Pulmonary Function Testing System Market Size, Share & Industry Analysis, By Type (Portable and Complete), By End-user (Hospitals, Physical Examination (Diagnostic) Centers, Physician Groups (Clinics), and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

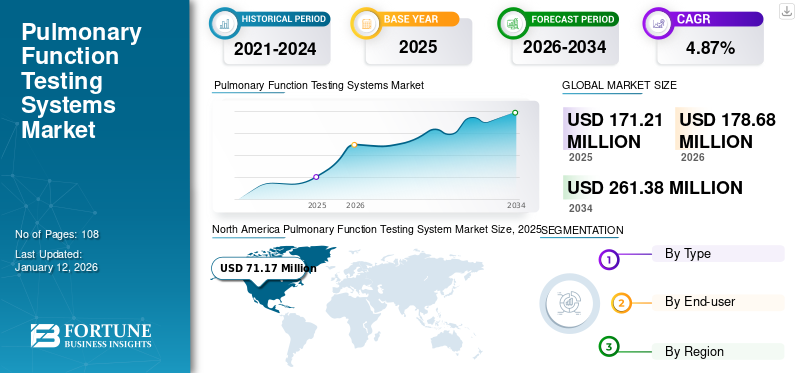

The global pulmonary function testing system market size was valued at USD 171.2 million in 2025 and is projected to grow from USD 178.68 million in 2026 to USD 261.38 million by 2034, exhibiting a CAGR of 4.87% during the forecast period. North America dominated the pulmonary function testing system market with a market share of 41.60% in 2025. Moreover, the U.S. pulmonary function testing systems market size is projected to grow significantly, reaching an estimated value of USD 90.1 million by 2032, driven by rising awareness about early diagnosis and advancements in pulmonary function testing systems.

Pulmonary Function Testing (PFT) system is a device that performs various pulmonary function tests, such as respiratory mechanics, nitrogen washout, spirometry, lung volumes, vital capacity, plethysmography, and diffusion capacity. There are two types of devices available, complete and portable systems. These devices can be utilized to monitor people suffering from severe breathing ailments such as asthma and COPD.

The pulmonary function testing system market growth is attributed to the growing occurrence of chronic respiratory ailments. Furthermore, technological advancements, such as portable systems, are anticipated to increase the demand for these devices in the coming years. Additionally, rising awareness regarding the usage of these devices and increasing product launches by the companies are predicted to accelerate the market growth during the forecast timeframe.

The influence of the COVID-19 pandemic resulted in lesser demand for pulmonary function testing systems. The widespread disruption caused by COVID-19 significantly affected the manufacturing of these systems. However, after the relaxation of lockdowns in some countries, the use of PFT resumed in healthcare facilities with the RT-PCR test.

- According to a research study published by the Canadian Thoracic Society (CTS) in August 2020, during the COVID-19 pandemic, testing for pulmonary function was resumed only for those patients whose COVID-19 tests were negative. Such guidelines favored the resumption of testing during COVID-19.

The market witnessed strong recovery from the COVID-19 pandemic in 2022 and is expected to grow steadily over the forecast period.

Global Pulmonary Function Testing System Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 171.21 million

- 2026 Market Size: USD 178.68 million

- 2034 Forecast Market Size: USD 261.38 million

- CAGR: 4.87% from 2026–2034

Market Share:

- North America dominated the pulmonary function testing system market with a 41.60% share in 2025, driven by the rapid implementation of portable systems, increased prevalence of respiratory diseases, and the rising adoption of pulmonary function tests in clinics and hospitals.

- By type, complete systems accounted for the largest market share in 2024 due to their growing adoption in hospitals for comprehensive respiratory assessments. Portable systems are projected to exhibit the fastest growth owing to their increasing use in independent clinics and the shift towards decentralized diagnostics.

Key Country Highlights:

- United States: Increasing focus on early diagnosis of respiratory diseases and continuous advancements in pulmonary function testing devices are driving the adoption of these systems across healthcare settings.

- Europe: Rising prevalence of COPD and asthma and an increasing number of independent physician clinics offering pulmonary function tests are supporting market growth in the region.

- China: Growing awareness about lung health, improvement in healthcare infrastructure, and strategic expansion by key market players are enhancing the adoption of pulmonary function testing systems.

