Printed Circuit Board Market Size, Share & Industry Analysis, By Product Type (Rigid Board (Single Layer Board, Double Layer Board, and Others (Multilayer)), HDI Board, Flexible Board, and Others), By Application (Automotive, Consumer Electronics, Telecommunication, Healthcare, Energy & Power, and Others (Military, Utilities)), and Regional Forecast, 2026–2034

Printed Circuit Board Market Size

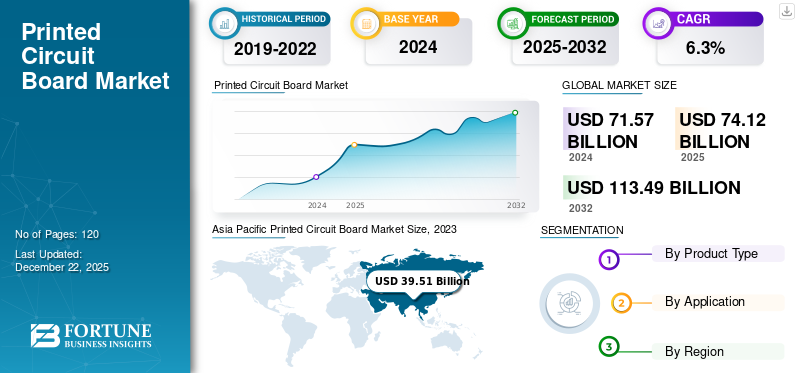

The global printed circuit board market size was valued at USD 74.12 billion in 2025. The market is projected to grow from USD 77.45 billion in 2026 to USD 129.65 billion by 2034, exhibiting a CAGR of 6.65% during the forecast period.

Printed circuit boards are hard components that transmit current from one part of an electronic component to another. These hard substrates provide additional physical strength and support for the wiring area due to the complexity of socketed and surface-mounted components. Most PCBs are manufactured from fiberglass, composite epoxy, and other composite materials. In addition, the majority of PCB designs are simple and composed of single layers and more sophisticated hardware devices such as computers, graphic cards, and motherboards, which have multiple layers. Technological advancements in display solutions, such as folding televisions and curved displays, are poised to boost the demand for flexible PCBs in the long term.

The product is more often used in computers, yet it has diverse applications across devices such as TVs, radios, cell phones, and digital cameras. In addition to the dominant use of PCB assembly in consumer electronics, it has increasing applications in automotive, telecommunication, healthcare, energy and power, and others (military, utilities). Additionally, budding automation needs and increased demand for smart electronic devices in industrial engineering have provided strength to the demand for printed circuit boards across the semiconductor and electronics industry.

The COVID-19 pandemic hampered the global supply chain of the semiconductor industry and led to electronics shortages globally. However, post-pandemic, the demand for printed circuit boards has increased, and the sales and price of PCB boards are poised to increase in the coming years.

Printed Circuit Board Market Trends

Dominant Application in New Age Electronics Drives the Trend for Flexible PCBs

The rise of miniaturized electronics with the most unconventional packaging has created plenty of opportunities for PCB panels, which are slated to expand printed circuit board market share and increase inclination toward flexible circuit boards. Flexible PCBs have the capability to bend and fit in odd shapes and figures and perform consistently in any operating conditions and high temperatures. This feature of the flexible circuit board drives its applications in commercial electronics, aerospace, medical and automotive.

Download Free sample to learn more about this report.

Printed Circuit Board Market Growth Factors

Growing Applications of HDI Boards in the Automotive Sector to Propel Market Growth

PCB discovery has enabled the compactness of electronic components that provide better conductivity and transmit currents to different components in a precise manner. High-density interconnect (HDI) PCBs have a higher wiring density that significantly reduces the size and weight of the PCB panels. These high-density interconnect PCBs are cost-effective, extremely reliable, and compatible with low-pitch IC packages that support high-speed signal transmission. These features expand the adoption of HDI boards in various fields, including aviation, automobile, and miniaturized electronic gadgets. These capabilities of HDI circuit boards are anticipated to drive the printed circuit board market growth in the long term.

