Software Defined Perimeter (SDP) Market Size, Share, & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Small & Medium Enterprise and Large Enterprises), By End User (BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Education, and Others) and Regional Forecast, 2026-2034

Software Defined Perimeter (SDP) Market Size

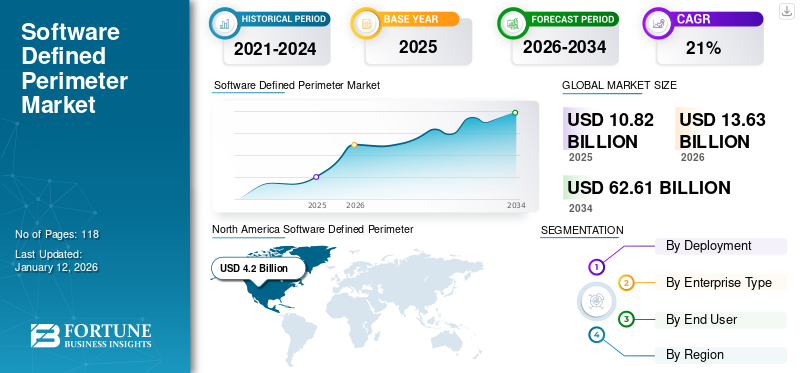

The global software defined perimeter (SDP) market was valued at USD 10.82 billion in 2025. The market is projected to be worth USD 13.63 billion in 2026 and reach USD 62.61 billion by 2034, exhibiting a CAGR of 21.00% during the forecast period. North America dominated the global market with a share of 38.80% in 2025. Additionally, the U.S. software defined perimeter market is predicted to grow significantly, reaching an estimated value of USD 14.42 billion by 2032.

A software defined perimeter (SDP) is a security framework that provides secured access to internet connected equipment, including routers and servers from external users. SDP works regardless of whether assets reside in the cloud or on-premise, or whether the users are working remotely or working from on-site. SDP protects SME’s and large enterprises network infrastructure from cyber-attacks, as it primarily authenticates the identity of user and device before giving them access to the organization’s data servers.

Furthermore, organizations are adopting cloud-based services to enhance protection by deploying security gateways over the on-premise or cloud infrastructure. The need for secure connection for remote working was the major reason that the adoption of SDP was spiked during the pandemic. The software defined perimeters secure hybrid and private clouds, thus minimizing the potential network attack surface and inhibiting port and vulnerability scanning by malicious players. Additionally, enterprises focus on adopting cloud-based technology to eliminate VPN pain points, avoiding added costs and complexities. For instance,

- January 2023, InstaSafe, a provider of cloud-based security solution, partnered with iValue InfoSolutions, a technology services and solutions provider in South-East Asia and India. Through this partnership InstaSafe aims to expand its product offerings by utilizing iValue's network throughout India. This partnership will enable iValue's existing customers to securely access business applications and servers across on-premise and multi-cloud environments, excluding VPNs.

In our market study, we have studied voyage management software offered by market players such as Verizon, Fortinet, Inc., Appgate, Zscalar, Inc., Perimeter 81, Palo Alto Networks, NTT DATA Corporation, and others. Our report has studied and analyzed companies offering software defined perimeter.

Software Defined Perimeter (SDP) Market Trends

Increasing Demand for SDP Solutions across the Industries to Aid Market Growth

Various cybersecurity solution providers have been increasing the deployment of technologies and tools to safeguard their environment and detect threats. Several industries are unlocking digital transformation across businesses, exposing the risk of developing and complex cyber threat landscape.

Moreover, financial services are adopting a zero-trust/SDP approach to safeguard their business against cyber threats and integrate platform-based models into digital channels by leveraging data analytics on the cloud and safety by blockchain technology.

