Shot Blasting Machine Market Size, Share & COVID-19 Impact Analysis, By Machine Type (Tumble Belt, Hanger Type, Roller Conveyor, Spinner Hanger, and Table Type Machine), By Technology (Wheel Blasting, Air Blasting, and Wet Blasting), By Mode of Operation (Automatic and Manual), By End-user (Automotive, Aerospace, Foundry, Construction, Shipbuilding, Rail, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

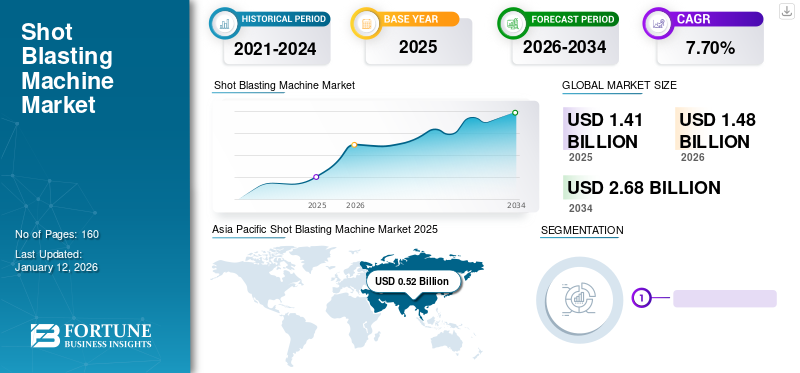

The global shot blasting machine market size was valued at USD 1.41 billion in 2025. The market is projected to grow from USD 1.48 billion in 2026 to USD 2.68 billion by 2034, exhibiting a CAGR of 7.70% during the forecast period. Asia Pacific dominated the shot blasting machine market with a market share of 36.90% in 2025.

Shot blasting machines are commonly used for surface treatment processes, such as cleaning, descaling, and peening, for metalworking and related industries. This machine is used for abrasive blasting to prepare and clean metals, stones, and other materials. The machine is used for shot peening and cleaning metal parts, such as casting, heavy metal, and rusted metal parts.

Blasting refers to a commonly used industrial process that involves cleaning, strengthening and polishing metal or metallic surfaces. An automatic spray cleaning machine effectively removes dirt from metal surfaces by cleaning and smoothing them before applying a primer or coating. Automatic spray cleaning machines are widely used for desilting, smoothing, carpeting, sanding, rust removal, and edge formation of various industrial equipment. Rising industrialization, infrastructure development, and the demand for efficient surface preparation and cleaning processes in industries such as aerospace, automotive, construction, and shipbuilding sectors.

There is a rising demand for shot blasting methods in the metal industry for surface preparation, finishing, and cleaning of metal components. This method is used in the metal fabrication and manufacturing sector. As industrial activities in the metal sector increase, driven by infrastructure development, construction projects, and demand for metal components in various industries, there is a corresponding increase in the need for these machines to ensure high-quality surface finishes, driving the growth of the market. The metalworking sector includes transforming and shaping metals to create useful parts, large-scale structures, and objects. The rising demand for surface treatment equipment is projected to support market expansion. All such favorable instances drive market growth.

COVID-19 IMPACT

COVID-19 Pandemic Impeded Market Growth Due to Decrease in Demand from Automotive Sector

The COVID-19 pandemic negatively impacted the global market due to the closure of construction activities and decreased demand from the automotive and metal sectors. During the COVID-19 pandemic, halted manufacturing activities and disruption in the supply chain of raw materials restricted market growth. Industries such as construction, automotive, and aerospace, which are significant users of shot blasting machines, experienced a decline in demand during the pandemic. Delays in project timelines and construction projects negatively affected the sales of these machines.

Major players suffered from revenue losses as manufacturers witnessed a decline in sales during the COVID-19 pandemic. For instance, the net sales of Norican Group decreased by 23.8% in 2020 as compared to 2019. All such factors hampered market growth.

