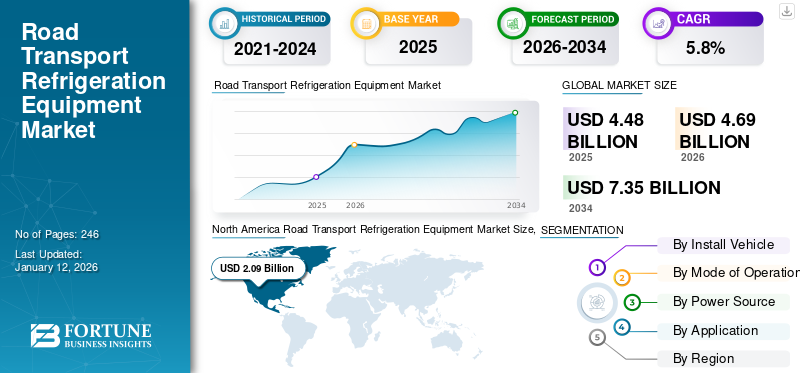

Road Transport Refrigeration Equipment Market Size, Share & Industry Analysis, By Install Vehicle (Van & Light Truck, Heavy Truck, and Trailer), By Mode of Operation (Single Temperature and Multi Temperature), By Power Source (Vehicle Powered and Self Powered), By Application (Food and Beverage Products, Floral Products, and Pharmaceutical and Other Healthcare Products), and Regional Forecast, 2026–2034

Road Transport Refrigeration Equipment Market Size

The global road transport refrigeration equipment market size was valued at USD 4.48 billion in 2025 and is projected to grow from USD 4.69 billion in 2026 to USD 7.35 billion by 2034, exhibiting a CAGR of 5.8% during the forecast period. North America dominated the global market with a share of 46.7% in 2026.

Road transport refrigeration equipment refers to cooling systems installed in trucks, trailers, or other vehicles used for transporting perishable goods over land. These refrigeration units are essential for maintaining specific temperature conditions to preserve the quality and freshness of perishable items such as food, pharmaceuticals, chemicals, or any other temperature-sensitive cargo during transit.

The equipment typically consists of a refrigeration unit mounted on the vehicle, connected to an insulated compartment or trailer where the goods are stored. The refrigeration unit may be powered by the vehicle's engine, an independent diesel engine, or an electric power source. It works by removing heat from the storage compartment, thereby maintaining the desired temperature.

The COVID-19 pandemic significantly impacted the market share. During the early stages of the pandemic, disruptions in the supply chain and restrictions on movement led to a temporary decline in product demand. However, the market quickly rebounded as the need for reliable transportation of essential goods, particularly food, beverages, and pharmaceutical products, increased. The pandemic highlighted the critical role of refrigeration equipment in ensuring the safe delivery of vaccines and medical supplies, driving investments in advanced and efficient refrigeration solutions. This shift underscored the importance of maintaining robust and resilient cold chain logistics in the face of global challenges.

Road Transport Refrigeration Equipment Market Trends

Rising Adoption of Electric Refrigeration Units and Integration of Telematics and IoT to Accelerate Market Growth

Electric-powered refrigeration systems offer lower emissions and reduced fuel consumption compared to traditional diesel-powered units, aligning with stricter environmental regulations. Advancements in refrigeration technology, such as the development of more energy-efficient compressors, improved insulation materials, and advanced temperature control systems, are enhancing the performance and efficiency of road transport refrigeration equipment. These technological innovations help reduce operating costs and improve the quality of transported goods.

Moreover, the integration of telematics and Internet of Things (IoT) technology into refrigeration units enables real-time monitoring of temperature, humidity, and other critical parameters during transit. This allows for proactive maintenance, temperature control optimization, and remote diagnostics, enhancing the reliability and efficiency of refrigerated transport operations. In addition, the pharmaceutical and healthcare industries require strict temperature control during transportation to maintain the efficacy and safety of medical products, vaccines, and biologics.

As these industries continue to grow, there is a corresponding increase in demand for specialized road transport refrigeration equipment capable of meeting stringent regulatory requirements. Overall, these trends reflect a dynamic and evolving market driven by changing consumer preferences, technological innovation, and industry-specific requirements. Adapting to these trends is essential for manufacturers, suppliers, and transportation companies to remain competitive and meet the evolving demands of the market.