In addition, IT and security practitioners are integrating the SDP solutions by combining secure and endpoint access platforms to gain visibility and control and address risk across endpoints, applications, and networks. For instance,

- Thales conducted a global survey of 2,600 IT decision-makers directed by 451 research group in 2022 about working environments globally and concerns about the security risks of remote work. In this survey, 84% of IT experts globally have some assurance in their user access security systems by enabling remote work securely and efficiently, up from 56% in 2021. Software-Defined Perimeter/Zero Trust Network Access, was the highest preference, selected by 44% of respondents globally.

Thus, continuous advancement and development across the industries creates ample growth for the market.

Download Free sample to learn more about this report.

Software Defined Perimeter (SDP) Market Growth Factors

Deployment of SDP Solutions in BYOD and IoT Aids the Market Growth across the Globe

The COVID-19 pandemic dispersed workforces by mobilizing their new remote workforce and securing the network in the new environment. The remote workforce creates a rise in cyber threats. To reduce the cyber threats, enterprises are adopting SDP/Zero Trust architecture into services, data and their associated identities.

Due to adoption of remote working environment, various organizations brought the role of BYOD, allowing users to access services or data on their personal, smartphones, and other devices, which increases the risk of data breaches. BYOD devices require stringent access procedures due to security concerns. The adoption of SDP offers access to BYOD devices and secures sessions on those devices. Additionally, various organizations focus on adopting software defined perimeter solutions to ensure data theft protection for remote employees.

Moreover, many organizations IT and operation technology (OT) teams are rapidly deploying software-defined perimeter technology and other zero-trust strategies by separating IoT data from the hidden and corporate networks. For instance,

- NetCloud Perimeter, a cloud-based substitute to Virtual Private Network (VPN), allows businesses to deploy virtual overlay networks that connect all IoT devices. It offers cloud-based security to small businesses to eliminate the hardware, difficulty, and operational expenses of traditional WANs.

Thus, deployment of the solutions in BYOD and IoT environment favors the global software defined perimeter market growth during the forecast period.

RESTRAINING FACTORS

Lack of Qualified Vendors with a Complete Solution Restrains the Market Growth

Many organizations struggle to implement complete zero-trust security solution, even though organizations have prominent focus on adoption of zero-trust strategy.

These organizations implement partial zero trust security solutions and allow them complete access to their network infrastructure and digital assets. Moreover, half of the respondents can't authenticate users and devices continuously and struggle to monitor users’ post-authentication. For instance,

- In September 2021 Fortinet surveyed 472 cybersecurity professionals and business leaders worldwide to understand organizations' usage in their zero-trust journey. In this survey, organizations' main challenge in developing a zero-trust strategy was the lack of qualified vendors with a complete solution.

As a result of aforementioned factors, limited availability of qualified venders could hamper the software defined perimeter (SDP) market growth.

Software Defined Perimeter (SDP) Market Segmentation Analysis

By Deployment Analysis

Increasing Deployment of Cloud-based Solutions by Enterprises to Boost the Growth

Based on the deployment, the market is divided into cloud and on-premise.

Cloud segment captured the highest market share of 84.52% in 2026. Software Defined Perimeter (SDP) deployment over cloud is becoming more popular across the globe, as more organizations move their IT infrastructure to the cloud. It allows businesses to reduce costs, quicken deployments, share files easily and collaborate efficiently without requiring an integrated location.

Deploying over cloud involves creating a virtualized network environment that can be accessed remotely over the internet securely. Further, it helps organizations to reduce their IT infrastructure cost. Thus, cloud-based solution is anticipated to grow at a highest CAGR during the forecast period.

By Enterprise Type Analysis

Increasing Adoption of Software Defined Perimeter (SDP) Solutions by Large Enterprise to Lead to Market Dominance

Based on enterprise size, the marketplace is divided into small and medium enterprises (SMEs) and large enterprises.

Large enterprises capture larger market share of 67.28% in 2026, as they are early adopter of these solution, due to the complex and distributed nature of their IT infrastructure. It provides a secure and isolated network environment to protect digital assets from cyber threats.