- Japan: Emphasis on technological innovation in diagnostic devices and the rising burden of chronic respiratory diseases are fueling the demand for advanced pulmonary function testing solutions.

Pulmonary Function Testing System Market Trends

Shift toward Portable Systems from Complete Systems to Augment Market Growth

The companies functioning in the global market are incessantly emphasizing on developments, such as launching portable systems with more parameters and promoting the adoption of these devices in independent clinics. These strategies augmented the shift from complete to portable systems, thereby spurring the overall market growth.

Aspects, such as immobile, low cost, and presence of standard parameters, such as lung volumes, diffusion capacity, and spirometry, motivated the healthcare facilities to shift toward portable pulmonary function testing systems. Moreover, many market players are developing new portable systems to diagnose various chronic respiratory disorders, which is anticipated to drive the market growth during the forecast period.

Download Free sample to learn more about this report.

Pulmonary Function Testing System Market Growth Factors

Increasing Prevalence of Respiratory Diseases to Drive Market Growth

In recent years, respiratory ailments, such as Chronic Obstructive Pulmonary Disease (COPD), asthma, lung cancer, and occupational lung diseases, have been the leading reasons of fatality across the globe. Furthermore, there is a considerable increase in the incidence of COPD and asthma globally, especially in developing countries.

- According to the Global Asthma Report 2022, in India, about 35 million people suffer from asthma.

In COPD and other chronic respiratory diseases, lung capacity is an important parameter. Lung capacity refers to the air volume in lungs at different respiratory cycle phases. The pulmonary function testing system helps measure different parameters of the lungs with the help of various tests, such as spirometry and plethysmography, and diagnose COPD and other lung-related disorders.

Such a huge occurrence of chronic respiratory diseases and rising focus of companies to increase their presence in developing countries for these systems are expected to boost the market growth in the coming years.

Rising Awareness of Early Diagnosis and Advancements of Testing Systems to Propel Market Progress

Pulmonary function testing systems are non-invasive tests that analyze the functioning of the lungs. The tests measure capacity, lung volume, gas exchange, and flow rates and determine the treatment for certain lung disorders.

Pulmonary function testing systems are quite useful in identifying the early-stage abnormalities in asymptomatic patients and evaluating the damage to the lungs before any signs and symptoms develop. Due to these reasons, pulmonary function testing has become important among physicians for screening and detection of pulmonary disorders.

- For instance, a study published by the American Journal of Managed Care (AJMC) in May 2021 concluded that physicians should use pulmonary function testing systems to ensure that patients are appropriately diagnosed with COPD. Such studies will favor the usage of these systems for lung testing, thereby increasing their adoption during the forecast period.

Furthermore, the increasing diagnosis of lung function with the help of pulmonary function tests has encouraged companies to introduce advanced testing systems in the market. The advanced products’ clearance by the U.S. FDA is expected to increase their adoption among healthcare providers, especially in independent physician clinics.

- For instance, in August 2019, VYAIRE MEDICAL, INC. announced the 510(k) clearance by the U.S. FDA for its two PFT technologies, which are Vyntus ONE and Vyntus BODY with SentrySuite Software.

The advancement of newly launched testing devices coupled with increasing awareness of these devices among healthcare providers is expected to propel the market growth in the long run.

RESTRAINING FACTORS

Risk of Cross-Contamination and Lack of Skilled Healthcare Professionals in Underdeveloped Countries to Hamper Market Growth

Pulmonary function testing represents a potential medium for the transmission of infection due to the gathering of patients with lung diseases and the increased risk of spread of these diseases through coughing and droplet formation during the pulmonary function test procedures.

These systems include mouthpieces, rebreathing valves, and tubings used in the laboratory. Mouthpieces are the most common medium of cross-infection during testing.

Exposed surface areas, quality of upholstery, general clutter, air conditioning, optimum temperature, and humidity conditions lead to cross-infections such as the risk of contracting tuberculosis.

Furthermore, the complexity of these systems, which measure various parameters while calculating the lung volume and capacity requires skilled physicians and technicians. However, there is a shortage of trained healthcare professionals in developing countries.

- For instance, according to an article published by BMJ Publishing Group Ltd. in May 2019, in India, the density of health professionals is estimated to be 29 per 10,000 people; however, the current density of trained workers is only 16 per 10,000. Furthermore, the trained healthcare workforce in India does not meet the minimum threshold of 22.8 skilled workers per 10,000 populations, which is recommended by the World Health Organization (WHO).