RESTRAINING FACTORS

Need for High Precision and Shortage of Skilled Workforce May Hamper PCB Manufacturing

Printed circuit boards are complex to manufacture in small and compact spaces, extra precision and very tiny pad sizes are needed to manufacture them. These challenges are hampering the fabrication and assembly of PCB units. Furthermore, the manufacturing of compact PCB units for high-speed signal transmission and safety requires precision engineering and a skilled workforce. These fabrication needs hamper the current growth rates of the PCB industry.

Printed Circuit Board Market Segmentation Analysis

By Product Type Analysis

Dominant Rigid Printed Circuit Board Use in Computer to Drive Market Demand

Based on product type, the market is classified into rigid board (single layer board, double layer board, and others (multilayer)), HDI board, flexible board, and others.

Rigid board dominated the product type segment share by 38.36% in 2025 owing to its dominant application in the computer and electronics industry. The physical strength and higher transmission capabilities are the prime drivers for the rigid board segment’s growth. Double-layer and multilayer PCBs are some of the new advancements that are highly demanded in compact and small devices, and they are slated to increase the demand for rigid PCBs in the long term.

The growing use of HDI circuit boards that can accommodate a high number of wiring connections and offer conductivity for different units is strengthening the share of the HDI board segment.

Furthermore, flexible boards are new advancements in printed circuit boards that have applications in different shapes and sizes of electronics and demonstrate smooth functionality in different operation conditions. This factor is poised to drive the trend of flexible circuit boards during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Dominant Consumer Electronic Application Bolster the Demand for PCB

By application, the market is divided into automotive, consumer electronics, telecommunication, healthcare, energy & power, and others (military, utilities).

Consumer electronics is likely to hold 32.03% of the market share in 2026, which include devices such as mobile phones, smart televisions, and other smart devices, have the dominant application owing to their compactness and better computing and processing capability, which optimizes computing and logical operations in very little time.

The expanding application of PCB in automotive for precise GPS tracking and the Internet of Things is growing progressively.

Furthermore, the demand for PCB units for telecommunication and healthcare devices is slated to expand the sales of flexible circuit boards in the forthcoming years.

In addition, the growing demand for energy and power and prominent military applications are slated to drive the demand for PCB units progressively in the long term.

The automotive segment is likely to exhibit a CAGR of 7.16% during the forecast period.

REGIONAL INSIGHTS

Globally, the PCB industry has prominent markets across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Printed Circuit Board Market Size, 2023 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The global PCB industry is growing with a stable CAGR and a rising need for precision components and compact devices. These necessities have expanded the demand for rigid PCBs in consumer electronics and computer devices. In addition, growing automation and adoption of the industrial Internet of Things (IIoT) has bolstered the demand for PCB components across various other domains of the industry.

Asia Pacific holds the major share of the global printed circuit boards (PCBs) revenue as it is a manufacturing hub of PCB fabrication. The region led the largest market value in 2026 with a value of USD 9.35 billion, and in 2025, the market value was USD 9.07 billion. The growth rate of the region is progressive, with exponential demand for compact consumer electronic devices in major trillion-dollar economies such as China, Japan, India, and Southeast Asia.

China holds the major share of the region due to its strong domestic manufacturing presence and robust hold over the economy of PCB fabrication, which has strengthened its position in Asia. In addition, India, a growing trillion-dollar economy, is establishing itself as a manufacturing hub, which is anticipated to enhance the position of the Indian PCB fabrication industry in the long term. Japan and Southeast Asia are set to grow steadily with a growing share of PCB manufacturing owing to their advancement in manufacturing and investments across PCB manufacturing. The market in China is expected to hit USD 22.45 billion in 2026, whereas India is likely to reach USD 2.49 billion and Japan is projected to hit USD 7.67 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is expected to follow the global growth trend owing to an increase in demand for advancement and technologies such as IIoT and Industry 4.0. The start-up industry is growing at a progressive rate, and needing economical and reliable solutions for product innovation has boosted the growth of the PCB industry. North America is anticipated to account for the second-highest market size of USD 16.12 billion in 2025, exhibiting the second-fastest growing CAGR of 5.48% during the forecast period.