Shot Blasting Machine Market Trends

Technological Advancement in Equipment to Propel Market Growth

Major players, such as Norican Group, Pangborn, Agtos GmbH, and Viking Corporation, among others, are engaged in providing new technologically advanced products, such as robotic systems and automated controls. For instance, in March 2022, Wheelabrator introduced a new digital tool that displays and monitors the overall efficiency of a shot blasting machine. It is used to identify problems and bottlenecks that are causing their blower to operate at less than optimal capacity. The integration of Internet of Things (IoT) technology and automated systems into such machines drives market growth.

In recent years, industries such as manufacturing and oil & gas, have adopted IIoT in their operations. The growing use of IIoT is a potential opportunity in the explosion monitoring equipment market. All such factors mentioned above are the blast monitoring equipment market trends.

Download Free sample to learn more about this report.

Shot Blasting Machine Market Growth Factors

Rising Demand from the Automotive and Construction Sectors to Aid Market Growth

The aftermarket sales companies and OEM manufacturers are using shot blasting machines to clean and polish various metal parts made in automotive and related sectors. Additionally, various End-user verticals require high-level finished materials. Increasing global population, which in turn, raises the focus on offering affordable housing infrastructure for individuals. As per an analysis by the Association of Equipment Manufacturers, the global construction sector increased by 4.5% in 2022 compared to 2021. Rising demand from the residential and commercial sectors, which subsequently increases the demand for heavy machinery, drives market growth. Additionally, growth in the global automotive sector fuels the demand for these machines for cutting and cleaning metal parts. For instance, according to the German Automotive Industry, the automotive sector growth in Germany increased by 8.4% in 2022 compared to 2021.

RESTRAINING FACTORS

High Capital Investment and Fluctuation in Raw Material Prices Required for Machinery to Impede Market Growth

Shot blasting machines, especially those equipped with advanced features, can involve a significant initial investment. This cost can be a restraint for small and medium-sized enterprises (SMEs) or businesses with budget constraints. In addition to the initial investment, there are operational and maintenance costs associated with these machines. These costs can include abrasive material, energy consumption, and regular maintenance. Businesses may find these ongoing expenses challenging, impacting the adoption of such equipment.

Moreover, the average cost required for such a machine is around USD 5,000 to USD 30,000.

However, metal, stainless steel, and brass are some of the materials used for manufacturing such machines. These materials experience price fluctuations frequently. For instance, according to JSW Steel, the steel price increased from USD 741.0/MT in April 2021 to USD 1,024.4/MT in 2022. Such a fluctuation in the raw material prices restricts market growth.

Shot Blasting Machine Market Segmentation Analysis

By Machine Type Analysis

Tumble Belt Segment Dominates Due to its Wide Use in Various Industry Verticals

Based on machine type, the market is segmented into tumble belt, hanger type, roller conveyor, spinner hanger, and table type machine.

The tumble belt segment dominates the market and is projected to grow at the highest rate. The segment’s growth is attributed to low energy utilization and its wide use in various industry verticals, such as automotive, construction, and related sectors. Also, it is used for abrasive materials, such as glass, corundum, and silicon carbide. In 2026, the tumble belt shot blasting machine segment is projected to lead the market with a 32.43% share.

The hanger type segment is projected to grow substantially as these machines are designed with various loading capacities, blast wheel configurations, and automation levels. Some hanger type machines are equipped with multiple blast wheels to ensure thorough coverage and efficient cleaning of complex parts.

The spinner hanger and table type segments are expected to grow with decent growth during the forecast period. They are designed for cleaning, descaling, and surface preparation of flat or large workpieces that can be placed on a rotating table. These machines are commonly used in industries such as automotive, aerospace, construction, and metal processing. Moreover, these machines find application in steel manufacturing, shipbuilding, and construction sectors.

To know how our report can help streamline your business, Speak to Analyst

By Technology Analysis

Wheel Blasting Segment to Lead the Market Owing to Wide Use in Automotive Sectors

Based on technology, the market is segmented into wheel blasting, air blasting, and wet blasting.