Download Free sample to learn more about this report.

Road Transport Refrigeration Equipment Market Growth Factors

Rising Demand for Refrigeration Units for Food Safety and Preventing Wastages to Boost Market Growth

Reasons for food wastage are numerous and can occur while producing, retailing, processing, storing, or consuming. In several developing countries, such as India, China, and Mexico, food wastage occurs owing to the poor connectivity of roads in intact areas and refrigeration technologies. Moreover, farmers produce food products in huge quantities, but due to low access to road transport and warehouse refrigeration systems, most of their crops get wasted. Reduction of food waste can automatically reduce the usage of water, energy, and fertilizer, which ultimately reduces carbon emissions.

The governments of several developing countries are taking initiatives to build better road connectivity and refrigeration units to store crops and other food products.

For instance, in India, the cold chain logistics and warehousing sector are fragmented with 3,500 players. The government is planning to increase this number in the future to reduce food wastage and also to increase the income of the farmers across the country.

According to the International Institute of Refrigeration, if developing countries had the same level of cold chain as developed, 200 million tonnes of food per year can be saved. This, in turn, is likely to generate new opportunities for refrigerating device manufacturers to set up networks in developing countries by partnering with local logistics service providers or with the government.

RESTRAINING FACTORS

Regulatory Compliances & High Maintenance Costs May Hamper Market Growth

Stringent regulations regarding emissions and environmental impact increase the cost of manufacturing and operating refrigeration equipment. Compliance with these regulations may require additional investment in research and development, leading to higher prices for consumers. Fluctuations in fuel prices also significantly impact operating costs for vehicles equipped with refrigeration units. In addition, high fuel prices can reduce profit margins for transportation companies and increase overall expenses. Furthermore, refrigeration units require regular maintenance to ensure optimal performance and reliability. Moreover, high maintenance costs can be a significant burden for transportation companies, especially smaller businesses with limited budgets.

Rapid advancements in refrigeration technology may render existing equipment obsolete or less efficient. This can lead to a reluctance among businesses to invest in new equipment due to concerns about the longevity of their investment. This can also make it challenging for manufacturers of refrigeration equipment to maintain profitability and invest in research and development to improve their products. Economic downturns or fluctuations in global trade can reduce demand for refrigerated transport services, affecting the market for road transport refrigeration equipment.

Overall, while the market offers significant opportunities, various restraints need to be carefully navigated by manufacturers, suppliers, and transportation companies to ensure sustained growth and profitability.

Road Transport Refrigeration Equipment Market Segmentation Analysis

By Install Vehicle Analysis

Trailers to Hold the Highest Market Share Owing to Increased E-Commerce Deliveries

By install vehicle, the market is divided into trailer, heavy truck, and van & light truck.

The refrigerated fleet varies from region to region, but the most popular is the trailer as it can prove to be more cost-effective and also offers features such as multi-temperature units allowing the transport of different types of goods in a single trip and reducing multi-trip transportation. The above factors are the reasons for the segment’s dominance in the market.

The van & light truck segment is poised to grow at the highest CAGR throughout the forecast period owing to the rising e-commerce deliveries in developed and emerging cities. In addition, vans and light trucks help in readily transporting products in compact locations and small urban roadways.

The heavy truck segment is poised to show stable growth with a share of 25% in 2024, due to their payload capacity and the ability to be equipped with a variety of mechanical refrigeration systems driven by minor transposition of engines that are diesel or use

carbon dioxide either in liquid form or in dry ice form as a conserving agent.

To know how our report can help streamline your business, Speak to Analyst

By Mode of Operation Analysis

Single Temperature Segment Dominates Due to Increased Penetration

Based on mode of operation, the market is segmented into multi temperature and single temperature.

Based on mode of operation, the market is segmented into multi temperature and single temperature.

The single temperature segment currently holds the highest road transport refrigeration equipment market share of 63.54% in 2026 owing to its widespread use and established presence in the industry. This is largely due to its reliability and cost-effectiveness for transporting goods that require a consistent temperature.