Europe is set to be the third-largest market with a value of USD 9.07 billion in 2025 and to grow progressively, with core Original Equipment Manufacturers (OEMs) focusing on collaborating with tech groups and start-ups to integrate technologies into their products or portfolios, which has supported the demand for PCB. The market value in U.K. is expected to be USD 1.86 billion in 2026. On the other hand, Germany is projecting to hit USD 2.98 billion in 2026 and France is likely to hold USD 0.53 billion in 2025.

The Middle East & Africa is anticipated to be the fourth-largest market with a value of USD 4.34 billion in 2025 and observed to grow at a steady pace owing to minimal innovation and rising imports of PCBs, especially from the PCB hubs such as China or other Asian countries. Also, the lack of PCB manufacturing infrastructure has declined the growth of the industry. The GCC market is estimated to be USD 2.12 billion in 2025.

List of Key Companies in Printed Circuit Board Market

Key Players Invest Heavily on Advancements to Expand Market Share in the Long-Term

The majority of key players in the industry have been working mainly on bringing advancements in IoT and developing compact printed circuit board panels for small spaces in computers and consumer electronic devices. In addition, the growing use of flexible consumer electronics such as OLED TVs, LEDs, and computer devices has increased the market share of core component manufacturers in the long term. Furthermore, players are accommodating small HDI PCB in small computer devices that develop high current transmission and computing speed, which is poised to establish their stronghold in the market.

List of Key Companies Profiled:

- Zhen Ding (China)

- Unimicron (China)

- DSBJ (China)

- Nippon Mektron (Japan)

- Compeq (China)

- Tripod (Taiwan)

- TTM Technologies (U.S.)

- SCC (China)

- Ibiden (Japan)

- Hannstar Board (China)

- AT&S (Austria)

- Rhyming Technology (China)

- Sanmina Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

February 2024: TTM Technologies Inc., a leading printed circuit board manufacturer, introduced a new series of radio frequency and specialty component business units for the 5G Transceiver and power amplifier.

January 2024: Green Circuits, a leading PCB manufacturer, showcased its most advanced PCB solution for the healthcare domain. These PCBs control and play a crucial role in controlling and enhancing mobility and improving lifestyle.

January 2024: Arch, a leading provider of machine data and manufacturing analytics, announced a collaboration with Jabil Inc. The strategic collaboration spans four major continents and 12 countries and helps manufacturers with actionable intelligence.

November 2023: TTM Technologies Inc., has announced the shifting of its facility from New York to the proposed high-tech manufacturing site at the new greenfield. The facility will support the capability of producing ultra HDI (High Density Interconnects) PCB to support national security requirements.

May 2023: Mitsubishi Electric, a prominent electronics manufacturer, invested around (USD 6.67 million) in Japanese start-up Elephatech Inc. in the funding round. The start-up is a mass producer of PCB using metal inkjet printers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.65% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 129.65 billion by 2034.

In 2025, the market was valued at USD 77.45 billion.

The market is projected to grow at a CAGR of 6.65% during the forecast period.

The rigid board segment is expected to lead the market.

Technological advancements and the need for flex circuit boards in consumer electronics are the key factors driving the market growth.

Zhen Ding, Unimicron, DSBJ, Nippon Mektron, Compeq, Tripod, TTM Technologies, SCC, Ibiden, Hannstar Board, AT&S, Rhyming Technology, Sanmina Corporation (U.S.) are the top players in the market.

Asia Pacific holds the largest market share.

The consumer electronics application segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us