The wheel blasting sector dominates the market and is projected to grow with potential growth during the forecast period. The segment’s growth is attributed to its wide use in various sectors, such as automotive and metalworking applications. They are used for tasks such as cleaning, descaling, deburring, and surface preparation. The wheel blasting segment is forecast to represent 46.62% of total market share in 2026.

The air blasting machine segment is anticipated to grow with potential growth due to its suitability for applications requiring cleaning and surface equipment. Also, the growing demand from the electronics, medical, and aerospace equipment manufacturing sectors are anticipated to drive market growth.

By Mode of Operation Analysis

Automatic Segment to Dominate the Market Owing to Rising Demand from Several Industries

Based on the mode of operation, the market is segmented into automatic and manual.

The automatic segment dominates the market and is projected to grow with the highest growth rate as automated shot blasting machines are generally more efficient and faster than manual systems. They can process a large number of workpieces consistently and continuously. The automatic shot blasting machine segment is poised to account for 62.84% of the market share in 2026.

The manual segment is anticipated to grow with potential growth during the forecast period, owing to features such as offering greater flexibility allowing operators to adapt to various work pieces and surface conditions. Additionally, manual machines are easy to install and maintain.

By End-user Analysis

Automotive Segment to Dominate Due to Growing Adoption of Shot Blasting Machine in Automotive Sectors

Based on End-user, the market is categorized into automotive, aerospace, foundry, construction, shipbuilding, rail, and others.

The automotive segment is expected to dominate the market during the forecast period, owing to the large adoption of shot blasting machines in the automotive sector. An increase in vehicle production and a growing need for efficient surface preparation in manufacturing contribute to the demand for blasting machines.

The aerospace segment is growing rapidly as aerospace components are often made from specialized materials, such as aluminum, titanium, and composites. These machines are designed to handle these materials without causing damage or altering their properties. The automotive segment is expected to account for 25.68% of the market in 2026.

The foundry, shipbuilding, and construction segments are projected to grow with potential growth during the forecast period due to rising demand for such machines for surface preparation, cleaning, and finishing of various components required for the end-users.

Shot blasting machines in the rail industry are designed for efficiency and productivity. They are often equipped with systems that allow continuous operation and quick turnaround times, minimizing downtime for rail maintenance or manufacturing processes.

The others segment consists of transportation and others. The transportation segment is projected to grow with decent growth. Shot blasting is used to clean and prepare the surfaces of automotive components such as chassis, engine blocks, and suspension parts before painting or coating driving segment expansion. This process removes rust, scale, old paint, and contaminants, ensuring better adhesion of coatings. All such factors drive the market growth.

REGIONAL INSIGHTS

The market report covers an in-depth scope and deep-dive analysis of five main regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Shot Blasting Machine Market 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market due to rising demand from the automotive and construction sectors. Also, ongoing infrastructure development projects, including the construction of roads, bridges, and other structures, in various Asia Pacific countries drive demand for such machines. These machines are used for preparing surfaces in construction projects before coating or painting them. Also, growth in the automotive sector across China, Japan, and India subsequently drives market expansion. For instance, according to the India Brand Equity Foundation, automotive production in India increased by 12.9% in 2024.

Asia Pacific

China to Dominate the Market Owing To Increasing Demand from the Infrastructure and Transportation Sector

Rising urbanization and industrialization across China are among the important factors driving the market growth during the forecast period. China is an important market for automotive and related sectors, which contributes around 30% of the shot blasting machine market share across the global market. Also, the automotive sector growth in China increased by 7.4% in 2024. The Japan market is forecast to reach USD 0.07 billion by 2026, the China market is set to reach USD 0.21 billion by 2026, and the India market is likely to reach USD 0.09 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America has been experiencing steady growth due to increased demand from the aerospace, automotive, construction, and manufacturing sectors. Additionally, growth in the construction and automotive sectors across the U.S., Canada, and Mexico fuels market expansion. For instance, according to USAspending, the spending on the shipbuilding industry in the U.S. increased by 73% in 2022 compared to 2021. Such favorable instances drive market growth. The U.S. market is estimated to reach USD 0.29 billion by 2026.