However, the multi temperature segment is slated to grow at the highest CAGR of 6.11% during the study period (2025-2032), driven by increasing demand for versatile and efficient refrigeration solutions that can simultaneously transport goods requiring different temperature settings. In addition, most road transport refrigeration equipment customers in developed countries choose multi-temperature units, even if they only function in single-temperature mode, to reduce the number of trips required for transportation. It is often utilized for urban distribution since it saves money on transportation.

By Power Source Analysis

Vehicle Powered Segment Holds Largest Share Owing to Growing Inclination toward Fuel-Efficient Cars

By power source, the market is categorized into vehicle powered and self powered.

The vehicle powered segment dominates the market with a CAGR of 6.75% during the forecast period (2025-2032), due to its integration with the vehicle’s engine, offering a cost-effective and efficient solution for temperature control during transportation. This segment is particularly favored for its simplicity and lower initial investment.

Currently, the self powered segment is experiencing significant growth with a market share of 86.57% in 2026, driven by the need for independent and reliable refrigeration systems that do not rely on the vehicle’s power. This growth is fueled by advancements in battery technology and a growing emphasis on sustainability and reducing fuel consumption. The rising preference for self powered units indicates a trend toward more autonomous and flexible refrigeration solutions in the road transportation sector.

By Application Analysis

High Demand for Safety Maintenance of Perishable Goods to Spur Food and Beverage Products Segment Growth

By application, the market is segmented into floral products, food and beverage products, and pharmaceutical and other healthcare products.

The food and beverage products segment holds the largest market share of 85.29% in 2026, driven by the high demand for maintaining the freshness and safety of perishable items during transportation. This segment benefits from the growing consumer preference for fresh and frozen food, requiring reliable and efficient refrigeration solutions.

The pharmaceutical and other healthcare products segment growth is propelled by the stringent requirements for transporting temperature-sensitive medical products, vaccines, and drugs. This segment is poised to grow at a CAGR of 6.32% during the forecast period (2025-2032). The increasing emphasis on maintaining the integrity of these products during transportation is boosting the demand for advanced refrigeration equipment.

The floral products segment, while smaller in comparison, is also experiencing a steady growth. The need to preserve the freshness and quality of flowers during transportation drives demand for specialized refrigeration solutions tailored to this market.

REGIONAL INSIGHTS

The regional analysis comprises five major regions: North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America.

North America held the highest share in the market with a valuation of USD 2.09 billion in 2025 and USD 2.19 billion in 2026, owing to the region's large and diverse economy, extensive transportation networks, and significant demand for perishable goods. The market has experienced steady growth over the years, supported by factors such as population growth, changing consumer preferences, and expanding e-commerce activities. Road transport refrigeration equipment is preferred more than stationary refrigeration equipment as it operates reliably in much harsher environments. Due to the wide range of operating conditions and constraints imposed by available space and weight, transport refrigeration equipment has lower efficiencies than stationary systems.

North America Road Transport Refrigeration Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The increasing demand for processed foods in the U.S., coupled with increasing investments toward the expansion of the cold supply chain, is expected to drive the growth of road transport refrigeration units in the region. In addition, demand for frozen foods and vegetables is constantly rising. Due to a lack of time, customers choose to buy processed and frozen fruits and vegetables. As a result, the market for transport refrigeration units is expected to experience rapid growth in the near future. The U.S. market is set to be worth USD 1.87 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe represents a significant market for road transport refrigeration equipment with a CAGR of 5.44% during the forecast period (2025-2032) and the market share of USD 1.19 billion in 2026, driven by the region's extensive distribution networks, robust cold chain logistics infrastructure, and diverse industries. The U.K. market is growing and is expected to reach a market value of USD 0.16 billion in 2026. The market has experienced steady growth, supported by increasing demand for perishable goods, including food, pharmaceuticals, and chemicals. Europe has stringent regulations governing emissions, fuel efficiency, and environmental sustainability, which significantly influence the design and manufacturing of road transport refrigeration e and the market share of quipment. Manufacturers must comply with regulations such as the European Union's Emission Standards and F-Gas Regulation, driving innovation in energy-efficient and environmentally friendly refrigeration technologies. Germany is poised to be worth USD 0.29 billion in 2026, while France is set to be valued at USD 0.15 billion in the same year.

