Self-service BI Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Industry (BFSI, Retail & E-commerce, Manufacturing, IT & Telecom, Healthcare & Life Science, Energy & Utility, Transportation, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

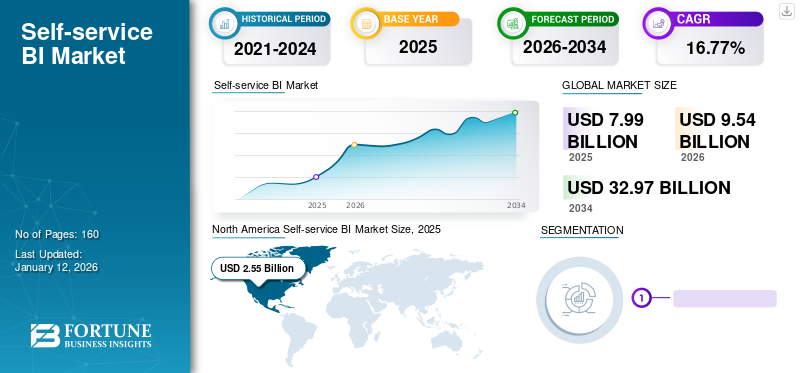

The global self-service BI market size was valued at USD 7.99 billion in 2025 and is projected to grow from USD 9.54 billion in 2026 to USD 32.97 billion by 2034, exhibiting a CAGR of 16.77% during the forecast period. North America dominated the global market with a share of 31.94% in 2025.

Self-service BI (Business Intelligence) offers automated report analytics and dashboard that helps management and businesses in drawing new strategies. The tool supports the teams across finance, marketing, human resource, sales, product development and more with valuable data insights to consider before making decision. The increasing demand for accessible tools for non-technical users is expected to rise the demand for self-service BI. Further, its capabilities such as intuitive user interface, semantic datalogs, collaboration skills under lesser time and with lesser reliance on IT team is likely to drive its adoption. Various companies are implementing the services to enable faster data insight acquisition across its teams. For instance,

- In February 2023, ThoughtSpot Inc. announced partnership with Snowflex Inc. company’s telecom data cloud to offer reliable self-service analytics. The partnership is supporting in enhancing digital transformation at telecom service provider to provide superior customer experience.

Self-Service BI Market Overview

Market Size:

- 2025 Value: USD 7.99 billion

- 2026 Value: USD 9.54 billion

- 2034 Forecast Value: USD 32.97 billion

- CAGR (2026–2034): 16.77%

Market Share:

- Regional Leader: North America led the global market with a 31.94% share in 2025.

- Fastest-Growing Region: Asia Pacific is expected to exhibit the highest growth rate during the forecast period, propelled by increasing investments in digital transformation and a growing number of internet users.

Industry Trends:

- Adoption of AI-Driven Tools: AI integration is transforming self-service BI platforms, offering smarter data analysis and improved decision-making capabilities.

- Cloud-Based Solutions: The shift towards cloud deployment is enhancing scalability, flexibility, and cost-efficiency of BI tools.

- Mobile Optimization: With the increasing use of smartphones, BI solutions are focusing on mobile-friendly designs to enhance user engagement.

- Integration with Other Business Tools: BI platforms are being integrated with CRM, ERP, and other business applications to provide a holistic view of organizational data.

Driving Factors:

- Empowerment of Non-Technical Users: Self-service BI tools enable non-technical users to perform data analysis, reducing reliance on IT departments and accelerating decision-making processes.

- Cost-Effectiveness: Compared to traditional BI solutions, self-service tools are relatively inexpensive, allowing businesses to access advanced analytics capabilities at a lower cost.

- Increased Data Availability: The growing volume of data generated by businesses is driving the need for tools that can efficiently analyze and interpret this information.

- Regulatory Compliance: With stricter data protection laws, businesses are seeking BI solutions that ensure compliance with regulations like GDPR.

COVID-19 pandemic has significantly impacted the spending pattern and capacity of the enterprises on business intelligence. Amid the 2020 crisis, enterprises highly invested in perceiving data access and business intelligence tools. The self-service BI emerged as a crucial tool for organization to offer work from home policies. The tool’s ability to co-create insights, collaborate and provide quicker result helped in gaining popularity during pandemic crises.

With the shift on digital platform, the organization witnessed unprecedented changes in the consumer behavior and buying patterns. Thus, the sudden increase in digital data and the significant changes in consumer behavior fueled the demand for self-service BI capabilities during pandemic crises. Post-pandemic, the market is expected to witness significant growth rate considering the growth of the digital data. Thus, soaring set of information owing to the pandemic crisis across channels to boost the self-service BI market growth.