Europe

Europe is projected to grow with potential growth during the forecast period, owing to European regulations regarding environmental protection and workplace safety, which can influence the design and adoption of these machines. Increasing awareness and regulations related to environmental sustainability may drive the adoption of such machines that are more eco-friendly. The UK market is expected to reach USD 0.07 billion by 2026, while the Germany market is anticipated to reach USD 0.09 billion by 2026.

Rest of The World

The Middle East & Africa and South America region is projected to grow with decent growth during the forecast period, owing to rising demand from oil & gas, mining, construction, and automotive sectors. Growing construction and infrastructure projects in the region can drive the demand for these machines. Regulations related to environmental protection, safety standards, and industrial practices can impact the adoption of shot blasting technology.

List of Key Shot Blasting Machine Market Companies

Key Players’ Focus on Adopting New Strategies to Intensify Market Competition

Market players, such as Norican Group, Shandong Kaitai Shot Blasting Machinery Co. Ltd, Rosler Oberflachentechnik GmbH, and Agtos GmbH are adopting product launch and acquisition as key developmental strategies to strengthen their market position. For instance, in January 2022, Rosler Oberflachentechnik GmbH launched a new machine enabled with two high-performance turbines that have an installed capacity of 11 KW each. This has a short cycle time. This machine has features such as high uptime, energy efficiency, and favorable operating costs and is largely used in the automotive and construction sectors. All such factors are anticipated to maintain market growth during the forecast period.

LIST OF KEY COMPANIES PROFILED:

- Agtos GmbH (Germany)

- Airblast B.V. (Netherlands)

- Airo Shot Blast (India)

- C.M. Surface Treatment S.p.A. (Italy)

- Guyson Corporation (U.S.)

- Norican Group (Denmark)

- Pangborn (U.S.)

- Rösler Oberflächentechnik GmbH (Germany)

- Shandong Kaitai Shot-blasting Machinery Co. Ltd (China)

- Viking Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Rosler Oberflachentechnik GmbH installed a new shot blasting machine for Taiyuan Iron and Steel Group Co. Ltd (TISCO) based in China. This is a vertical shot blast machine that is 14 meter high and has a depth of 2.5 meter. These machines are capable of weighing a maximum of 35 tons and have a high throughput capacity and precision ability.

- November 2022: Sinto America, a subsidiary of Roberts Sinto, signed a collaboration agreement with KB Foundry Services, LLC. This partnership was done for corrosion removal, partial restoration of metal products, machining, and cleaning.

- July 2022: Agtos GmbH installed the Agtos Monorail Shot Blasting machine at Peddinghaus Corporation, which is based in the U.S. The installation is aimed at enhancing the product development of shot blasting machines for railway lines.

- May 2022: The AMT agency launched PostProDP MAX, a completely computerized depowering and shot blasting gadget created for huge thing runs and used in large batches. This machine is used to prevent corrosion and slurry fabric and ease the product’s floor.

- December 2021: GPAINNOVA, which deals in surface finishing technologies, installed a Rosler Dlyte 500 blasting machine in Untermerzbach, Germany. DLyte PRO500 is designed for the processing of large batches and larger parts with complex geometry that require high-quality surface treatment.

REPORT COVERAGE

The global market research report covers a detailed depth analysis of the machine type, technology, mode of operation, and end-user. It provides information about leading players in the blast monitoring equipment and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, trends analysis, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the market report encompasses several factors contributing to the market's growth in recent years.

An Infographic Representation of Shot Blasting Machine Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Machine Type

By Technology

By Mode of Operation

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 2.68 billion by 2034.

In 2025, the market was valued at USD 1.41 billion.

The market is projected to grow at a CAGR of 7.70% during the forecast period.

By machine type, the tumble belt segment leads the market.

Increasing investment in the construction and mining sectors, which boosts the demand for blasting monitors, fuels the market growth.

Norican Group, Rosler Obe Rösler Oberflächentechnik GmbH, Pangborn, Agtos GmbH, and Airo Shot Blast are major players in the market.

Asia Pacific region is expected to hold the highest market with a share of 36.9% in 2025.

By end-user, the automotive segment is expected to dominate the market during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic