Smart Label Market Size, Share & Industry Analysis, By Technology (Electronic Article Surveillance (EAS) Security, RFID, Sensing Labels, Near Field Communication Tag, and QR Code/2D Barcode), By End-User (Retail, Healthcare & Pharmaceuticals, Food & Beverages, Consumer Electronics, Supply Chain and Logistics, Transportation, and Others (Automotive and Manufacturing)), and Regional Forecast, 2026 – 2034

Smart Label Market Size

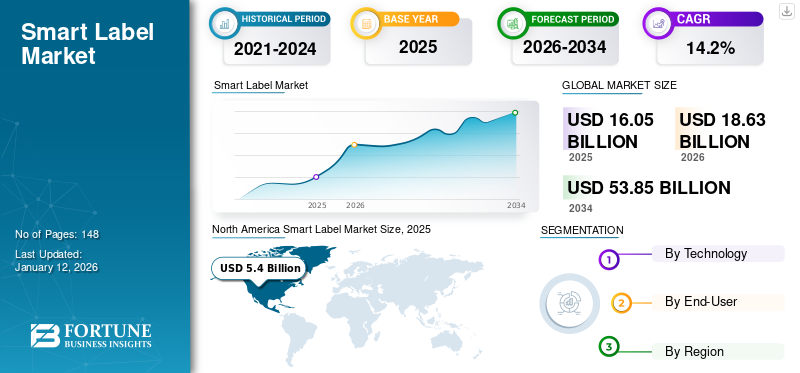

The global smart label market size was valued at USD 16.05 billion in 2025 and is projected to grow from USD 18.63 billion in 2026 to USD 53.85 billion by 2034, exhibiting a CAGR of 14.2% during the forecast period. North America dominated the smart label market with a market share of 33.6% in 2025.

Smart labels incorporate advanced technologies such as Radio Frequency Identification (RFID), Near Field Communication (NFC) tags, and QR codes to expand their functionality and data beyond conventional labels. These labels become active in response to a trigger, such as UV radiation, temperature change, or any physical action. Smart labels offer numerous benefits to businesses, including improved customer engagement, real-time inventory tracking, effective anti-counterfeiting, and streamlined operations. The report covers smart label solutions from key players such as CCL Industries, Honeywell International Inc., Zebra Technologies Corp., and Avery Dennison Corporation.

The global market is growing significantly with the surge in intelligent label applications, increased number of relevant partnerships and collaborations, and rise in the use of smartphones. In addition, the growing importance of reducing paper wastage, resource conservation, enhancing operational efficiency across various industries, and increasing packaged goods labeling awareness among consumers drives market growth. Advancements in smart label technologies such as the Internet of Things (IoT), smart sensors, Radio-frequency Identification (RFID), and cloud computing promise healthy growth for the market in the coming years.

COVID-19 IMPACT

Increased Demand for Medical and Healthcare Packaging and Labeling Solutions Provided Lucrative Opportunities for Market Growth

The coronavirus pandemic brought unprecedented disruptions to economies, various industries, and consumer behavior globally. The pandemic impacted several industries, among which the packaging and labeling industry was the most impacted industry. It witnessed several opportunities and challenges. For instance, There was a massive upsurge in demand for medical and healthcare packaging and labeling. Smart labels ensure the authenticity, traceability, and efficient distribution of vaccines, pharmaceuticals, and medical supplies.

In addition, the growth in the demand for counterfeit products during the pandemic also offered lucrative opportunities for the market.

Despite all these opportunities, the market also experienced significant challenges due to supply chain disruptions caused by stringent lockdowns, labor shortages, and economic downturns. These factors negatively impacted the production and distribution of intelligent labels, causing shortages and delays in adoption across industries. To summarize, the pandemic moderately impacted this market.

Smart Label Market Trends

Smart Labels for Product Traceability and Verification in Various Industries to Spur Innovation and Adoption

Counterfeits are unlawful copies or impersonations of authentic goods. Commercial-scale copyright piracy and trademark counterfeiting threaten legitimate manufacturers and consumers. The problem of fake products concerns various manufactured goods, from cosmetics to medical devices and pharmaceuticals.