The adoption of these solution by small and medium size enterprises (SMEs) is gradually increasing, as these organizations are now starting to recognize the benefits of SDP, such as improved security, reduced complexity, and increased agility.

Thus, SMEs are anticipated to grow at the highest CAGR during the forecast period.

By End User Analysis

Rising Deployment of Software Defined Perimeter (SDP) Solutions across IT and Telecom Industry to Boost the Market Growth

Based on end user, the market is segmented into BFSI, IT and telecommunications, retail, government, manufacturing, travel and transportation, healthcare, energy and utilities, and others.

Among end user, BFSI is expected to hold prominent share of 20.76% in 2026. In the IT industry, many organizations are adopting SDP as a replacement for traditional VPNs (Virtual Private Networks) and other remote access control. For instance,

- In December 2022, InstaSafe, collaborated with ZNet Technologies, a provider of cloud services, IT infrastructure, and cybersecurity solutions, expanding their product base by leveraging ZNet's partner network across the Indian market. This collaboration will address InstaSafe's software defined perimeter based zero trust security solutions, cloud security, identity management, and remote access globally.

Adoption of SDP technology in government agencies is growing, as protection of sensitive data is a top priority for governments around the world. It provides a more secure way to authenticate users and devices and to protect sensitive data. Thus, it is expected to grow at a highest CAGR during the forecast period.

Further, adoption of these solution in healthcare sector is expected to grow at a noteworthy rate during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Geographically, the market is categorized into five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Software Defined Perimeter (SDP) Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America holds the highest share in the global software-defined perimeter (SDP) market with a valuation of USD 4.2 billion in 2025 and USD 5.22 billion in 2026. The major reason that accelerates the need for software defined perimeter (SDP) solutions across the region is due to technological advancements, an increase in cloud adoption, and other emerging technologies. Businesses require secure access to cloud-based resources, thus increasing demand for (software defined perimeter) SDP solutions across the region. Besides, the rise in remote workforce continues to propel the market growth. The U.S. market is projected to reach USD 3.69 billion by 2026. For instance,

According to a study published by Forbes, over 32.6 million Americans are expected to opt to work remotely by 2025. This data is equal to around 22% of the workforce.

Moreover, the majority of market players based in the U.S. have proven to accelerate the country’s dominance across the region. In addition, cybersecurity-related investments have become a priority for several businesses that also contribute to the factors that positively influence market growth.

Asia Pacific

Asia Pacific is expected to grow at a highest CAGR during the forecast period. Various industrial sectors in countries such as China, Japan, India, Oceania, South Korea, South East Asian, and others, are increasing their investment to adopt software defined perimeter in their businesses. The organizations in the region are majorly adopting these solution, owing to its improved security, reduced complexity, and increased agility. The Japan market is projected to reach USD 0.6 billion by 2026, the China market is projected to reach USD 0.97 billion by 2026, and the India market is projected to reach USD 0.48 billion by 2026. For instance,

- In September 2022, Wipro Limited expanded its collaboration with Palo Alto Networks to provide network transformation and managed security solutions including Security Operations Center (SOC) and Secure Access Service Edge (SASE) solutions based on zero trust principles for enterprises across the globe.

Europe

Europe is expected to cover major share for the market due to increase in the adoption of cloud services, surge in data generation in banking and financial services, government, manufacturing, and other sectors create massive demand for these solution to provide security for their digital assets. The UK market is projected to reach USD 0.78 billion by 2026, and the Germany market is projected to reach USD 0.61 billion by 2026. For instance,

- According to European administrations, around 70% of the organizations across Europe are transferring their workloads to the cloud. This is mainly credited to optimizing cost due to cloud usage, and around 50% of organizations have installed cloud-first approach to increase business productivity.

South America

Additionally, South America market to show the moderate growth for software defined perimeter due increasing adoption of advanced digital technologies by organizations. Also, there is increasing interest and awareness of software defined perimeter (SDP) as a potential solution to address the growing cyber threats in the region.