Such unavailability of a skilled workforce to operate PFT systems and the high risk of contamination associated with these systems are expected to hamper the market growth during the forecast period.

Pulmonary Function Testing System Market Segmentation Analysis

By Type Analysis

Complete Systems to Dominate Market Due to their Growing Adoption in Hospitals

Based on type, the market is segmented into portable and complete.

In 2026, the complete PFT systems segment is expected to reach USD 105.47 million and accounted for a 59.03% market share, and is projected to register a significant CAGR during the forecast period of 2026–2034. An increase in the number of hospitals requiring complete systems is expected to drive the segment’s growth. Moreover, the surging number of patient visits coupled with the huge occurrence of respiratory illnesses, such as asthma and COPD, are expected to increase the demand for complete systems.

The portable segment is projected to expand at the highest CAGR during the forecast timeframe. The high growth rate of this segment is due to the increase in adoption of portable systems in independent and diagnostics clinics. Moreover, increasing launches of these products for the diagnosis of asthma and COPD and rising air pollution are expected to surge their demand in the future.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Hospitals to Continue Dominance Due to Rising Patient Visits

By end-user, the market is divided into physical examination (diagnostic) centers, physician groups (clinics), hospitals, and others.

In 2026, the hospitals segment is expected to reach USD 95.32 million and accounted for a 53.35% market share, and is likely to expand at a moderate CAGR over the forecast period. The segment’s growth is due to the surging visits of asthma and COPD patients in hospitals. Moreover, the growing adoption of complete systems for diagnosing patients in hospitals is expected to drive the segment's growth in the coming years. Furthermore, the growing geriatric population highly contributes to the increasing patient pool of asthma and COPD, which increases the number of visits to the hospital for appropriate diagnosis and treatment.

The physician groups (clinics) segment is expected to grow at the highest CAGR over the forecast period. The segment’s growth is attributed to factors, such as the growing incidence of chronic respiratory diseases, rising focus of key players in the market on introducing portable systems for clinics, and an increase in the implementation of pulmonary function testing systems in clinics.

Introduction of these systems in the physician groups (clinics) coupled with the increasing number of COPD and asthma patients in clinics is expected to boost the segment’s growth during the forecast period.

The physical examination (diagnostic) centers accounted for a substantial market share in 2024 and is projected to grow significantly during the forecast period from 2025-2032. The increasing awareness among individuals regarding lung health and the demand for early diagnosis and treatment of respiratory diseases has led to increased demand for pulmonary function testing systems in physical examination (diagnostic) centers. Moreover, the government initiatives and programs promoting the importance of lung health and early disease detection due to the rising prevalence of such diseases is expected to increase the number of patient visits to physical examination (diagnostic) centers, driving the market growth.

REGIONAL INSIGHTS

North America Pulmonary Function Testing System Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 68.4 million in 2024 and USD 71.17 million in 2025. It is projected to expand at a substantial CAGR during the forecast period. The growth is due to the prompt implementation of portable systems and increasing usage of these devices in physician groups (clinics) in the region. Furthermore, the increasing prevalence of chronic respiratory diseases and rising hospital admissions are anticipated to propel the market growth across the region. The US market is projected to reach USD 68.5 million by 2026.

Europe is projected to expand at a reasonable CAGR during the forecast timeframe. The growth is due to the surging number of patients suffering from COPD and asthma and growing number of visits to independent physician clinics to diagnose these diseases. Furthermore, the improvement in healthcare infrastructure and presence of major players will surge the demand for these systems in the region. The UK market is projected to reach USD 7 million by 2026, while the Germany market is projected to reach USD 11.2 million by 2026.

The market in Asia Pacific is projected to record the highest CAGR over the forecast period. The market growth across the region is accredited to the growing awareness regarding the usage of pulmonary function tests and increasing emphasis on enhancing hospital infrastructure. Furthermore, the rising geographical footprint of market players in developing countries of Asia Pacific are expected to propel the market development during the forecast period. The Japan market is projected to reach USD 11.5 million by 2026, the China market is projected to reach USD 14.5 million by 2026, and the India market is projected to reach USD 5 million by 2026.