Self-service BI Market Trends

The Growing Volume of Business Data Coupled with AI-driven Visualizations to Boost Market Growth

As organizations collect and generate more data from multiple sources, there is a growing need for tools that aid users to analyze and visualize this data effectively. AI-driven visualizations are crucial in leveraging artificial intelligence algorithms to create insightful and interactive visual representations of data automatically. These visualizations make it easier for users to understand complex data sets and enable them to identify trends, outliers, and patterns that may not be apparent in raw data.

Moreover, AI-driven visualizations enhance self-service BI platforms by providing users with personalized and actionable insights. By analyzing user behavior and data usage patterns, AI algorithms can suggest relevant visualizations and analyses tailored to the user’s needs and preferences. This level of personalization improves the user experience and increases the effectiveness of data analysis, enabling users to make more informed decisions. As organizations continue to rely on data-driven insights to drive business growth, the demand for self-service BI tools with Aid-riven visualizations is expected to grow, further fueling the expansion of the market.

- For instance, in October 2023, GoodData launched its FlexHouse Analytics Lake platform, which consolidated disparate data assets into a single environment for streamlined ML, AI, and BI workflows. It simplifies visualizations, development, and analysis for datar insights and more informed decision making.

Download Free sample to learn more about this report.

Self-service BI Market Growth Factors

Rise in SMEs Investment in Self-service Analytics to Drive the Market Growth

Small and medium enterprises (SMEs) around the globe are facing tough competition to sustain in the digital era. The growing customer’s preferences on digital platform has significantly contributed to the expanding volume of business data. Thus, to win the customers, the S MEs are implementing tools to understand the customers buying pattern and changing need of the market. The adoption of self-service BI tools are helping these enterprises in responding to the queries in real-time and with strong dashboard statistics. For instance,

- In March 2021, India-based Megenta BI launched business intelligence platform for small and medium enterprises of the country with self-service and real-time analysis capabilities. The company aims to support digital transformation strategies of the companies in India.

Thus, the increasing investments by SMEs to boost customer engagement is likely to drive the market growth.

RESTRAINING FACTORS

Data Protection Law and Inaccuracy in Data to Hamper Market Growth

data is a very important factor in offering self-service report analysis and dashboard. However, any inaccuracy in the collected data might severely impact the output. Thus, any organization can suffer major losses by making strategies on inaccurate data. Thus, enterprises are being skeptical in adopting the tools. Further, many countries have stringent rules in using public data, thus organizations need to be careful in collecting the data. Hence, the regulations on data acquisition and inaccurate inputs is likely to hinder the market share.

Self-service BI Market Segmentation Analysis

By Deployment Analysis

Enhanced Performance to Fuel Demand for Cloud-based Solution

The market is segmented on the basis of deployment into cloud and on-premises.

The Cloud segment is projected to dominate the market with a share of 55.58% in 2026. On-premises to dominate the revenue share initially during the forecast period. The organizations are still investing in on-premises owing to the higher security of the data. The enterprises with sensitive stored data still opt for on-premises based self-service BI.

Cloud deployment to gain rapid growth rate during the forecast period. The cloud-based solution can always provide up-graded versions of tools with newest feature. Also, regular updates and software integration on cloud solutions is easier as compared to other deployment options. Similarly, as the data storage is not restricted such as on-premises, the cloud-based solution can draw better scalability and performance.

By Enterprise Type Analysis

Increase in Digital Data to Boost the Investments of the Large Enterprises in BI Tools

Based on enterprise type, the market is segmented into large enterprises and small and medium enterprises.

Large enterprises to gain maximum segment share 57.02% in 2026. The collection of huge set of insights from all the potential platforms to fuel the demand for business intelligence tools in large enterprises. Also, the IT spending capacity is more for large organizations and the competition is always tough to sustain dominant market position.

Small and medium enterprises are now steadily investing in BI tools, thus to gain rapid growth rate. It allows non-technical user to quickly access analysis report, thus driving organization investment with limited resources.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Rapidly Growing Sensitive Data to Surge the Implementation of BI Tools in the Healthcare

By industry, the market is categorized into BFSI, retail & e-commerce, manufacturing, IT & telecom, healthcare & life science, energy & utility, transportation, and others.

The BFSI segment is expected to lead the market, contributing 18.24% globally in 2026. Healthcare to grow at a rapid CAGR during the forecast period. The industry is witnessing increase in number of vast sensitive data of patients and healthcare providers. The BI tools support in empowering the healthcare providers with efficient decision making options. Retail and e-commerce to showcase steady growth owing to the rise in online stores and number of shoppers.

IT and telecom to gain dominant share during the forecast period. The presence of vast number of customers across various digital platform is likely to drive the demand. Also, the industry is an early adopter of digital solution, thus the need to manage and analyses data is growing.

BFSI to gain maximum revenue share after IT and telecom. The surge in digital transformation and growing number of customers’ online services preferences to drive the market share.

Further, the industry is sub-segmented by risk and compliance management, fraud, and security management, retail & e-commerce, inventory management, sales & marketing management, supply chain and procurement management, operations management, insight-driven diagnosis, inventory management, and others.