Asia Pacific is the third largest market holding a share of USD 0.77 billion in 2026. This region offers considerable cold chain opportunities for the cold chain industry, including warehousing and transportation sectors. In this region, China is set to exhibit a valuation of USD 0.39 billion in 2026. Asian road transport refrigeration equipment market growth is likely to be driven by an increase in awareness about the prevention of food wastage before consumption, rapid urbanization, growth of the organized retail sector, government support & initiatives in this sector, and a rise in consumer demand for perishable foods. The market in India is expected to reach a value of USD 0.08 billion in 2026, while Japan is predicted to be worth USD 0.14 billion in the same year.

The Middle East & Africa market is experiencing steady growth, driven by increasing demand for perishable goods, including food, pharmaceuticals, and chemicals. The market is expanding as countries in the region invest in infrastructure development and modernize their transportation and logistics networks. GCC is anticipated to be valued at USD 0.08 billion in 2025.

Latin America market is growing steadily and is expected to reach a value of USD 0.33 billion in 2026, driven by increasing demand for perishable goods, including food, pharmaceuticals, and agricultural products. The market is expanding as countries in the region focus on improving cold chain logistics infrastructure and modernizing their transportation networks.

KEY INDUSTRY PLAYERS

Leading Players Emphasize Developing and Delivering Eco-friendly and Energy-efficient Products to Gain a Competitive Edge

Key players such as Carrier Global Corporation, Mitsubishi Heavy Industries, and others focus on creating eco-friendly refrigeration units for road transport refrigeration equipment that are equipped with cutting-edge technology with the restricted use of diesel. Furthermore, to lower the rate of global warming, manufacturers are creating electrical, solar-powered, and battery-powered refrigeration systems. In addition, manufacturers range from huge multinational organizations to small privately-held businesses hold almost 55% of the market share.

List of Top Road Transport Refrigeration Equipment Companies

- Carrier (U.S.)

- Mitsubishi Heavy Industries (Japan)

- G.A.H. Refrigeration (U.K.)

- Hwasung Thermo Co. Ltd. (Korea)

- Trane Technologies plc (U.S.)

- Daikin Industries Ltd. (Italy)

- Songz Automobile Air Conditioning Co., Ltd. (China)

- Safkar (Turkey)

- Kingtec Group Company Limited (U.S.)

- Zhengzhou Corun Tech Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- November 2023: Trane Technologies announced to offer direct zero-emission, all-electric Thermo King refrigeration solutions to all segments in the Middle East & Africa and Europe region. Advanced all-electric refrigeration technology for heavy-duty truck transport refrigeration units helps accelerate next-generation last-mile delivery operations.

- September 2023: Mitsubishi Heavy Industries Thermal Systems, Ltd. launched the `TEJ35GAM' electric transport refrigeration machine exclusively for small and medium-sized trucks, which complements the plug-in hybrid transport refrigeration machine `TE20/30 series' and the `TEJ35AM.’

- September 2022: Daikin Europe N.V., a subsidiary of Daikin Industries, Ltd., introduced Exigo Electric Future, shaping the future of cooling, heating, ventilation and refrigeration systems, with a presence in more than 171 countries and a motorless drive architecture developed specifically for automotive applications. It is purpose-built to provide clean and flexible motorless propulsion capabilities.

- July 2022: GAH announced an innovation in refrigeration units for hybrid & electric vehicles, fleet management systems, WLTP-compliant undermounts, and ground-breaking remote service capability.

- March 2022: ConMet eMobility and Carrier Transicold have partnered with Sysco Corp. to develop a zero-emission refrigeration system for commercial trailers. This system uses ConMet’s eHub technology to generate regenerative energy, powering Carrier’s Vector refrigeration unit.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.8% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Thousand Units) |

|

Segmentation |

By Install Vehicle

By Mode of Operation

By Power Source

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 7.35 billion by 2034.

In 2025, the market was valued at USD 4.48 billion.

The market is projected to grow at a CAGR of 5.8% during the forecast period.

Trailer segment holds the highest share in the market.

The rising demand for refrigeration units for food safety and preventing wastage is driving the market growth.

Carrier, Mitsubishi Heavy Industries, Trane Technologies plc, and Daikin Industries Ltd. are the top players in the market.

North America region holds the highest share in the market.

Food and beverage products segment holds the highest share in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us