Latin America and the Middle East & Africa markets are anticipated to expand at a lower CAGR compared to other regions during the forecast period. The growth is attributed to the rising investments in improvement of healthcare infrastructure, increasing prevalence of COPD & asthma, and growing demand for testing lung function across these regions.

List of Key Companies in Pulmonary Function Testing System Market

Strong Product Portfolio of Companies to Strengthen their Market Position

The market is consolidated due to the presence of key companies that deal in the production of pulmonary function testing systems.

VYAIRE MEDICAL, INC. and MGC Diagnostics Corporation accounted for the largest share of the market. This is due to their strong product portfolio of PFT systems and increasing focus on approvals to introduce advanced devices in the market.

Moreover, the consistent focus of the key companies on introducing these systems in developing countries is expected to strengthen their market share during the forecast period. Furthermore, companies, such as PulmOne Advanced Medical Devices, have been aggressively focusing on expanding their product range and geographical presence worldwide.

Other companies with new product launches include ndd Medizintechnik AG, KoKo PFT, CHEST M.I., Inc., and other small & medium-sized market players. Moreover, a growing focus of companies on collaboration with healthcare providers is expected to fuel the global market growth in the coming years.

LIST OF KEY COMPANIES PROFILED:

- ndd Medizintechnik AG (Switzerland)

- COSMED srl (Italy)

- MGC Diagnostics Corporation (U.S.)

- PulmOne Advanced Medical Devices (Israel)

- CHEST M.I., Inc. (Japan)

- VYAIRE MEDICAL, INC. (U.S.)

- KoKo PFT (U.S.)

- Medical Electronic Construction (Belgium)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Vitalograph, a respiratory diagnostic devices manufacturer, announced the launch of the VitaloPFT Pulmonary Function Testing Series at the annual Arab Health Exhibition in Dubai. The product was launched with an aim for use in secondary care.

- March 2023: Vitalograph partnered with Morgan Scientific to launch a new range of pulmonary function testing (PFT) systems. Jointly, the partnership integrates advanced comprehensive PFT software from Morgan Scientific with PFT hardware from Vitalograph.

- January 2023: CAIRE Inc., a subsidiary of NGK SPARK PLUG CO., LTD., acquired MGC Diagnostics Corporation to expand its expertise in pulmonary disease.

- May 2022: MGC Diagnostics Corporation partnered with a U.K. med-tech company, Bedfont Scientific Ltd. for the distribution of its products.

- July 2022: PulmOne Advanced Medical Devices announced the opening of a new office in Japan, which would focus on MiniBox+ sales and services in Japan.

- June 2022: PulmOne Advanced Medical Devices announced the opening of a new subsidiary, PulmOne France.

- March 2022: KoKo PFT signed a three-year partnership with MAGNET GROUP. The partnership would give the company access to all respiratory and pulmonary function testing systems of the company.

- October 2020: Community HealthCare System, in Kansas, U.S., installed an Ultima Pulmonary Function System by MGC Diagnostics Corporation to provide the most innovative testing of lungs.

- September 2020: PulmOne Advanced Medical Devices announced the launch of MiniBox Academy, an innovative, self-paced e-learning training and certification program for MiniBox+ customers. The academy is designed to improve PFT testing expertise, ensure testing consistency, reproducibility, and accuracy and facilitate an outstanding patient experience.

- November 2019: PulmOne Advanced Medical Devices entered a partnership with Circassia Pharmaceuticals to develop NIOX VERO as an integrated add-on to PulmOne's MiniBox+.

REPORT COVERAGE

The research report provides a detailed competitive landscape and market dynamics. It focuses on key aspects, such as regulatory policies regarding the prevalence of major pulmonary diseases such as COPD and asthma. Furthermore, the report provides information related to key industry developments such as mergers and acquisitions. In addition, the report includes insights related to the pulmonary function testing system market trends and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.87% from 2025-2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD 171.2 million in 2025 to USD 261.38 million by 2034.

In 2025, market in North America was valued at USD 71.17 million.

The market is expected to expand at a CAGR of 4.7% during the forecast timeframe of 2026-2034.

The complete segment is set to lead the market by type.

The rising prevalence of chronic respiratory disorders, growing geriatric population, and rising awareness regarding technologically advanced PFT systems to test the functioning of lungs are the key factors driving the market growth.

VYAIRE MEDICAL, INC. and MGC Diagnostics Corporation are the top players in the market.

North America dominated the market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us