REGIONAL INSIGHTS

North America Self-service BI Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 2.55 billion in 2025 and USD 2.92 billion in 2026. The region is expected to maintain a dominant revenue share during the forecast period, supported by growing digital transformation efforts that are driving investments in self-service BI tools to better understand market conditions. The presence of a prominent number of key market players in the U.S. is further expected to fuel the country’s growth rate. The U.S. market is expected to reach USD 1.82 billion by 2026.

Europe

Europe is projected to secure the second position in revenue share. Increasing investments in digital tools by start-ups and SMEs are fueling the demand for self-service analytics across the region. With intensifying competition across European countries, businesses are focusing on implementing innovative digital solutions to stay resilient and address market challenges. The U.K. market is projected to reach USD 0.34 billion by 2026, while the Germany market is anticipated to reach USD 0.36 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to witness a rapid growth rate during the forecast period. The increasing population in countries such as India and China is generating a large volume of structured and unstructured data, driving industries to adopt self-service BI tools to better understand market trends and customer needs. With accelerating investments in digitalization across industries, India is projected to record a rapid CAGR. The Japan market is expected to reach USD 0.45 billion by 2026, the China market is projected to reach USD 0.58 billion by 2026, and the India market is anticipated to reach USD 0.45 billion by 2026.

Middle East & Africa is expected to showcase a significant growth rate over the forecast period, supported by growing investments in digital solutions that enable non-technical users to easily access analytical insights through self-service tools. Similarly, the digital transformation trend is expected to boost market growth across South America.

List of Key Companies in Self-service BI Market

Strategic Partnership for Customer Expansion to Boost Key Players Revenue Share

Key market players are strategically entering into partnership and collaboration with the clients to expand its customer base. Globally, the key players are offering new and innovative tools to support growing demand as per industry specification. Also, the companies are integrating the self-service tools with its other solution to provide quicker and reliable insights. Strategic acquisition is growing considering the vast opportunity and ever growing customers and their demand.

- October 2022: ThoughtSpot Inc. launched ThoughtSpot for Sheets that can offer self-service data on Google sheets just by plug-in. Users can install and connect with data sheet to get instant data analysis. The company is planning for more partnerships in the futures.

List of Key Companies Profiled:

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- IBM Corporation (U.S.)

- SAP SE (Germany)

- ThoughtSpot Inc. (U.S.)

- Zoho Corporation (U.S.)

- Qlik Technologies, Inc. (U.S.)

- Microstrategy, Inc. (U.S.)

- Tableau Software (Salesforce, Inc.) (U.S.)

- Domo, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: MicroStrategy launched MicroStrategy AI, enabling organizations to integrate refining AI experiences into their BI applications and products based on trusted data. This product allowed seamless incorporation of generative AI in BI applications, simplifying and accelerating data analysis and interaction with insights for enhanced enterprise-wide innovation.

- September 2023: Collibra acquired Busprey, an integrated SQL data notebook platform, to enhance its Data Intelligence Cloud and BI tools. Husprey’s platform enabled data and business analysts to create SQL notebooks to easily derive and collaborate insights, adding further context and meaning to data through the company.

- August 2023: Smollan and Pyramid Analytics partnered to enhance data-driven solutions, allowing Smollan to sell and implement Pyramid Analytics software through its DatOrbis Business. This collaboration aimed to provide clients superior BI value and functionality, enabling better decision-making and performance in the competitive landscape.

- June 2023: xnPOS launched xnPOS BI, a cloud-based F&B business analytics platform. This platform offered detailed insights into the performance of F&B operations for hotel owners, operators, and management by converting POS transaction data into actionable KPIs that are remotely accessible.

- June 2023: ThoughtSpot Inc. announced the acquisition of BI platform provider, Mode Analytics, to boost the capabilities of data teams and the ecosystem. Together, the companies can offer quick self-service analytics for all types of use cases.

- March 2023: AtScale announced collaboration with Snowflake Ready Technology Validation Partner to boost business intelligence and analytics with higher performance. The integration includes self-service analytics capabilities of consumer interaction with live data.

- February 2023: Omni Analytics announced the commercial availability of its next-generation BI platform with self-service tools and fully governed capabilities. The company aims to offer growing enterprises needs through its services, with cost-effective and higher performance capabilities.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

An Infographic Representation of Self-service BI Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.77% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 32.97 billion by 2034.

In 2025, the market was valued at USD 7.99 billion.

The market is projected to grow at a CAGR of 16.77% during the forecast period.

The IT and telecom industry segment is expected to lead the market.

Rise in SMEs investment in self-service analytics to drive market growth.

Microsoft Corporation, Oracle Corporation, IBM Corporation, SAP SE, SAS Institute, Zoho Corporation, Qlik Technologies, Inc., Microstrategy, Inc. are the top players in the market.

North America is expected to hold the highest market share.

By deployment, the cloud is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic