focused company. The acquisition aimed to expand the company’s poultry diagnostics product portfolio and direct-to-producer offering

- August 2020: IDEXX Laboratories, Inc. launched ProCyte One Hematology Analyzer. The analyzer aid in simplifying workflow and providing accurate results at the point of care.

REPORT COVERAGE

The global poultry diagnostics market report provides qualitative and quantitative insights on the global market and a detailed analysis of the global market size & growth rate for all possible segments in the market. The report also provides an elaborative analysis of the market dynamics and competitive landscape. The report presents key insights, including the prevalence of key poultry diseases by key countries/regions, key industry developments by key players, technological advancements in poultry diagnostics, and the impact of COVID-19 on the global market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.31% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Technology

|

|

|

By Disease Indication

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 1.13 billion in 2026 to USD 3.31 billion by 2034.

In 2025, the North America market stood at USD 0.56 Billion.

The market is projected to grow at a CAGR of 14.31% over the forecast period (2026-2034).

Consumables & kits segment is expected to be the leading segment in this market during the forecast period.

The rising prevalence of poultry diseases and the emphasis of market players on introducing educational programs to increase awareness related to timely diagnosis are some of the major factors driving the global market growth.

IDEXX Laboratories, Inc., Zoetis Services LLC, and others are the some of the prominent market players in the global market.

North America dominated the poultry diagnostics market with a market share of 53.02% in 2025.

Increasing active investment of government and non-government organizations to increase the availability and accessibility of poultry diagnostic services is expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us