In 2022, The U.S. Customs and Border Protection (CBP) captured about 25 million counterfeit goods with an evaluated manufacturer’s suggested retail price (MSRP) of nearly USD 3 billion.

Smart product labeling is increasingly helping manufacturers get away with the problem of product counterfeiting by introducing advanced security features such as encrypted data, tamper-evident seals, and authentication codes that are hard to copy. These solutions boost consumer trust and strengthen brands' commitment in fighting counterfeiting. Thus, as counterfeiting surges globally, the demand for these labels increases simultaneously.

Download Free sample to learn more about this report.

Smart Label Market Growth Factors

Growing Need for Reducing Food Loss and Improving Food Security to Drive Market Growth

Food loss is a global concern, and its reduction is extremely important to fight climate change, improve food availability and accessibility, and reduce pressures on land, water, and biodiversity. Less awareness among consumers about various date marks that appear on food labels, such as “use by” or “best before,” is one of the major factors responsible for food loss or waste. With an aim to reduce food and packaging waste, various governments, environmental agencies, and businesses are consistently looking at effective ways. A smart label is one such innovation that can be used to improve food visibility, product information, and food safety while also helping to improve sales and margins of businesses.

Additionally, stringent labeling regulations in the pharmaceutical and food industries and increasing consumer packaged goods labeling awareness drive product demand. The Growing importance of reducing paper wastage, resource conservation, and enhancing operational efficiency across various industries are the other factors driving the market growth.

RESTRAINING FACTORS

High Cost and Lack of Awareness in Developing Economies to Limit Market Growth

Smart label implementation involves complex steps such as data integration, network configuration, and hardware installation, which raises the overall cost of the end product. This high cost proves to restrain the market growth. Additionally, lack of awareness regarding the product in developing economies is another major factor anticipated to hinder market expansion.

Furthermore, there are no specific regulatory requirements when using intelligent labeling technology. However, several general regulations must be considered while manufacturing intelligent labels. Meeting this requirement can slow down the adoption.

However, many of the challenges of these labels are minor, and if minimized, their high adoption is expected.

Smart Label Market Segmentation Analysis

By Technology Analysis

Growing Popularity of RFID Tags across Retail and Food & Beverages Industries to Aid the Market Growth

Based on technology, the market is divided into RFID, electronic article surveillance (EAS) security, near-field communication tags, sensing labels, and QR code/2D barcodes. Among these, RFID holds the largest market share of 37.52% in 2026, owing to its growing popularity across retail and food & beverages industries. For instance, in August 2023, McDonalds (France) partnered with Checkpoint Systems to infuse food-safe RFID technology into its reusable containers. This initiative was implemented to aid McDonald' in package tracking and reduce food waste.

Moreover, the Near Field Communication (NFC) Tags segment is expected to grow with the highest CAGR during the forecast period. NFC aids in real time tracking and managing inventory through the supply chain.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Retail Sector Dominated the Market Due to the Need to Minimize Fraud and Counterfeit Products

Based on end-users, the market is divided into transportation, retail, food & beverages, healthcare & pharmaceuticals, supply chain and logistics, consumer electronics, and others (automotive and manufacturing). Among these, the retail segment held the largest market with a share of 25.82% in 2026. The market primarily drives the industry's growing demand for anti-counterfeiting measures. Key players in the market are providing intelligent labeling solutions customized for the retail and e-commerce sectors to reduce fraud and counterfeit products.

Furthermore, the food & beverages sector segment is anticipated to grow with the highest CAGR due to increased demand for food traceability and consumers' need for product information.

REGIONAL INSIGHTS

Based on region, the market is studied across North America, South America, Europe, Middle East & Africa, and Asia Pacific.

North America

North America dominated the market with a valuation of USD 5.4 billion in 2025 and USD 6.13 billion in 2026. North America accounts for the largest market share owing to the region's digital maturity. The market is driven by the rising applications of smart labels across industries, including retail, healthcare, manufacturing, and logistics, among others. The growing need for inventory management, anti-counterfeit measures, and efficient supply chain management are some of the factors that contribute to its growth. Key players in the U.S. offer advanced labels infused with advanced RFID and IoT technologies, contributing to the region's growth. Additionally, the smart label market in U.S is predicted to grow significantly, reaching an estimated value of USD 7,748.3 million by 2032. The U.S. market is projected to reach USD 4.03 billion by 2026.