Middle East Africa

Middle East Africa is in emerging phase due to growing adoption of software defined perimeter (SDP) solution by end users including banking and financial institutions, manufacturing, IT & telecom, and other industries. Various key players in the market are focusing on adoption of advanced technology in software defined perimeter to cater End Users such as corporate, government and others.

Key Industry Players

Market leaders Focus on expanding their Product Offerings to Gain Competitive Edge

Key players in the global market such as Verizon, Fortinet, Inc., Appgate, Zscalar, Inc., Perimeter 81, Palo Alto Networks, NTT DATA Corporation, and others are focused on expanding their geographic boundaries by launching industry-specific solutions to get innovations, and new product launches to attract a large customer base, thereby increasing sales. Innovations and new product launches attract a vast customer base, thus improving revenue for SDP.

List of Key Companies Profiled:

- NTT DATA Corporation (Japan)

- Zscaler, Inc. (U.S.)

- Appgate (U.S.)

- Cisco Systems, Inc. (U.S.)

- Palo Alto Networks, Inc. (U.S.)

- Verizon (U.S.)

- Fortinet, Inc. (U.S.)

- Check Point Software Technologies (Israel)

- Perimeter 81 Ltd. (Israel)

- CERTES NETWORKS, INC. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Tech Mahindra, a provider of digital transformation, consulting and business re-engineering services and solutions, partnered with Cisco Business Unit (BU) to develop and implement a range of services to maintain secure, agile, collaborative, and hybrid networks. The Cisco solutions new BU will provide secure access service edge (SASE), software-defined wide area network (SD-WAN) and managed Wi-Fi networks for organizations and hyper network automation.

- February 2023: NTT and Dimension Data, a parent company, integrated Palo Alto Networks Prisma SASE into its Managed Campus Networks portfolio, offering comprehensive managed secure access service edge solutions containing cloud-delivered security, SD-WAN and enhanced automation and reporting.

- January 2023: Perimeter 81 introduced malware protection to support its security offering and enhanced customer protection from internet-borne risks. The malware protection employs a combination of continually simplified advanced machine learning-based and signature-based detection capabilities for recognizing and blocking complex and zero-day attacks.

- December 2022: Cisco expanded its secure access service edge (SASE) environment by integrating with security service edge (SSE) providers Netskope and Cloudflare. The integration of SSE solutions streamlines SASE architecture for organization and improves the IT experience with reduced manual effort and fewer errors.

- November 2022: Zscaler, Inc. announced the deployment of Zscaler Private Access (ZPA) through the FedRAMP program at high and moderate levels authorized through the U.S. Federal government. The use of Zscaler’s Zero Trust platform allows government agencies and contractors to manage sensitive information and protect against cyber threats.

- November 2022: Verizon Business announced a partnership with Wipro Limited, a technology services and consulting company, by integrating Wipro’s Network-as-a-Service (NaaS) solution with Verizon Business to accelerate the cloud transformation and network modernization for businesses. The partnership enables Wipro to change customers from legacy deployment cycles of hardware, services and applications to an automated and highly secure network service environment.

REPORT COVERAGE

The software defined perimeter (SDP) market research report highlights leading regions across the world to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further offers some drivers and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.00% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By End User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global size market is projected to reach USD 62.61 billion by 2034.

In 2025, the market value stood at USD 10.82 billion.

The market is projected to grow at a CAGR of 21.00% during the forecast period.

Based on enterprise type, the large enterprise is expected to be the leading segment in the market.

The deployment of SDP solutions in BYOD and IoT across the globe is the key factor driving market growth.

Verizon, Fortinet, Inc., Appgate, Zscalar, Inc., Perimeter 81, Palo Alto Networks, NTT DATA Corporation, and others are the top players in the market.

North America dominated the global market with a share of 38.80% in 2025.

Asia Pacific is expected to grow with the largest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us