North America Smart Label Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Furthermore, the Asia Pacific smart label market is expected to grow with the highest CAGR in the forecast period. The growing adoption of smartphones and internet penetration are some of the factors that drive the market. Also, countries like China, India, Japan, and South Korea rapidly adopt technologies to create a better-connected nation. The Japan market is projected to reach USD 1.43 billion by 2026, the China market is projected to reach USD 1.57 billion by 2026, and the India market is projected to reach USD 0.74 billion by 2026.

Europe

Moreover, Europe stands second in the smart label market share landscape, majorly due to the increasing number of partnerships by key players. Smart label players in European countries such as Germany, the U.K., Italy, and the Netherlands, among others, are launching technologically advanced smart labels to promote product efficiency and reduce waste. Also, they are merging and collaborating with similar technological companies in order to boost each other’s product portfolio. Further, the Middle East & Africa and South American regions stand behind these regions in the race to generate revenue for the market. However, the increasing active participation of associations and organizations in the region marks them at a well-paced position in the coming years. The UK market is projected to reach USD 1.24 billion by 2026, while the Germany market is projected to reach USD 1.19 billion by 2026.

KEY INDUSTRY PLAYERS

Rise in Technological Investments by Key Players Indicates Positive Growth for the Market

In addition to the existing business strategies such as product enhancements, strategic partnerships and acquisitions, and others, the key players operating in the market are continuously engaged in investments related to technological advancements that enhance their smart label technology. This strategy adopted by the key players helps them enhance their product solutions and better serve their customers. This strategy helps these players to have an edge over other players operating in the market and makes them mark a higher position in the market’s landscape. It helps them deliver advanced solutions to their end users.

LIST OF TOP SMART LABEL MARKET COMPANIES:

- Avery Dennison Corporation (U.S.)

- CCL Industries (Canada)

- Honeywell International Inc (U.S.)

- Zebra Technologies Corp. (U.S.)

- Alien Technology, LLC. (U.S.)

- Multi-Color Corporation (U.S.)

- Invengo Information Technology Co., Ltd. (China)

- Insignia Technologies Ltd. (BioCity Glasgow)

- Covectra, Inc. (U.S.)

- VCQRU (India)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: Toppan (packaging and printing provider) launched paper-based NFC tag labels to reduce fraudulent activities. The new NFC tag uses paper material instead of traditional PET film.

- September 2022: Avery Dennison and The R Collective collaborated, intending to provide the fashion brand with QR code labels for garments. This collaboration is part of a series of partnerships dedicated to using digital labeling solutions for fashion garments.

- May 2022: CCL Industries Inc. acquired Floramedia Group B.V. and made it a part of Avery. The acquired company specializes in horticulture media with in-house tag and label production.

- September 2021: Insignia Technologies Ltd. introduced an automatic “After Opening Timer.” This newly found technology indicates to the end users about the food packet's condition after being opened.

- September 2021: Covectra, Inc. launched StellaGuard, a cloud-based smart security label and mobile authentication solution to combat counterfeiting. The solution combines advanced technologies such as serialized QR codes and holographic stars to offer universal brand protection.

REPORT COVERAGE

The report covers a detailed analysis of the market, probing key aspects such as key market players, their intelligent smart label solutions, and the leading applications of these solutions. The report also summarizes the factors directly or indirectly affecting the smart label market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.2% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By End-User

By Region

|

Frequently Asked Questions

The market is projected to reach USD 53.85 billion by 2034.

In 2025, the market was valued at USD 16.05 billion.

The market is projected to grow at a CAGR of 14.2% during the forecast period.

The RFID technology is expected to lead the market.

Growing need for reducing food loss and improving food security to drive market growth.

CCL Industries, Honeywell International Inc., Zebra Technologies Corp., Avery Dennison Corporation, Invengo Information Technology Co., Ltd., and Insignia Technologies Ltd. are the top players in the market.

North America is expected to hold the highest market share.

By end-user, the food & beverages is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us